Rosetta Stone Inc. - University of Oregon Investment Group

advertisement

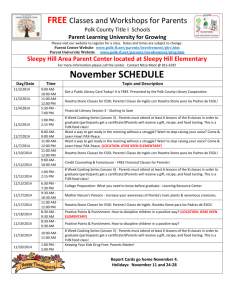

UNIVERSITY OF OREGON INVESTMENT GROUP 4-30-2010 Consumer Goods Rosetta Stone Inc. RECOMMENDATION: BUY Stock Data Price (52 weeks) Symbol/Exchange Beta Shares Outstanding Average daily volume (3 month average) Current market cap(M) Current Price Valuation (per share) DCF Analysis Comparables Analysis Current Price Target Price $16.06- 32.97 RST / NYSE .65 19.9 287,505 $569 $26.25 $31.88 (50% weight) $37.10 (50%) $26.25 $34.49 Summary Financials 2009A ($M) Revenue Net Income Operating Cash Flow $252 $13.4 $41.1 CORPORATE SUMMARY Rosetta Stone Inc. (RST) joined the public markets in the spring of 2009. As of the end of their fiscal year 2009 they reported $252 million in sales, while also growing profits at 54 percent year over year. The company’s goal is to create a program that surrounds their customers directly with the language, without translation. Their proprietary teaching method called Dynamic Immersion has been the key driver for the company’s recent growth. They offer courses in 31 languages to a large customer base, ranging from government officials to armed forces. RST has offices in Virginia, London, Tokyo, Colorado and other various locations around the world. The focus point going forward is to keep up with growing international demand whiling continuing to enhance their proprietary curriculum. Covering Analyst: Matthew Hollands Email: Mhollan1@uoegon.edu The University of Oregon Investment Group (UOIG) is a student run organization whose purpose is strictly educational. Member students are not certified or licensed to give investment advice or analyze securities, nor do they purport to be. Members of UOIG may have clerked, interned or held various employment positions with firms held in UOIG’s portfolio. In addition, members of UOIG may attempt to obtain employment positions with firms held in UOIG’s portfolio. Rosetta Stone Inc. university of oreg on investment g roup http://uoig.uoregon.edu The products offered are available in four versions that use the standard learning model but are tailored specific to the customer’s preference. The personal edition is for those who are looking to pick up a language on their own time and convenience. These normally appear for purchases at kiosks, retailer stores and or online to be used in the home. Schools that are looking for assistance with teaching their curriculum can purchase the classroom edition. For those who are teaching the language can use the tools offered in this edition to create track record for students as well as helpful activities, guidance to enhance the process, and detailed lesson plans. Families who use their home as a means for education are offered a targeted course that enhances lesson planning. Parents can create a formal language learning environment with ease. The Home School Edition provides similar functionalities as the classroom. Corporations who are need of language support for international activities can supply their employees with a convenient, user friendly platform that gives them total control of their learning experience. The latest data in the 10k shows that 87 percent of their sales were CD-ROM based purchases while the remaining 13 percent came from online subscriptions. The chart above shows the recent growth by the company, both domestically and internationally. This trend is set to continue for the next 3-4 years as expansion efforts and global demand pick up. BUSINESS AND GROWTH STRATEGIES RST has been able to generate quarter over quarter double digit growth because of several factors: Advancements in proprietary learning software Increased market demand Versatile curriculum that can be translated across many languages. Cost-effective product portfolio. The aforementioned determinates could not be achieved without the company’s ability to utilize their marketing and operational channels. Using retailers such AMZN, AAPL and BKS customers are targeted directly. This coupled with radio, T.V. and other mediums, has created strong brand recognition for the company. Studies from various research firms show that RST’s investments into marketing and S&GA has create nearly 80 percent brand awareness and has confirmed that Rosetta Stone is the most recognized language learning brand in the US (data from SP500 and 10k report). 2 Rosetta Stone Inc. university of oreg on investment g roup http://uoig.uoregon.edu A little more than 90 percent of the business’ top line figures came from customers in the US during fiscal year 2009. Market research suggests that the market of the language learning industry is around $85 billion dollars of total consumer spending. It further suggests that demand is fueled by consumer’s preferences shifting towards increased taste for language learning. Consistently developing the language platform and increasing the accessibility of it will keep top line growth in the 12-14 percent range for the next three years. Users have shifted towards interactive platforms as a means of performing activities. Worldwide growth for using computers as a teaching tool has exploded in recent years. Its projected that there will be nearly 1 billion personal computers in use within the next few years. Strong demand will continue to pick up for the company because of consumers preferences shifting to at home education, away from conventional classroom setting. RST has various product developments slated to hit the market within the next few quarters. Management has stated that investors can expect to see product launches similar to that of their midsummer introduction of TOTALe. This edition is a web-based upgrade that gives clients the opportunity to be instructed by professionals over the internet. Customers also have a chance to interact with other users to play games and practice the language. Upgrades in the level of language proficiencies will continue to occur as the company strives to supply their customers with a wide range of languages and levels. The company will seek bottom line growth by implementing various cost-effective strategies in their operations. Examples of these include using third-party manufactures to construct and package their product. In the past this has equated into reduction in costs and increases in capacity. To handle the roughly 8% of sales overseas, the company has firms in Munich, Tokyo, and Neverthlands. They will continue to expand operations overseas in order to increase sales growth while cutting down on operational expenses. RECENT NEWS Rosetta Stone looks to growth outside U.S. – 4-13-2010- Reuters New An article by Reuters touched on major business model changes that look to boost RST sales growth. The article names Brazil and Italy as possible areas of growth. The goal is to have international revenue account for 50% of total revenue within the next 4-5 years. As of fiscal year 2009 international sales accounted for around 8%. The cash on the company’s balance sheet will be used to accomplish these goals. The company will use debt as a last resort when it comes to financing expansions. China has been hindering RST from entering the market. The concern is the “lack of respect for intellectual property rights” China has. To combat such challenges, the company will continue to push the expansion of their current product line by introducing upgrades. The company is looking to launch its 4 th edition of its popular software, which can be used on the iphone. Rosetta Stone launches higher-education program – 3-24-2010- Virginia Business RST just announced an upgrade to their higher-education program that allows teacher to supplement class time with online learning. Students now have the ability to read, write, listen, and speak the language while being taught by a native speaker. This allows for fluid learning and different aspects of studying the language to emerge. This type of learning is set to launch at Universities and other colleges in the next few years. 3 Rosetta Stone Inc. university of oreg on investment g roup http://uoig.uoregon.edu Consumer Sentiment: Actions Speak Louder Than Words- 2-26-210 - IndieResearch RST reported that its Q4 profit more than doubled due to strong demand. Net income for the three months ended December 31st was $12.2 million, or 58 cents a share, up from $4.9 million, or 29 cents a share, last year. Adjusted EPS was 61 cents, easily topping the 38-cent consensus. Revenue climbed 18% to $78.3 million, also beating analyst expectations of $74.3 million. Looking forward, the company expects Q1 adjusted EPS of 7-9 cents on revenue of $58-$60 million versus the consensus of 12 cents on revenue of $56.2 million. For the full year, adjusted EPS is expected to be 90 cents to $1.00 on revenue of $286-$299 million compared to the analyst estimate of $1.16 on revenue of $279.6 million. INDUSTRY Rosetta Stone and its main competitors operate in the Software Publishing segment of the US. Business operations include distribution, publishing, and designing computer programs. Mass production within this industry usually occurs through 3rd party partnerships. This helps create a cost effective means of developing a product. IBISWorld lists the main functions of the industry on the graph to the right. Technological innovation and development is a key component of the success of this industry. Growth is likely to surpass historic levels within this industry due to R&D investments as well as falling hardware and software prices. As the global economies continue to rebound, the demand for such products is likely to reach historic growth through 2015. Macroeconomic fluctuations like rising unemployment and lower consumer spending can have adverse effects companies operations. As consumers continue to make investments in computers and software, demand will increase at healthy rates (near double digits). Market research provides projected investments into such activities for the next six years. The information suggests this trend is likely to keep RST at the forefront of language learning software. Computers are able to handle more data than ever and while at the same time operating at a faster pace. The costs during this time period have been decreasing. This has increased the affordability of products within the industry. Growth internationally is likely to be sustained around 6-7% for the next five years, with a bulk of the growth coming from emerging markets. In order to gain market share, businesses must continue to focus on strategies and decisions based on market demand determinates. Introducing new application platforms that improve customer service, profitability, marketing, and cost cutting management decisions give corporations opportunities to expand at record rates. These new product offerings serve as a driver for margin growth and continued reoccurring revenue. Software companies work to do this by creating new editions and upgrades to current product lines. Within the next few years larger 4 Rosetta Stone Inc. university of oreg on investment g roup http://uoig.uoregon.edu players in the market may be able to achieve operating income margins of 36-38 percent. The typical households buying decisions are directly tied to disposable incomes. As economic conditions strength major growth is likely to continue. As the World Wide Web becomes more readily available to other nations, growth for software related products will expand. Designers and distributors will push to make it easier for consumers to buy such products. This will equate to higher levels. Companies like RST strive for scucess in the global environment by reaching customers in an affordable fashion. To grow profitability in the double digits, businesses must be able to expand international sales while lowering SG&A and marketing expenses. Language learning programs require a strong brand name in order to survive. This can be achieved through brand position and increases in customer services. Firms must be willing to set up offices closer to their customers in order to effectively create a strong relationship. You may see slight increases in business marketing and or sales expenses if a company tries to push for stronger market recognition. The graph to the left shows how the current revenue segmentation is broken down within the industry. System software publishing and Application software publishing will continue to represent a large portion S.W.O.T. ANALYSIS Strengths Advanced proprietary programming that effectively teaches users the language of choice in an interactive fashion Language learning software that can be easily and cost effectively used throughout many nations and translations Leading brand awareness, customer loyalty, and highest product positioning Weaknesses Nearly all revenue is derived from one type of revenue stream- language learning solutions Current business model is tailored heavily to economic conditions in the US (nearly 92 percent of revenue comes from US). Opportunities Large market demand for learning language solutions both internationally and domestically Projected that $82 billion of consumer spending will be on language learning products Market for interactive language learning programs is relatively new with large growth potentials 5 Rosetta Stone Inc. university of oreg on investment g roup http://uoig.uoregon.edu Threats Prolonged global recession that effects disposable income and unemployment negatively Consumer preferences change substantially COMPARABLES ANALYSIS For selecting my comparable companies I used numerous scanning programs to base the businesses on specific criteria. It was especially important to evaluate risk, both from a market perspective (i.e. industry risks) and financial structure. The reason behind this was that the conventional method for deriving a beta (5 year, monthly regression) wasn’t possible because RST went public a little over a year ago. Thus I needed strong comparable companies in order derive an implied price (using enterprise metrics) and industry beta (Humada). The companies are all equity financed and have strong balance (quick ratios generally above 1.2 and strong cash positions). They have exposure to learning solution programs and face similar demand determinates. All though some had either stronger or weaker historic revenue growth, going forward the comparables will grow between 12-20 percent year over year for the next 3-5 years. The LTM gross margin percent, net income, and EBITDA for my comparables are approximately 72, 14, and 9 respectively. RST came in at 86, 8.5, and 5.3 respectively. As previously mentioned, these rates converge together in the next few years to similar growth rates as RST. Business descriptions and activities are described below by FactSet. I used four metrics to derive an implied price for Rosetta Stone Inc.: EV/Revenue, EV/Gross Profit, EV/EBITDA, and EV/OCF. Enterprise value (EV) over revenue is a measurement for how well a company produces revenue relative to its takeover value and it’s fundamentally affected by how good a company’s margins, growth, and risk are. Since the companies share future risks, growth, etc this was weighted at 30 percent. The metrics for finding how well cash flow is produced relative to the size of the firm was EV/EBITDA. Similarly I wanted a metric to estimate how well a company produces operational cash flows relative to their enterprise (over OCF). To see how well the companies compare based on their effectiveness of COGS management is relative to their firm’s size, I used EV/Gross profit. Renaissance Learning Inc (NASDAQ Stock Market: RLRN)- 30% Weight Renaissance Learning, Inc. is a provider of computer-based assessment technology for pre-kindergarten through senior high (pre-K-12) schools and districts. The Company’s tools provide daily formative assessment and periodic progress-monitoring technology to enhance core curriculum, 6 Rosetta Stone Inc. university of oreg on investment g roup http://uoig.uoregon.edu support differentiated instruction, and personalize practice in reading, writing, and math. Its products and services are primarily focused on three key pre-K-12 curriculum areas: reading, writing, and math. Accelerated Reader, STAR Reading, STAR Early Literacy, Successful Reader, and Read Now Power Up! comprise its reading products. Its math products include Accelerated Math, STAR Math, and Math Facts in a Flash. NEO laptops and related software are its primary writing and keyboarding products. It also addresses language acquisition for English language learners with its English in a Flash software. Its 2Know! response system is a classroom tool. Scientific Learning Corp. (NASDAQ Stock Market: SCIL) -15% Scientific Learning Corporation develops, distributes the Fast ForWord family of software. The Company creates educational software that accelerates learning by improving the processing efficiency of the brain. Its products are marketed primarily to K-12 schools. The Company’s products are marketed in 45 countries globally. It offers an online data analysis and reporting tool that uses algorithms to provide diagnostic and prescriptive information and intervention strategies. The Company provides a variety of on-site, Web-based and telephone-based services and support. During the year ended December 31, 2009, the K-12 sector accounted for 90% of the net sales of the Company. During 2009, the sale were concentrated in K-12 schools in the United States, and accounted nearly 117,000 schools serving approximately 56 million students. Art Technology Group, Inc. (NASDAQ Stock Market: ARTG) – 25% Art Technology Group, Inc. (ATG) develops and markets a suite of e-commerce software products. ATG Commerce is an e-commerce platform and set of e-commerce applications, which the Company delivers through perpetual software licenses, software as a service (SaaS) or on a managed services basis. Its optimization services include Click-to-Call, Click-to-Chat, Call Tracking and ATG Recommendations services. The Company sells its products primarily through its direct sales organization. ATG Partners include global systems integrators, such as Accenture, Acquity Group, Capgemini, CGI, Deloitte Consulting, Infosys and Sapient, as well as regional systems integrators and interactive agencies, such as Aaxis Group, Empathy Lab, LBi Group, Professional Access, Razorfish and Resource Interactive. On January 8, 2010, the Company acquired InstantService.com, Inc. Universal Technical Institute, Inc. (NYSE: UTI) 30% Universal Technical Institute, Inc. is a provider of postsecondary education for students seeking careers as professional automotive, diesel, collision repair, motorcycle and marine technicians as measured by total average undergraduate enrollment and graduates. It offer undergraduate degree, diploma and certificate programs at 10 campuses across the United States under the banner of brands, including Universal Technical Institute (UTI), Motorcycle Mechanics Institute and Marine Mechanics Institute (collectively, MMI) and NASCAR Technical Institute (NTI). The Company also offer manufacturer-specific training programs including both student paid electives at the campuses and manufacturer or dealer sponsored training at dedicated training centers. As of September 30, 2009, the average undergraduate enrollment was 15,854 full-time students. 7 Rosetta Stone Inc. university of oreg on investment g roup http://uoig.uoregon.edu DISCOUNTED CASH FLOW ANALYSIS Revenue Revenues are based on the percent of growth model. I took into account the following information to project future sales (some of the data for how growth was forecasted is available in the appendixes): Revenue from sales channels (direct-to-consumer, Kiosk, Retail) International expansion Product & service revenue growth rates (both historic and projected) A list of how revenue is broken down is provided to the right. The company going forward will look to boost top line growth by increasing their customer base (both domestically and internationally) through marketing, sales force, and securing more distribution channels. The latter is going to be a key driver for RST within the next few quarters as they bring to market higher margin offerings and upgrades. Securing channels through retailers and online (direct-to-consumer) will be especially important for them while they look overseas for growth and consumer preferences change. The company will look to generate margin growth through cost management activities. This can occur in trimming marketing, development in production, and creating means for effective sales. Rosetta Stone will continue to leverage its business to its bread and butter product line, Language Learning Solutions. Upgrades and higher margin versions of their products will help them grow at near historic rates. Growth 2-3 years out is indicative of international expansion and economic rebounds. This coupled with lowered costs to operations will allow the company to growth at double digit rates for the next 5 years. For the nearer term forecasted years I went with CEO guidance, analyst, and numerous research reports. Gross Margin The company seeks to slowly grow top line margins at around 20-50 bbps average for the next coming years. They plan to accomplish this by lowering expenses. They plan to allocate capital and company resources in a way that facilitates the improvement of technology in the management of processing, inventory, and distribution channels. The COGS for expanding overseas should have material effects on gross margins as it’s easy for the proprietary information to be translated into several other languages. EBIT Margins In order to keep on top of their proprietary software and technology leadership, growth in the R&D is necessary. This will be especially important as expansion overseas and consumer demand picks up. You will see low upticks in R&D as this occurs. In the past this has enhance how subscribers and customers interact in the learning program. Some of 8 Rosetta Stone Inc. university of oreg on investment g roup http://uoig.uoregon.edu the new advancements can be seen in the company allowing users to join online chats with native speakers. Improvements in distribution are also aided by capital fusions into R&D. By utilizing the development of their technology they will continue to grow faster than their competition and stay the leader in this niche market. Whether you watch TV, listen to the radio, shop at the mall, or search online you have more times than not seen the yellow box in which RST’s software comes in. Although not as big of a factor going forward, the company’s marketing scheme has helped fuel large growth for them. Management has stated that the marketing mix will shift based on how well revenues and brand awareness continues to expand. Operational Cash Flow (NI + D/A + Interest Expense) Net income is projected based on the revenue projections and the margins above. Depreciation and amortization is projected based on management, analyst estimates, and the expansion of acquisitions/ CAPEX. Interest Expense was kept constant. Assumptions Beta- Looking at the appendixes you can see that I conducted a Hamada beta based on my comparables and a selection of industry related companies given by FactSet and SP500 compustat report. The Hamada resulted in a beta of .65. This seems reasonable given the nature of the industry and the current positions of its balance sheets (see NWC in the appendix). Cash- Cash wasn’t added into the equity value because the CEO has stated it will be used for acquisitions (CAPEX) within the next 2-3 years. RECOMMENDATION I am recommending a buy for all portfolios’s based on Rosetta Stone’s implied value being greater than its current market price. The report shows both the quantitative and qualitative information that went into the valuation. 9 Rosetta Stone Inc. university of oreg on investment g roup http://uoig.uoregon.edu APPENDIX 1 – COMPARABLES ANALYSIS In Millions RST Price Shares Outstanding (MRQ/Diluted) Total Debt (MRQ) Enterprise Value Revenue (TTM) Gross Profit(TTM) EBIT (TTM) EBITDA (TTM) Net Income (TTM) OCF (TTM) Beta D/E Cash Quick Ratio RLRN 0 95 1.1 30.00% 15.9 29.9 0 436.41 121.5 96.1 31 33.6 19.9 34.3 1.1 0 39.5 1.15 SCIL 15.00% 5.2 18.7 0 77.24 55 43.7 5.3 7.2 4.8 14.5 0.7 0 20 1.15 ARTG 25.00% 4.59 133 0 610.47 179.4 118 16.8 26 16.8 30.2 1.2 0 79 1.62 UTI 30.00% 24.71 24.6 0 607.866 366 82.9 19.4 37 11.7 49.2 0.8 0 81 1.1 1.70 1.96 16.35 10.36 3.59 4.54 12.99 12.72 1.40 1.77 10.73 5.33 3.40 5.17 23.48 20.21 1.66 7.33 16.43 12.36 26.25 20 0 430 252 219 21 26 13 41.5 Multiples EV/Revenue EV/Gross Profit EV/EBITDA EV/OCF Weighted Average Implied Price Weighted Average 2.64 38.02 30.0% 4.15 50.20 30.0% 16.30 26.19 30.0% 13.38 27.76 10.0% Implied Price 37.10 Current Price 26.25 Undervalued 41.3% *SCIL’s Gross Margin was thrown out in the weighted average 10 Rosetta Stone Inc. university of oreg on investment g roup http://uoig.uoregon.edu APPENDIX 2 – DISCOUNTED CASH FLOWS ANALYSIS 1 (In Millions) Net Revenue 2007 137 % Growth COGS(incl. D&A) 2008 2009 2010E 2 2011E 3 2012E 4 2013E 5 2014E 6 2015E 7 2016E 8 2017E 9 2018E 10 2019E 209 252 295 348 418 481 529 571 600 618 636 655 52.5% 20.5% 17.0% 18.0% 20.0% 15.0% 10.0% 8.0% 5.0% 3.0% 3.0% 3.0% 24 32 33 38 45 52 60 65 69 72 74 76 79 %Revenue Gross Profit Gross Margin Operating Expenses SG&A %Revenue R&D %Revenue Other Operating Expense %Revenue Non-Operating Income (expense) %Revenue Operating income Operating Margin Non-Operating Items Interest Expense % Revenue Pretax Income Total Income Taxes Tax Rate Net Income Net Margin EPS 18% 113 82.3% 15% 178 84.9% 13% 219 86.8% 13% 257 87.0% 13% 304 87.2% 13% 366 87.5% 13% 421 87.5% 12% 464 87.7% 12% 503 88.0% 12% 528 88.0% 12% 543 88.0% 12% 560 88.0% 12% 577 88.0% 92 66.7% 13 9.40% 0 0% 0.90 0.7% 9.4 6.8% 130 62.1% 18 8.79% 2 1% 0.70 0.3% 28.2 13.5% 172 68.2% 26 10.38% 0 0% 0.30 0.1% 20.9 8.3% 198 67.0% 30 10% 233 67.0% 35 10% 282 67.5% 46 11% 312 65.0% 58 12% 344 65.0% 63 12% 371 65.0% 57 10% 390 65.0% 48 8% 401 65.0% 31 5% 413 65.0% 32 5% 426 65.0% 33 5% 29.5 10.0% 35.5 10.2% 37.6 9.0% 50.5 10.5% 56.6 10.7% 74.2 13.0% 89.9 15.0% 111.2 18.0% 114.5 18.0% 117.9 18.0% 1.3 0.9% 8 5 66.7% 3 2.0% 0.9 0.4% 27 13 49.1% 14 6.6% 0.4 0.2% 21 7 34.6% 13 5.3% Add Back: Deprec. & Amort. % Revenue Add Back: Interest expense*(1-tax rate) Cash From Operations % Revenue Current Assets % Revenue Current Liabilities % Revenue Net Working Capital Change in Networking Capital Cap EX % Revenue Free Cash Flow 8 5.7% 1.3 12 8.6% 43 31.0% 36 26.5% 6 $ 10 7.1% 2 7 3.3% 0.9 22 10.4% 109 52.2% 48 22.7% 62 56 7 3.3% -41 5 2.1% 0.4 19 7.6% 155 61.5% 66 26.2% 89 27 9 3.4% -16 PV of FCF 0 0 0.0% 0.0% 30 36 10 12 35.0% 35.0% 19 23 6.5% 6.6% 0.96 $ 1.15 $ 0 0.0% 38 13 35.0% 24 5.8% 1.22 $ 0 0.0% 50 18 35.0% 33 6.8% 1.64 $ 0 0.0% 57 20 35.0% 37 7.0% 1.84 $ 0 0.0% 74 26 35.0% 48 8.5% 2.41 $ 0 0.0% 90 31 35.0% 58 9.8% 2.92 $ 0 0.0% 111 39 35.0% 72 11.7% 3.61 $ 0 0.0% 115 40 35.0% 74 11.7% 3.72 $ 0 0.0% 118 41 35.0% 77 11.7% 3.83 9 3.0% 0 28 9.5% 183 62.0% 77 26.0% 106 17 10 3.5% 0 0 17 4.0% 0 41 9.8% 230 55.0% 109 26.0% 121 10 19 4.5% 13 10 20 4.2% 0 53 11.0% 240 50.0% 125 26.0% 115 -6 20 4.2% 39 28 16 3.0% 0 53 10.0% 291 55.0% 137 26.0% 153 38 21 4.0% -6 -4 14 2.5% 0 63 11.0% 314 55.0% 148 26.0% 166 12 17 3.0% 33 21 12 2.0% 0 70 11.8% 360 60.0% 156 26.0% 204 38 15 2.5% 17 10 6 1.0% 0 78 12.7% 371 60.0% 161 26.0% 210 6 15 2.5% 57 30 6 1.0% 0 81 12.7% 382 60.0% 165 26.0% 216 6 13 2.0% 62 30 7 1.0% 0 83 12.7% 393 60.0% 170 26.0% 223 6 13 2.0% 64 29 12 3.5% 0 35 10.1% 202 58.0% 91 26.0% 111 5 16 4.5% 14 12 11 Rosetta Stone Inc. university of oreg on investment g roup http://uoig.uoregon.edu APPENDIX 3 – DISCOUNTED CASH FLOWS ANALYSIS ASSUMPTIONS Risk-Free Rate Beta 3.69% Equity Cost of Capital 0.65 Equity Weighting 7% Tax Rate 3.0% Debt Weighting Risk Premium Terminal Growth Rate 8.24% 100% 35% 0% 0.0% 8.24% Cost of Debt 95 WACC 0 20 525 ∑ PV of FCF's Cash Long-term-debt Shares Outstanding (Dil) Enterprise Value 166 Terminal Value PV of Terminal Value Firm Value Equity Value Implied Price Current Price (Undervauled)/Over 1,251 567 733 638 31.88 26.25 -17.7% APPENDIX 4 – BETA Company Ticker Software Programing & Education Industry Renaissance Learning Inc. RLRN Scientific Learning Corp. SCIL Art Technology Group Inc. ARTG Universal Technical Institute Inc UTI Corinthian Colleges Inc. COCO Lincoln Educational Services Corporation LINC ITT Educational Services Inc. ESI Career Education Corp. CECO Mean Median Tax Rate RST D/E 35.0% 0.0 Unlevered Beta 0.656 Beta SE D/E 1.100 0.700 1.100 0.800 0.250 0.450 0.219 0.630 0.100 0.119 0.144 0.112 0.134 0.101 0.134 0.145 0.000 0.000 0.000 0.000 0.002 0.200 0.800 0.007 0.656 0.700 0.124 0.119 0.126 0.000 12 Rosetta Stone Inc. university of oreg on investment g roup http://uoig.uoregon.edu Beta Implied Value Valued 54.62 32.62 0.526 41.35 -51.00% -35.00% Beta Sensitivity Analysis SE= .124 0.65 31.88 -17.00% 0.774 25.7 0.898 12.4 2.00% 25.00% APPENDIX 5 – NWC 2007 22.1 52% 2008 69.1 212.7% 63% 2009 95.2 37.8% 61% 42.6 31% 11.9 27.9% 3.9 9.2% 4.7 109.4 52% 26.5 24.2% 4.9 4.5% 8.9 155.1 61% 37.4 24.1% 9 5.8% 13.5 36.4 27% 47.5 23% 30% 0 66.1 26% 39% 0 Cash & Short-term Investment Percent Growth Percent of Total asset Total Current Assets %Revenue A/R Percent of CA Inventories Percent of CA Other Current Assets Total Current Liabilities %Revenue %Growth ST Debt and Current of LT Percent of TCL Accounts Payable Percent of TCL Income Tax Payable Percent of TCL Other Current Liabilities Percent of TCL 3.4 13% 0% 4.6 17% 1.5 6% 26.9 74% 0% 3.2 8% 2.9 7% 41.4 87% 1.6 3% 6.2 11% 58.3 88% APPENDIX 6 – SOURCES FACTSET IBIS RST 10k (2009) Fidelity Schwab S&P 500 13