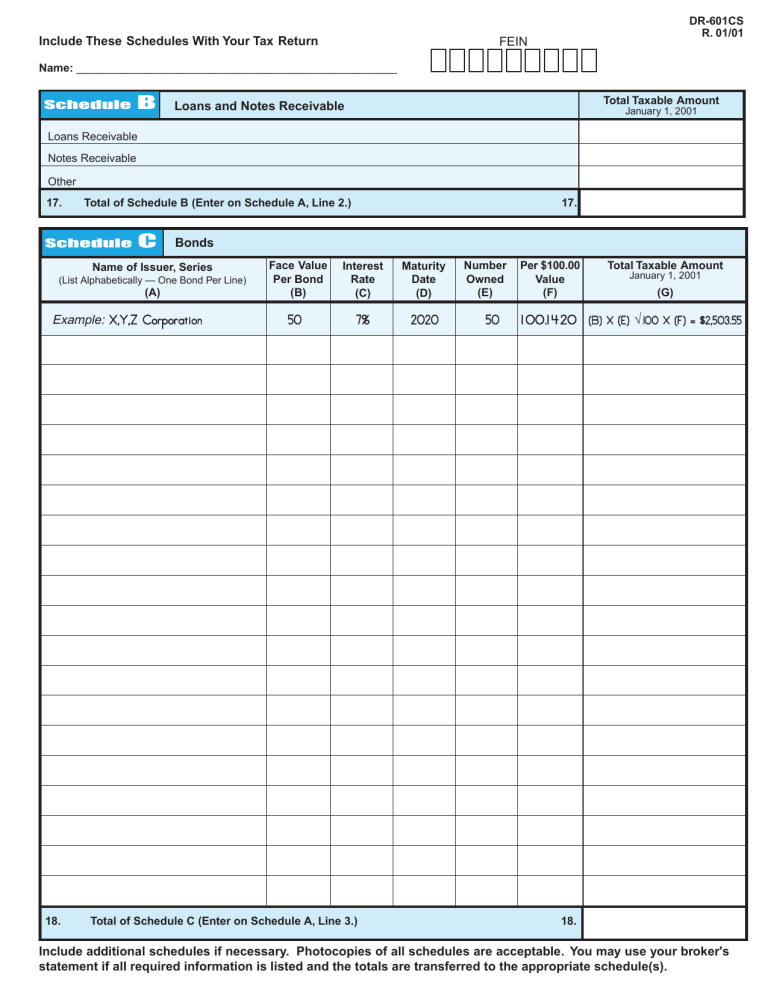

Example: X,Y,Z Corporation 50 7% 2020 50 1

advertisement

Include These Schedules With Your Tax Return DR-601CS R. 01/01 FEIN Name: ___________________________________________________ Schedule B Total Taxable Amount Loans and Notes Receivable January 1, 2001 Loans Receivable Notes Receivable Other 17. Total of Schedule B (Enter on Schedule A, Line 2.) Schedule C Bonds Name of Issuer, Series (List Alphabetically — One Bond Per Line) (A) Example: X,Y,Z Corporation 18. 17. Face Value Per Bond (B) 50 Interest Rate (C) Maturity Date (D) 7% 2020 Total of Schedule C (Enter on Schedule A, Line 3.) Number Owned (E) 50 Per $100.00 Value (F) Total Taxable Amount January 1, 2001 (G) 1 00. 00.11 4 20 (B) X (E) ÷ 100 X (F) = $2,503.55 18. Include additional schedules if necessary. Photocopies of all schedules are acceptable. You may use your broker's statement if all required information is listed and the totals are transferred to the appropriate schedule(s). DR-601CS R. 01/01 Schedule D Stocks, Mutuals, Money Market Funds, Limited Partnership Interests, and Beneficial Interest in any Trust The law provides for a specific penalty of 10% for omitted and/or undervalued stock. Class Name of Company Issuing Stocks C 100 P = Preferred (A) Example: X,Y,Z Corporation 19. (B) Number of Shares (C) C = Common (List Alphabetically — Do not Abbreviate) Just Value Per Share (D) 8.875 Total of Schedule D (Enter on Schedule A, Line 4.) Schedule Class of Stock E Total Just Value January 1, 2001 (E) (C) X (D) = $887.50 19. Corporations Only — Paying as Agent for Florida Stockholders Total Number of Shares Outstanding (1) No. of Taxable Shares (All shares held by Florida residents) (2) Just Value Per Share (3) Value of Shares Outstanding (4) Total Taxable Amount January 1, 2001 (5) Common Preferred Other LOANS and ADVANCES FROM FLORIDA STOCKHOLDERS 20. Total of Schedule E (Enter on Schedule A, Line 5.) 20. Include additional schedules if necessary. Photocopies of all schedules are acceptable. You may use your broker's statement if all required information is listed and the totals are transferred to the appropriate schedule(s).