legal reserves

FORMAL REQUIREMENTS OF FINANCIAL REPORTING

IN THE NETHERLANDS

LEGAL RESERVES

The distribution of dividends, or the repurchase of own shares, or the reduction of capital on redemption by companies that are in the scope of Civil Code Book

2 Title 9 is limited to the availability of distributable reserves within equity. The typical components of equity are capital, share premium, and reserves. In addition to the non-distributable capital, in some cases legal reserves apply. These legal reserves are generally formed by reducing either the general reserves

(retained earnings) or share premium, thereby reducing the amounts available for distribution or share repurchase.

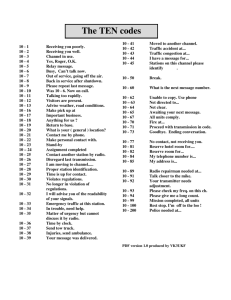

The following legal reserves may apply:

Revaluation reserve, Civil Code Book 2 section 2:390

and section 423 (for banks)

Translation reserve, Civil Code Book 2 section 389

Reserve for capitalized development costs, Civil

Code Book 2 section 365

Reserve for capitalized formation expenses and costs

of the issue of shares, Civil Code Book 2 section 365

Reserve for retained earnings by associates or

subsidiaries, Civil Code Book 2, section 389

Reserve for financing of shares, Civil Code Book 2

section 98c and section 207c

Reserve for rounding differences on capital

translation to Euros, Civil Code Book 2, section 67a

andsection 178a

Reserve for BV capital lower than the current

mandatory minimum amount, Civil Code Book 2

section 178

Reserve for contribution in kind at the incorporation

of a NV, Civil Code Book 2 section 94a that although revaluations of property investments are presented in the income statement (similar to IFRS), a revaluation reserve is still required. The revaluation reserve may be reduced by any deferred tax liability related to revaluation.

Dutch law facilitates cash flow hedge accounting. For effective hedges, subsequent changes in value of the hedging instrument may be presented in a revaluation reserve until the hedged item affects profit and loss.

For the purpose of cash flow hedge accounting, the revaluation reserve can be negative. Any negative legal reserves have to be subtracted from distributable reserves to determine the amount available for distribution.

Investment companies that are in the scope of the Wet op het financieel toezicht (Financial Supervision Act), are allowed to take changes in fair value of investments directly in equity. For the cumulative changes, a legal reserve applies.

Translation reserve

Under Dutch GAAP, assets and liabilities held by associates or subsidiaries with a functional currency different from the presentation currency of the entity are translated following the closing rate method. (Some minor differences apply when compared to IFRS). For cumulative translation differences, a legal reserve applies. This reserve can be negative. Any negative legal reserves have to be subtracted from distributable reserves to determine the amount available for distribution.

MORE INFORMATION

For more information please contact your adviser at BDO Accountants & Adviseurs.

FREEDOM TO DO BUSINESS

BDO is synonym for freedom to do business. More specific: you are the entrepreneur and we are engaged with the restrictive regulations and the difficult figures. Our professionals are your assistants in such a way that you are in the position to perform your core business.

This is our way of working with approximately 2,000 specialists.

Not only in the Netherlands but throughout our international

BDO network, which is present in more than 100 countries.

Revaluation reserve

Dutch law allows assets to be revaluated at fair value.

For unrealized (positive) revaluations, a non-distributable revaluation reserve applies. This revaluation reserve does not apply for listed securities if changes in value are presented in the income statement. Note

Reserve for capitalized development costs

Dutch GAAP requires that development costs (from

R&D-activities) shall be capitalized when certain conditions are met (similar to IFRS). For the carrying amount of capitalized development costs, a legal reserve applies.

2 Legal reserves

Reserve for capitalized formation expenses and costs of the issue of shares

Under Dutch law it is allowed to capitalize formation expenses and the costs of the issue of shares. For the carrying amount of these capitalized expenses and costs, a legal reserve applies. Note however, that capitalization of such costs is not common anymore in the

Netherlands.

The legal reserve has to be determined for each individual associate or subsidiary.

Note that on the acquisition date of an associate or subsidiary, the legal reserve will be nil. Any existing legal reserves or restrictions within the participating interest are not relevant. The legal reserve only applies to subsequent increases in net asset value.

Reserve for retained earnings by associates or subsidiaries

Civil Code Book 2 section 389 requires that in the separate financial statements, interests in associates and subsidiaries are accounted for at net asset value. This method resembles the equity method as used under IFRS, however, any goodwill is accounted for separately.

Accordingly, the entity recognizes earnings from such interest based on the relative interest of the entity.

The legal reserve also applies to increases of the net asset value due to other comprehensive income than earning in profit and loss, such as revaluations of assets within the participating interest. Increases due to transactions with the entity in its capacity of shareholder (e.g., additional contributions of share premium) are excluded, as they are not part of comprehensive income.

Decisions on dividend by the General Meeting of

Shareholders of the participating interest after the balance sheet date of the entity may affect the legal reserve. For example, the legal reserve can be reduced for dividends declared after balance sheet date.

Civil Code Book 2 section 389, subsection 6 prescribes a legal reserve for earnings from such participating interests reported by the entity as part of its own income, to the extent that those earnings are not yet paid out as dividends, and the entity has no control over the pay out of such dividends. The background of this legal reserve is, that although the accounting method of net asset value allows investors to include income of associates and subsidiaries in their own income, distribution of such income by the investors is allowed only when the investor can collect such income from the interests.

Retained earnings can only be reduced from the legal reserve if the entity faces no restrictions on deciding to make the interest pay out comprehensive income. The list of possible restrictions is not limited, and restrictions should be assessed in substance.

The legal reserve is determined as follows:

Add up all comprehensive income subsequent

to the first application of the net asset

value method (i.e., normally when the inter-

est is acquired, or when an existing partici-

pating interest becomes an associate or a

subsidiary). Participating interests with nega-

tive cumulative comprehensive income are

excluded;

Subtract any distributions to which the entity

became entitled up to the moment that the

financial statements of the entity are

authorized for issue;

Subtract any distributions the entity may

cause to be made without restrictions.

Examples of restrictions:

No power to govern decisions on dividend in

the General Meeting of Shareholders. This

typically applies to associates where the

entity has no control;

Legal reserves to be kept by the participating

interest;

Minimum capital requirements at

the participating interest. For example, if

distributions would violate bank covenants

(or shareholder agreements on distributions),

such distributions are effectively not possible;

Any taxes that an participating interest has to

withhold in the event of distributions. On a

net basis, the entity will not be able to receive

the full amount of earnings from this interest.

Reserve for financing of own shares

An entity may only provide loans to shareholders for the purpose of financing the acquisition of shares of the entity by these shareholders to a maximum of the distributable reserves. A legal reserve applies for the outstanding balance of such loans.

Reserve for rounding differences on capital translation to Euros

Bylaws of an entity may still refer to amounts in the former Dutch currency, the Guilder. If the nominal value of shares is formally translated into Euros, Dutch law allows some rounding upwards or downwards. If rounded downwards, a legal reserve applies to the decrease in capital, in order to prevent additional distributable reserves solely caused by the formal translation.

Note that the amount of this legal reserve will normally be small, but will remain indefinitely.

Rounding upwards is far more common in practice. The increase in capital is accompanied by a decrease in distributable reserves. To the extent that the level of distributable reserves is insufficient, a (negative) legal reserve applies for the deficit.

Reserve for BV capital lower than the current mandatory minimum amount

For the BV, the minimum share capital as issued and funded is currently 18,000 Euro. In the past, a lower amount applied. When this minimum was raised, existing BVs had either to raise additional equity, or maintain a legal reserve for the deficit. Such deficits are rare in current practice. For the NV, with a minimum share capital of 45,000 Euro, no similar requirement applies.

Reserve for contribution in kind at the incorporation of a NV

If contributions on shares at, or after incorporating a NV are other than in cash,

Dutch law requires a public statement with a description of the contribution in kind, including the estimated value, and an audit opinion that the estimated value can be substantiated and is at least equal to the agreed funding. An exemption for the description and audit opinion applies if certain conditions are met. One of the conditions is that the founding legal entity (or, after establishing the NV, the contributing legal entity) is several liable for the liabilities of the

NV to a maximum of the capital contributed by the legal entity. In addition, for the founding/ contributing legal entity a legal reserve applies for this maximum liability, i.e., the capital contributed by the founding legal entity.

Colophon

This publication has been carefully prepared, but it has been written in general terms and should be seen as broad guidance only. The publication cannot be relied upon to cover specific situations and you should not act, or refrain from acting, upon the information contained therein without obtaining specific professional advice. Please contact BDO Accountants & Adviseurs to discuss these matters in the context of your particular circumstances. BDO Accountants & Adviseurs, its partners, employees and agents do not accept or assume any liability or duty of care for any loss arising from any action taken or not taken by anyone in reliance on the information in this publication or for any decision based on it. – May 2011

BDO is a registered trademark owned by Stichting BDO, a foundation established under Dutch law, having its registered office in Amsterdam (the Netherlands).

In this publication ‘BDO’ is used to indicate the organisation which provides professional services in the field of accountancy, tax and consultancy under the name ‘BDO’.

BDO Accountants & Adviseurs is a registered trade name owned by BDO Holding B.V., having its registered office in

Eindhoven (the Netherlands), and is used to indicate a group of companies, each of which separately provides professional services in the field of accountancy, tax and/or consultancy.

BDO Holding B.V.

is a member of BDO International Ltd, a UK company limited by guarantee, and forms part of the worldwide network of independent legal entities, each of which provides professional services under the name ‘BDO’.

BDO is the brand name for the BDO network and for each of the BDO Member Firms.

06/2011 – FA11151