Notes to the Consolidated Financial Statements

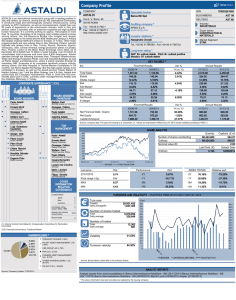

advertisement