HSBC Global Businesses Programme Structure Overview

advertisement

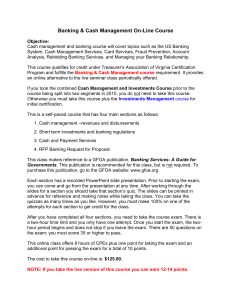

HSBC Global Businesses Programme Structure Discover how we fit together We offer graduate programmes across a range of areas within HSBC’s Global Banking and Markets, Global Private Banking and Global Transaction Banking businesses. Use this chart to discover how the business areas relate to each other and fit into the wider Global Businesses structure. Each of the business areas are discussed in full following the chart. GLOBAL BANKING AND MARKETS Global Banking and Markets is an emerging markets-led and financing-focused business that provides tailored financial solutions to major government, corporate and institutional clients worldwide. Managed as a global business, we offer clients geographic reach, deep local knowledge and a full range of banking capabilities. Global Global Global Global Global Banking Markets Research Capital Financing Infrastructure GLOBAL ASSET MANAGEMENT Global Asset Management is a key part of HSBC's wealth management strategy and one of the fastest growing parts of the HSBC Group. We provide sound investment solutions to institutions, financial intermediaries and individual investors around the world, from our global network of offices in more than 30 countries. GLOBAL TRANSACTION BANKING Global Transaction Banking (GTB) provides transaction banking products, services and solutions to clients of HSBC’s Global Banking and Markets and Commercial Banking businesses. Our products are generally transactional, high volume and process-intensive, with short-term, self-liquidating credit risk. GLOBAL PRIVATE BANKING Global Private Banking focuses on protecting and enhancing the wealth of international high net worth clients and their families through a comprehensive range of wealth management and specialist advisory services including investment, asset management and trustee services. Global Banking and Markets Global Banking Global Banking is responsible for the overall management of relationships with major corporate and institutional clients across a broad range of geographies. This involves working closely with a variety of product specialists to deliver a comprehensive range of services such as: treasury and capital markets, transaction banking, strategic advisory and investment management and the origination and ongoing management of the credit and lending product. Global expertise is at the heart of the Global Banking business. Global Banking advisers' collective knowledge of global economies, sector, industries and institutions, coupled with the understanding of local markets and cultures worldwide, help to deliver innovative, integrated financial solutions to our clients. Strategic Transactions Group Client Management Global Markets Global Markets provides origination, sales, trading and structuring services across our key product offerings for a diversified portfolio of clients. These range from the world's central banks and government agencies to international and local corporations, as well as institutional investors and hedge funds. Global Research Global Research, a division of HSBC Global Banking and Markets, has over 500 staff in 20 countries both developed and emerging. We specialise in four core product areas – currency, economics, equities and fixed income – with a particular emphasis on emerging markets and climate change. Global Capital Financing Global Capital Financing incorporates Leveraged and Acquisition Finance, Equity Capital Markets, Debt Capital Markets, Asset and Structured Finance and Project Finance Execution, providing clients with one point of contact for their financing needs. Leveraged and Acquisition Finance Global Infrastructure Supporting Global Banking and Markets, our Infrastructure business focuses on adding value and increasing efficiency, allowing our businesses to continually capitalise on new opportunities. Compliance Finance Global Markets Operations Global Banking Strategic Transactions Group The Strategic Transactions Group focuses on transactions including mergers and acquisitions, IPOs, rights issues, financial restructurings, recapitalisations, joint ventures, strategic investments and divestitures. Our bankers play a trusted role and help shape industry and company strategies around the world. Client Management Client coverage is the unit within Global Banking that focuses on the overall relationship management of major corporate and financial institution clients. Clients are managed by account managers responsible for: - delivering all HSBC products and services - managing the financial returns from the client - developing a trusted adviser relationship at CFO/Group Treasurer level - identifying event opportunities and bringing in sector/country/product expertise as appropriate - building the HSBC franchise/reputation in the market Coverage sectors include: Consumer and Retail Group; Diversified Industries Group; Financial Institutions Group; Financial Sponsors; Government; Resources and Energy Group. Global Capital Financing Leveraged and Acquisition Finance Leveraged and Acquisition Finance provides innovative financing solutions to help our clients achieve their strategic objectives. ‘Leveraged finance’ is funding a company with more debt than would be considered normal for that company or industry. The funding is riskier, and therefore more costly, than normal borrowing. Global Infrastructure Compliance Compliance focuses on assisting those who are responsible for the conduct of the Group's business to manage compliance risk by setting policies and standards to cover compliance issues; advising line management on the impact on their business of applicable rules and regulations; and fostering good relations with the Group's regulators. Finance Finance works in partnership with the business, manages regulatory changes, and ensures a strong control environment in a complex and growing organisation. Our departments include CFO. Product Control, Business Information Planning and Analysis, Finance Regulatory and Accounting Policy, Operational Risk and Internal Control (ORIC) and Global Controller. Global Markets Operations Global Markets Operations support the processing of the full spectrum of products which are traded in large and complex transactions conducted by the Global Banking and Markets business across our international network.