Page 1 of 3

Gleim / Flesher CMA Review

15th Edition, 1st Printing

Part 2 Updates

Available December 2010

NOTE: Text that should be deleted from the outline is displayed as struck through with a red

background. New text is shown in courier font with a green background.

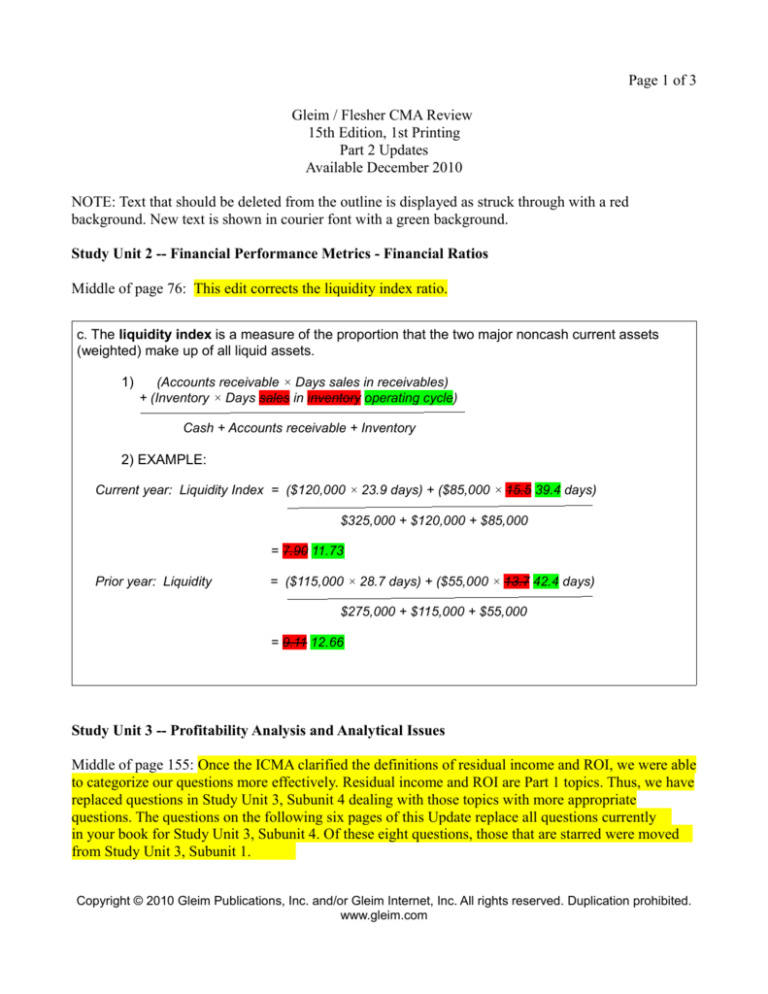

Study Unit 2 -- Financial Performance Metrics - Financial Ratios

Middle of page 76: This edit corrects the liquidity index ratio.

c. The liquidity index is a measure of the proportion that the two major noncash current assets

(weighted) make up of all liquid assets.

1)

(Accounts receivable × Days sales in receivables)

+ (Inventory × Days sales in inventory operating cycle)

Cash + Accounts receivable + Inventory

2) EXAMPLE:

Current year: Liquidity Index = ($120,000 × 23.9 days) + ($85,000 × 15.5 39.4 days)

$325,000 + $120,000 + $85,000

= 7.90 11.73

Prior year: Liquidity

= ($115,000 × 28.7 days) + ($55,000 × 13.7 42.4 days)

$275,000 + $115,000 + $55,000

= 9.11 12.66

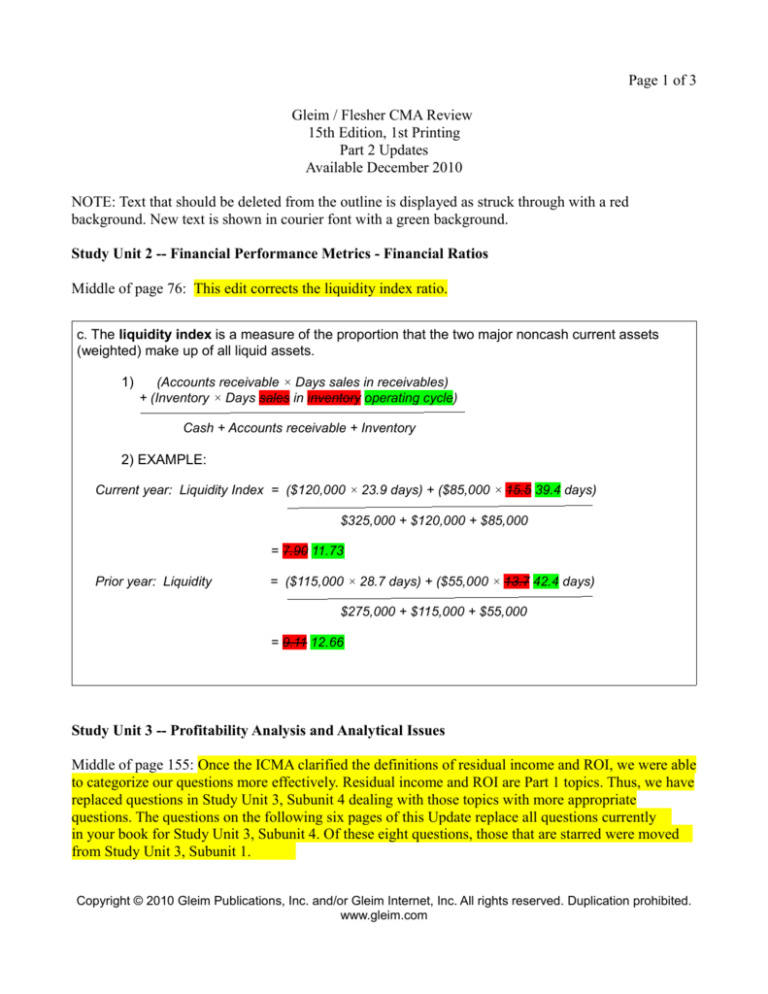

Study Unit 3 -- Profitability Analysis and Analytical Issues

Middle of page 155: Once the ICMA clarified the definitions of residual income and ROI, we were able

to categorize our questions more effectively. Residual income and ROI are Part 1 topics. Thus, we have

replaced questions in Study Unit 3, Subunit 4 dealing with those topics with more appropriate

questions. The questions on WKHIROORZLQJVL[pageVRIthis Update replace all questions FXUUHQWO\

in your book for Study Unit 3, Subunit 4. Of these eight questions, those that are starred were PRYHG

from Study Unit 3, Subunit 1.

Copyright © 2010 Gleim Publications, Inc. and/or Gleim Internet, Inc. All rights reserved. Duplication prohibited.

www.gleim.com

153

SU 3: Profitability Analysis and Analytical Issues

3.4 Profitability Analysis

39. The following information pertains to Andrew Co.

for the year ended December 31:

Sales

Net income

Average total assets

Answer (C) is correct. (Publisher, adapted)

REQUIRED: The formula used to compute ROI.

DISCUSSION: The DuPont model depicts return on assets

as total asset turnover (sales divided by average total assets)

times the profit margin (net income divided by sales). Therefore,

Andrew’s ROA calculation uses the formula [($720,000 ÷

$480,000) × ($120,000 ÷ $720,000)].

$720,000

120,000

480,000

Which one of the following formulas depicts the use of

the DuPont model to calculate Andrew’s return on

assets?

A. (720,000 ÷ 480,000) × (720,000 ÷ 120,000)

B. (480,000 ÷ 720,000) × (720,000 ÷ 120,000)

C. (720,000 ÷ 480,000) × (120,000 ÷ 720,000)

D. (480,000 ÷ 720,000) × (120,000 ÷ 720,000)

Questions 40 and 41 are based on the following information. The information that follows pertains to Devlin Company.

Statement of Financial Position as of May 31

(in thousands)

Income Statement for the year ended May 31

(in thousands)

Year 2 Year 1

Assets

Current assets

Cash

Trading securities

Accounts receivable (net)

Inventory

Prepaid expenses

Total current assets

Investments, at equity

Property, plant, and equipment (net)

Intangible assets (net)

Total assets

$ 45

30

68

90

22

$255

38

375

80

$748

$ 38

20

48

80

30

$216

30

400

45

$691

Liabilities

Current liabilities

Notes payable

Accounts payable

Accrued expenses

Income taxes payable

Total current liabilities

Long-term debt

Deferred taxes

Total liabilities

$ 35

70

5

15

$125

35

3

$163

$ 18

42

4

16

$ 80

35

2

$117

$150

225

$150

195

114

96

$585

$748

100

129

$574

$691

Equity

Preferred stock, 6%, $100 par value,

cumulative

Common stock, $10 par value

Additional paid-in capital -- common

stock

Retained earnings

Total equity

Total liabilities and equity

Net sales

Costs and expenses

Costs of goods sold

Selling, general, and administrative

Interest expense

Income before taxes

Income taxes

Net income

Year 2 Year 1

$480

$460

330

52

8

$ 90

36

$ 54

315

51

9

$ 85

34

$ 51

154

*

SU 3: Profitability Analysis and Analytical Issues

40. Assuming there are no preferred stock dividends

in arrears, Devlin Company’s return on common

equity for the year ended May 31, Year 2, was

A. 6.3%

B. 7.5%

C. 7.8%

D. 10.5%

*

41. Devlin Company’s rate of return on assets for the

year ended May 31, Year 2, was

A. 7.2%

B. 7.5%

C. 7.8%

D. 11.2%

Answer (D) is correct. (CMA, adapted)

REQUIRED: The return on common equity.

DISCUSSION: The return on common equity equals income

available to common shareholders divided by average common

equity. Income available to common shareholders is $45 [$54

net income – ($150 par value of preferred stock × 6%)]. Average

common equity is $429.5 {[$574 beginning total equity – $150

beginning preferred stock) + ($585 ending total equity – $150

ending preferred stock)] ÷ 2}. Thus, the return is 10.5% ($45 ÷

$429.5).

Answer (A) is incorrect. Average total assets are based on

6.3%. Answer (B) is incorrect. Net income divided by average

total assets equals 7.5%. Answer (C) is incorrect. Net income

divided by beginning total assets equals 7.8%.

Answer (B) is correct. (CMA, adapted)

REQUIRED: The rate of return on assets.

DISCUSSION: The rate of return on assets equals net

income divided by average total assets. Accordingly, the rate of

return is 7.5% {$54 ÷ [($748 + $691) ÷ 2]}.

Answer (A) is incorrect. The figure of 7.2% uses ending total

assets instead of average total assets. Answer (C) is incorrect.

Net income divided by beginning total assets equals 7.8%.

Answer (D) is incorrect. The return on sales is 11.2%.

Question 42 is based on the following information. The Statement of Financial Position for King Products Corporation for

the fiscal years ended June 30, Year 2, and June 30, Year 1, is presented below. Net sales and cost of goods sold for the

year ended June 30, Year 2, were $600,000 and $440,000, respectively.

King Products Corporation

Statement of Financial Position

(in thousands)

Cash

Marketable securities (at market)

Accounts receivable (net)

Inventories (at lower of cost or market)

Prepaid items

Total current assets

June 30

Year 2

Year 1

$ 60

$ 50

40

30

90

60

120

100

30

40

$ 340

$280

Land (at cost)

Building (net)

Equipment (net)

Patents (net)

Goodwill (net)

Total long-term assets

Total assets

200

160

190

70

40

$ 660

$1,000

190

180

200

34

26

$630

$910

Notes payable

Accounts payable

Accrued interest

Total current liabilities

$

46

94

30

$ 170

$ 24

56

30

$110

Notes payable, 10% due 12/31/Year 7

Bonds payable, 12% due 6/30/Year 10

Total long-term debt

Total liabilities

Preferred stock -- 5% cumulative, $100 par,

nonparticipating, authorized, issued and outstanding,

2,000 shares

Common stock -- $10 par, 40,000 shares authorized,

30,000 shares issued and outstanding

Additional paid-in capital -- common

Retained earnings

Total equity

Total liabilities & equity

20

30

$ 50

$ 220

20

30

$ 50

$160

200

200

300

150

130

$ 780

$1,000

300

150

100

$750

$910

155

SU 3: Profitability Analysis and Analytical Issues

*

42. Assuming that King Products Corporation’s net

income for the year ended June 30, Year 2, was

$70,000 and there are no preferred stock dividends in

arrears, King Products Corporation’s return on

common equity was

A. 7.8%

B. 10.6%

C. 10.9%

D. 12.4%

*

43. If Company A has a higher rate of return on

assets than Company B, the reason may be that

Company A has a <List A> profit margin on sales, a

<List B> asset-turnover ratio, or both.

List A

List B

A.

Higher

Higher

B.

Higher

Lower

C.

Lower

Higher

D.

Lower

Lower

Answer (B) is correct. (CMA, adapted)

REQUIRED: The return on common equity for Year 2.

DISCUSSION: The return on common equity equals income

available to common shareholders divided by the average

common equity. The preferred stock dividend requirement is

$10,000 ($200,000 par value × 5%), so the income available to

common shareholders is $60,000 ($70,000 NI – $10,000). Given

that preferred equity was $200,000 at all relevant times,

beginning and ending common equity was $550,000 ($750,000

total – $200,000) and $580,000 ($780,000 total – $200,000), an

average of $565,000 [($580,000 + $550,000) ÷ 2]. The return on

common equity was therefore 10.6% ($60,000 ÷ $565,000).

Answer (A) is incorrect. The percentage 7.8% includes

preferred equity in the denominator. Answer (C) is incorrect.

Using beginning-of-the-year equity results in 10.9%. Answer (D)

is incorrect. Not subtracting the preferred dividend requirement

from net income results in 12.4%.

Answer (A) is correct. (CIA, adapted)

REQUIRED: The reason for a higher rate of return on

assets.

DISCUSSION: The DuPont model treats the return on

assets as the product of the profit margin and the asset turnover:

96 8

8

If one company has a higher return on assets than another, it

may have a higher profit margin, a higher asset turnover, or

both.

156

SU 3: Profitability Analysis and Analytical Issues

Question 44 is based on the following information.

Lisa, Inc.

Statement of Financial Position

December 31, Year 2 (in thousands)

Assets

Current assets

Cash

Trading securities

Accounts receivable (net)

Inventories (at lower of cost or market)

Prepaid items

Total current assets

Long-term investments

Securities (at cost)

Property, plant, & equipment

Land (at cost)

Building (net)

Equipment (net)

Intangible assets

Patents (net)

Goodwill (net)

Total long-term assets

Total assets

Liabilities & shareholders’ equity

Current liabilities

Notes payable

Accounts payable

Accrued interest

Total current liabilities

Long-term debt

Notes payable 10% due 12/31/Year 9

Bonds payable 12% due 12/31/Year 8

Total long-term debt

Total liabilities

Shareholders’ equity

Preferred - 5% cumulative, $100 par,

non-participating, 1,000 shares authorized,

issued and outstanding

Common - $10 par 20,000 shares authorized,

15,000 issued and outstanding shares

Additional paid-in capital - common

Retained earnings

Total shareholders’ equity

Total liabilities & equity

44. Assuming that Lisa, Inc.’s net income for Year 2

was $35,000, and there were no preferred stock

dividends in arrears, Lisa’s return on common equity

for Year 2 was

A. 7.8%

B. 10.6%

C. 10.9%

D. 12.4%

Year 2

Year 1

$ 30

20

45

60

15

170

$ 25

15

30

50

20

140

25

20

75

80

95

75

90

100

35

20

330

$500

17

13

315

$455

$23

47

15

85

$12

28

15

55

10

15

25

$110

10

15

25

$ 80

$100

$100

150

75

65

$390

$500

150

75

50

$375

$455

Answer (B) is correct. (CMA, adapted)

REQUIRED: The return on common equity assuming no

preferred stock dividends are in arrears.

DISCUSSION: The return on common equity equals income

available to common shareholders divided by average common

equity. The preferred stock dividend requirement is 5%, or

$5,000 (5% × $100,000). Deducting the $5,000 of preferred

dividends from the $35,000 of net income leaves $30,000 for the

common shareholders. The firm began the year with common

equity of $275,000 and ended with $290,000. Thus, the average

common equity during the year was $282,500. The return on

common equity was 10.6% ($30,000 ÷ $282,500).

Answer (A) is incorrect. Including the $100,000 of preferred

stock in the denominator results in 7.8%. Answer (C) is

incorrect. The beginning shareholders’ equity of $275,000 is

based on 10.9%. Answer (D) is incorrect. Total net income of

$35,000 is based on 12.4%.

SU 3: Profitability Analysis and Analytical Issues

157

Question 45 is based on the following information.

A company reports the following account balances

at year-end:

Account

Long-term debt

Cash

Net sales

Fixed assets (net)

Tax expense

Inventory

Common stock

Interest expense

Administrative expense

Retained earnings

Accounts payable

Accounts receivable

Cost of goods sold

Depreciation expense

Balance

$200,000

50,000

600,000

320,000

67,500

25,000

100,000

20,000

35,000

150,000

65,000

120,000

400,000

10,000

Additional Information:

• The opening balance of common stock was

$100,000.

• The opening balance of retained earnings

was $82,500.

• The company had 10,000 common shares

outstanding all year.

• No dividends were paid during the year.

45. For the year just ended, the company had a rate

of return on common equity, rounded to two decimals,

of

A. 31.21%

B. 58.06%

C. 67.50%

D. 71.68%

Answer (A) is correct. (CIA, adapted)

REQUIRED: The rate of return on common equity for the

year just ended.

DISCUSSION: The return on common equity equals income

available to common shareholders divided by average common

equity. Since the company has no preferred stock, income

available to common shareholders is the same as net income

($600,000 sales – $400,000 cost of goods sold – $35,000

administrative expenses – $10,000 depreciation – $20,000

interest expense – $67,500 taxes = $67,500). The opening

balance of common equity was $182,500 ($100,000 common

stock + $82,500 retained earnings) and the closing balance was

$250,000 ($182,500 opening balance + $67,500 net income).

Average common equity for the year was thus $216,250

[($182,500 + $250,000) ÷ 2]. Return on common equity was

31.21% ($67,500 ÷ $216,250).

Answer (B) is incorrect. This percentage excludes common

stock from the denominator. Answer (C) is incorrect. This

percentage excludes retained earnings from the denominator.

Answer (D) is incorrect. This percentage excludes interest

expense and tax expense from the numerator.

158

*

SU 3: Profitability Analysis and Analytical Issues

46. The Intelinet Corporation and Comp, Inc. have

assets of $100,000 each and a return on common

equity of 17%. Intelinet has twice the debt of Comp

while Comp has half the sales of Intelinet. If Intelinet

has net income of $10,000 and a total assets turnover

ratio of 3.5, what is Comp Inc.’s profit margin?

A. 3.31%

B. 7.71%

C. 10.00%

D. 13.50%

Answer (B) is correct. (Publisher, adapted)

REQUIRED: The profit margin percentage for Comp.

DISCUSSION: Since Intelinet’s ROCE, net income, assets,

and debt (in terms of Comp’s debt) are known, they can be

plugged into the formula for return on common equity to

determine Comp’s debt level:

ROCE = (Net income – Preferred dividends) ÷

Average common equity

.17 = ($10,000 – $0) ÷ ($100,000 – 2D)

.17 × ($100,000 – 2D) = $10,000

$17,000 – .34D = $10,000

.34D = $7,000

D = $20,588

Now that Comp’s debt is known, it can be substituted in the

ROCE formula to find net income:

ROCE = (Net income – Preferred dividends) ÷

Average common equity

.17 = (NI – $0) ÷ ($100,000 – $20,588)

= NI ÷ $79,412

NI = $13,500

Since Comp’s sales are one-half those of Intelinet, they amount

to $175,000 ($350,000 ÷ 2). Therefore, Comp’s profit margin

percentage is $13,500 ÷ $175,000, or 7.71%.

Answer (A) is incorrect. This percentage is based on the

wrong income. Answer (C) is incorrect. This percentage is the

return on assets for Intelinet Corp. Answer (D) is incorrect. This

percentage is the return on assets for Comp.

Page 2 of 3

Study Unit 5 -- Financial Instruments and Cost of Capital

Middle of page 215: This corrects an amount in the example.

Component cost of preferred equity = Cash dividend ÷ Market price of stock

= ($40,000,000 × 11.5%) ÷ $4,600,000

= 10.0%

Top of page 239: This corrects the cost of capital curve description.

52. In referring to the graph of a firm’s cost of capital,

if e is the current optimal position, which one of the following

statements best explains the saucer or U-shaped

curve?

A. The composition of debt and equity does not

affect the firm’s cost of capital.

B. The cost of capital is almost always favorably

influenced by increases in financial leverage.

C. The cost of capital is almost always negatively

influenced by increases in financial leverage.

D. Use of at least some debt financing will

enhance the value of the firm.

53. In referring to the graph of a firm’s cost of capital,

if e is the current optimal position, which one of the following

statements best explains the saucer or U-shaped

curve?

A. The cost of capital is almost always favorably

influenced by increases in financial leverage.

B. The cost of capital is almost always negatively

influenced by increases in financial leverage.

C. The financial markets will penalize firms that

borrow even in moderate amounts.

D. Use of at least some debt financing will

enhance the value of the firm.

Answer (D) is correct. (CMA, adapted)

REQUIRED: The best explanation of the U-shaped curve

in a cost-of-capital graph.

DISCUSSION: The U-shaped curve indicates that the cost

of capital is quite high when the debt-to-equity ratio is quite

low. As debt increases, the cost of capital declines as long as

the cost of debt is less than that of equity. Eventually, the

decline in the cost of capital levels off because the cost of debt

ultimately rises as more debt is used. Additional increases in

debt (relative to equity) will then increase the cost of capital.

The implication is that some debt is present in the optimal

capital structure because the cost of capital initially declines

when debt is added. However, a point is reached (e) at which

debt becomes excessive and the cost of capital begins to rise.

Answer (A) is incorrect. The composition of the capital

structure affects the cost of capital since the components have

different costs. Answer (B) is incorrect. The cost of debt does

not remain constant as financial leverage increases.

Eventually, that cost also increases. Answer (C) is incorrect.

Increased leverage is initially favorable.

Answer (D) is correct. (CMA, adapted)

REQUIRED: The best explanation of the U-shaped curve

in a cost-of-capital graph.

DISCUSSION: The U-shaped curve indicates that the cost

of capital is quite high when the debt-to-equity ratio is quite

low. As debt increases, the cost of capital declines as long as

the cost of debt is less than that of equity. Eventually, the

decline in the cost of capital levels off because the cost of debt

ultimately rises as more debt is used. Additional increases in

debt (relative to equity) will then increase the cost of capital.

The implication is that some debt is present in the optimal

capital structure because the cost of capital initially declines

when debt is added. However, a point is reached (e) at which

debt becomes excessive and the cost of capital begins to rise.

Answer (A) is incorrect. The cost of debt does not remain

constant as financial leverage increases. Eventually, that cost

also increases. Answer (B) is incorrect. Increased leverage is

initially favorable. Answer (C) is incorrect. The initial decline in

the U-shaped graph indicates that the financial markets

reward moderate levels of debt.

Copyright © 2010 Gleim Publications, Inc. and/or Gleim Internet, Inc. All rights reserved. Duplication prohibited.

www.gleim.com

Page 3 of 3

Study Unit 6 -- Managing Current Assets

Middle of page 255: This corrects amounts in the example.

October purchases:

September purchase:

August purchases:

October payroll:

October op. expenses

Interest

Total October disbursements

$350,000 × 50% = $150,000175,000

$300,000 × 25% = 102,00075,000

$250,000 × 25% = 33,00062,500

$370,000 × 10% = 37,000

$280,000 × 20% = 56,000

5,000

$410,500

Bottom of page 302: This corrects the calculations in the answer explanation to match the question

stem.

94. A firm that often factors its accounts receivable

has an agreement with its finance company that

requires the firm to maintain a 6% reserve and

charges a 1.4% commission on the amount of the

receivables. The net proceeds would be further

reduced by an annual interest charge of 15% on the

monies advanced. Assuming a 360-day year, what

amount of cash (rounded to the nearest dollar) will the

firm receive from the finance company at the time a

$100,000 account that is due in 60 days is turned

over to the finance company?

Answer (C) is correct. (Publisher, adapted)

REQUIRED: The proceeds of factoring.

DISCUSSION: The first step is to calculate the gross

proceeds the firm will receive from the factoring transaction:

Amount of receivable

Less: reserve ($100,000 × 6%)

Less: factor fee ($100,000 × 1.4%)

Gross proceeds

$100,000

(6,000)

(1,400)

$ 92,600

This amount must be reduced by the interest charged on the

gross proceeds:

A. $92,600

B. $96,135

C. $90,285

Gross proceeds

Times: annual finance charge

Annualized interest expense

Times: portion of year (9060 days ÷ 360 days)

Interest expense

$92,600

× 15%

$13,890

× 16.7%

$ 2,315

D. $85,000

The actual cash the firm will receive from this factoring

transaction is thus calculated as follows:

Gross proceeds

Less: interest expense

Net proceeds

$92,600

(2,315)

$90,285

Answer (A) is incorrect. The amount of $92,600 results from

failing to consider the interest expense. Answer (B) is

incorrect. The amount of $96,135 results from failing to

subtract the 6% reserve. Answer (D) is incorrect. The amount

of $85,000 assumes that the only amount withheld is a full

year’s interest on $100,000.

Copyright © 2010 Gleim Publications, Inc. and/or Gleim Internet, Inc. All rights reserved. Duplication prohibited.

www.gleim.com