Update on APRA's Update on APRA s Risk Management Prudential

advertisement

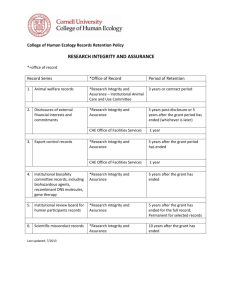

Update on APRA APRA’ss Risk Management Prudential Standard ROYCE BRENNAN GENERAL MANAGER RISK BT FINANCIAL GROUP OUTLINE 1 APRA Risk Management Prudential Standards 1. • Current state • Future state 2. Overview of BT Financial Group’s Risk Management Framework 3. Controls Assurance framework within the three lines of defence 4. Controls Assurance by the Second Line of Defence (Risk) • Purpose and Scope of the Controls Assurance Program • Development of BTFG’s BTFG s Annual Assurance Plan 2014 The Year of… 2 1. APRA RISK MANAGEMENT PRUDENTIAL STANDARDS Current State Since its establishment as an integrated prudential regulator in 1998, APRA has sought to take a consistent, harmonised approach to the setting of prudential requirements for APRA-regulated institutions, irrespective of the industry in which the p institutions operate. In this way, like risks are treated in a like manner. Harmonisation creates a common l language andd also l simplifies i lifi compliance, li particularly ti l l ffor groups th thatt operate t across regulated industries. Prior to APRA’s release of Combined Prudential Standard 220 separate risk management standards existed for superannuation, life insurance and general insurance companies companies. The risk management requirements for ADIs were spread throughout various prudential standards. 2014 The Year of… 3 1. APRA RISK MANAGEMENT PRUDENTIAL STANDARDS Future state On 31 January 2014 APRA released a package to harmonise and enhance risk management across the industry for ADIs, general and life insurance companies. The package included: • • • • Combined Prudential Standard 220 Risk Management; Combined Prudential Standard 510 Governance; APRA’s response paper to submissions received; and Draft Combined Practice Guide 220. Prior to the CPS being issued APRA had set risk management standards at an industry specific level. Note: the superannuation industry is still subject to an industry specific standard. 2014 The Year of… 4 1. APRA RISK MANAGEMENT PRUDENTIAL STANDARDS APRA’s standards become effective from 1 January 2015. The main requirements of CPS 220 are to have a designated risk management framework, including appointing a Chief Risk Officer (CRO) who: • is independent, challenges and involved in decisions that may materially affect the organisation’s risk profile. • has a direct reporting line to the Chief Executive Officer (CEO) and unrestricted access to the Board Risk Committee to be established also under CPS 220. • cannot be the CEO, Chief Financial Officer, the Appointed Actuary or the Head of Internal Audit. 2014 The Year of… 5 1. APRA RISK MANAGEMENT PRUDENTIAL STANDARDS APRA’s standards become effective from 1 January 2015 and the main q of CPS 220 are to: requirements • establish a Board Risk Committee comprised of non-executive directors that provides the Board with objective oversight of the implementation and operation of the risk management framework. • the Board Audit Committee must not only provide prior endorsement for the appointment or removal of the institution’s external auditors but now also Heads of Internal Audit. Group’ss behalf • meet risk management standards on a Group level attesting on the Group and being able to identify, measure, evaluate, report and control or mitigate all material risks across the Group and also capture material risks from any nonAPRA regulated institutions within the Group. Group 2014 The Year of… 6 1. APRA RISK MANAGEMENT PRUDENTIAL STANDARDS Draft Prudential Practice Guide 220 contains APRA’s expectations on how the standard will be met in practice: • Foster a risk management culture though: − Codes of Conduct; − ongoing risk education; and g within risk − pprocesses to ensure behaviour is monitored and managed appetite. • Assess that A th t the th Risk Ri k Management M t Framework F k is i ‘fit for f purpose’’ andd bbe able bl tto provide a summary of this assessment. 2014 The Year of… 7 1. APRA RISK MANAGEMENT PRUDENTIAL STANDARDS Draft Prudential Practice Guide 220 contains APRA’s expectations on how the standard will be met in practice. Ensure the Risk Management Framework contains a number of components which: develops and uses risk appetite statements determines materiality of risk categories and identify the key risk drivers express risk tolerances and action risks that fall outside the risk tolerance have sufficient information in the risk management strategy to communicate how the institution identifies, identifies measures measures, evaluates evaluates, monitors monitors, reports and mitigates material risks of its operations • Structure the risk management function including, for example, by placing risk management personnel within business line divisions. • • • • 2014 The Year of… 8 HOW DOES BT FINANCIAL GROUP MEET THE REQUIREMENTS OF APRA’S RISK MANAGEMENT PRUDENTIAL STANDARDS? Focusingg on BTFG’s risk management g framework,, controls assurance and how the three lines of defense provide the basis for annual attestations required under d CPS 220 220. 2014 The Year of… 9 2. OVERVIEW OF BT FINANCIAL GROUP’S RISK MANAGEMENT FRAMEWORK The Risk Management Framework enables a structured approach to risk and compliance management by the business. It provides: • a deep understanding by Management and Boards of their risks and obligations; • a reduction in incidents and overdue issues and satisfactory audit outcomes; • a platform for robust engagement with the regulators; and • support for BTFG’s growth objectives. 2014 The Year of… 10 2. OVERVIEW OF BT FINANCIAL GROUP’S RISK MANAGEMENT FRAMEWORK Compliance with the Risk Management Framework is monitored continuously and any material deviations or breaches are reported to Business Unit Risk Forums, BT Risk Review Committee, BT B d and, Boards d where h appropriate, i t R Regulators: l t 1st Line Monitors their control environment through management control self assessments and regular review i off kkey risks i k andd controls t l iindicators. di t 2nd Line BT Risk operates an independent controls assurance program to assess the effectiveness of controls t l th thatt mitigate iti t kkey risks i k andd achieve hi compliance obligations. BT Risk chairs an Assurance Tripartite attended by Internal Audit and External Audit to ensure coordination and alignment while executing the various Monitoring and Audit Plans throughout the year. 3rd Line 2014 The Year of… Evaluates, tests and reports on the adequacy and effectiveness of the 2nd Line and 1st line controls and monitoring that occur. 11 3. CONTROLS ASSURANCE FRAMEWORK WITHIN THE THREE LINES OF DEFENCE The diagram below illustrates the roles of the first, second and third lines of defence. First line of defence Second line of defence Third line of defence Business unit Risk Group Assurance Identify key Identify key compliance obligations Evaluation control framework Control C t l framework BT Risk Assurance & Monitoring Validate key controls • Control framework • Control self‐assessments • 1st line Monitoring activities Evaluation Second line of defence Validate key Validate key controls 2nd line Monitoring activities line Monitoring activities Comprehensive Assurance 2014 The Year of… Group Assurance “In a three lines of defence model, monitoring of controls should controls should occur at each line of defence.” Internal audits Internal audits External audit is part of the third line External audit is part of the third line of defence and they will evaluate and validate the BTFG internal control framework and key controls relating to their audits. 12 4. CONTROLS ASSURANCE BY THE SECOND LINE OF DEFENCE Purpose of Controls Assurance BU ) control environment • Provide assurance on the Business Unit ((“BU”) The BTFG Controls Assurance Function provides assurance to BTFG Governance Committees and Business Unit Management with assurance that the Business Control Environment is designed g and operating p g effectively. y This includes assurance on the components p of the BU’s control framework and validation of controls that mitigate key operational risks and support compliance plan obligations. The next slide notes the components of the Business Control Environment that will be evaluated in a 2 LOD review. • Monitor key risk indicators Provides business management with a view on the effectiveness of its controls and an ‘early warning’ of control weaknesses. Examples of these indicators include reports such as the monthly Single View of Issues and Incidents Report, incidents analysis, etc. • H Help l BUs BU enhance h its it control t l framework f k so that th t BU managementt can obtain bt i th the earliest li t insights on the effectiveness of its key controls that fulfil compliance plan obligations and mitigate key operational risks. 2014 The Year of… 13 4. CONTROLS ASSURANCE BY THE SECOND LINE OF DEFENCE Scope of 2 LOD Controls Assurance When performing reviews, the BTFG Controls Assurance Team will evaluate the holistic Business Control Environment includingg keyy components p such as: • Governance at the business unit level • Business process documentation • Risk assessment – risks and compliance obligations in the key business processes • Control activities - These are controls that mitigate key process risks and/or meet key compliance plan obligations. • Business Unit Management’s Management s monitoring of key controls (e.g. (e g controls self assessment assessment, compliance plans attestations, monitoring key indicators, etc) • Incident Management capability • Audit and Monitoring outcomes 2014 The Year of… 14 4. CONTROLS ASSURANCE BY THE SECOND LINE OF DEFENCE Development of BTFG’s Annual Assurance Plan Two main inputs into the development of the Annual Assurance Plan are: • Inherent risk assessments performed on each business unit (refer to Page 16) • BTFG’s Assurance universe (refer to Page 18) The following approach was taken to develop the Annual Assurance Plan. Risk Assessment and Assurance Universe Develop Plan • Inherent risk assessments completed for all business units • Establish BTFG’s Assurance Universe to ensure all areas that require assurance are considered Review Plan • Monitoring Team develops FY 2013 Plan based on risk assessments • BTFG Risk Leadership Team (RLT) and Business Unit managementt review Plan Share Plan • Share and align Plan with Internal and External auditors to ensure comprehensive coverage and prevent duplication in assurance work Approve Plan • The BTFG RLT and relevant Governance Committees approve the Pl Plan The following pages illustrate the Inherent Risk Assessment criteria and Assurance Universe. 2014 The Year of… 15 4. CONTROLS ASSURANCE BY THE SECOND LINE OF DEFENCE Inherent Risk Assessments The following four criteria were used to perform the Inherent Risk Assessment for each Business Unit. Existing risk assessments Nature of operations Changes in business In considering the nature of operations, the factors assessed were: Existing risk assessments: • Business unit risk maps • Risk and Control Management reviews (“RCM”) • Risk s Appetite ppe e S Statements ae e s (“RAS”) • extent of regulation within the business area (e.g. APRA, ASIC, ATO, ASX, etc) • nature of process, i.e. manual or automated • Key person risk • degree of touch points and handoffs between business units and teams (including to outsourced providers) • degree of complexity and the use of human judgement. 2014 The Year of… Internal Control Framework maturity The following were considered when assessing the internal control framework: Changes in strategy, significant projects and external environmental factors such as new regulatory reforms, industry changes, economic factors and natural/financial disasters. • Track T k recordd ffrom assurance activities • High and Medium rated incidents • Extent of key processes and controls in scope for external audits, investor statement audits, APRA returns, etc; and • Maturity of the first line of defence’s internal control framework, risk resources and business unit monitoring. 16 4. CONTROLS ASSURANCE BY THE SECOND LINE OF DEFENCE Inherent Risk Assessment output Summary of Inherent Risk Assessments by Business Unit Area BTFG Business Unit Business Unit 1 Business Unit 2 Business Unit 3 Business Unit 4 Business Unit 5 Business Unit 6 Business Unit 7 Business Unit 8 Business Unit 9 Business Unit 10 Business Unit 11 Business Unit 12 Business Unit 13 Business Unit 13 Business Unit 14 Business Unit 15 Business Unit 16 Business Unit 17 Business Unit 18 Business Unit 19 Business Unit 20 Business Unit 21 Business Unit 22 Business Unit 22 Business Unit 23 Business Unit 24 Business Unit 25 Business Unit 26 Business Unit 27 Business Unit 28 Offshore Service Provider Offshored Process 1 Offshored Process 2 Offshored Process 3 Offshored Process 4 Offshored Process 5 Offshored Process 6 Offshored Process 7 Offshored Process 8 Inherent Risk Rating BU Risk assessments BU Risk assessments Inherent Risk Risk Maps/ Risk appetite Legal/ Score RCAs statements Compliance obligations Manual/ automated) processing Nature of operations Nature of operations Key person Touch points risks and outsourcing Complexity and human judgement High Medium Medium Medium Medium Medium Medium High Medium Medium Medium Medium Medium Medium Medium Medium Medium Medium Medium Medium Medium Medium Medium Medium Medium Medium Medium Medium 3.8 2.9 2.8 3.2 3.3 2.7 3.5 3.8 3.3 2.8 3.2 3.0 2.8 3.7 3.1 3.5 3.4 3.5 2.8 3.1 3.2 32 3.2 3.2 3.1 3.2 3.5 3.6 3.2 3 2 2 2 2 2 2 2 2 2 3 2 N/A 3 3 3 3 3 3 3 3 3 3 3 3 3 4 3 4 2 2 2 4 N/A 5 5 N/A 4 4 3 N/A 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 5 5 5 5 4 4 5 5 4 5 5 5 4 5 5 5 5 5 5 5 5 5 5 5 5 5 4 4 4 3 2 2 3 3 4 4 5 3 3 3 3 3 5 5 5 5 3 3 5 3 3 2 4 4 3 4 1 4 4 2 5 3 2 2 3 1 2 3 2 2 1 1 1 1 1 1 1 1 1 1 5 1 2 1 4 3 3 5 3 3 3 3 2 4 4 4 2 5 4 5 5 4 4 4 3 4 4 2 5 4 3 4 5 4 4 2 5 5 4 4 4 2 2 2 4 5 2 5 3 5 2 5 5 5 5 5 3 4 5 4 Medium Medium Medium Medium Medium Medium Medium Medium 3.2 3.2 3.4 3.4 2.9 3.0 3.1 3.1 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 5 4 4 5 4 4 5 5 4 3 4 4 4 5 4 3 1 2 4 3 1 2 1 3 3 4 3 3 3 3 2 4 4 4 4 4 2 1 3 3 2014 The Year of… Changes in business Changes in business Internal control framework Internal control framework Changes from Project Impacts from Track record: External Audit Maturity of BU BSRs impacts external GA results & reliance first line of defence (business, IT, factors incidents product) 5 5 5 5 2 2 2 2 5 2 1 3 2 2 5 2 1 2 2 5 5 4 3 2 2 4 4 1 2 4 2 N/A 4 1 2 1 4 4 4 4 2 2 5 5 5 5 2 2 4 4 4 2 2 3 1 3 4 2 4 2 2 2 4 4 4 3 1 3 4 2 4 3 2 2 4 N/A 1 4 2 3 5 5 5 2 3 3 3 3 3 2 3 3 5 3 3 2 3 3 3 3 5 2 2 4 5 3 4 2 3 3 3 4 1 2 3 3 3 3 2 2 3 3 3 5 1 2 2 3 4 1 5 2 2 3 3 3 5 2 2 4 3 4 5 1 3 3 3 1 2 2 4 4 5 4 2 3 4 4 5 N/A 2 4 3 3 4 N/A 2 3 3 3 3 3 2 2 4 2 3 3 3 3 2 2 4 2 3 4 4 4 4 4 4 3 2 2 2 2 3 3 2 3 4 4 4 4 4 4 2 3 3 3 3 3 3 3 3 3 17 4. CONTROLS ASSURANCE BY THE SECOND LINE OF DEFENCE BTFG Assurance Universe REAT MIS Compliance Plans Equities MIS Compliance Plans Superannuation Compliance Plan Monthly Single View of Issues and Incidents Risk Appetite Statements (RAS) Risks and Controls Management (RCM) Emerging themes etc BTFG Business Units High and some Medium Risk BUs – from Annual Inherent Risk Assessment Wrap Compliance Plans (i I (i.e. Investment Wrap, Super Wrap and W S W d Asgard eWrap) General Insurance Compliance Plan Life Insurance Compliance Plan Offshored Processes BTFG Assurance Assurance Program High and some Medium Risk processes – from Annual Inherent Risk Assessment from Annual Inherent Risk Assessment Lenders Mortgage Insurance Compliance Plan Project Assurance j Advice Compliance Plan High risk and High priority projects Private Wealth Compliance Plan ASX Compliance Plans APRA Prudential Standards Monitoring Universe APRA Prudential Standards relevant to BTFG AFSL Compliance Obligations Sarbanes‐Oxley (“SOX”) Processes – y( ) DE and OE • BT Super • BT Platform • Equities AML and NCCP Compliance Obligations p g 2014 The Year of… 18 Questions? 19