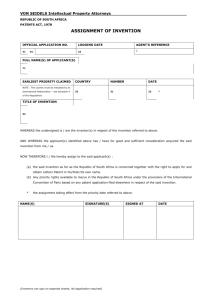

Independent Invention as a Defense to Patent Infringement

advertisement