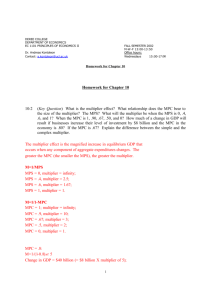

1. ME

advertisement

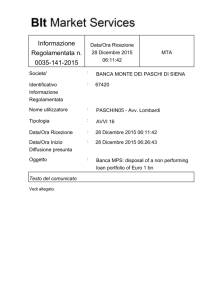

Building [Simple [Basic] economy to Complex economy] [C + Ig] Private - closed [C + Ig + Xn] Private-open [C+Ig+G+Xn] …added foreign trade Mixed - open Added gov spending S AE3 (C+Ig+G+Xn) (Complex Economy) [Mixed-open] (AE3)630 (AE2)550 (AE1)470 Consumption C=390 +80 +80 +80 45° 0 390 470 550 630 Real GDP “ME” = 4 AE(C+Ig) AE2 (C+Ig+Xn) (Private-open) [X(40)-M(20)] AE1(C+Ig)[Basic Economy][Private(no G)-Closed(no X or M)] S AE(C+Ig2) AE(C+Ig1) 45° 460 YR 500 Real GDP Y* Building the Model S $530 Private - Closed 510 C + Ig Consumption 490 Equilibrium 470 AE[C + Ig] Multiplier=4 (billions of dollars) AE[C+Ig] [“Basic” or “Simple” economy] Ig = $20 Billion 450 430 410 C =$450 Billion 390 370 +80 45 o o Real GDP GDP will increase by a “multiple” of 4 & that is why it is called the “multiplier”. 370 390 410 430 450 470 490 510 530 550 Change in QC (or QS) Consumption [Income change, movement from point to point] DISSAVING SAVING Consumption C2 Breakeven So, the key to a change in QC(QS) is a change in ? C1 o 45 o DI3 DI1 DI2 (Disposable Income) S Saving [Negative saving] S SAVING o DISSAVING S Disposable Income NON-INCOME DETERMINANTS [Shifters] OF CONSUMPTION AND SAVING Wealth Increase or decrease in wealth Increase/decrease in PL Taxation increases/decreases Consumer Expectations [about future availability, income, & prices] Household Debt Increase in Consumption (Decrease in Saving) [shift/whole curve/non-income] C2 C1 Increase in wealth Decrease in PL Expect. PL incr. Expect. of positive Y Expect. of shortages Decrease in debt *Decrease in taxes Consumption May be caused by: Saving *Decrease in taxes o increases both C & S I’ll buy more and save even more. Increases in consumption means… o 45 Disposable Income Decrease S1 S2 in saving o Disposable Income Decrease in Consumption (Increase in Saving) [shift/whole curve/non-income] Decrease in wealth Increase in PL Expect. PL decrease Expect. neg. future Y Increase in debt *Increase in taxes o Saving *Increase in taxes decreases both C & S C1 C2 Consumption May be caused by: o Decreases in consumption means… 45 Disposable Income Increase S2 S in saving 0 o Disposable Income GLOBAL PERSPECTIVE Average Propensities to Consume [C/Y], Selected Nations, 2000 .80 Canada .85 .90 .95 United States Netherlands .976 .972 United Kingdom .940 Germany .907 Italy 1.0 .986 .873 Japan .869 France .842 [Nominal I.R. – inflation rate = Real I.R.] - 2% 8% Nominal Interest Rate = - Inflation Premium = 6% Real Interest Rate Marginal Efficiency of Investment [MEI] [If expected returns equal or exceed the real interest rate of interest, the firm will normally make the investment.] [One firm’s demand curve for investment] MEI = 27% 30% Real Interest Rate 25% MEI=20% 20% MEI=15% 15% MEI=12% 10% 5% Add new wing to factory $1 mil. Renovate plant $2 million 0 1 2 MEI = 7% Acquire additional power facilities Install computer $1.5 mil. system $1 mil. Purchase machines $1.5 mil. 3 4 5 6 [QID] Quantity of Investment Demanded (millions) [MEI] Firms invest with their profits Real Interest Rates 25% & also borrow(5%) to invest.(10%) 20% [A 20% cost of funds attract $100 billion of investment 15% 10% 5% I.R. DI (MEI) A 5% cost of funds attracts $200 bil. Ig 0 50 100 QID1 QID 150 200 250 QID2 Change in QID [interest rate change, point to point movements] Single Firm Positive profit expectations and the real interest rate are the most important determinants of investment. Drill Press - $1,000 A. Expected gross profits = $1,100 or a 10% return. [$100/$1,000 x 100 = 10%] [At 8%, invest; at 12%, don’t invest] B. Real interest rate [nominal interest rate-inflation] Change in Quantity of Investment Demanded [QID] (percents) Expected rate of return, and interest rate, 10 r, 16 i (Interest rate change, point to point movement) DI Firms will undertake all investments [additions to plant, equipment, inventory, 14 and residential construction] which have an expected rate of net profit greater than [or equal to] the real rate of interest. 12 Monetary Policy – by lowering interest rates, the Fed can increase Ig & employment. 8% 6 4% 2 0 1 10 15 20 25 30 35 40 Investment (billions) QID QID [Inverse relationship between real interest rate and QID] CHANGE [Shift] IN INVESTMENT [curve] Increase in Investment 1. 2. 3. 4. 5. I1 Positive profit expectations Scarcity of inventory Technology [innovation] Decrease in production costs Decrease in business taxes I2 8% QID1 QID2 INVESTMENT DEMAND & SCHEDULE Investment Investment Schedule Ig independent of Y DI Investment (billions of dollars) Expected rate of return, r, and real interest rate, i (percents) Demand Curve 20 8 Ig 20 20 20 20 Investment (billions of dollars) Y1 Y2 Y3 Real Domestic Product, GDP (billions of dollars) In constructing the AE graph, Ig will be independent [not influenced] by income. Investment decisions are made months ahead. “Closed” Closed and “private” [C+Ig] “Simple Economy” “Open” & “private” [C+Ig+Xn] “Open” & “mixed” [C+Ig+G+Xn] “Complex Economy” C+Ig Assumptions: No internat. trade or “G” ; no business saving; depreciation & NFFIEUS are 0; PL is constant [Keynesian] [GDP = DI] 1. The most important determinant of consumer spending is (wealth/indebtedness/income). 2. As aggregate income increases, consumption and saving both (increase/decrease). 3. The (consumption/saving) schedule shows how much households plan to consume at various income levels. 4. Dissaving occurs where consumption (exceeds/is less than) Y. 5. If the consumption schedule shifts upward [not caused by a tax change], the saving schedule will shift (upward/downward). 6. (The expectation of a recession/A change in consumer incomes/ An expected change in the price level) will not cause the consumption curve to shift. APC and APS APC - percentage of income (“Y”) consumed. APS – percentage of income (“Y”) saved. APC = C/Y(DI)=$48,000/$50,000 = .96 1 APS = S/Y(DI)= $2,000/$50,000 = .04 APC = C/Y=$52,000/$50,000 = 1.04 1 APS = S/Y= -$2,000/$50,000 = -.04 “Econ, Econ, APS=S/Y “High maintenance Econ teacher” ? AE=GDP APC=C/Y MPC, MPS, & the Multiplier ME=1/MPS MPC - % change in Y consumed. MPS - % change in Y saved. MPC = C/ Y = $750/$1,000 = .75 MPS = S/ Y = $250/$1,000 = .25 Multiplier [1/MPS]=1/.25=$1/.25 = “M” of 4 [MPC is important for G in policy making decisions.] *The ME is the reciprocal of the MPS. The “M” works like a concentric circle. The First Round of Government Spending Causes The Biggest Splash MPC of 75% G spends $200 billion on the highways. Highway workers save 25% of $200 billion [$50 billion] & spend 75% or $150 billion on boats. Boat makers save 25% of $150 bil. [$37.50 bil.] & spend 75% or $112.50 bil. on iPod Videos, etc. ME = 1/MPS, 1/.25 = $1/.25 = ME of 4 (billions ) ME is 4 & we are short of Y*[$860] by $60 billion AE[C+Ig+G] Equilibrium AE[C+Ig+G] AE[C+Ig] G = $15 Billion +60 Recess. Spending gap o Recessionary GDP Gap 45 o Recess. Gap 800 Yr “M” = 860 Y* Real GDP Y/ E = 60/15 = 4 Now, let’s look at the Tax Multiplier [MT] MT = MPC/MPS, .75/.25 = ME of 3 MT is 3 & we are short of Y*[$860] by $60 billion 3 x ? will close a $60 billion GDP gap? With this situation, [short of Y* by $60 bil.], we would need to decrease taxes by $20 billion, with a multiplier of 3. MT = MPC/MPS, .75/.25 = MT of 3 (billions ) MT is 3 & we are short of Y*[$860] by $60 billion AE[C+Ig+G] Equilibrium AE[C+Ig+G] AE[C+Ig] +60 Recess. Spending gap o Recessionary GDP Gap 45 o Recess. Gap 800 Yr 860 Y* Real GDP ME = 1/MPS, 1/.50 = $1/.50 = ME of 2 (billions of dollars) ME is 2 & we are short of Y*[$860] by $60 billion AE[C+Ig+G] Equilibrium AE[C+Ig] AE[C+Ig+G] G = $30 Billion +60 Recess. Spending gap o Recessionary GDP Gap 45 o Recess. Gap 800 YR “M” = 860 Y* Real GDP Y/ E = 60/30 = 2 MT = MPC/MPS, .50/.50 = MT of 1 recessionary gap with a tax cut. MPS=.5 AE[C+Ig+G] Equilibrium AE[C+Ig] AE[C+Ig+G] Now, let’s look at correcting this $60 billion (billions of dollars) MT is 1 & we are short of Y*[$860] by $60 billion +60 Recess. Spending gap o Recessionary GDP Gap 45 o Recess. Gap 800 YR 860 Y* Real GDP ME = 1/MPS, 1/.50 = $1/.50 = ME of 2 ME is 2 & we are beyond Y*[$840] by $40 billion AE [C+Ig+G] AE[C+Ig+G] (billions of dollars) 2 x -? = -40 o AE[C+Ig-G] Equilibrium Inflationary Spending gap=$20 B -40 45 o Inflat. Gap 840 Y* 880 Real GDP YI Inflationary GDP Gap MT = MPC/MPS, .50/.50 = MT of 1 MT is 1 & we are beyond Y*[$840] by $40 billion 1 x -? = -40 $40 billion tax increase AE[C+Ig+G] Now, with a MT of 1, we would need a tax increase of how much to close the $40 bil. inflationary gap? (billions of dollars) AE [C+Ig+G] o AE[C+Ig+G] Equilibrium -40 45 o Inflat. Gap 840 Y* 880 Real GDP YI Inflationary GDP Gap ME [Change in G, Ig, or Xn] = 1/MPS MPC .90 .80 .75 .60 .50 1/MPS = ME 1/.10 = 10 1/.20 = 5 1/.25 = 4 1/.40 = 2.5 1/.50 = 2 MT [Change in Taxes] = MPC/MPS MPC .90 .80 .75 .60 .50 = MT MPC/.10 = 9 MPC/.20 = 4 MPC/.25 = 3 MPC/.40 = 1.5 MPC/.50 = 1 MPC/MPS When the G gives a tax cut, the MT is smaller than the ME because a fraction [MPS] is saved and only the MPC is initially spent. So, the MT = MPC/MPS. 1. INSTRUCTIONS FOR THE NEXT FOUR AE SLIDES We will start at $500 equilibrium GDP on each. Inflationary spending gap 2. Of the three items (equilibrium GDP, change in expenditures, and MPC), you will be given two and if you know two you can always figure out the 3rd. For instance if you knew that equilibrium GDP increased by $400 and the multiplier was 4, then the change in expenditures was obviously $100. AE2 AE Recessionary spending gap E2 AE1 E1 AE3 E3 500 Recessionary Inflationary GDP gap GDP gap 3. Except for 6, 9, 15, & 18, you will increase equilibrium GDP above $500, because there is an increase in G, or a decrease in T, or an equal increase in G&T. Ex: With MPC of .75 & therefore a ME of 4, an increase in G of $20 means $20 x 4 = $580 4. On questions 6, 9, 15, & 18, you will decrease equilibrium GDP below $500 because you are either decreasing G, increasing T, or there is an equal decrease in G & T. Ex: With MPC of .75 & therefore a ME of 4, a decrease in G of $20 means -$20 x 4 = $420. The Multiplier & Equilibrium GDP [Give the correct equilibrium GDP [start from $500] using the ME, MT, MBB] MT = MPC/MPS [Chg in T ] MBB = 1 [G&T ] ME=1/MPS [chg in G, Xg, or Xn] Inflationary Spending gap AE E2 E1 Chg in Equilibrium GDP MPC [So MPS & ME, MT, & MBB] Change in Expenditures [+G] 1. ME = ____ 560 [-T] 2. MT = ____ 548 [+G&T] 3. MBB =____ 512 1 60 Y with ME ____ 48 ____Y with MT 12 ____Y with MBB $12 .80 ME__ 5 4 MT___ MBB1 ___ ME’s [G,Ig,Xn] MPC M .90 = 10 .87.5= 8 .80 = 5 .75 = 4 .60 =2.5 .50 = 2 540 [+G] 1. ME = ____ S [-T] 2. MT = ____ 520 AE1 520 AE2 [+G&T] 3. MBB =____ AE3 E3 40 ___ Y with ME 20 with MT ____Y 20 with MBB ____Y 45° Recessionary $500 Spending gap 700 [+G] 1. ME = ____ [-T] 2. MT = ____ 650 [+G&T] 3. MBB =____ 550 2 $200 Y with ME 150 _____Y with MT 50 with MBB _____Y $50 .75 4 ME__ 3 MT___ 1 MBB___ 2 ME__ 1 MT___ MBB___ 1 $20 .50 MT’s MPC M .90 = 9 .87.5= 7 .80 = 4 .75 = 3 .60 =1.5 .50 = 1 [+G] 1. ME = ____ 600 [-T] 2. MT = ____ 590 510 [+G&T] 3. MBB =____ 3 $100 Y with ME 90 ___Y with MT 10 with MBB ___Y $10 __ .9 ME10 9 ? MT___ 1 MBB___ [+G] 1. ME = ____ 550 [-T] 2. MT = ____ 530 [+G&T] 3. MBB =____ 520 [+G] 1. ME = ____ 600 [-T] 2. MT = 550 ____ [+G&T] 3. MBB =____ 550 4 Here are5 a few helpers… 7 8 try the rest on your own ___ Y with ME 50 ____Y 30 with MT ____Y 20 with MBB 100 ___ Y with ME 50 with MT ____Y ____Y with MBB 50 .60 $20 2.5 ME__ 1.5 MT___ 1 MBB___ [+G] 1. ME = ____ 575 [-T] 2. MT = ____ 560 [+G&T] 3. MBB =____ 515 ___ 75 Y with ME ____Y 60 with MT 15 with MBB ____Y $15 6 -40 ___ Y with ME -35 ____Y with MT ____Y -5 with MBB .50 87.5 ME__ 2 MT___ 1 MBB___ 1 $50 [+G] 1. ME = ____ 900 [-T] 2. MT = 800 ____ [+G&T] 3. MBB =____ 600 ___ 400 Y with ME ____Y with MT 300 ____Y with MBB 100 .80 ME__ 5 MT___ 4 MBB___ 1 [-G] 1. ME = 460 ___ 465 [+T] 2. MT =___ [-G&T]3.MBB=___ 495 -$5 [-G] 1. ME =___ 300 [+T] 2. MT =___ 320 [-G&T]3.MBB=___ 480 9 -200 ___ Y with ME ____Y with MT -180 ____Y with MBB -20 .9 .75 $100 ME__ 4 MT___ 3 1 MBB___ ME__ 8 7 MT___ MBB___ 1 -$20 ME__ 10 MT___ 9 MBB___ 1 [+G] 1. ME =512.5 ____ [-T] 2. MT =507.5 ____ [+G&T] 3. MBB =____ 505 [+G] 1. ME = ____ 540 [-T] 2. MT = 538 ____ [+G&T] 3. MBB =____ 502 [+G] 1. ME = 550 ___ 540 [-T] 2. MT =___ [+G&T]3.MBB=___ 510 Here are a few helpers… try the rest on your own 10 __._ Y with ME 125 _.___Y with MT 75 __ 50 with MBB .60 ME__ 2.5 MT___ 1.5 1 MBB___ $5 [+G] 1. ME = ____ 560 [-T] 2. MT = ____ 545 [+G&T] 3. MBB =____ 515 13 ___ 60 Y with ME ____Y 45 with MT 15 with MBB ____Y 11 40 Y with ME ___ 38 with MT ____Y ____Y with MBB 2 ? $2 $15 ME__ 4 MT___ 3 MBB___ 1 ME__ 20 19 MT___ 1 MBB___ ___ 200 Y with ME ____Y with MT 100 ____Y with MBB 100 .75 .50 $100 50 Y with ME ___ 40 with MT ____Y ____Y 10 with MBB .95 [+G] 1. ME = ____ 700 [-T] 2. MT = 600 ____ [+G&T] 3. MBB =____ 600 14 12 ME__ 2 MT___ 1 1 MBB___ $10 ? ME__ 5 4 MT___ MBB___ 1 [-G] 1. ME =___ 420 [+T] 2. MT =___ 430 [-G&T]3.MBB=___ 490 15 -80 Y with ME ___ ____Y with MT -70 ____Y with MBB -10 87.5 ME__ 8 7 -$10 MT___ MBB___ 1 [+G] 1. ME = ____ 625 [-T] 2. MT = ____ 600 [+G&T] 3. MBB =____ 525 16 125 ___ Y with ME 532 [+G] 1. ME = ____ [-T] 2. MT = 524 ____ [+G&T] 3. MBB =____ 508 17 100 ____Y with MT 25 with MBB ____Y $25 18 -100 ___ Y with ME ____Y with MT -90 ____Y with MBB -10 .75 .80 ME__ 5 MT___ 4 1 MBB___ 32 Y with ME ___ 24 with MT ____Y 8 with MBB ____Y [-G] 1. ME = ___ 400 410 [+T] 2. MT =___ [-G&T]3.MBB=___ 490 $8 4 ME__ 3 MT___ 1 MBB___ .9 -$10 ME10 __ 9 MT___ 1 MBB___