File

advertisement

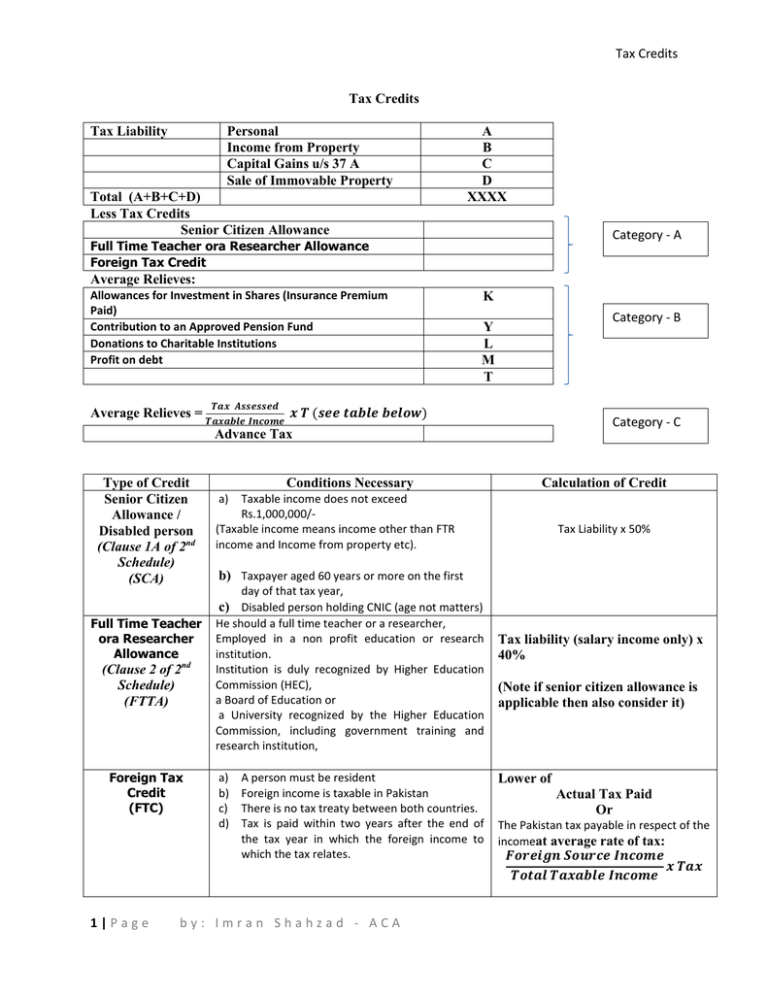

Tax Credits

Tax Credits

Tax Liability

Personal

Income from Property

Capital Gains u/s 37 A

Sale of Immovable Property

Total (A+B+C+D)

Less Tax Credits

Senior Citizen Allowance

A

B

C

D

XXXX

Category - A

Full Time Teacher ora Researcher Allowance

Foreign Tax Credit

Average Relieves:

Allowances for Investment in Shares (Insurance Premium

Paid)

Contribution to an Approved Pension Fund

Donations to Charitable Institutions

Profit on debt

Average Relieves =

Type of Credit

Senior Citizen

Allowance /

Disabled person

(Clause 1A of 2nd

Schedule)

(SCA)

K

Category - B

Y

L

M

T

𝑻𝒂𝒙 𝑨𝒔𝒔𝒆𝒔𝒔𝒆𝒅

𝑻𝒂𝒙𝒂𝒃𝒍𝒆 𝑰𝒏𝒄𝒐𝒎𝒆

𝒙 𝑻 (𝒔𝒆𝒆 𝒕𝒂𝒃𝒍𝒆 𝒃𝒆𝒍𝒐𝒘)

Advance Tax

Conditions Necessary

Category - C

Calculation of Credit

a)

Taxable income does not exceed

Rs.1,000,000/(Taxable income means income other than FTR

income and Income from property etc).

Tax Liability x 50%

b) Taxpayer aged 60 years or more on the first

day of that tax year,

c) Disabled person holding CNIC (age not matters)

Full Time Teacher

ora Researcher

Allowance

(Clause 2 of 2nd

Schedule)

(FTTA)

Foreign Tax

Credit

(FTC)

1|Page

He should a full time teacher or a researcher,

Employed in a non profit education or research

institution.

Institution is duly recognized by Higher Education

Commission (HEC),

a Board of Education or

a University recognized by the Higher Education

Commission, including government training and

research institution,

a)

b)

c)

d)

A person must be resident

Foreign income is taxable in Pakistan

There is no tax treaty between both countries.

Tax is paid within two years after the end of

the tax year in which the foreign income to

which the tax relates.

by: Imran Shahzad - ACA

Tax liability (salary income only) x

40%

(Note if senior citizen allowance is

applicable then also consider it)

Lower of

Actual Tax Paid

Or

The Pakistan tax payable in respect of the

incomeat average rate of tax:

𝑭𝒐𝒓𝒆𝒊𝒈𝒏 𝑺𝒐𝒖𝒓𝒄𝒆 𝑰𝒏𝒄𝒐𝒎𝒆

𝒙 𝑻𝒂𝒙

𝑻𝒐𝒕𝒂𝒍 𝑻𝒂𝒙𝒂𝒃𝒍𝒆 𝑰𝒏𝒄𝒐𝒎𝒆

Tax Credits

Average Relieves

Type

Allowances for

Investment in Shares

(Insurance Premium

Paid)

Contribution to an

Approved Pension

Fund

Donations to

Charitable

Institutions

Profit on debt

Conditions

A resident person other than a company

Acquiring new shares offered to the public by a public

company.

He is an original allottee.

Acquired from the Privatization Commission of

Pakistan;

Any life insurance premium paid on a policy to a life

insurance company registered by the Securities and

Exchange Commission of Pakistan.

Shares are required to be held for 24 months from the

date of purchase.

An Individual holds NTN or Valid CNIC.

Driving income under the head salary or income from

business.

Contributes or pay premium in the year in approved

pension fund under the Voluntary Pension System

Rules, 2005.

Amount Lower of

1- Actual amount

Paid by a crossed cheque or in kind to:

Any board of education, educational

institution or any university in Pakistan run by Govt.

any govt. hospital or relief fund

Any non-profit organization.

1- Actual amount

2- 20% of taxable

income(1)

3- Rs1,000,000/-

2- 20% of taxable

income(2)

L

2- 30% of taxable

income

M

(20% for companies)

Loan by a scheduled bank or non-banking finance 1- Actual amount of

institution regulated by the Securities and Exchange

Profit.

Commission of Pakistan or advanced by Government

or the Local Government or a statutory body or a 2- 50% of taxable

public company listed on a registered stock exchange

income

Loan is taken for house.

3- Rs750,000/-

(1) Taxable income excluding share from AOP.

(2) 20% limit shall be relaxed if person joining at the age of 41 years or above. 2% additional contribution

each year subject to max of 50% of income taxable of latest tax year.

Note: Amount of tax assessed shall after tax credit i.e.SCA, FTTA and FTC. Tax and taxable

income shall be taken after considering Share from AOP.

by: Imran Shahzad - ACA

K

1- Actual amount

Total

2|Page

Rs.

N

T

Tax Credits

Question - 1

Mr. Z requested you to calculate his tax liability from the following information:

a)

Taxable salary Rs.400,000 as a full time teacher from an approved non-profit educational

institution

b)

Taxable capital gain Rs.90,000.

c)

Taxable business income from a foreign country Rs. 150,000 where Mr. Z paid income tax of

Rs.30,000. There is no tax treaty with that foreign country.

d)

Mr. Z visited that foreign country for 182 days during the year and that was his only foreign

traveling.

e)

Mr. Z was born on 25.7.1941 and therefore he wants to claim senior citizen allowance

f)

Zakat was deducted at source Rs.7,000. He also paid zakat of Rs.23,000 to his relatives

g)

Donation was paid by him Rs.11,000 to a private approved charitable institution in cash for which

he has a proper receipt.

h)

He donated his household furniture to a government hospital. FMV is estimated at Rs.95,000

i)

He obtained a loan 3 year ago for the acquisition of his house. He paid mark up on the loan

Rs.9,000 during the year.

j)

k)

He purchased the following shares during the year:

i.

Shares of Rs.65,000 of a private company as an original allottee

ii.

Shares of Rs. 105,000 of a listed company as an original allottee

iii.

Shares of Rs.25,000 of a listed company from his relatives

Tax deducted at source is Rs. 1,000.

Question - 2

Mr. Asim Javed has been teaching at a well-known university named Pak University. He joined university

25 years ago when he was 40 years old. The detail of his emoluments during the tax year ended June 30,

2015 are as under:

Basic salary (per month) Rs. 30,000

Dearness allowance (per month) Rs. 10,000

Medical Allowance (per month) Rs. 5,000

Annual Bonus Rs. 36,000

Additional Information:

a) During the year, Mr. Asim sold 1,000 shares of a UK based company @ GBP 12.25. The said

shares were purchased by him several months ago @ GBP 11 and paid tax on gain amounting

GBP 31.25 (GBP 1 = Rs. 160).

3|Page

by: Imran Shahzad - ACA

Tax Credits

b) He sold a piece of land for Rs. 500,000 which he had purchased 9 months ago for Rs. 300,000.

c) He sold 20,000 Modaraba Units @ Rs. 55 per Unit in March 2015. These units were purchased in

July 2013 for Rs. 50 per unit.

d) He is also a partner in a trading firm. The firm earned profit before tax amounting Rs. 2,133,333

for the tax year 2015. His share in the profit and loss of the firm is 25%.

e) Zakat deducted Rs. 10,000 and Donation of Rs. 30,000 paid to Shaukat Khanam Memorial Trust.

f) During the year, he made the investment in the following shares:

i) Shares of a listed company as original allottee of Rs. 150,000

ii) Shares of a private company for Rs. 90,000

iii) Shares of a listed company for Rs. 200,000 from Karachi Stock Exchange

g) He made contribution of Rs. 500,000 to an approved pension fund.

h) He donated Rs. 20,000 to a local hospital. The payment was made through banking channel.

i) Loan for the construction of his house from HBFC. Share paid on that loan amounted to

Rs. 10,000.

Required:

Compute the taxable income, tax liability and tax payable/ refundable, if any, to Mr. Asim Javed for the

tax year 2015.

Question -3

Compute the taxable income and tax payable by Mr. AOP for the current tax year from the following

information:

Rs.

Rs.

Taxable annual salary

500,000

Taxable Income from business

300,000

Gain from the disposal of private company’s share within 1 year

100,000

Gain from the disposal of listed company’s share within 1 year

50,000

Taxable Income from other sources

50,000

Taxable business income from Malaysia

200,000

Tax deducted in Malaysia

15,000

Zakat deducted by the bank

20,000

Donation under clause 61

30,000

Donation to approved institutions through cheque

500,000

After tax share received from AOP

300,000

Taxable Income from property

350,000

Tax deducted on salary income

5,000

4|Page

by: Imran Shahzad - ACA

Tax Credits

Mr. ABC

Pakistani resident (Non-Salaried)

Tax year 2015

Computation of taxable income and tax payable

Income from salary

Income from business

Income from capital gain under section 37

Income from other sources

Rs.

500,000

300,000

100,000

50,000

Foreign source income

200,000

Rs.

950,000

1,150,000

Less:

Zakat deducted at source

Donation under clause 61

(20,000)

(30,000)

Add:

Share from AOP

300,000

Income from property

Capital Gain under section 37A

350,000

50,000

(50,000)

1,100,000

1,400,000

Total taxable Income including share from AOP

700,000

1,800,000

Taxation (Non-Salaried Case)

{Salary income/ total income * 100} = [500,000/1,500,000 * 100] = 33.33%

So this is Non-Salaried case.

Calculation of tax Liability:

For rate Purpose

Tax on Rs. 1,400,000

Tax on Rs.(1,400,000 – 750,000)= 650,000 * 15%

Tax Liability under normal slab rates

{132,500/1,400,000 * 1,100,000}

Tax on property income {(350,000 – 150,000) * 5%}

Tax on Capital gain u/s 37A {50,000 * 10%}

35,000

97,500

132,500

104,107

10,000

5,000

119,107

Less:

Foreign tax credit:

Tax actually paid

(119,107/1,500,000 * 200,000}

Credit is allowed on lower amount

5|Page

by: Imran Shahzad - ACA

15,000

15,881

(15,000)

Tax Credits

104,107

Donation under section 61:

Actual amount of donation paid

500,000

1,500,000 * 15%

450,000

Lower amount shall be used in formula.

{(10,000 + 5000 + 132,500) / 1,800,000 * 450,000}

Total tax Liability

Less: Tax deducted on salary at source

Tax payable with return

6|Page

by: Imran Shahzad - ACA

(36,875)

67,232

(5,000)

62,232