The economic charts investment pros are watching

advertisement

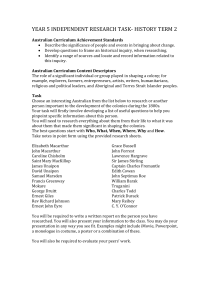

The economic charts investment pros are watching | afr.com TODAY'S PAPER VIDEOS INFOGRAPHICS Page 1 of 4 MARKETS DATA MY AFR LOGOUT search the AFR NEWS BUSINESS MARKETS STREET TALK REAL ESTATE OPINION TECHNOLOGY PERSONAL FINANCE LEADERSHIP LIFESTYLE ALL Home / Markets Jul 1 2015 at 4:34 PM | Updated Jul 1 2015 at 4:34 PM SAVE ARTICLE | PRINT REPRINTS & PERMISSIONS The economic charts investment pros are watching The Australian dollar, wages, bonds and unemployment are among the themes being watched by fund managers and economists. Jim Rice The new financial year has begun entrenched in global uncertainty. The headline act during the past few months has been Greece's messy negotiations with creditors, but the lift-off for United by Vanessa Desloires States interest rates is also drawing closer. At home, the Australian sharemarket has stemmed the losses from the sell-off in the big four banks, which was spurred on by the threat of increased capital requirements. But investors still have concerns the Reserve Bank of Australia may cut interest rates again if levels of business investment do not improve. With these factors as a backdrop, some of Australia's top fund managers, economists and analysts have their attention on a wide variety of financial data that will influence markets in the new financial year. RELATED ARTICLES Painful waiting game for investors The movement in the Australian dollar is high on Clime Asset Management chief investment officer John Abernethy's list. "It's my strong belief that the Australian dollar needs to weaken to below US70¢ if current commodity prices are maintained," he said. "Indeed, weakness against all currencies of our major trading partners is required. A cursory look at [the Australian dollar trade weighted index] shows that our currency remains elevated," he said. | Chinese market dives again as losses top $2.4tr since June 12 Polls swing towards 'Yes' as Tsipras digs in against bailout Former Italian PM Enrico Letta: Grexit will spark decline of Europe Crisis-weary Greeks take another deadline in stride http://www.afr.com/markets/the-economic-charts-investment-pros-are-watching-20150... 3/07/2015 The economic charts investment pros are watching | afr.com Alphinity Investment Management portfolio manager Andrew Martin said negative Page 2 of 4 LATEST STORIES revisions in the resources sector had driven the 2015 financial year to be one of no earnings growth on the Australian sharemarket. "Given the market price-earnings rating is a bit above long-term averages, we think some positive growth is needed to push the market forward from here. This will be helped by a weaker Australian dollar and company productivity initiatives," he said. Three of Australia's top economists, Saul Eslake, CommSec's Craig James and ANZ's Warren Hogan, are all looking at Australia's unemployment trend to guide interest rates, the Australian dollar, consumer spending, economic growth and the sharemarket. Popular online grammar course gets a second run 2 mins ago "At present, there are early signs that the jobless rate has peaked," Mr James said. "If this indeed turns out to be the case, then we should be confident that the nonmining recovery is gaining traction," Mr Hogan said. G8 lobs $162m takeover bid for Affinity 5 mins ago "It will also rule out the need for further rate cuts from the RBA ... it will be a signal to FX [foreign exchange] markets that the Australian dollar is supporting the economy and significant further depreciation is not likely." NAOS Asset Management chief investment officer Sebastian Evans said Australian wage price growth was a useful indicator for consumer and business confidence and the outlook for interest rate levels. "We believe they will continue to fall to offset wage price deflation against a backdrop of household debt to disposable income ratio, which remains above 150 per cent as the RBA tries to stimulate domestic economic activity," he said. Macquarie Securities Group head of economic research James McIntyre said weak wages growth and the shifting industry composition of Australian jobs were weighing on the pace of Australian household paypackets. "At present, the slowdown in household income growth is being offset by interest rate cuts and wealth effects from rising asset prices. To sustain spending, a pickup in income will be needed, or the RBA will need to further support spending through lowering rates to reduce debt-servicing costs," he said. Global bonds are also on many of the lists of economists and fund managers alike, as volatility increased on the back of a European economic stimulus program and a move towards higher interest rates in the US. TD Securities head of Asia Pacific research Annette Beacher said Australian government two-year bonds were still too attractive for global money, and the net yield keeping a floor on the Aussie dollar, and would see it remain above US75¢ by the end of 2015. K2 Asset Management portfolio manager Jeff Thomson said US bonds were a focus, particularly with the second-half big-ticket item of a US interest rate hike. "Bonds look especially vulnerable to any upside surprise in inflation and/or reacceleration of growth, which means rates go up further than is currently expected," he said. "Given historically low yields and tight spreads, the risk/reward for bonds looks unattractive, and perhaps now reflects a degree of complacency and overconfidence in central banks." WaveStone Capital principal Raaz Bhuyan said the US unemployment rate at 5.5 per cent, after reaching a peak of 10 per cent in 2009, was hardly a level requiring the monetary accommodation now in place. http://www.afr.com/markets/the-economic-charts-investment-pros-are-watching-20150... 3/07/2015 The economic charts investment pros are watching | afr.com Page 3 of 4 "Any normalisation in the rate environment will have a bearing on equity markets, in that performance will be driven by changes to companies' earnings and returns rather than a PE re-rating across the market," he said. However, Tim Carleton, Auscap Asset Management's portfolio manager, had his eye on China, arguing a big risk to the Australian economy was a recession in China, fuelled by an accumulation of bad debts against uneconomic property and infrastructure projects. One measure on Mr Carleton's radar is five-year Chinese government bonds, which he said were "slightly elevated". "A rising line indicates that the credit market is assessing that the risks of default are also rising, which we think is worth paying attention to," he said. RECOMMENDED FROM AROUND THE WEB Goldman follows Buffett's lead into big four banks SMSF deep dive: What you need to know about a self-managed fund Esuperfund Abbott rolls out the red carpet for Shorten Move from Excel to accounting software Xero Invest for the really long term Cheap night out ? Beware the taxman FIX MY TAX Business class is one of life's great luxuries Robo knows how to spot a good ETF Sydney Morning Herald Australia near 'bottom' among Asia-Pacific equity markets, says Deutsche Quiz: Which Melbourne suburb should you live in? Domain Blog Recommended by MY FINANCIAL REVIEW FAIRFAX BUSINESS MEDIA My Alerts | Create alert Portfolio Account My Saved Articles (0) Asset The Australian Financial Review Magazine BOSS BRW Chanticleer Luxury Rear Window Smart Investor The Sophisticated Traveller TOOLS Markets Data Australian Equities World Equities Commodities Currencies Derivatives Interest Rates Share Tables CONNECT WITH US YOUR OPINION IS IMPORTANT TO US GIVE FEEDBACK CHOOSE YOUR READING EXPERIENCE CONTACT & FEEDBACK FAQ Contact us Letters to the Editor Give feedback Advertise Reprints & Permissions ABOUT About us Our Events Digital Subscription Terms Newspaper Subscription Terms Site Map © Copyright 2015 Fairfax Media Publications Pty Ltd | Privacy | Terms & Conditions of Use http://www.afr.com/markets/the-economic-charts-investment-pros-are-watching-20150... 3/07/2015 The economic charts investment pros are watching | afr.com Page 4 of 4 http://www.afr.com/markets/the-economic-charts-investment-pros-are-watching-20150... 3/07/2015