Annual Report - Treasury Board of Canada Secretariat

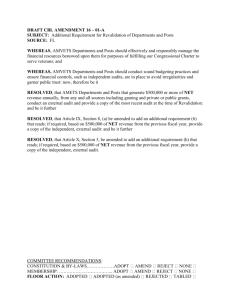

advertisement