Environment Scan – 2012 - Innovation & Business Skills Australia

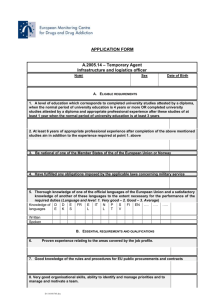

advertisement