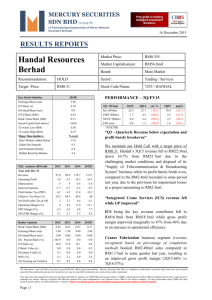

Key Stock Statistics

advertisement

MERCURY SECURITIES SDN BHD (113193-W) (A Participating Organisation of Bursa Malaysia Securities Berhad) 25 Feb 2016 RESULTS REPORTS Handal Resources Berhad Market Price: RM0.310 Market Capitalisation: RM48.8mil Board: Main Market Recommendation: HOLD Sector: Trading / Services Target Price: RM0.31 Stock Code/Name: 7253 / HANDAL Key Stock Statistics 2016E Earnings/Share (sen) P/E Ratio (x) Dividend/Share (sen) NTA/Share (RM) Book Value/Share (RM) Issued Capital (mil shares) 52-weeks High (RM) 52-weeks Low (RM) 3.64 8.52 0.63 0.71 160.0 0.27 0.41 Major Shareholders: .Dato' Mohsin Abdul Halim .Zahari bin Hamzah .Joel Emanuel Heaney .Mallek Rizal bin Mohsin .OSK Capital Partners S/B % (est) 15.8 9.3 6.5 5.8 5.6 PERFORMANCE – 4Q/FY15 3Q / 30 Sept Rev (RMm) EBIT (RMm) NPAT^(RMm) EPS (sen) yoy % 3Q15 qoq% 49.9 5.9 2.6 1.7 (17.7) 3.7 7.9 7.8 22.9 1.7 0.0 0.0 79.3 251.5 6,621.4 5,866.7 “Q4 – Revenue lower, profit margin marginally higher” 2013A 2014A 2015A 2016E Year end: Dec 31 Revenue Operating Profit Depreciation Interest Expenses Profit before Tax (PBT) Effective Tax Rate (%) Net Profit after Tax & MI Operating Margin (%) PBT Margin (%) NPATMI Margin (%) 100.7 12.1 -3.1 -2.5 6.5 72.1 1.9 12.0 6.5 1.9 123.8 18.1 -3.6 -2.5 12.0 48.3 6.2 14.6 9.7 5.0 114.6 17.0 -3.2 -2.4 11.4 48.3 5.9 14.9 10.0 5.1 107.8 16.9 -3.2 -2.4 11.3 48.3 5.8 15.7 10.5 5.4 2013A 2014A 2015A 2016E 0.63 1.23 37.9 0.8 1.9 0.4 0.67 3.93 15.1 0.6 5.8 0.4 0.70 3.74 8.6 0.5 5.2 0.4 0.74 3.64 8.5 0.4 4.9 0.4 Book Value/Share (RM) Earnings/Share (sen) Dividend/Share (sen) Div. Payout Ratio (%) P/E Ratio (x) P/Book Value (x) Dividend Yield (%) ROE (%) Net Gearing (or Cash)(x) 4Q14 41.1 6.1 2.8 1.8 ^NPATMI P&L Analysis (RM mil) Ratios Analysis 4Q15 We maintain our Hold Call with a target price of RM0.31. Handal’s 4Q15 revenue fell to RM41.1mil, down 17.7% from RM49.9mil due to the challenging market conditions however registered marginally higher profit before tax of RM5.41mil as compare to RM5.36mil in the preceding year corresponding quarter. On yearly basis, the group registered marginally lower revenue and profit nevertheless it meets our estimates. “Integrated Crane Services (ICS) higher with better GP” revenue ICS, the key revenue contributor increase from RM29.2mil to RM32.8mil while gross profit margin improved marginally to 36% from 35% due to an increase in operational efficiency. Cranes Fabrication business segment booked RM5.2mil sales compared to RM13.1mil however profit margin improved substantially from 34% to 42% in same quarter last year. On yearly basis, the revenue increased from RM16.7mil to RM20.7mil All information, views and advice are given in good faith but without legal responsibility. Mercury Securities Sdn. Bhd. or companies or individuals connected with it may have used research material before publication and may have positions in or may be materially interested in any stocks in the markets mentioned. This report has been prepared by Mercury Securities Sdn Bhd for purposes of CMDF-Bursa Research Scheme ("CBRS") administered by Bursa Malaysia Berhad and has been compensated to undertake the scheme. Mercury Securities Sdn Bhd has produced this report independent of any influence from CBRS or the subject company. For more information about CBRS and other research reports, please visit Bursa Malaysia’s website at: http://www.bursamalaysia.com/market/listed-companies/research-repository/research-reports/ Page | 1 MERCURY SECURITIES SDN BHD (113193-W) (A Participating Organisation of Bursa Malaysia Securities Berhad) with better profit margin of 40% compare to 32% “Maintain Hold Call” last year. We maintain our Hold recommendation with FYWorkover Project Business segment revenue had end Target Price (TP) of RM0.31 based on reduced from RM2.76mil to RM2.35mil due to a estimated P/E of 8.5 times of Handal’s lower decrease in business activity with lower profit FY16 earnings/share which reflects a P/BV of margin of 72% from 79%. 0.50 times of its FY16 NTA/Share. The main risk factors for Handal is further delays in E&P capital Supply, fabrication & Servicing industrial expenditure by oil majors (such as Petronas), slow equipment & tank’s revenue decreased from implementation pace of major Oil/Gas/Energy RM4.39mil to RM0.73mil with lower gross profit EPPs, higher steel costs for crane fabrication, margin of 9% compared to 23%. foreign exchange fluctuations and also stiff competition with major international rival O&G companies. OUTLOOK/CORP. UPDATES Handal’s management expect market conditions remains challenging for the current financial year amidst depressed crude oil price however the Group expect to sustain its performance in view of the nature of business activities in a niche market as well as its existing long term contracts. 1-YEAR HISTORICAL SHARE PRICE “WTI crude oil futures – Hover around US$30” The oil price outlook remains bearish and this doesn’t bode well with Handal. In medium term, Handal seems not much affected from capex cuts given its long term maintenance service contracts and healthy balance sheet and cash flow however we remains cautious on the oil & gas sector. Source: Bloomberg VALUATION/CONCLUSION Handal (-11.4% YTD) has underperformed the KLCI (-2.0% YTD) in 2016. Handal’s stock price has been trading in the range of RM0.270RM0.410. Since oil peaked in Jun 2014, the sentiments turned and remain bearish. Handal relatively smaller market-cap and thin trading volume put further pressure on its market visibility compared to its peers. All information, views and advice are given in good faith but without legal responsibility. Mercury Securities Sdn. Bhd. or companies or individuals connected with it may have used research material before publication and may have positions in or may be materially interested in any stocks in the markets mentioned. This report has been prepared by Mercury Securities Sdn Bhd for purposes of CMDF-Bursa Research Scheme ("CBRS") administered by Bursa Malaysia Berhad and has been compensated to undertake the scheme. Mercury Securities Sdn Bhd has produced this report independent of any influence from CBRS or the subject company. For more information about CBRS and other research reports, please visit Bursa Malaysia’s website at: http://www.bursamalaysia.com/market/listed-companies/research-repository/research-reports/ Page | 2