Energy Super easily meets APRA's new prudential standards

advertisement

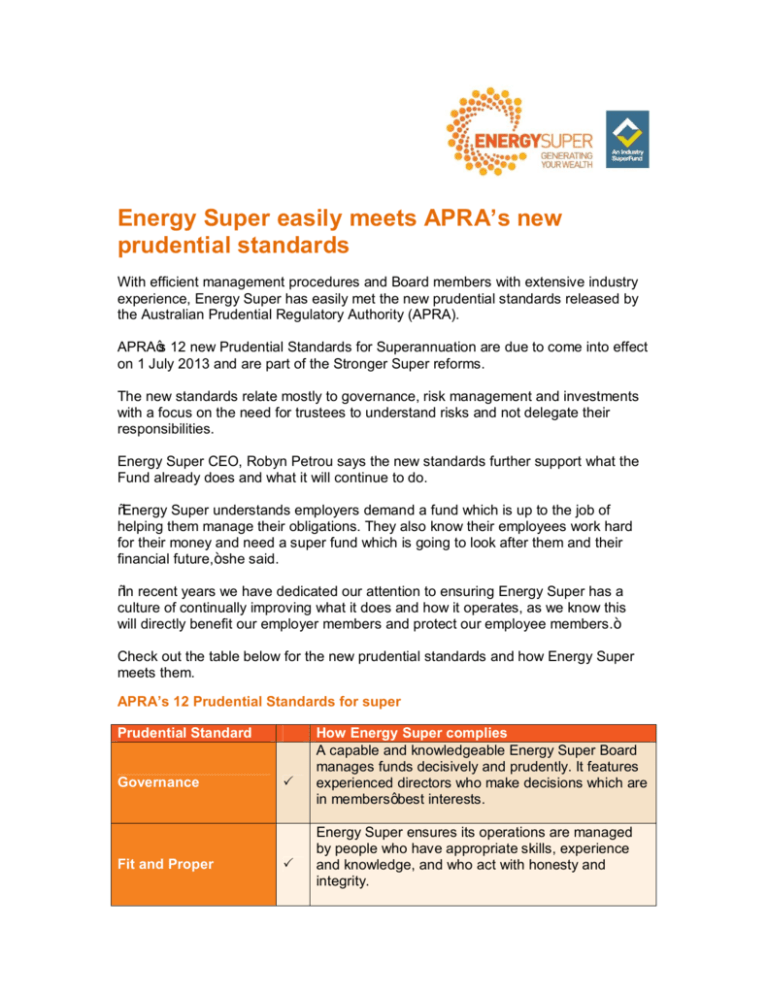

Energy Super easily meets APRA’s new prudential standards With efficient management procedures and Board members with extensive industry experience, Energy Super has easily met the new prudential standards released by the Australian Prudential Regulatory Authority (APRA). APRA’s 12 new Prudential Standards for Superannuation are due to come into effect on 1 July 2013 and are part of the Stronger Super reforms. The new standards relate mostly to governance, risk management and investments with a focus on the need for trustees to understand risks and not delegate their responsibilities. Energy Super CEO, Robyn Petrou says the new standards further support what the Fund already does and what it will continue to do. “Energy Super understands employers demand a fund which is up to the job of helping them manage their obligations. They also know their employees work hard for their money and need a super fund which is going to look after them and their financial future,” she said. “In recent years we have dedicated our attention to ensuring Energy Super has a culture of continually improving what it does and how it operates, as we know this will directly benefit our employer members and protect our employee members.” Check out the table below for the new prudential standards and how Energy Super meets them. APRA’s 12 Prudential Standards for super Prudential Standard Governance Fit and Proper P P How Energy Super complies A capable and knowledgeable Energy Super Board manages funds decisively and prudently. It features experienced directors who make decisions which are in members’ best interests. Energy Super ensures its operations are managed by people who have appropriate skills, experience and knowledge, and who act with honesty and integrity. P Energy Super minimises risks by having all outsourcing arrangements involving material operations subject to appropriate due diligence, approval and ongoing monitoring. P Energy Super protects its financial position and increases its resilience through a whole-of-business approach to business continuity management. P Energy Super has robust systems for identifying, assessing, managing, mitigating and monitoring material risks. Audit and Related Matters P Members benefit from Energy Super’s sound and prudential management, assisted by independent advice on the operations, financial position and risk controls of the fund. Investment Governance P Members’ best interest forms the basis of Energy Super’s sound investment governance framework. Conflicts of Interest P Energy Super has a process for identifying, avoiding and managing any conflicts of duty and interest, ensuring legislative obligations are met. Defined benefit funding and solvency P Defined Benefit members have their entitlements protected by a set of dedicated requirements. P Energy Super will maintain adequate financial resources to address any potential losses arising from operational risks. P Members’ insured benefits will be made available to nominated beneficiaries because of Energy Super’s insurance management framework . P Should members transition to MySuper, they are protected by a regulated and staged process, and prudent practices. Outsourcing Business continuity management Risk Management Operational risk financial requirement Insurance in superannuation Transition to MySuper Electricity Supply Industry Superannuation (Qld) Ltd (ABN 30 069 634 439 AFSL 224952) is the Trustee and issuer of Energy Super (ABN 33 761 363 685). A Product Disclosure Statement (PDS) is available from energysuper.com.au/pds or by calling 1300 4 ENERGY (1300 436 374). Any advice contained in this article is general in nature and not specific to your particular circumstances. You should consider your financial situation before acting on the advice. Financial advice is provided by ESI Financial Services Pty Ltd (ABN 93 101 428 782, AFSL 224952), a wholly owned subsidiary of the Trustee.