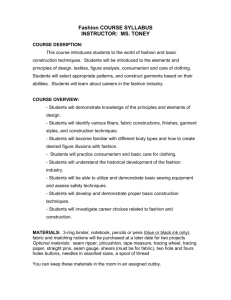

designing the boundaries of the firm

advertisement