Homework for Chapter 10 10-2

advertisement

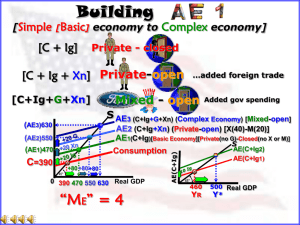

DEREE COLLEGE DEPARTMENT OF ECONOMICS EC 1101 PRINCIPLES OF ECONOMICS II FALL SEMESTER 2002 M-W-F 13:00-13:50 Office hours: Wednesdays 15:00-17:00 Dr. Andreas Kontoleon Contact: a.kontoleon@ucl.ac.uk Homework for Chapter 10 Homework for Chapter 10 10-2 (Key Question) What is the multiplier effect? What relationship does the MPC bear to the size of the multiplier? The MPS? What will the multiplier be when the MPS is 0, .4, .6, and 1? When the MPC is 1, .90, .67, .50, and 0? How much of a change in GDP will result if businesses increase their level of investment by $8 billion and the MPC in the economy is .80? If the MPC is .67? Explain the difference between the simple and the complex multiplier. The multiplier effect is the magnified increase in equilibrium GDP that occurs when any component of aggregate expenditures changes. The greater the MPC (the smaller the MPS), the greater the multiplier. M=1/MPS MPS = 0, multiplier = infinity; MPS = .4, multiplier = 2.5; MPS = .6, multiplier = 1.67; MPS = 1, multiplier = 1. M=1/1-MPC MPC = 1; multiplier = infinity; MPC = .9, multiplier = 10; MPC = .67; multiplier = 3; MPC = .5, multiplier = 2; MPC = 0, multiplier = 1. MPC = .8: M=1/(1-0.8)? 5 Change in GDP = $40 billion (= $8 billion X multiplier of 5); 1 MPC = .67: M=1/(1-0.67)? 3 Change in GDP = $24 billion ($8 billion ? multiplier of 3). The simple multiplier takes account of only the leakage of saving. The complex multiplier also takes account of leakages of taxes and imports, making the complex multiplier less than the simple multiplier. 10-3 Graphically depict the aggregate expenditures model for a private closed economy. Next, show a decrease in the aggregate expenditures schedule and explain why the decrease in real GDP in your diagram is greater than the initial decline in aggregate expenditures. What would be the ratio of a decline in real GDP to the initial drop in aggregate expenditures if the slope of your aggregate expenditures schedule were .8? The decrease in real GDP in the diagram is greater than the initial decline in aggregate expenditures because of the multiplier effect. The multiplier is given by: M=1/(1-0.8) =5 The ratio of decline in real GDP to the initial drop of expenditures would be a ratio of 5:1. That is, if expenditures declined by $5 billion, GDP should decline by $20 billion. On the graph it can be seen that a one unit decline in (C + I) leads to a four-unit decline in real GDP. 2 10-3 Suppose that Zumo has an MPC of .9 and real GDP of $400 billion. If investment spending falls by $4 billion, what will be its new level of real GDP? The multiplier is 10 or 1/(1-.9) so 10 x -$4 billion = -$40 billion. The new GDP is $400 billion $40 billion = $360 billion. 10-4 (Key Question) The data in columns 1 and 2 of the table below are for a private closed economy. (1) Real domestic output (GDP=DI) billions (2) Aggregate expenditures private closed economy, billions $200 $250 $300 $350 $400 $450 $500 $550 $240 $280 $320 $360 $400 $440 $480 $520 (3) (4) (5) (6) Exports, billions Imports, billions Net exports, private economy Aggregate expenditures, open billions $20 $20 $20 $20 $20 $20 $20 $20 $30 $30 $30 $30 $30 $30 $30 $30 $ _____ $ _____ $ _____ $ _____ $ _____ $ _____ $ _____ $ _____ $ _____ $ _____ $ _____ $ _____ $ _____ $ _____ $ _____ $ _____ a. Use columns 1 and 2 to determine the equilibrium GDP for this hypothetical economy. b. Now open this economy for international trade by including the export and import figures of columns 3 and 4. Calculate net exports and determine the equilibrium GDP for the open economy. Explain why equilibrium GDP differs from the closed economy. c. Given the original $20 billion level of exports, what would be the equilibrium GDP if imports were $10 billion greater at each level of GDP? Or $10 billion less at each level of GDP? What generalization concerning the level of imports and the equilibrium GDP do these examples illustrate? d. What is the size of the multiplier in these examples? 3 (1) Real domestic output (GDP=DI) billions (2) Aggregate expenditures private closed economy, billions $200 $250 $300 $350 $400 $450 $500 $550 $240 $280 $320 $360 $400 $440 $480 $520 (3) (4) (5) (6) Exports, billions Imports, billions Net exports, private economy Aggregate expenditures, open billions $20 $20 $20 $20 $20 $20 $20 $20 $30 $30 $30 $30 $30 $30 $30 $30 $ -10 $ -10 $ -10 $ -10 $ -10 $ -10 $ -10 $ -10 $230 $270 $310 $350 $390 $430 $470 $510 (a) Equilibrium GDP for closed economy = $400 billion. (b) See table above Equilibrium GDP for the open economy is $350 billion, $50 billion below the $400 billion equilibrium GDP for the closed economy. The $-10 billion of net exports is a leakage which reduces equilibrium GDP by $50 billion. (c) Imports = $40 billion: Aggregate expenditures in the private open economy would fall by $10 billion at each GDP level and the new equilibrium GDP would be $300 billion. Imports = $20 billion: Aggregate expenditures would increase by $10 billion; new equilibrium GDP would be $400 billion. Exports constant, increases in imports reduce GDP; decreases in imports increase GDP.? imports are forms of leakages (d) Since every rise of $50 billion in GDP increases aggregate expenditures by $40 billion, the MPC is .8 i.e. MPC=change in spending/change in income=40/50=0.8 and then M=1/(1-MPC)=5 4 10-5 Assume that, without taxes, the consumption schedule of an economy is as shown below: GDP, billions Consumption, billions $100 200 300 400 500 600 700 $120 200 280 360 440 520 600 a. Graph this consumption schedule and note the size of the MPC. b. Assume now a lump-sum tax system is imposed such that the government collects $10 billion in taxes at all levels of GDP. Graph the resulting consumption schedule and compare the MPC and the multiplier with that of the pretax consumption schedule. (a) The size of the MPC is 80/100 or .8 because consumption changes by 80 when GDP changes by 100. (b) Before we introduced the tax GDP=DI (since we have no taxes). Once we introduce tax for each level of GDP the DI will fall short of GDP by the amount of the tax. In this case by $10 billion. This decline in DI reduces both C and S at each level of GDP. The MPC and MPS determine the declines in C and S. In our case MPC is 0.8 and hence we calculate C at every level by reducing each level of C by 0.8*10=8 The new (after tax C schduel is shown in the table below) (c) The multiplier should be 5 because the MPS is .2 and 1/.2 is 5. The MCP and M are the same for both C-schedules since the slope of the C has not changed (we only have a shift). GDP, billions $100 200 300 400 500 600 700 Consumption, billions $120 200 280 360 440 520 600 DI GDP-Tax 90 190 290 390 490 590 690 5 After-tax Consumption 112 192 272 352 432 512 592 10-8 (Key Question) Refer to columns 1 and 6 of the tabular data for question 4. Incorporate government into the table by assuming that it plans to tax and spend $20 billion at each possible level of GDP. Also assume that all taxes are personal taxes and that government spending does not induce a shift in the private aggregate expenditures schedule. Compute and explain the changes in equilibrium GDP caused by the addition of government. Before G is added, open private sector equilibrium will be at 350. The addition of government expenditures of G to our analysis raises the aggregate expenditures (C + I g +Xn + G) schedule and increases the equilibrium level of GDP as would an increase in C, Ig, or Xn. Note that changes in government spending are subject to the multiplier effect which is M=5 The addition of $20 billion of government expenditures and $20 billion of personal taxes increases equilibrium GDP from $350 to $370 billion. The $20 billion increase in G raises equilibrium GDP by $100 billion (= $20 billion x the multiplier of 5); the $20 billion increase in T reduces consumption by $16 billion at every level. (= $20 billion x the MPC of .8). This $16 billion decline in turn reduces equilibrium GDP by $80 billion ( $16 billion x multiplier of 5). The net change from including balanced government spending and taxes is $20 billion (= $100 billion - $80 billion). 6 10-10 (Key Question) Refer to the accompanying table in answering the questions which follow: (1) Possible levels of employment, millions 90 100 110 120 130 (2) Real do mestic output, billions $500 550 600 650 700 (3) Aggregate Expenditures C + Ig +Xn + G $520 560 600 640 680 a. If full employment in this economy is 130 million, will there be an inflationary or recessionary gap? What will be the consequence of this gap? By how much would aggregate expenditures in column 3 have to change at each level of GDP to eliminate the inflationary or recessionary gap? Explain. b. Will there be an inflationary or recessionary gap if the full-employment level of output is $500 billion? Explain the consequences. By how much would aggregate expenditures in column 3 have to change at each level of GDP to eliminate the inflationary or recessionary gap? Explain. c. Assuming that investment , net exports, and government expenditures do not change with changes in real GDP, what are the sizes of the MPC, the MPS, and the multiplier? 7 (a) Equilibrium GDP is $600 billion, while full employment GDP is $700 billion? we have a recessionary gap. In this situation: Employment will be 20 million less than at full employment. Aggregate expenditures would have to increase by $20 billion (= $700 billion -$680 billion) in order to shift the AE curve up. (i.e. $20b increase at each level of GDP to eliminate the inflationary gap). AE0 AE AE1 Recessionary gap= $20 million Real GDP $600 $700 8 (b) Aggregate expenditures will be excessive, causing demand-pull inflation.? An inflationary gap. Aggregate expenditures would have to fall by $20 billion (= $520 billion -$500 billion) in order to shift the AE curve down. (i.e. $20b decrease at each level of GDP to eliminate the inflationary gap). AE AE1 AE0 Inflationary gap= $20 million Real GDP $500 $600 (c) MPC = .8 (= $40 billion/$50 billion); MPS = .2 (= 1 -.8); multiplier = 5 (=1/(1MPC)=1/(1-0.8)=1/.2). 9