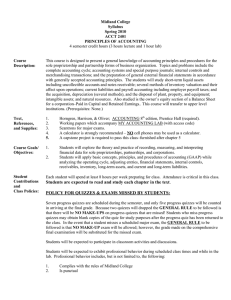

1. Horngren, Harrison, Oliver ACCOUNTING, 9th edition, Prentice

advertisement

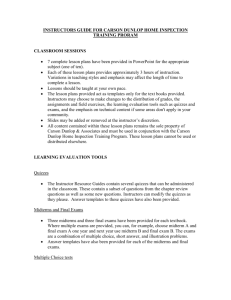

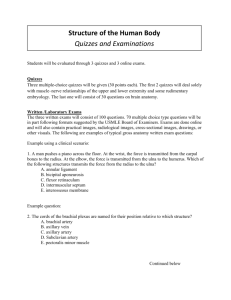

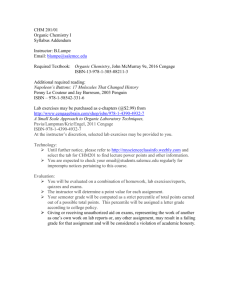

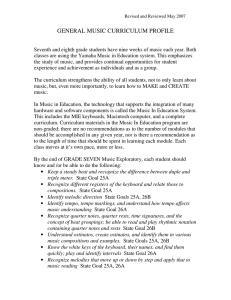

Midland College Syllabus FALL 2013- 2015 ACCT 2402 Principles of Accounting II Course Description: A continuation of ACCT 2401 completing the study of corporate financial accounting data for cost control and management decision making. The student is required to learn the preparation of Cash Flow Statement and review the relationships among all the corporate financial statements. The student will use financial statement analysis to track a firm=s trends and to determine a firm=s liquidity, profitability, and solvency. The student will learn the basis of manufacturing cost accounting and product costing, as well as basic planning and control tools such as break-even and marginal analysis. The study will include the planning and budgeting function, including cash budgeting and the use of standard costs for cost control. The student will learn the variable costing method, incremental cost analysis, and the use of present value and other techniques to analyze alternatives such as capital expenditures, make-or-buy, sales mix and other managerial accounting decision making techniques. This course will transfer to most upper level institutions as ACCT 2302. (Prerequisites: ACCT 2401) Text, References, and Supplies: 1. Horngren, Harrison, Oliver ACCOUNTING, 9th edition, Prentice Hall (required). 2. MY ACCOUNTING LAB (access code) for homework (included with book or purchase separately). A project for understanding annual reports (furnished). Course Goals/ Objectives: 3. 4. 5. 1. 2. 3. 4. Student Contri bution s and 1. 2. Class Policies: 3. 4. 5. Scantrons for major exams. A calculator is strongly recommended B NO cell phones used for calculators. Students will explore the theory and practice of recording, measuring, and interpreting financial data for partnerships and corporations. Students will apply basic concepts, principles, and procedures of accounting while analyzing corporate financial statements for decision making purposes by completing a special project.. Students will survey management accounting and concentrate on cost accounting techniques for manufacturing entities by preparing journal entries and completing a Cost of Goods Manufactured Statement. Students will prepare budgets and performance reports and preform cost-volume-profit analysis (break-even) from management=s perspective. Each student should spend at least 8 hours per week preparing for class. Attendance is critical in this class. Students are expected to read and study each chapter in the text. POLICY FOR QUIZZES & EXAMS MISSED BY STUDENTS: Seven progress quizzes are scheduled during the semester, and only five progress quizzes will be counted in arriving at the final grade. Because two quizzes will be dropped, the GENERAL RULE to be followed is that there will be NO MAKE-UPS on progress quizzes that are missed! Students who miss progress quizzes may obtain blank copies of the quiz for study purposes when the progress quiz is returned to the class. In the event that a student misses a scheduled major exam, the GENERAL RULE to be followed is that all makeup exams will be given on the day of the final exam. Students will be expected to participate in classroom activities and discussions. Students will be expected to exhibit professional behavior during scheduled class times and while in the lab. Professional behavior includes, but is not limited to, complying with the rules of Midland College; being punctual; exhibiting cooperative behavior in class; avoiding the use of earphones, cell phones, and beepers, which are disruptive to the class. The use of cell phones, even for calculators, will result in a zero on the quiz or exam. Evaluation of Students: 1. 2. Performance will be measured according to established grading standards by student testing, including exams consisting of true-false, multiple-choice, matching; fill-in-the-blanks; short-answer; essays; problems; or any combination. Grading for this course will be as follows: Best 5 Progress Quizzes (20 points each) 3 Major Exams (100 points each) All homework Project Final Examination (emphasis on last 3 chapters) Maximum Points Grade A B C D F Course Schedule: Scholastic Dishonesty & Academic Misconduct 100 points 300 points 100 points 100 points 100 points 700 points Points 630+ 560-629 490-559 420-489 less than 420 A grade of W will only be given at the request of the student. Please review the withdrawal policy in the Midland College Catalog. The class meets for 3 lecture hours per week. A tentative course schedule will be provided to the student during the first class meeting. Cheating: The deliberate use of unauthorized materials and/or actions or fraudulent acquisition in order to obtain information for an examination or assignment. . 1. Plagiarism: Appropriation, buying, receiving as a gift, or obtaining by any means another=s work and the unacknowledged submission or incorporation of it in one=s own written work offered for credit. 2. Collusion: The unauthorized collaboration with another person in preparing written work offered for credit or collaboration with another person to commit a violation of the rules of scholastic dishonesty. 3. Penalties: The instructor has the primary responsibility for recommending the penalties for any type of scholastic dishonesty describe on pages 66 and 67 of the Catalog and Handbook. These penalties include: 1. Failure of the test/assignment. 2. Failure of the course. 3. Recommendation for disciplinary action, including institutional suspension or dismissal. Note: Students are encouraged to contact the instructor at any time; however, making an appointment will guarantee the instructor=s availability at a specific time. Division Information Division Dean: Division Secretary: Norma Duran (685-6830) Division Office: Room 154 MHAB ACCOUNTING LAB The accounting lab is located in room 170 TC (432-686-4212). More definite information will be posted in the lab after the first week of class. STUDENTS WITH DISABILITIES Midland College provides services for students with disabilities through Student Services. In order to receive accommodations, students must place documentation on file with the Counselor/Disabilities Specialist. Students with disabilities should notify Midland College prior to the beginning of each semester. Student Services will provide each student with a letter outlining any reasonable accommodations. The student must present the letter to the instructor at the beginning of the semester. ACCT 2402 - Principles of Accounting II HOMEWORK ASSIGNMENTS - (ACCOUNTING, 9th edition, Horngren, Harrison, Oliver). At the end of each chapter in your textbook, you will find a glossary of terms, Quick Check test, Short Exercises, Exercises, and Problems. SHORT EXERCISES generally review concepts and terminology. You may be assured that a significant number of questions concerning concepts and terminology will appear on both progress quizzes and major exams. Therefore, students are advised to study and be able to answer these short exercises. EXERCISES represent short applications of the concepts contained in the chapter (usually covering one or two chapter objectives). Often a student can work an exercise in his head or on scratch paper C although some exercises are more detailed and require more thought and concentration. PROBLEMS are longer and more complex than exercises, often involving several chapter objectives. semester students will complete selected exercises and problems for a homework grade. This CHAPTER FOURTEEN HOMEWORK--EXERCISES and PROBLEMS P14­25A, P14­26A FIFTEEN P15­23A, P15­24A, P15­25A, P15­26A SIXTEEN P16­26A, P16­25A SEVENTEEN P17­25A, P17­28A, 17A­12A, P17A­13A EIGHTEEN P18­27A, P18­29A NINETEEN P19­23A, P19­24A TWENTY P20­21A, P20­23A TWENTY­ONE omitted TWENTY­TWO E22­14, E22­16, E22­18, E22­20 TWENTY­THREE P23­28A TWENTY­FOUR P24­19A, P24­21A Competencies Purpose and/or Sample of Real Life Applications Assignments Used Through-out the Course Build a vocabulary of accounting terminology as it relates to corporations and manufacturing companies To understand the difference in accounting for the sole proprietorship and corporation forms of business using GAAP. Write answers to select questions and short exercises Yes Recognize two ways to internally finance a corporationBselling stock and profitable operations and how to display these sections on a Balance Sheet for corporations. To distinguish the owner=s equity section of a Balance Sheet of a sole proprietorship or partnership from that of a corporation. Record transactions to sell capital stock, declare and pay/distribute cash and stock dividends and prepare several Stockholder=s Equity sections of Balance Sheets for No corporations. Identify an additional way to finance corporations- using external sources. Illustrate external long term financing opportunities for a corporationBspecifically bonds. Record entries to issue bonds, pay interest, and amortize Premiums and Discounts. No Identify the three basic financial activities in which all businesses engageBoperating, investing, and financing. Catagorize financial activities into three separate activities. Prepare several Cash Flow Statements using the Indirect Method of preparation. No To make informed decisions about the financial health of a company. Complete a major project that analyzes a company=s financial position Utilize horizontal and vertical analysis plus 14 common financial statement ratios to interpret a company=s financial status. No Describe/distinguish three types of business organizations-service, merchandizing, and manufacturing, and classify their costs by value-chain element. Classify costs into 3 cost categoriesBdirect materials, direct labor, and factory overhead. Record entries for job order costing and process costing. No Use Cost-Volume-Profit analysis to determine a company=s breakeven point. Demonstrate how changes in volume affect costs/profits. Compute the breakeven point for a business using equation approach, Income Statement approach, and CVP graph. No To develop a Master Budget for a businessBincluding a budgeted Income Statement & Balance Sheet. To develop strategies (business goals) that help a business plan and control revenues and costs. Prepare budgets for sales, purchases, cost of goods sold, and inventory; cash budgets, and performance reports. No Competencies Evaluate a manufacturing company=s performance using standard cost accounting procedures for Direct Materials, Direct Labor, and Factory Overhead. Purpose and/or Sample of Real Life Applications Companies must know how to use variance to learn why actual results differ from budgets. Assignments Prepare flexible budgets and use these budgets to show why actual results differ from standardsBcompute efficiency and price variances for direct materials and direct labor. Compute overhead variances. Used Through-out the Course No