DECEMBER 2014 AND JUNE 2015

SUPPLEMENT

Qualification Programme

Module C

Business Assurance

Published by BPP Learning Media Ltd.

The copyright in this publication is jointly owned by

BPP Learning Media Ltd and HKICPA.

All rights reserved. No part of this publication may be

reproduced or transmitted in any form or by any means

or stored in any retrieval system, electronic, mechanical,

photocopying, recording or otherwise without the prior

permission of the copyright owners.

©

HKICPA and BPP Learning Media Ltd 2014

ii

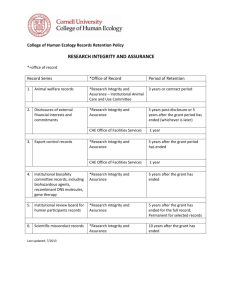

Changes at a glance

Changes at a glance

Amended on Learning Pack and Flashcards

Chapter Name

Supplement

Page

Technical Updates

Learning Pack

1

Scope of corporate governance

1

4

Code of ethics

2

5

Framework for assurance engagements

4

Audit related services and other assurance engagements

6

19

Flashcards

5

19

Appendix 1

Framework for assurance engagements

18

Audit related services and other assurance engagements

18

Revised Flashcards: Chapter 19: Audit related services and

other assurance engagements

19

iii

Business Assurance

Reminder of the examination

cut-off rule

HKICPA operates a 'cut-off' rule whereby students will only be examined on standards and

legislation that had been released on or before 31 May each year.

The same examinable contents applies to the December session of 2014 and the June

session of 2015. Examinable contents are applicable to both module and final examinations.

In determining what is examinable, reference must be made to both the release date of the

pronouncements (or the enactment date of the legislation) and their corresponding effective date.

Legislation and the Institute's pronouncements that meet the following conditions will be examined:

Condition 1: Have been released/enacted six months prior to the reference date of 1 December

2014 (cut-off being 31 May 2014) AND

Condition 2: Have been effective/will be effective on or before the 13th month from the

reference date i.e. 1 January 2016.

Examinable standards

You will find a list of the standards that are examinable in your examination session by logging onto

the HKICPA online QP Learning Centre.

iv

Introduction

Introduction

This Supplement has been produced for those candidates preparing for the December 2014 and

June 2015 examination sessions of the HKICPA Qualification Programme.

It is designed to be used in conjunction with the fourth edition of the Learning Pack, and it will bring

you fully up to date for developments that have occurred in the period since publication of the

Learning Pack and 31 May 2014, the cut-off date for examinable standards and legislation for the

December 2014 and June 2015 examinations.

The Supplement comprises a technical update on developments that will be examinable in

December 2014 and June 2015 examination sessions that are not currently covered in the

Learning Pack. The topics covered are listed on the contents page, and are covered in chapter

order.

In each case the text in the Supplement explains how the Learning Pack is affected by the change,

for example whether the new material should be read in addition to the current material in the

Learning Pack, or whether the new material should be regarded as a replacement.

Good luck with your studies!

v

Business Assurance

vi

December 2014 and June 2015 Supplement

Technical Update – Learning Pack

Chapter 1

Scope of corporate governance

A Guide on Better Corporate Governance Disclosure

In February 2014 HKICPA issued A Guide on Better Corporate Governance

Disclosure. The following information should be read in conjunction with

section 1.6 Chapter 1 of the Learning Pack.

The aim of this Guide is to encourage meaningful corporate governance

disclosures by Hong Kong listed companies under the revised Code which took

effect in 2012. It contains four sections and within each section a number of

'themes' are addressed. The themes are key areas that disclosures should

address. These are as follows:

(1)

The board: its role, what it did during the year and how

Theme A: The board's key roles are setting the issuer's strategy and

monitoring the management’s performance.

Theme B: A good board process facilitates the operation of the board.

Theme C: The board’s work during the year and how it is linked to the

issuer’s strategy.

(2)

Accountability and audit: internal controls – sound and effective controls

Theme A: The issuer has to maintain a sound internal controls system.

Theme B: The board is responsible for the issuer's maintaining a sound

internal controls system and should acknowledge this in the Corporate

Governance report.

Theme C: The board has to review the system’s effectiveness and report

to the shareholders at least on an annual basis.

Theme D: Report users, including investors, would also appreciate a high

level description of key risks facing the company, their impact and the

mitigating measures taken.

(3)

Accountability and audit: audit committee – rigorous and effective

oversight

Theme A: Audit committee members, in particular its chairman, must

possess the right skills and experience to effectively carry out their

responsibilities.

Theme B: A good process facilitates the working of the audit committee.

Theme C: The audit committee should carry out its responsibilities in an

objective and conscientious manner, to effectively monitor the integrity of

the company's financial reporting and maintain oversight of its internal

control and risk management systems and other relevant internal

processes, as stated in its terms of reference.

Theme D: In fulfilling its responsibilities, the audit committee should

engage with and assess the effectiveness of the work of external and

internal auditors.

1

Business Assurance

Theme E: In addition, investors would also be interested to know how the

audit committee's focus, including new areas of focus, during the year link

to the issuer’s strategy, development and changing risks.

(4)

Communication with shareholders: encouraging participation by

shareholders

Theme A: The board should maintain effective on-going dialogue with

shareholders.

Theme B: AGMs are a special focus of the shareholders' communication

policy and should be treated as an opportunity to enhance two-way

communication with shareholders.

Directors' Duties

Add the text below to Chapter 1 section 4.1 of the Learning Pack.

The new Companies Ordinance has introduced a statutory statement to provide

clear guidance to directors on their duty of skill, care and diligence. The old

ordinance did not contain any provisions on this area, and the common law

position in Hong Kong was not entirely clear. The Companies Ordinance now

states that a director must exercise reasonable care, skill and diligence, and it

sets out a mixed objective and subjective test to be applied in determining the

standard required. The objective test refers to the general degree of knowledge,

skill and experience that may reasonably be expected of a person carrying out

the functions of the director in question.

Chapter 4

Code of ethics

A number of changes have been made to the Code of Ethics for Professional

Accountants.

These include the following:

A change to the definition of those charged with governance as follows:

The person(s) or organizations(s) (for example, a corporate trustee) with

responsibility for overseeing the strategic direction of the entity and obligations

related to the accountability of the entity. This includes overseeing the financial

reporting process. For some entities in some jurisdictions, those charged with

governance may include management personnel, for example, executive

members of a governance board of a private or public sector entity, or an ownermanager.

A revision of the requirements dealing with breaches resulting in a more

robust framework for dealing with these situations.

More specific requirements and comprehensive guidance regarding the

identification and managing of conflicts.

As a result of the changes to guidance on conflicts of interest sections 4.1 and

4.2 of Chapter 4 should be replaced with the following text.

Conflicts of interest

A conflict of interest may be created when:

The professional accountant provides a professional service related to a

particular matter for two or more clients whose interests with respect to that

matter are in conflict; or

2

December 2014 and June 2015 Supplement

The interests of the professional accountant with respect to a particular matter

and the interests of the client for whom the professional accountant provides a

professional service related to that matter are in conflict.

Examples of situations in which conflicts of interest may arise provided by the

Code of Ethics (s. 220) include the following:

Providing a transaction advisory service to a client seeking to acquire an

audit client of the firm, where the firm has obtained confidential

information during the course of the audit that may be relevant to the

transaction

Advising two clients at the same time who are competing to acquire the

same company where the advice might be relevant to the parties'

competitive positions

Providing services to both a vendor and a purchaser in relation to the

same transaction

Representing two clients regarding the same matter who are in a legal

dispute with each other

Providing strategic advice to a client on its competitive position while

having a joint venture or similar interest with a major competitor of the

client

Advising a client on the acquisition of a business which the firm is also

interested in acquiring

Evaluating potential issues

One of the key principles that the professional accountant must consider when

evaluating issues relating to conflicts of interest is whether a reasonable and

informed third party would be likely to conclude that compliance with the

fundamental principles of the Code have not been compromised.

The Code requires that an effective conflict identification process should be in

place. The nature of this process will depend on factors including:

The nature of the professional service provided

The size of the firm

The size and nature of the client base

The structure of the firm, for example the number and geographic

location of the offices

Identified conflicts of interest

If a conflict of interest is identified the professional accountant is required to

evaluate:

The significance of the relevant interests or relationships

The significance of the threats created by performing the service

Safeguards

It may be necessary to apply safeguards in order to eliminate threats or reduce

them to an acceptable level. The Code provides the following examples of

relevant safeguards:

Implementing procedures to prevent unauthorised disclosure of

confidential information. This could include:

-

Using separate teams

-

Creating separate areas of practice for speciality functions within the

firm

3

Business Assurance

-

Establishing policies and procedures to limit access to client files,

the use of confidentiality agreements and/or the physical and

electronic separation of confidential information

Regular review of the application of safeguards by a senior individual not

involved in the engagement

Review of the work performed by an individual not involved in the

engagement

Consulting with third parties, such as a professional body, legal counsel

or another professional accountant

In addition, the nature of the conflict of interest and the related safeguards if any,

should be disclosed to the clients affected, and when safeguards are required,

their consent must be obtained to the professional accountant performing the

service.

If explicit consent is requested from a client and the consent is refused, the

professional accountant should decline the engagement or discontinue the

service (or terminate other relationships which are the cause of the conflict).

Safeguards insufficient

If safeguards cannot reduce the threat created by the conflict of interest to an

acceptable level the professional accountant must decline the engagement or

discontinue the service. Alternatively the relationship/interest causing the conflict

could be terminated/disposed of.

Conflicts of interest – professional accountant in business

More comprehensive guidance is also provided for the professional accountant in

business (s.310).

Chapter 5

Framework for assurance engagements

Hong Kong Standards on Auditing

The table in section 1 of Chapter 5 which lists the Hong Kong Standards in issue

should be amended as follows:

Hong Kong Framework for Assurance Engagements (Amended)

HKSA 610 (Revised 2013) Using the Work of Internal Auditors

HKSAE 3000 (Revised) Assurance Engagements Other than Audits or Reviews

of Historical Financial Information

A new standard, HKSIR 500 Reporting on Profit Forecasts, Statements of

Sufficiency of Working Capital and Statements of Indebtedness was issued in

April 2014 and has an effective date of 1 July 2014.

Hong Kong Framework for Assurance Engagements

An amended Framework was issued in March 2014 to take in to account

conforming amendments resulting from the release of HKSAE 3000 (Revised)

Assurance Engagements other than Audits or Reviews of Historical Financial

Information.

4

December 2014 and June 2015 Supplement

All references to HKSAE 3000 in Chapter 5 should be to HKSAE 3000 (Revised).

Section 2.2 of Chapter 5 should be replaced with the following material:

2.2 Elements of an assurance engagement

Key term

An assurance engagement is an engagement in which a practitioner aims to

obtain sufficient appropriate evidence in order to express a conclusion designed

to enhance the degree of confidence of the intended users other than the

responsible party about the outcome of the measurement or evaluation of an

underlying subject matter against criteria (Framework para 10).

The following changes should be made to section 2.3.

2.3.1 A three party relationship

The reference to a direct reporting engagement should be deleted.

2.3.4 Sufficient appropriate evidence

This section should be replaced with the following text.

The practitioner plans and performs an assurance engagement with professional

scepticism in order to obtain sufficient appropriate evidence in the context of the

engagement about the reported outcome of the measurement or evaluation of

the underlying subject matter against criteria. The practitioner considers

materiality assurance engagement risk (see section 2.3.6 below) and the quantity

and quality of evidence when planning and performing the engagement, in

particular when determining the nature, timing and extent of evidence gathering

procedures.

Sufficiency is about the quantity of evidence.

Appropriate is about quality of evidence (relevance and reliability).

2.3.5 Written assurance report

This section should be replaced with the following text.

In a reasonable assurance engagement the practitioner’s conclusion is

expressed in the positive form that conveys the practitioner’s opinion on the

outcome of the measurement or evaluation of the underlying subject matter.

In a limited assurance engagement, the practitioner’s conclusion is expressed

in a form that conveys whether, based on the engagement performed, a

matter(s) has come to the practitioner’s attention to cause the practitioner to

believe the subject matter information is materially misstated.

(This is discussed further in section 2.4 and Chapter 19.)

2.4 Types of assurance engagement

The text in this section should be replaced with the following.

In accordance with the amended Framework and HKSAE 3000 (Revised)

Assurance Engagements other than Audits of Historical Financial Information an

assurance engagement will be classified on two dimensions:

An assurance engagement will be either a reasonable assurance engagement

or a limited assurance engagement (Framework paras 14 –15).

5

Business Assurance

An assurance engagement will be either an attestation engagement or a direct

engagement (Framework paras 12 – 13).

Attestation engagements and direct engagements are discussed further in

Chapter 19.

2.4.2 Limited level of assurance

The text in this section should be replaced with the following.

Engagement risk must be reduced to an acceptable level under the

circumstances but that risk will be greater than for a reasonable assurance

engagement.

For example: A review performed in accordance with HKSRE 2400 (Revised)

Engagements to Review Historical Financial Statements is a limited assurance

engagement.

The conclusion is expressed in 'negative terms' for example:

'Based on the procedures performed and evidence obtained, nothing has come

to our attention that causes us to believe that the entity has not complied, in all

material respects with XYZ law' (Framework para 86).

Section 4.3 Investment circular reporting engagements

The reference to HKSIR 300 Accountants’ Reports on Pro Forma Financial

Information in Investment Circulars should be deleted as it has been replaced by

HKSAE 3420.

Chapter 19

Audit-related services and other assurance engagements

Section 2.1 of Chapter 19 of the Learning Pack should be replaced with the

following material.

HKSAE 3000 (Revised) Assurance Engagements other than Audits or

Reviews of Historical Financial Information

HKSAE 3000 (Revised) Assurance Engagements other than Audits or Reviews

of Historical Financial Information was issued in March 2014 and is effective for

assurance reports dated on or after 15 December 2015. This revised standard

has also resulted in an Amended Framework (see Chapter 5) and conforming

amendments to:

HKSAE 3402 Assurance Reports on Controls at a Service Organisation

HKSAE 3410 Assurance Engagements on Greenhouse Gas Statements

HKSAE 3420 Assurance Engagements to Report on the Compilation of Pro

Forma Financial Information Included in a Prospectus

Assurance engagements

As seen in Chapter 5 an assurance engagement is defined as:

'An engagement in which a practitioner aims to obtain sufficient appropriate

evidence in order to express a conclusion designed to enhance the degree of

confidence of the intended users other than the responsible party about the

subject matter information (that is, the measurement or evaluation of an

underlying subject matter against criteria).' (HKSAE (Revised) 3000.12)

6

December 2014 and June 2015 Supplement

An assurance engagement will be classified on two dimensions.

An assurance engagement will be either:

(i)

A reasonable assurance engagement – an engagement in which the

practitioner reduces engagement risk to an acceptably low level in the

circumstances of the engagement as the basis for the practitioner’s

conclusion. The practitioner’s conclusion is expressed in a form that

conveys the practitioner’s opinion on the outcome of the measurement or

evaluation of the underlying subject matter against criteria.

(ii)

A limited assurance engagement – an assurance engagement in which

the practitioner reduces engagement risk to a level that is acceptable under

the circumstances of the engagement but where that risk is greater than for

a reasonable assurance engagement as the basis for expressing a

conclusion in a form that conveys whether, based on the procedures

performed and evidence obtained, a matter(s) has come to the practitioner’s

attention to cause the practitioner to believe the subject matter information is

materially misstated. The nature, timing and extent of procedures performed

in a limited assurance engagement is limited compared to that necessary in

a reasonable assurance engagement but is planned to obtain a level of

assurance that is, in the practitioner’s professional judgment, meaningful. To

be meaningful, the level of assurance obtained by the practitioner is likely to

enhance the intended users’ confidence about the subject matter information

to a degree that is clearly more than inconsequential.

An assurance engagement will be either:

(i)

An attestation engagement – an assurance engagement in which a

party other than the practitioner measures or evaluates the underlying

subject matter against the criteria. A party other than the practitioner also

often presents the resulting subject matter information in a report or

statement. In some cases however, the subject matter information may

be presented by the practitioner in the assurance report. In an attestation

engagement, the practitioner’s conclusion addresses whether the subject

matter information is free from material misstatement.

(ii)

A direct engagement – an assurance engagement in which the

practitioner measures or evaluates the underlying subject matter against

the applicable criteria and the practitioner presents the resulting subject

matter information as part of, or accompanying, the assurance report. In

a direct engagement, the practitioner’s conclusion addresses the

reported outcome of the measurement or evaluation of the underlying

subject matter against the criteria.

Examples of an attestation engagement include the following:

Providing assurance on a sustainability performance report prepared by

management/management’s expert

Providing assurance on a statement by another party of compliance with

law or regulations

Providing assurance on a value for money assessment made by another

party

7

Business Assurance

Acceptance and continuance

In accordance with HKSAE 3000 (Revised) the practitioner is required to comply

with relevant ethical requirements. In addition the pre-conditions for an

assurance engagement must exist (HKSAE (Revised) 3000.24) in order to

determine whether this is the case the practitioner must discuss the following

with the appropriate party:

(a)

Whether the roles and responsibilities of the appropriate parties are

suitable in the circumstances, and

(b)

Whether the engagement exhibits all of the following characteristics:

(i)

The underlying subject matter is appropriate

(ii)

The criteria that the practitioner expects to be applied in the

preparation of the subject matter information are suitable for the

engagement circumstances, including that they exhibit the

characteristics of relevance, completeness, reliability, neutrality

and understandability

(iii)

The criteria that the practitioner expects to be applied in the

preparation of the subject matter information will be available for

the intended users

(iv)

The practitioner expects to be able to obtain the evidence

needed to support the practitioner’s conclusion

(v)

The practitioner’s conclusion is to be contained in a written report

(vi)

A rational purpose including in the case of a limited assurance

engagement, that the practitioner expects to be able to obtain a

meaningful level of assurance

If the preconditions for an assurance engagement do not exist and changes are

not made, the practitioner should not accept the engagement as an assurance

engagement.

Quality control

The engagement partner is responsible for quality control. He must ensure that

he has sufficient competence to accept this responsibility and must ensure that

the engagement team is sufficiently competent and capable. Where law or

regulation requires it, quality control reviews must be conducted.

Planning and performing the engagement

HKSAE 3000 (Revised) requires the practitioner to plan and perform the

engagement with professional scepticism and to exercise professional judgment.

The practitioner is also required to plan the engagement so that it will be

performed in an effective manner and will achieve the practitioner’s objectives.

Examples of the main matters that may be considered include (HKSAE (Revised)

3000.A86-89):

8

The circumstances of the engagement that define its scope

The expected timing and nature of the communications required

The results of engagement acceptance activities

December 2014 and June 2015 Supplement

The engagement process

The practitioner’s understanding of the appropriate party and their

environment, including the risks that the subject matter information may

be materially misstated

Identification of the intended users and their information needs, and

consideration of materiality and the components of engagement risk

The extent to which fraud is relevant

The nature, timing and extent of resources necessary to perform the

engagement, such as personnel and expertise requirements, including

the nature and extent of expert’s involvement

The impact of the internal audit function on the engagement

If the practitioner discovers, after the engagement has been accepted that not all

the preconditions for the assurance engagement are present, the practitioner

must assess whether the matter can be resolved. The practitioner must decide

whether they should continue with the engagement and whether the matter

should be reported in the assurance report, and if so how (HKSAE (Revised)

3000.42).

The practitioner may also discover after the engagement has been accepted that

some of the applicable criteria are unsuitable or some or all of the underlying

subject matter is not appropriate. In this situation the practitioner will consider

withdrawing from the engagement (if this is allowed by law or regulation). If the

practitioner continues the impact of these issues on the assurance report must be

considered. A qualified or adverse conclusion must be expressed or a disclaimer of

conclusion depending on the circumstances (HKSAE (Revised) 3000.43).

Materiality

The practitioner must consider materiality in order to determine the nature, timing

and extent of procedures and to determine whether the subject matter is free

from material misstatement. HKSAE (Revised) 3000.A92 states that materiality is

not affected by the level of assurance provided by the engagement because

materiality is based on the information needs of the intended users. This means

that materiality for a reasonable assurance engagement is the same as for a

limited assurance engagement.

Understanding the underlying subject matter and other engagement

circumstances.

The practitioner must obtain an understanding of the underlying subject matter.

The extent of the work and the nature of the procedures performed will depend of

whether the engagement is a limited or reasonable assurance engagement

(HKSAE (Revised) 3000.45).

Obtaining evidence

The practitioner must consider the following:

Risk consideration and responses to risk

Relevance and reliability of information used as evidence

Whether the work of a practitioner’s expert is expected to be used

9

Business Assurance

Whether the work of another practitioner, a responsible party’s or

measurer’s or evaluator’s expert or an internal auditor is expected to be

used

Written representations from appropriate parties will also be sought.

Subsequent events

When relevant the practitioner is required to consider the effect of events up to the

date of the assurance report and must also act appropriately where facts become

known after the date of the assurance report which may have caused the report to

be amended had they been known at the time. The practitioner does not have a

responsibility, however, to perform any specific procedures regarding the subject

matter after the date of the assurance report (HKSAE (Revised) 3000.61).

Assurance report

HKSAE (Revised) 3000.69 requires that the assurance report contains the

following basic elements at a minimum:

10

(a)

A title that clearly indicates that the report is an independent assurance

report

(b)

An addressee

(c)

An identification or description of the level of assurance obtained by the

practitioner, the subject matter information, and when appropriate, the

underlying subject matter. When the practitioner’s conclusion is phrased

in terms of a statement made by the appropriate party, that statement

shall accompany the assurance report, be reproduced in the assurance

report or be referenced therein to a source that is available to the

intended users

(d)

Identification of the applicable criteria

(e)

Where appropriate, a description of any significant inherent limitations

associated with the measurement or evaluation of the underlying subject

matter against the applicable criteria

(f)

When the applicable criteria are designed for a specific purpose, a

statement alerting readers to this fact and that, as a result, the subject

matter information may not be suitable for any other purpose

(g)

A statement to identify the responsible party and the measurer or

evaluator if different, and to describe their responsibilities and the

practitioner’s responsibilities

(h)

A statement that the engagement was performed in accordance with

HKSAE 3000 or where there is a subject-matter specific HKSAE, that

HKSAE

(i)

A statement that the firm of which the practitioner is a member applies

HKSQC 1, or other professional requirements, or requirements in law or

regulation, that are at least as demanding as HKSQC 1.

(j)

A statement that the practitioner complies with the independence and

other ethical requirements of the Code, or other professional

requirements, or requirements imposed by law or regulation, that are at

least as demanding as Parts A, B and D of the Code related to

assurance engagements.

December 2014 and June 2015 Supplement

(k)

(l)

An informative summary of the work performed as a basis of the

practitioner’s conclusion. In the case of a limited assurance engagement,

an appreciation of the nature, timing, and extent of procedures

performed is essential to understanding the practitioner’s conclusion. In a

limited assurance engagement, the summary of the work performed shall

state that:

(i)

The procedures performed in a limited assurance engagement

vary in nature and timing from, and are less in extent than for, a

reasonable assurance engagement; and

(ii)

Consequently, the level of assurance obtained in a limited

assurance engagement is substantially lower than the assurance

that would have been obtained had a reasonable assurance

engagement been performed.

The practitioner’s conclusion:

(i)

When appropriate, the conclusion shall inform the intended users

of the context in which the practitioner’s conclusion is to be read.

(ii)

In a reasonable assurance engagement, the conclusion shall be

expressed in a positive form.

(iii)

In a limited assurance engagement, the conclusion shall be

expressed in a form that conveys whether, based on the

procedures performed and evidence obtained, a matter(s) has

come to the practitioner’s attention to cause the practitioner to

believe that the subject matter information is materially

misstated.

(iv)

The conclusion in (ii) or (iii) shall be phrased using appropriate

words for the underlying subject matter and applicable criteria

given the engagement circumstances and shall be phrased in

terms of (a) the underlying subject matter and applicable criteria,

(b) the subject matter information and the applicable criteria, or

(c) a statement made by the appropriate party.

(v)

When the practitioner expresses a modified conclusion, the

assurance report must contain a section that provides a

description of the matter(s) giving rise to the modification and a

section that contains the practitioner’s modified conclusion.

(m)

The practitioner’s signature

(n)

The date of the assurance report

(o)

The location in the jurisdiction where the practitioner practices

An example of a conclusion expressed in a form appropriate for a reasonable

assurance engagement would be:

'In our opinion, the entity has complied, in all material respects, with XYZ law.'

An example of a conclusion expressed in a form appropriate for a limited

assurance engagement would be:

'Based on the procedures performed and evidence obtained, nothing has come

to our attention that causes us to believe that the entity has not complied, in all

material respects, with XYZ law.'

11

Business Assurance

The assurance report may also include an Emphasis of Matter paragraph or an

Other Matter paragraph (HKSAE (Revised) 3000.73).

Modified conclusions

Where a scope limitation exists and the effect of the matter could be material the

practitioner must express a qualified conclusion or a disclaimer of conclusion.

Where the subject matter information is materially misstated the practitioner must

express a qualified conclusion or an adverse conclusion.

Conforming amendments

Conforming amendments have been made to a number of other HKSAEs as a

result of the issue of HKSAE 3000 (Revised).

HKSAE 3402 Assurance Reports on Controls at a Service Organisation

The following should be read in conjunction with section 2.1.3 of Chapter 19.

The conforming amendments are effective for assurance engagements where

the assurance report is dated on or after 15 December 2015. The following

points should be noted:

There are a number of changes in terminology:

Old terminology

New terminology

Professional accountant in public practice

Practitioner

Assertion-based engagement

Attestation engagement

Direct reporting engagement

Direct engagement

Assertion

Statement

All references to HKSAE 3000 are replaced with references to HKSAE

3000 (Revised).

The definition of the internal audit function has been revised as follows:

'A function of an entity that performs assurance and consulting activities

designed to evaluate and improve the effectiveness of the entity’s

governance, risk management and internal control procedures.'

The content of the service auditor’s assurance report has been revised

to include a statement that the firm of which the practitioner is a member

applies HKSQC 1 or other professional requirements, or requirements in

law or regulation, that are at least as demanding as HKSQC 1. A

statement must also be included that the practitioner complies with

independence and other ethical requirements of the Code or other

professional requirements that are equally demanding.

HKSAE 3410 Assurance Engagements on Greenhouse Gas Statements

The following should be read in conjunction with section 2.1.4 of Chapter 19.

The conforming amendments are effective for assurance engagements where

the assurance report is dated on or after 15 December 2015. The following

points should be noted:

12

As above, 'assertion-based' engagement has been replaced with

'attestation engagement' and 'direct-reporting engagement' is now 'direct

engagement'.

December 2014 and June 2015 Supplement

All references to HKSAE 3000 are replaced with references to HKSAE

3000 (Revised).

Guidance on the practitioner’s responsibilities to read other information

have been clarified.

The content of the assurance report has been revised. It must now

include an identification and description of the level of assurance

(reasonable or limited) obtained by the practitioner. A statement must be

made that the firm of which the practitioner is a member applies HKSQC

1 or other professional requirements, or requirements in law or

regulation, that are at least as demanding as HKSQC 1. A statement

must also be included that the practitioner complies with independence

and other ethical requirements of the Code or other professional

requirements that are equally demanding.

The conforming amendments remove the reference to a negative form of

conclusion for a limited assurance engagement. This has been reworded

as follows:

'In a limited assurance engagement, the conclusion shall be expressed in a form

that conveys whether, based on procedures performed and evidence obtained, a

matter(s) has come to the practitioner’s attention to cause the practitioner to

believe that the GHG statement is prepared, in all material respects, in

accordance with the applicable criteria.'

Also a point has been added stating that where a modified conclusion is

given, the matters giving rise to the modification must be described.

HKSAE 3420 Assurance Engagements to Report on the Compilation of Pro

Forma Financial Information Included in a Prospectus

The following should be read in conjunction with section 3 of Chapter 19.

The conforming amendments are effective for assurance engagements where

the assurance report is dated on or after 15 December 2015. The following

points should be noted:

The content of the assurance report has been revised. It must now

include an identification and description of the level of assurance

(reasonable or limited) obtained by the practitioner. A statement must be

made that the firm of which the practitioner is a member applies HKSQC

1 or other professional requirements, or requirements in law or

regulation, that are at least as demanding as HKSQC 1. A statement

must also be included that the practitioner complies with independence

and other ethical requirements of the Code or other professional

requirements that are equally demanding.

The following additional paragraphs should be added to the example

report in section 3.3.1 of Chapter 19 above the Practitioner’s

Responsibilities section.

'Our independence and quality control

We have complied with the independence and other ethical requirements of

the Code of Ethics for Professional Accountants issued by the Hong Kong

Institute of Certified Public Accountants, which is founded on fundamental

principles of integrity, objectivity, professional competence and due care,

confidentiality and professional behaviour.

13

Business Assurance

The firm applies Hong Kong Standard on Quality Control 1 and accordingly

maintains a comprehensive system of quality control including documented

policies and procedures regarding compliance with ethical requirements,

professional standards and applicable legal and regulatory requirements.'

HKSIR 300 Accountants report on pro forma financial information in

investment circulars

Section 3.4 of Chapter 19 should be deleted as HKSIR 300 is replaced by

HKSAE 3420.

HKSIR 500 Reporting on profit forecasts, statements of sufficiency and

statements of indebtedness

This is a new standard which was issued in April 2014 and is effective where the

investment circular is dated on or after 1 July 2014. The following material should

be added to Chapter 19.

1 Introduction

HKSIR 500 Reporting on Profit Forecasts, Statements of Sufficiency and

Statements of Indebtedness provides guidance for accountants when reporting

on specific types of information included in an investment circular. An investment

circular is issued by an entity for the use of third parties to assist them in making

investment decisions, for example when there is a new listing of equity securities.

Rules Governing the Listing of Securities on the Stock Exchange of Hong Kong

Limited (Listing Rules) and the Rules Governing the Listing of Securities on the

Growth Enterprise Market Operated by the Stock Exchange of Hong Kong

Limited (GEM Rules) set out the reporting requirements that companies must

follow:

Profit forecasts

There is no specific requirement that an investment circular should incorporate a

profit forecast, however where it is included it must be clear, unambiguous and

presented in an explicit manner. The principal assumptions on which it is based

must be stated and it must be prepared on a basis that is consistent with the

accounting policies normally adopted by the entity (HKSIR 500.4).

Statement of sufficiency of working capital

The Listing Rules and GEM Rules require that an investment circular relating to a

new listing of equity securities must include a statement by the directors that in their

opinion the working capital available to the group is sufficient for the group’s present

requirements (that is for at least the next 12 months from the date of publication of

the investment circular) or if not, how the directors propose to provide that additional

working capital required (HKSIR 500.9).

Statement of indebtedness

The Listing Rules and GEM Rules require that an investment circular relating to a

new listing of equity securities must include a statement as at the most recent

practicable date (normally no more than two months before the issue of the

investment circular) of the total amount of debt securities, borrowings,

indebtedness, mortgages, charges, contingent liabilities and guarantees (HKSIR

500.13).

14

December 2014 and June 2015 Supplement

2 Directors' responsibilities

HKSIR 500 makes it clear that the directors are solely responsible for the

preparation of the profit forecast, working capital statement and indebtedness

statement (HKSIR 500.16).

3 Reporting accountant's responsibilities: Profit forecasts

The reporting accountant is required to report (normally in a letter) on the

accounting policies and the calculations used for the forecast. In order to do this

the accountant must plan and perform the work in accordance with HK SIR 500

and HKSAE 3000. Typically the following procedures will be required:

Obtain the board memorandum prepared by the directors.

Review the issuer’s recent history regarding the general nature of its

activities, its main products, markets, customers, suppliers and so on.

Discuss the plans, strategic and risk analysis with the directors.

Consider the consistency of underlying assumptions with the business

analysis of the directors and assess the source and reliability of the

evidence supporting management’s best-estimate assumptions.

Establish which accounting policies have been adopted by the issuer in

published financial statements so as to ensure that they are acceptable

and have been consistently applied in the preparation of interim

accounts and the profit forecast.

Consider the assumptions on which the profit forecast has been based in

the course of their work to determine that the profit forecast is consistent

with and has been properly compiled on the basis of the assumptions

made by the directors.

Read the minutes of the board and of other important management

meetings which contain key factors that might affect the forecast.

Check the arithmetical accuracy of the forecast and the supporting

information.

Obtain written representations from the board of directors regarding the

intended use of the profit forecast, the completeness of significant

management assumptions and management’s acceptance of its

responsibility for the profit forecast.

Reporting accountant’s letter

The letter is addressed to the directors and the sponsors and would normally

include the following:

A specific identification of the profit forecast and documents to which the

letter refers

The fact that the directors are solely responsible for the profit forecast

The fact that the reporting accountants have reviewed the accounting

policies and calculations used in arriving at the profit forecast

If, as will frequently be the case, the reporting accountants have not

carried out an audit of results for the expired period, a statement to that

effect

15

Business Assurance

Whether in the opinion of the reporting accountant the profit forecast, so

far as the accounting policies and calculations are concerned, has been

properly compiled on the basis of the assumptions made by the

directors, as set out in the document, and is presented on a basis

consistent with the accounting policies normally adopted by the issuer

An example of a letter on a profit forecast is provided in HKSIR 500 Appendix 1.

4 Reporting accountant’s responsibilities: Reporting on statements of

sufficiency of working capital

The reporting accountant is required to plan and perform work in accordance

with HKSIR 500 and HKSAE 3000. The degree of work required will in part

depend on the reliability of forecasts made in the past and the extent of the

surplus of resources over those required. The approach adopted will be similar to

that for the profit forecast together with the following procedures:

Comparing the forecast with the group’s existing financing facilities and

cash resources, or that are to become available to the group;

Independently obtaining direct confirmation from the appropriate third party

of the extent of financing facilities and resources available to the group;

Considering adjustments for items such as capital expenditure and

prepayments which exert no impact on the profit forecast but may

significantly impact the working capital forecast; and

Considering management’s sensitivity analysis and the extent of any

margin or headroom.

Letter on statement of sufficiency of working capital

The following is an extract from a letter on a statement of sufficiency of working

capital as provided by HKSIR 500 Appendix 2.

'Opinion

On the basis of our procedures, we report that:

(a)

In our opinion, the statement has been made by the directors of the

company after due and careful enquiry; and

(b)

The persons or institutions providing finance have confirmed in writing the

existence of such facilities as of (date) that are shown to be required by

the company’s working capital forecast.'

5 Reporting accountant’s responsibilities: Reporting on statements of

indebtedness

When issuing a letter on a statement of indebtedness the reporting accountant

will perform a range of agreed upon procedures which are agreed with the entity

issuing the information. The work is performed in accordance with HKSIR 500

and HKSRS 4400. Typically procedures would include the following:

16

Obtaining the schedule of indebtedness prepared by the directors

including a complete list of bankers and other lenders of the group;

Agreeing amounts to the issuer’s records;

Obtaining bank reconciliations;

December 2014 and June 2015 Supplement

Checking that cash book figures are included in the schedule of

indebtedness;

In respect of debt securities, checking the amounts to underlying

agreements;

Comparing amounts disclosed in respect of mortgages and charges to

bank confirmations received directly by the reporting accountants or, in

the absence of such, to loan agreements or similar documents;

Obtaining direct confirmation from banks and other lenders and finance

providers regarding the amounts of term loans and other borrowings or

indebtedness in the nature of borrowing outstanding at the relevant date

and whether the amounts are secured or if such confirmation has not

been received, setting out the alternative evidence in support of the

amount; and

Obtaining written representations from the issuer’s directors regarding

the completeness and accuracy of the amounts disclosed in the

schedule of indebtedness.

Letter on a statement of indebtedness

Appendix 3 of HKSIR 500 includes an example of a letter on a statement of

indebtedness. The precise detail will depend on the nature of the procedures

agreed with the entity.

17

Business Assurance

Technical Update – Flashcards

Chapter 5

Framework for assurance engagements

On page 32 replace text describing an assurance engagement as follows:

An assurance engagement is an engagement in which a practitioner aims to

obtain sufficient appropriate evidence in order to express a conclusion designed

to enhance the degree of confidence of the intended users other than the

responsible party about the outcome of the measurement or evaluation of an

underlying subject matter against criteria.

On page 33 replace the text under the heading 'Assurance given' as

follows:

An assurance engagement can be a reasonable assurance engagement or a

limited assurance engagement. Absolute assurance cannot be given.

On page 33 change the second bullet point in the 'Reporting' box as

follows:

Limited assurance is expressed in negative terms.

On page 37 First bullet point

Reference to HKSAE 3000 should be changed to HHSAE 3000 (Revised).

On page 37 Second bullet point

Delete reference to HKSIR 3000.

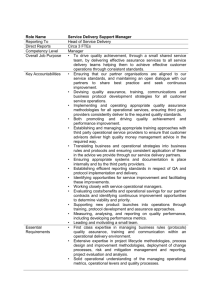

Chapter 19

Audit-related services and other assurance engagements

Replace pages 158 and 161 (see Appendix)

Page 163

Add: Reporting on profit forecasts, statements of sufficiency of working capital

and statement of indebtedness (HKSIR 500)

18

December 2014 and June 2015 Supplement

Appendix 1

Revised Flashcards: Chapter 19: Audit related services and other assurance engagements

19

Business Assurance

20