johns hopkins donor advised fund

advertisement

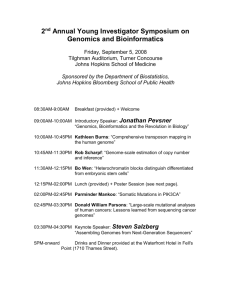

JOHNS HOPKINS DONOR ADVISED FUND: A PRACTICAL ALTERNATIVE TO A FAMILY FOUNDATION Manage your charitable giving efficiently with a Johns Hopkins Donor Advised Fund account, offering you and your family the flexibility to recommend support for Johns Hopkins and your other favorite charitable organizations, and simplifying your record-keeping and giving. In the year that Paula Boggs, A&S ’81, retired from her position as general counsel for an international company, she received additional income due to her transition. Paula, a Johns Hopkins trustee and Legacy Society co-chair, is a longtime supporter of the Krieger School of Arts and Sciences and also gives generously to other charitable organizations. She wanted to expand her giving to other areas of Johns Hopkins, including the Peabody Institute, and sought an income tax deduction in the year that she retired, so she established a Johns Hopkins Donor Advised Fund account. This provides Paula with tax advantages, a streamlined approach for giving to Johns Hopkins and other organizations, and the flexibility to make grant requests at any time. HOW IT WORKS With a fully deductible gift to Johns Hopkins of $250,000 or more in cash, securities, or other assets, you can establish a Johns Hopkins Donor Advised Fund (DAF) account in your or a loved one’s name to serve as a central source for your philanthropy. Then recommend distributions in the form of grants to any area of Johns Hopkins and other charitable organizations on your own timetable. Johns Hopkins approves the recommendations (unless they would benefit you or your family or an organization whose values are in conflict with those of Johns Hopkins). At least 60 percent of the distributions must support Johns Hopkins projects of your choice. Make additional gifts to your account at any time. BENEFITS OF A DONOR ADVISED FUND ACCOUNT • Simplify giving to Johns Hopkins and other charities. • Leverage Johns Hopkins’ expertise in fund maintenance and distribution, investment management, and administration. • Build a charitable legacy for you and your family. • Claim an immediate tax deduction. • Remain anonymous, if desired. • Avoid costly and complicated foundation rules. If you have an existing family foundation, you can even convert it to a DAF account. The Johns Hopkins Donor Advised Fund at a Glance Minimum to open an account: $250,000 in cash, publicly traded securities, or other approved assets Minimum balance required: $100,000 Minimum for additional gifts: None Required annual distributions: None Minimum amount per grant: $1,000 Minimum of total distributions required to Johns Hopkins: 60 percent Frequency of distributions: At donor’s discretion Termination of account: Donor’s death (or deaths of donor and spouse) with up to an additional 10 years if a third-party advisor is named, or when the balance falls below $100,000 for two consecutive quarters, if earlier Investment and management: Johns Hopkins University, in conjunction with Kaspick & Company, LLC Johns Hopkins does not give tax, legal, or financial advice; please consult your own advisor for individual advice. The information contained in this publication is not intended to or written to be used, and cannot be used, for the purpose of avoiding penalties imposed under the Internal Revenue Code or promoting, marketing, or recommending to another party any transaction or matter addressed herein. DONOR ADVISED FUND DETAILS Tax-wise: Claim a federal charitable income tax deduction for the full amount of your gift to establish a DAF account. Gifts of cash are deductible up to 50 percent of your adjusted gross income. Pay no capital gains tax on gifts of long-term appreciated securities, which are deductible up to 30 percent of your adjusted gross income. Unused deductions can be used over the five-year period after the year of your gift. All assets donated to your account are removed from your taxable estate. Convenient: Create one source for your charitable giving. When you request distributions in the form of grants to Johns Hopkins, and if you wish, to other qualified nonprofits, Johns Hopkins will handle the payments and paperwork. Decide which areas of Johns Hopkins and other charities to support on your own schedule. Eliminate having to track your giving for tax purposes. Unlike private foundations, which require a fivepercent minimum distribution annually, there are currently no requirements for annual distributions from your DAF account. Efficient: There are no start-up charges or fees. A competitive annual administrative fee is paid from the account’s principal. When you are ready, make your recommendations for grants of at least $1,000 to approved charities. You may make additional gifts of any amount to your account at any time. Professionally Invested and Managed: Johns Hopkins University, in conjunction with Kaspick & Company, LLC (a subsidiary of TIAA-CREF) will provide expert investment and administrative services for your account. Accounts will be invested in one of Johns Hopkins’ standard asset allocation mixes or in a special cash option. Your objectives and time horizon for your account will help guide the investment decisions. Johns Hopkins will manage all record keeping and provide you with detailed annual reports. CONTACT US Contact the Office of Gift Planning to speak with a gift planning advisor who will be happy to discuss your philanthropic goals and financial needs. Our services are confidential and collaborative, and we provide them without obligation. We look forward to sharing more about the Johns Hopkins Donor Advised Fund and discussing other philanthropic strategies. Johns Hopkins Office of Gift Planning San Martin Center, 2nd Floor 3400 North Charles Street Baltimore, Maryland 21218 giftplanning@jhu.edu 410-516-7954 800-548-1268 rising.jhu.edu/giftplanning