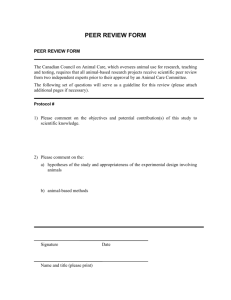

Questions and Answers About the AICPA Peer Review Program

advertisement