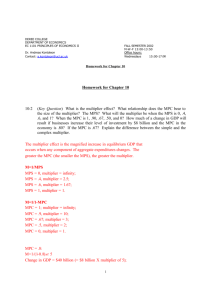

28

The Aggregate Expenditures

Model

McGraw-Hill/Irwin

Copyright © 2012 by The McGraw-Hill Companies, Inc. All rights reserved.

Assumptions and Simplifications

• Use the Keynesian aggregate

•

•

•

LO1

expenditures model

Prices are fixed

GDP = DI

Begin with private, closed economy

• Consumption spending

• Investment spending

28-2

Aggregate expenditures, C + Ig (billions of dollars)

Equilibrium GDP

530

C + Ig

(C + Ig = GDP)

510

490

470

450

Equilibrium

point

Aggregate

expenditures

C

Ig = $20 billion

430

410

390

C = $450 billion

370

45°

370 390 410 430 450 470 490 510 530 550

Real domestic product, GDP (billions of dollars)

LO1

28-3

Other Features of Equilibrium GDP

• Saving equals planned investment

• Saving is a leakage of spending

• Investment is an injection of

•

LO2

spending

No unplanned changes in inventories

• Firms do not change production

28-4

Aggregate expenditures (billions of dollars)

Changes in Equilibrium GDP

(C + Ig)1

(C + Ig)0

(C + Ig)2

510

490

Increase in

investment

470

Decrease in

investment

450

430

45°

430

450

470

490

510

Real domestic product, GDP (billions of dollars)

LO3

28-5

Adding International Trade

• Include net exports spending in

•

•

•

LO4

aggregate expenditures

• Private, open economy

Exports create production,

employment, and income

Subtract spending on imports

Xn can be positive or negative

28-6

Net Exports and Equilibrium GDP

C + Ig+Xn1

C + Ig

C + Ig+Xn2

Aggregate expenditures

(billions of dollars)

510

Aggregate expenditures

490 with positive

net exports

Aggregate expenditures

with negative net

exports

470

450

430

45°

Net exports, Xn

(billions of

dollars)

430

LO4

450

470

490

510

Real domestic product GDP (billions of dollars)

+5

0

-5

Positive net exports

450

470

Negative net exports

Xn1

490

Xn2

Real

GDP

28-7

International Economic Linkages

• Prosperity abroad

• Can increase U.S. exports

• Exchange rates

• Depreciate the dollar to increase

•

LO4

exports

A caution on tariffs and devaluations

• Other countries may retaliate

• Lower GDP for all

28-8

Adding the Public Sector

• Government purchases and

•

LO4

equilibrium GDP

• Government spending is subject to

the multiplier

Taxation and equilibrium GDP

• Lump sum tax

• Taxes are subject to the multiplier

• DI = GDP

28-9

Aggregate expenditures (billions of dollars)

Government Purchases and Eq. GDP

C + Ig + Xn + G

C + Ig + X n

C

Government spending

of $20 billion

45°

470

550

Real domestic product, GDP (billions of dollars)

LO4

28-10

Aggregate expenditures (billions of dollars)

Taxation and Equilibrium GDP

C + Ig + Xn + G

Ca + Ig + Xn + G

$15 billion

decrease in

consumption

from a

$20 billion

increase

in taxes

45°

490

550

Real domestic product, GDP (billions of dollars)

LO4

28-11

Equilibrium versus Full-Employment

• Recessionary expenditure gap

• Insufficient aggregate spending

• Spending below full-employment GDP

• Increase G and/or decrease T

• Inflationary expenditure gap

• Too much aggregate spending

• Spending exceeds full-employment

GDP

• Decrease G and/or increase T

LO5

28-12

Aggregate expenditures

(billions of dollars)

Equilibrium versus Full-Employment

AE0

AE1

530

510

Recessionary

expenditure

gap = $5 billion

490

Full

employment

45°

490

510

530

Real GDP

(a)

Recessionary expenditure gap

LO5

28-13

Aggregate expenditures

(billions of dollars)

Equilibrium versus Full-Employment

AE2

530

Inflationary

expenditure

gap = $5 billion

AE0

510

490

Full

employment

45°

490

510

530

Real GDP

(b)

(billions of dollars)

LO5

28-14