suppose assumption

advertisement

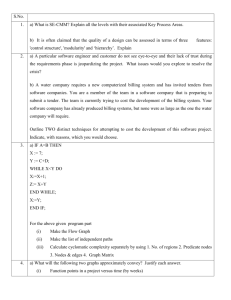

22. (problem number in the 4th edition) Suppose the strategic options available to the Rollins Company in the last problem result in temporarily enhanced growth. Each option can be associated with a super normal growth rate that lasts for some period after which growth returns to the firm's normal 5%. Further suppose the duration of the super normal growth is a variable that can also be affected by strategic policy. Use the STCKVAL program for two-stage growth to develop the following chart assuming a required return of 10%. The Price of Rollins Stock as a Function of Temporary Growth Rate and Duration at a Required Rate of Return of 10% SUPER NORMAL GROWTH RATES(g1) 12% Duration of g1 in years (n) 14% 16% 18% 2 4 6 8 Can you use your charts to make any general comments about the risk-return tradeoff under this assumption about the nature of the strategic options? SOLUTION: The Price of Rollins Stock as a Function of Temporary Growth Rate and Duration at a Required Rate of Return of 10% SUPER NORMAL GROWTH RATES(g1) Duration of g1 in years (n) 12% 14% 16% 2 $56 $58 $60 4 $63 $67 6 $70 $77 $85 $93 8 $77 $88 $100 $113 $72 18% $62 $77 The benefit of extending the duration of the super normal growth is substantial. For the figures shown it is in the same order of magnitude as raising the rate of super normal growth. Hence, it's a viable policy option.