Chapter 1 - Truckload Transportation

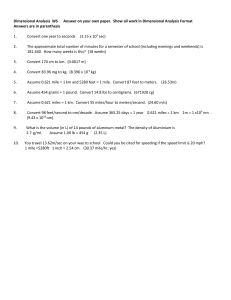

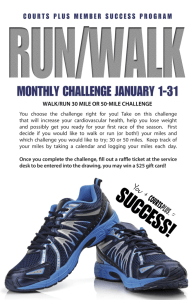

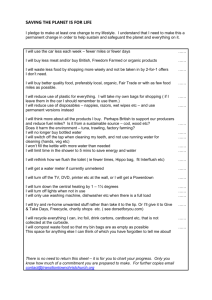

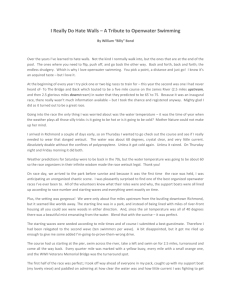

advertisement