Red Raider Analysts

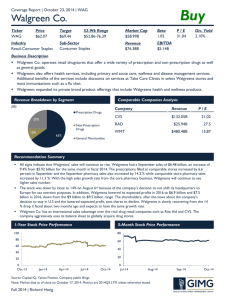

advertisement