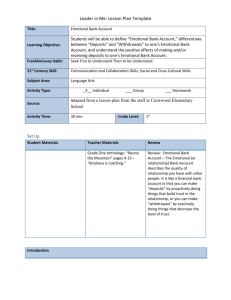

Money Supply

Our Money Supply

• Money consist of coins, paper money, demand (or checking) deposits, and checklike deposits (commonly called NOW

– or negotiable order of withdrawal – accounts) held by the nonbank public

– Coins and paper money together are considered currency

– Six of every ten dollars in our money supply are demand deposits and other checkable deposits

• Virtually all the rest is currency

– Checks are not money but checking deposits are

Copyright

©

2002 by The McGraw-Hill Companies, Inc. All rights reserved.

13-12

Our Money Supply

Federal Reserve Statistical Release, April 5, 2001

Copyright

©

2002 by The McGraw-Hill Companies, Inc. All rights reserved.

13-13

1

Our Money Supply: M1

Currency

+ Demand deposits

+ Other checkable deposits

+ Traveler’s checks

M1(traditionally our basic money supply)

Copyright

©

2002 by The McGraw-Hill Companies, Inc. All rights reserved.

13-14

M1

= $1,368.4 (billions of dollars),

June 2005

The Federal Reserve uses three definitions of the money supply: M1, M2, and M3.

M1 is equally split between currency in circulation and checkable bank deposits

Our Money Supply: M2

Currency

+ Demand deposits

+ Other checkable deposits

+ Traveler’s checks

M1

+ Savings deposits

+ Small-denomination time deposits (less than $100,00)

+ Money market mutual funds held by individuals

M2

Copyright

©

2002 by The McGraw-Hill Companies, Inc. All rights reserved.

13-15

2

M2

= $6,510.0 (billions of dollars),

June 2005

• The Federal Reserve uses three definitions of the money supply: M1, M2, and M3.

M2 has a much broader definition: it includes M1, plus a range of other deposits and deposit-like assets, making it about three times as large .

Our Money Supply: M1, M2, M3

Currency

+ Demand deposits

+ Other checkable deposits

+ Traveler’s checks

M1

+ Savings deposits

+ Small-denomination time deposits (less than $100,00)

+ Money market mutual funds held by individuals

M2

+ Large denomination time deposits (more than $100,00)

+ Money market mutual funds held by institutions

+ Other less liquid assets

M3

13-16

Our Money Supply

M1, M2, and M3, January 2001

Federal Reserve Bulletin

M3=7,361

Money market mutual funds held by institutions

903

M1=1,107 M2=5,111

Currency in circulation

539

Traveler's checks

8

Other checkable deposits

251

M1

1107

Saving deposits

1970

Large-denomination time deposits

797

Other less liquid assets

550

Demand deposits

309

Money market mutual funds held by individuals

985

Small-denomination time deposits

1049

Copyright

©

2002 by The McGraw-Hill Companies, Inc. All rights reserved.

M2

5111

13-17

3

Our Growing Money Supply

Annual Percentage Change in the Money Supply, M1, 1960-2000

2

0

6

4

Ð2

Ð4

1960

20

18

16

14

12

10

8

1964 1968 1972 1976 1980 1984 1988 1992 1996 2000

Copyright

©

2002 by The McGraw-Hill Companies, Inc. All rights reserved.

13-18

Credit Cards

• Is the Credit Card in your wallet Money?

– It is accepted everywhere

(Medium of exchange)

– You get a bill (Unit of Account)

4