file pdf - Borsa Italiana

advertisement

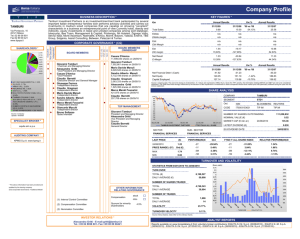

Company Profile ASTALDI is an international construction group with a leading position in Italy and ranked, by revenue, among the top 100 International Contractors. It constructs large and technologically complex infrastructures, acting primarily as EPC Contractor, as well as Concessionaire. Astaldi has over 90 years of experience in the construction industry, both in Italy and abroad, where it operates with an extensive expertise and high-qualified human resources. It is currently working on approx. 100 projects in more than 16 countries. Examples of its ongoing most notable projects include, among others, the 3rd Bosporus Bridge (the longest and largest suspended bridge in the world) and the Etlik Healthcare Campus in Ankara (the largest ongoing healthcare project in Europe), in Turkey. Other major ongoing projects are new subway lines in Italy, Romania, Poland, relevant highway and railway links in Italy, Turkey, Russia, Romania, Algeria, Venezuela, USA, Central America, energy production plants in Canada, Peru, Poland. Listed on the Milan Stock Exchange since 2002, as of December 2013 Astaldi had 13 billion of order backlog, over 2.5 billion of consolidated total revenues and more than 9,600 employees. Astaldi operates through the following business lines: Transport Infrastructures, Water and Energy Production Plants, Civil and Industrial Buildings, as well as Plants Design and Maintenance, where it mainly operates through its subsidiary NBI. Examples of its completed landmark projects include, among others: the New Hospital in Venice-Mestre (completed in 24 months), the Rome-Naples HS Railway (the first high-speed railway to be completed in Europe), as well as the award-winning Toledo Station of Naples Subway Line 1 and the Milan Subway Line 5 in Italy. Astaldi also constructed the Chacayes Hydroelectric Plant in Chile (the first ecofriendly plant built in Chile, currently under management by Astaldi) and the Anatolian Motorway in Turkey. BOARD MEMBERS C.C.I.(1) C.R.(2) C.N.(3) Executive Non executive Independent CORPORATE GOVERNANCE * (CG) Paolo Astaldi BOARD MEMBERS OWNERSHIP Stefano Cerri Chairman COMPANY Specialist broker ISIN ASTALDI Banca IMI SpA BLOOMBERG AST IM REUTERS AST.MI Via G. V. Bona, 65 00156 ROMA KPMG S.p.A. www.kpmg.com Alessandra Onorati E-mail:a.onorati@astaldi.com Tel.:+39 06 41766389 - Fax:+39 06 41766733 S&P: B+ outlook stable Fitch: B+ outlook positive Moody's: B1 outlook stable KEY FIGURES * €m Total Sales Ebitda Ebitda margin Ebit Ebit Margin Ebt Ebt margin Net Result E-Margin First-Half Results 30/06/14 30/06/13 1,201.52 1,150.66 149.26 145.04 12.42% 12.60% 118.13 113.00 9.83% 9.82% 54.71 57.10 4.55% 4.96% 34.33 32.28 2.86% 2.81% Var % '14 vs '13 4.42% 2.91% Net Financial Debt / (Cash) Net Equity Capital Employed First-Half Results 30/06/14 30/06/13 1,101.56 733.00 564.73 575.20 1,666.29 1,308.19 Var % '14 vs '13 50.28% -1.82% 27.37% 185,000 shares on 12/31/13 Giuseppe Cafiero Paolo Astaldi Vice-Chairman 76,526 shares on 12/31/13 Stefano Cerri Caterina Astaldi Chief Executive Officer 4,800 shares on 12/31/13 Caterina Astaldi Market Segment STAR Long term rating * Giuseppe Cafiero Vice Chairman Super sector CONSTRUCTION & MATERIALS Investor relations * 365,599 shares on 12/31/13 Ernesto Monti Industry INDUSTRIALS Auditing company * Tel.: +39 06 41766.1 Fax: +39 06 41766713 http://www.astaldi.com IT0003261069 Annual Results 31/12/13 31/12/12 2,519.68 2,456.90 324.02 264.47 12.86% 10.76% 235.95 211.82 9.36% 8.62% 138.59 129.84 5.50% 5.28% 75.21 74.13 2.99% 3.02% 4.54% -4.19% 6.35% Annual Results 31/12/13 31/12/12 800.98 626.00 603.92 553.95 1,404.91 1,179.95 Source: company data. The year-end closing is at December, 31. Values are expressed in Million Euro.H1 2013 results restated according to IFRS-11. Board member TOP MANAGEMENT Luigi Guidobono Cavalchini SHARE ANALYSIS Board member Giorgio Cirla Paolo Astaldi Board member Ernesto Monti Board member Deputy Chairman Piero Gnudi Giuseppe Cafiero Board member Deputy Chairman Chiara Mancini Stefano Cerri Board member Last Divid. (€) 0.190 Ordinary Chief Executive Officer Nicoletta Mincato Quantity 98,424,900 98,424,900 Number of shares outstanding Ordinary Nominal value (€) Chairman Paolo Cuccia Capitalis. (€ m) 564.57 564.57 2.00 Detach Date 12/05/2014 Paolo Citterio Board member GM Administr. & Finance Eugenio Pinto Cesare Bernardini Board member GM International Luciano De Crecchio GM Italy Mario Lanciani GM International Filippo Stinellis GM International OTHER INFORMATION RELATING GOVERNANCE Last price Ord Performance Ord 27/01/2015 5.74 -2Y 0.87% -2Y 76.16% -75.29% Price range (-2y) Ord -1Y -16.71% -1Y 20.68% -37.39% MAX 8.37 -3M 3.55% -3M 19.29% -15.75% MIN 4.44 -1M 20.23% -1M 11.32% 8.91% Relative perf. TURNOVER AND VOLATILITY - STATISTICS FROM 02/01/2015 TO27/01/2015 Compensation Stock Mbo Incentivo Turn over Total(€) Daily average(€) List based voting system (BoD / MB) Quorum for minority shareholders INDEX ITSTAR 2.5% Record Date 29,831,482 1,657,305 Number of shares traded Total Daily average 5,879,656 326,648 Number of trades (1): Internal Control Committee (2): Compensation Committee (3): Nomination Committee Total Daily average 12,363 687 (CG) Corporate Governance: Traditional Model A SHAREHOLDERS * Volatility 31.53% TREASURY SHARES: 0.66% PICTET ASSET MANAGEMENT LTD: 2.09% A Turnover velocity 84.30% UBS GROUP AG: 4.76% FMR LCC: 5.03% PIONEER ASSET MANAGEMENT S.A.: 5.07% OTHER SHAREHOLDERS < 2%: 29.73% Source: Borsa Italiana. Data refer to the ordinary shares. FIN.AST S.R.L.: 52.66% Source: Company Update: 21/05/2013 ANALYST REPORTS Analyst reports from www.borsaitaliana.it: Banca Intermediazione Mobiliare - IMI (26/11/2014) Banca Intermediazione Mobiliare - IMI (05/11/2014) Banca Intermediazione Mobiliare - IMI (08/08/2014) Merrill Lynch (04/08/2014) Kepler (27/06/2014) * The above information has been provided and updated by the issuing company