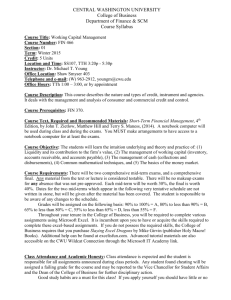

ACG 3341 – Cost Accounting and Control I Spring, 2013

advertisement

ACG 3341 – Cost Accounting and Control I Spring, 2013 Section 591: Wednesday 6:00-8:50 p.m. in SMC B226 Instructor: Kristine Del Vecchio, Master of Accountancy, CPA, CIA, CGMA Office hours: Sarasota – SMC C264 – Wednesday 4:30-5:30 p.m. or by appointment Tampa – BSN 3314 – Thursday 5-6 p.m. or by appointment Email: kdelvecchio@usf.edu Phone: (941) 351-1731 Normally scheduled time on campus (either Sarasota or Tampa campus) is limited but I can be reached at any time via email and can schedule time to meet on campus between class meetings. I will always be available after each class to meet with students. COURSE DESCRIPTION: ACG 3341 is a study of cost accounting systems for different entities, cost behavior patterns, cost-volume-profit analysis, relevant information for decision making, budgets and standard costs for planning and control. COURSE OBJECTIVES: We will discuss concepts and practices used by accountants to provide useful information to management for decision-making. At the conclusion of this course, you should be able to use skills developed to: 1. 2. 3. 4. 5. Allocate costs to production departments Determine product costs using job-order costing and activity-based costing Develop and implement cost-volume-profit analysis Prepare operating budgets Compute and analyze variances from cost standards for direct material, direct labor, and manufacturing overhead 6. Analyze business decisions using relevancy costing 7. Perform well on relevant sections of professional exams PREREQUISITES: ACG 2021 and ACG 2071 with grades of “C” or better. COURSE MATERIALS: Cost Accounting: A Managerial Emphasis (14th Edition - 2012) by Horngren et al. (Prentice Hall). ISBN # 978-0-13-210917-8. Do not purchase the international edition. There is a looseleaf edition available but it may or may not be bundled with the My Accounting Lab access code. My Accounting Lab: My Accounting Lab is web-based tutorial and assessment software for accounting that we will use for many assignments. We will discuss procedures and details in class. It is also a supplementary resource for additional learning materials. You will register for My Accounting Lab at www.pearsonmylabs.com. Computer: You will need access to a computer and Microsoft Office – for spreadsheet (Excel), word processing, access to Blackboard/Canvas and internet research. Publishers Website: The textbook has a very useful website at www.prenhall.com/horngren features current topics relating to the information we study as well as additional practice material (including PowerPoint slides, additional practice questions, video cases, and check figures). I strongly encourage you to use it as we study each chapter. www.pearsonmylabs.com CLASS POLICIES: 1. ACADEMIC HONESTY: Academic honesty is expected in all areas of the course (exams, homework, quizzes, etc.). Cheating will not be tolerated and will be punished to the maximum extent allowed under University guidelines. From the USF-SM Undergraduate Catalog: “Academic integrity is the foundation of the University of South Florida’s commitment to the academic honesty and personal integrity of its University community. Academic integrity is grounded in certain fundamental values, which include honesty, respect and fairness. Broadly defined, academic honesty is the completion of all academic endeavors and claims of scholarly knowledge as representative of one’s own efforts. Knowledge and maintenance of the academic standards of honesty and integrity as set forth by the University are the responsibility of the entire academic community, including the instructional faculty, staff and students.” 2. GRADES: Final letter grades will be based on total points earned as follows: Exam 1 (Chapters 1, 2, 3, 10, 11) Exam 2 (Chapters 4, 5, 6, and 17) Exam 3 (Chapters 6, 7, 21) Final Exam (Chapters 9, 16 and 19) Excel Assignments Quizzes, Homework, Attendance, Participation Total Possible Points 15% of final grade 20% 20% 15% 15% 15% 100% of final grade Grades will be posted on Canvas/Blackboard. No grades will be released by email or telephone. The +/grading system will NOT be used for final letter grades in this course. The standard grading scale (A=90%, B=80%, etc.) will be used in this class. 3. EXAMS: There will be four exams in this class. The final exam is NOT cumulative but 10 Academic Learning Concept (ALC) questions are included on this exam. The exam dates for this semester are: Exam 1– January 30th, 2013 Exam 2 – February 27th, 2013 Exam 3 – April 1st, 2013 Final Exam – May 2nd, 2013 All exams will be held at the regular class time (Wednesday, 6 p.m.). Any scheduling conflicts with these dates must be resolved before the end of the add/drop period (the first week of classes). All exams will include objective questions, computational and accounting exercises, and short answers. Supporting calculations for exercises must be clearly shown and labeled in order to receive full credit. ONLY basic 4-function calculators may be used during exams. Calculators that can store equations, formulas or written text in memory or those with time value of money functions may NOT be used during any exam. Calculators may not be shared between students. Smart phones, cell phones, or any other electronic devices are NOT permitted during any exam. RETURN OF EXAMS: Anyone failing to return a test to the instructor at the end of an exam or at the end of the class when the exam is reviewed may receive an F for the course. All exams will be retained for one month after the end of the semester and then will be destroyed. MAKE-UP EXAMS: Make-up exams will be allowed ONLY at the discretion of the instructor and for highly unusual, extenuating circumstances only. Any request for a make-up exam must be discussed with the instructor in advance of the scheduled exam time unless circumstances make such notice impossible. Written documentation will be required to support the reason for missing an exam. Please review the dates of the exams to ensure there are no schedule conflicts. 4. ASSIGNMENTS: It is important that class time be used as effectively as possible. Therefore, assigned readings are to be completed outside of class and prior to our class meeting. Most classes will begin with a quick quiz to assess understanding of basic concepts in the assigned readings. Class time will be devoted to lecture, demonstration and practice of exercises and review of homework. There are also assigned quizzes to be completed at the end of each chapter. These quizzes are scheduled and completed through My Accounting Lab and are to be taken outside of class after successful completion of the homework assignment. My Accounting Lab is set up to provide review additional material and exercises for the content areas that were missed on the quiz. Completion of homework assignments is essential and is a minimum requirement of the course. Each week, there will be a homework assignment to be completed during the week. Three excel exercises will be assigned this semester. Details on these assignments will be provided with the final assignment schedule. 5. ATTENDANCE & CLASS BEHAVIOR CODE: Regular attendance is imperative to successfully complete this course. Attendance will be recorded for each class. Excessive absences may negatively impact final grades. Students are expected to attend class and participate appropriately. Participation is defined as attentiveness, volunteering answers to questions, asking questions and providing feedback on lecture material. Students are expected to conduct themselves in a professional and respectful manner at all times. Each class is approximately 3 hours long. If you need to leave early please let the instructor know in advance. Leaving early will otherwise be treated as not attending at all. ELECTRONIC EQUIPMENT: During lectures and discussion, the use of electronic equipment is disruptive and distracting. There is no need to access the internet during class, therefore, it is not allowed during class. All cell phones and devices must be set so no audible signals are emitted during class. Taking calls or sending or receiving text messages during class is not allowed. 6. S/U GRADES: No upper level accounting courses may be taken on an S/U basis. 7. WITHDRAWAL: No "W" grades can be obtained after the official drop or withdrawal date of Saturday, March 23rd, 2012. All students still enrolled after Saturday, March 23rd will receive a letter grade of A, B, C, D, or F. Accounting faculty will NOT comment on petitions for late withdrawal after Saturday, March 23rd. 8. INCOMPLETE GRADES: Incomplete (I) grades are given only in those rare instances where the course cannot be completed for a valid reason and the student is otherwise passing the course. An 'I' grade must be completed (not by repeating the course) in the first subsequent semester. An 'I' grade cannot be used to avoid a poor course grade. 9. RELIGIOUS OBSERVANCES: Students who anticipate being absent from class due to the observance of a major religious holiday are must provide notice of date(s), in writing, to the professor, no later than the 2nd class meeting. 10. DISABILITIES: Reasonable accommodations will be made for students with disabilities. Students in need of academic accommodations for a disability may consult with the office of Students with Disabilities Services (SDS) to arrange appropriate accommodations. CONTACT INFORMATION: Pat Lakey, Coordinator, (941) 359-4714, plakey@sar.usf.edu , http://www.sarasota.usf.edu/students/disability/ Students must give reasonable notice (typically 5 business days) for any accommodation request and provide the professor with a copy of the Memo of Accommodation. 11. EMERGENCIES: The University uses the MoBull Plus Emergency Communication System to notify students, faculty and staff in the event of a life-threatening emergency on campus. See www.mobull.usf.edu and become familiar with the system. Important information about emergencies also will be communicated by Canvas and USF websites. The USF hotline (800) 992-4231 is updated with pre-recorded information during an emergency. Students are responsible for monitoring these systems. In an emergency, it may be necessary for USFSM to suspend normal operations. During this time, USFSM may opt to continue delivery of instruction through methods that include but are not limited to: Canvas, Elluminate, Skype, email messaging and/or alternate schedules. In the event of a fire alarm or bomb threat, all scheduled classes will be held in an alternate room. At the beginning of each semester please note the emergency exit maps posted in each classroom. These signs are marked with the primary evacuation route (red) and secondary evacuation route (orange) in case the building needs to be evacuated. For more information, please refer to the University’s Emergency Evacuation Procedures (http://www.sarasota.usf.edu/Facilities/documents/EAP_FAQ.pdf). Date Topic Jan 9 Jan 16 Course Introduction and Review of Basic Concepts Cost-Volume-Profit Analysis Jan 23 Determining How Costs Behave/Relevance Jan 30 Feb 6 Exam 1: Chapters 1-2-3-10-11 Job Costing Chapter 4 Feb 13 Activity-Based Costing and Activity-Based Management Chapter 5 Feb 20 Process Costing Feb 27 Exam 2: Chapters 4-5-17 Master Budget and Responsibility Accounting Mar 6 Mar 13 Chapter Reading Chapters 1-2 Chapter 3 Chapter 10 Chapter 11 pp. 390-394 Chapter 6 Spring Break Flexible Budgets, Direct-Cost Variances, and Management Control Capital Budgeting and Cost Analysis Chapter 21 Apr 10 Exam 3: Chapters 6-7-21 Inventory Costing & Capacity Analysis Chapter 9 Apr 17 Cost Allocation; Joint Products and By Products Chapter 16 Apr 24 Balanced Scorecard Chapter 17 May 1 Exam 4: Chapters 9-16-19 Mar 20 Mar 27 Apr 3 Chapter 7