FINANCIAL PLANNING PROBLEMS CHAPTER 14

advertisement

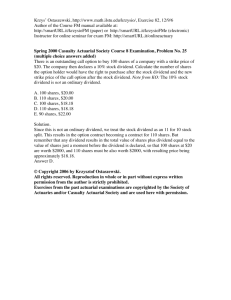

FINANCIAL PLANNING PROBLEMS CHAPTER 14 1. Calculating Dividend Amounts. Betty and John Martinez own 220 shares of Exxon common stock. Exxon’s quarterly dividend is $1.08 per share. What is the amount of the dividend check that the Martinez couple will receive for this quarter? Quarterly dividend = 220 shares $1.08 = $237.60 (pp. 443-448) 2. Determining the Number of Shares after a Stock Split. In March, stockholders of Dress Barn Corporation approved a two for one stock split. After the split, how many shares of Dress Barn stock will an investor have if she or he owned 360 shares before the split? 360 shares before the split 2 = 720 shares after the split. (pp. 445-446) 3. Calculating Total Return. Tammy Jackson purchased 100 shares of All-American Manufacturing Company stock at $29 1/2 a share. One year later, she sold the stock for $38 a share. She paid her broker a $34 commission when she purchased the stock and a $42 commission when she sold it. During the 12 months that she owned the stock, she received $184 in dividends. Calculate Ms. Jackson’s total return on this investment. Current Return = $184 in dividends over the past 12 months Purchase Price = $29.50 100 shares + $34 commission = $2,984 Selling Price = $38 100 shares - $42 commission = $3,758 Capital gain = $3,758 - $2,984 = $774 Total Return = $184 Current Return + $774 capital gain or $958. (pp. 444-445) 6. Calculating the Dividend Amount for a Cumulative Preferred Stock Issue. Wyoming Sports Equipment issued a $3 cumulative preferred stock issue. In 2005, the firm’s board of directors voted to omit dividends for both the company’s common stock and preferred stock issues. Also, assume that the corporation’s board of directors votes to pay dividends in 2006. a. How much did the preferred stockholders receive in 2005? Because of the board’s action, preferred stockholders received $0 in 2005. b. How much did the common stockholders receive in 2005? Because of the board’s action, common stockholders received $0 in 2005. c. How much did the preferred stockholders receive in 2006? Cumulative preferred stockholders received $6 in 2006, as illustrated below. $3 (2005 omitted dividend) + $3 (2006) = $6 total dividend (p. 447) 9. Calculating Return on Investment. Two years ago, you purchased 100 shares of Coca-Cola Company. Your purchase price was $41 a share, plus a total commission of $29 to purchase the stock. During the last two years, you have received the following dividend amounts: $1.03 per share for the first year, and $0.91 per share, the second year. Also assume that at the end of two years, you sold your Coca-Cola stock for $52 a share plus a total commission of $34 to sell the stock. a. Calculate the current yield for your Coca Cola stock at the time you purchased it. $1.03 first year dividend ÷ $41 original purchase price = 2.51 percent. b. Calculate the current yield for your Coca-Cola stock at the time you sold it. $0.91 second year dividend ÷ $52 selling price = 1.75 percent c. Calculate the total return for your Coca-Cola investment when you sold the stock at the end of two years. Current Return = $1.03 + $0.91 = $1.94 100 shares = $194 Capital Gain = $52 selling price - $41 original purchase price = $11 100 shares = $1,100 Capital Gain = $1,100 - $63 commission = $1,037 Total Return = $194 Current Return + $1,037 Capital Gain = $1,231 d. Calculate the annualized holding period yield for your Coca-Cola investment at the end of the two-year period. Annualized Holding Period Yield = $1,231 Total Return ÷ $4,129 original investment 1/2 = 0.149 = 14.9 percent (pp. 456-458) 11. Using Dollar Cost Averaging. For four years, Mary Nations invested $3,000 each year in America Bank stock. In 2003, the stock was selling for $34. In 2004, the stock was selling for $48. In 2005, the stock was selling for $37. In 2006, the stock was selling for $52. a. What is Ms. Nations’s total investment in America Bank? Ms. Nations’s total investment is $12,000, as illustrated below. $3,000 x 4 years = $12,000 total investment. b. After four years, how many shares does Ms. Nations own? Ms. Nations owns 289.5 shares, as illustrated below. 2003 $3,000 ÷ $34 = 88.2 shares 2004 62.5 shares $3,000 $48 = 2005 81.1 shares $3,000 $37 = 2006 57.7 shares $3,000 $52 = Total Shares 289.5 shares c. What is the average cost per share of Ms. Nations’s investment? The average cost per share is $41.45, as illustrated below. $12,000 total investment 289.5 shares = $41.45 per share cost. (p. 467) FINANCIAL PLANNING PROBLEMS CHAPTER 15 1. Calculating Interest. Calculate the annual interest and the semiannual interest payment for the following corporate bond issues with a face value of $1,000. (p. 482) Annual Interest Rate Annual Interest Amount Semiannual Interest Payment 5.125% $51.25 $25.625 = $25.63 6.25% $62.50 $31.25 7.0% $70.00 $35.00 7.125% $71.25 $35.625 = $35.63 8. Calculating Tax-equivalent Yields. Assume that you are in the 35 percent tax bracket and that you purchase a 5.12 percent tax-exempt municipal bond. Calculate the tax equivalent yield for this investment. Tax equivalent yield = tax-exempt yield divided by (1.0 minus current tax rate) (p. 496) Tax equivalent yield = 5.12 percent divided by (1.0 minus 0.35) = 0.0788=7.88 percent