NAPFA

Planning Perspectives

Volume 8 | Issue 3 | July 2013

NAPFA Headquarters

3250 N. Arlington Heights Road

Suite 109

Arlington Heights, IL 60004

888-FEE-ONLY

847.483.5400

Time-Tested Advice During Volatile Times

Kevin Adler, NAPFA Editor

What Happened to My Bull Market?................2

Avoiding High 401(k) Fees............................3

Why You Should Not Add Your Child’s Name to

Your Bank Account...................................4

Increase Your Happiness............................5

The stock market seems to be in another one of its unsettled periods, as

a significant falloff in May and June has been followed by a rally to new

record highs in mid-July. While many people are tempted to watch the

market every hour (or even every minute), the experts know that trying to

predict its fluctuations is almost impossible.

Instead, investors need to stay with their long-term strategy and ignore

the hourly and daily headlines. In this issue of Planning Perspectives, we

return to some of the time-tested themes that drive long-term financial

success:

•

NAPFA Consumer

Education Foundation

Promoting Consumer Financial Education

As a public service, we are pleased

to offer members of the public several

opportunities to get their pressing

financial questions answered by

members of NAPFA. In partnership

with Kiplinger's Personal Finance

magazine and the NAPFA Consumer

Education Foundation, we are offering

monthly Jump Start Your Retirement

online chats where you can interact with

NAPFA Fee-Only financial planners.

These chats take place on the third

Thursday of every month from 1 p.m.

to 3 p.m. Eastern Time. The next chat

will be on:

August 15, 2013

September 19, 2013

October 17, 2013

To access the chats, please click here

to jump to Kiplinger.com.

•

•

•

Why bond markets overreacted to rumors of major changes in Federal

Reserve policy.

How investment expenses -- in this case, 401(k) fees -- can have a

huge impact on long-term returns.

How to avoid a basic financial planning mistake that can be costly

and, even worse, can lead to family disputes.

Why having more stuff does not create happiness.

Enjoy this issue of Planning Perspectives, and have a great summer.

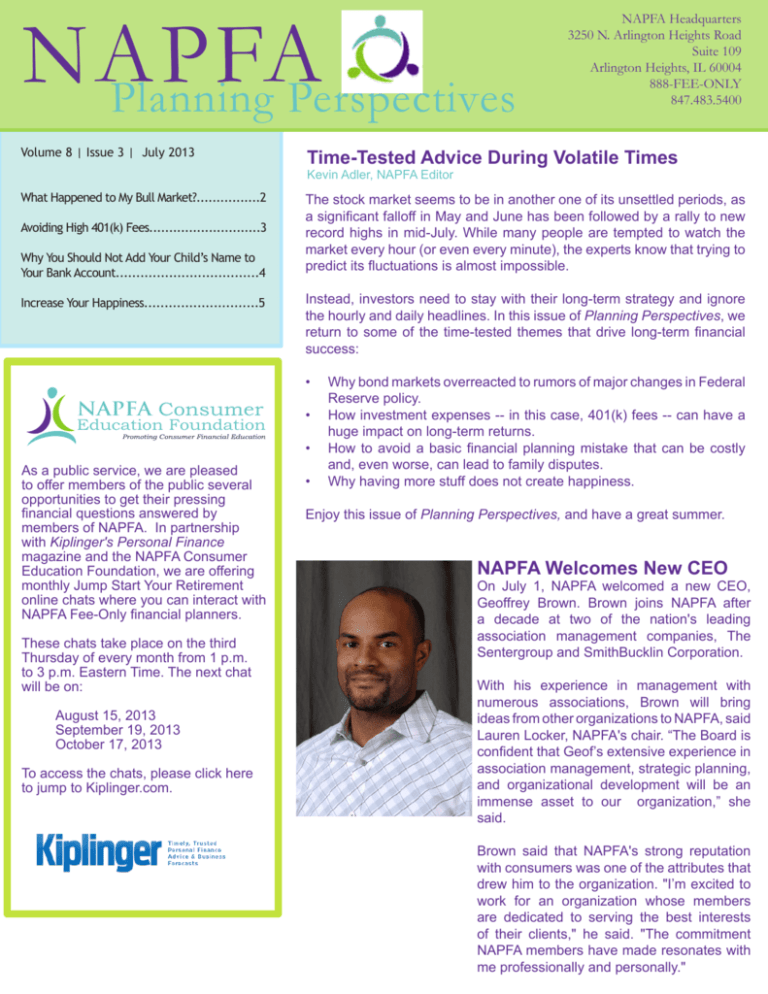

NAPFA Welcomes New CEO

On July 1, NAPFA welcomed a new CEO,

Geoffrey Brown. Brown joins NAPFA after

a decade at two of the nation's leading

association management companies, The

Sentergroup and SmithBucklin Corporation.

With his experience in management with

numerous associations, Brown will bring

ideas from other organizations to NAPFA, said

Lauren Locker, NAPFA's chair. “The Board is

confident that Geof’s extensive experience in

association management, strategic planning,

and organizational development will be an

immense asset to our organization,” she

said.

Brown said that NAPFA's strong reputation

with consumers was one of the attributes that

drew him to the organization. "I’m excited to

work for an organization whose members

are dedicated to serving the best interests

of their clients," he said. "The commitment

NAPFA members have made resonates with

me professionally and personally."

Investing

What Happened to My Bull Market?

By Constanza Low and John Henry Low, CFP®

hen Ben Bernanke signaled in June

that the Fed might start reducing its

Quantitative Easing (QE) programs,

the bond markets went into a tail-spin. It was a

typical market over-reaction.

Oh the irony. On the one hand, Wall Street

couldn’t stop criticizing QE at every turn,

and yet, when Ben Bernanke announced a

thoughtful and measured reduction/exit strategy,

Wall Street panicked.

Why? Apparently, the Masters of the Universe

believed that the bull market of the past four

years was totally dependent on QE (it may have

helped, but it was hardly totally dependent on)

and that interest rates are going up (and no one

wants to hold bonds when interest rates are

rising). Add to that the leveraged traders/hedge

funds that didn’t want to be caught on the wrong

side of rising interest rates (especially at the

end of a quarter), so they sold deep and fast.

Investors who bought into riskier asset classes

for yield after they could no longer tolerate zero

percent bank interest also panicked and sold

(thus turning a temporary downturn into their

permanent loss).

www.knick.com

It's been a classic downward panic spiral. No

one really thought about the two important

things. First, the announcement is actually

GOOD news because it indicates that the Fed

thinks that the economy is strengthening and

doesn’t need ‘life support’ anymore. Besides,

the pullback of QE might not even happen this

year, as the tapering is conditional on economic

data. Tepid first-quarter growth of 1.8% makes it

unlikely the Fed will act right now, and if growth

slows further, we would expect an increase in

QE, not a withdrawal. This ‘conditionality’ of

the Chairman’s statements just started to sink

in during the very last days of June, and the

markets began to recover.

Second, this market rout is not about inflation.

Money manager Jeffrey Gundlach of Doubleline

says there are no signs of inflation in the

economy. None. Interest rates won’t be heading

up soon. This was a classic market overreaction and misreading of the situation.

Copyright 2013, Knickerbocker Advisors Inc. All

rights reserved.

What the Pundits Are Saying About the Economy and the Fed

“The Fed pullout is a sign the economy is getting stronger, which is nothing to fear –

and all of that is good for stocks.”

–Elizabeth MacDonald, Fox Business, who adds that stocks are still cheap at 15.5x earnings, lower than

the 17.3x earnings median since 1993 and lower than the average going back to 1954.

“Besides, the Fed can always start buying again if it is wrong…so what is there to worry about?”

-- Wharton economics guru Jeremy Siegel, who maintains his 16,000

to 17,000 target for the Dow Jones Industrial Index by year end.

“Really!?!! Really traders!?! Did you really believe that the Fed was never going to stop buying

bonds? Really?!? Do you think that the Fed was going to have an infinite accommodation, and

that rates were going to stay at zero forever? Is that what you expected from the Central bank.

C’mon, Really!?

--Barry Ritholz, financial author, analyst, and blogger.

Standard Bearer for the Profession - Champion for the Public - Beacon for Objective Financial Advisors

www.NAPFA.org

W

Knickerbocker Advisors Inc.

2

Investing

Avoiding High 401(k) Fees

By Mark Stinson, CFP®, CPA, MBA

Baltimore-Washington Financial Advisors

www.bwfa.com

Once again, the plan is not required to allow these

options.

Bo Lu, co-founder of FutureAdvisor, compared two

employees, one working for FedEx and one for

Best Buy, contributing to a 401(k). Both were the

same age (25), had the same salary ($55,000),

had the same wage growth, and contributed 10%

per year to their employer’s 401(k) plan. At the

end of 40 years, one employee’s 401(k) balance

was $87,000 higher. The difference was fees.

Besides high fees, there are other reasons to

consider in-service distributions:

• Fund performance. The funds offered in the

plan may be poor performers.

• Fund diversification. Some sectors of the

market might not be represented. For

example, few 401(k) plans offer a foreign bond

fund.

• Roth conversion. You might be in a tax

situation in which it is advantageous to convert

a portion of your 401(k) to a Roth IRA.

• Professional management. As Thomas

Friedman noted, investing in a 401(k) requires

you to know something about investing. With

your funds in an IRA, you can get outside

professional investment advice.

f you’re stuck in an expensive 401(k) plan, it

could be a $100,000 mistake.

While a significant fee difference between large

employers might be unusual, it is well known in

our industry that small-employer 401(k) fees are

much higher than large-company fees. The table

below, compiled from data in The 401(k) Averages

Book, compares the cost of large- and smallcompany 401(k) fees in 2012:

Avoid High 401(k) Fees with an In-Service

Distribution

What are your options if your employer has

negotiated a plan with high fees? One littleknown solution is an “in-service distribution.” Most

workers over 59½ (and some who are younger)

can roll over some, or all, of their 401(k) to an IRA

while they are still working and contributing to the

plan.

Current law allows employees to withdraw or roll

over (in-service distribution) without paying tax to

an IRA at 59½. However, the employer can decide

whether or not to allow in-service distribution.

Check with your 401(k) plan administrator and the

Summary Plan Document (SPD) for the rules in

your plan.

For those under 59½, the law permits in-service

distribution of money under any of these four

conditions: 1) it was rolled over into the 401(k)

from a previous employer; 2) employee (but not

employer) pre-tax contributions; 3) employee

after-tax contributions; or 4) account earnings.

Type of Plan

Small Plans

Large Plans

Plan Fees

1.46%

1.03%

However, there are reasons why leaving the funds

in your 401(k) might remain the best option, even

if your plan is fairly costly:

•

•

•

Early retirement. If you retire between age

55 and 59½, you can make penalty-free

withdrawals from your 401(k).

Working and over age 70. If you are working

and over age 70 ½, you are not required to

include the balance in your active employer

401(k) plan when calculating the Required

Minimum Distribution (RMD). You can keep

your money in your tax-deferred retirement

account longer, if you do not need the current

income.

Company stock. If you hold your employer’s

company stock in your 401(k), you might be

eligible for a tax break. (But the rules are

complicated.)

The bottom line is that you should watch the

fees on your 401(k) and talk with your plan

administrator and a financial advisor if you feel

that they are too high. You might have alternatives

that will save you money.

Investment Fees

1.37%

1.00%

www.NAPFA.org

I

Total Fees

2.83%

2.03%

Standard Bearer for the Profession - Champion for the Public - Beacon for Objective Financial Advisors

3

Taxes

Why You Should Not Add Your

Child's Name to Your Bank Account

By Eve L. Kaplan, CFP®

Kaplan Financial Advisors, LLC

lients sometimes ask me if they can add

their adult child’s name to their bank

account(s) so the child can tap funds as

needed or write checks on behalf of the client.

While adding a child’s name seems like a

harmless, familial gesture of love and trust,

the financial consequences can be extremely

negative to both parent and child.

Let's use a hypothetical example. June (age

65, widowed) has a $400,000 bank account in

her name. She wants to add her son, Henry

(age 35), to her bank account. June prefers

to bypass her daughter, Matilda, since Henry

is “more organized and better able to issue

checks” if June is sick or away in Florida

several months each winter.

•

Henry is separated from his wife, and they

likely will divorce. Henry’s wife will now

be entitled to a portion of this jointly held

account when their assets are divided.

(This is upsetting to June, too, because

she is on poor terms with Henry’s soon-tobe-ex-wife.)

•

If Henry accidentally rear-ends a

school bus and becomes involved in a

lawsuit, subsequent financial claims and

judgments will include June and Henry’s

account as part of Henry’s assets. The

entire $400,000 could be awarded to the

wronged party.

•

June has a will that clearly states she

wants to divide all her assets equally

between Henry and her daughter, Matilda.

If June dies unexpectedly after Henry’s

name is added to her bank account,

this ‘rights of survivorship’ joint account

bypasses her will entirely. In effect,

Henry will receive this extra $400,000

inheritance, and it’s unlikely this account

can be divided after the fact with Matilda.

If June has specific trust provisions in

her will, her joint account with Henry can

undermine the initial intention of her trust.

•

Adding Henry’s name to June’s account

can affect Medicaid benefits, including

entitlement to long-term care.

•

Henry's daughter is 17 and will be

attending college. Her application for

needs-based financial aid will be affected

by Henry's joint account with June.

Here are some unintended consequences

June could encounter:

•

•

•

Adding Henry’s name with rights of

survivorship means Henry is entitled to

all the same rights and responsibilities

as June. June never intended to make

this account a “gift” to Henry, but adding

Henry’s name means she has made a gift

to Henry. This may trigger gift taxes, or

at least require June to file forms with the

IRS to alert the federal agency about her

“gift” to Henry.

If Henry has some issues with a creditor

and a judgment is levied against him, the

entire $400,000 bank account could be

garnished -- even though June is co-owner

of this account and she was not involved

in any way.

Henry can withdraw the entire $400,000

at any time for his own use and is not

required to pay it back. In other words, the

entire account could evaporate, leaving

June empty-handed.

Adding a child’s name to your bank account

is an example of a number of harmless, wellintentioned gestures that trigger unexpectedly

negative consequences. It pays in spades to

consult with your financial planner and your

estate attorney before contemplating even the

simplest decisions.

Standard Bearer for the Profession - Champion for the Public - Beacon for Objective Financial Advisors

www.NAPFA.org

C

www.kaplanfinancialadvisors.com

4

LIFE

Increase Your Happiness: Shop, Don't Buy

By Mitch Conlon, CFP®

aniel Kahneman, the Nobel Prizewinning psychologist, famously argued

that upon reaching a certain income

point, money fails to buy additional happiness.

In fact, after covering the basics, plus a few

comfortable extras, we find ourselves on a

“hedonic treadmill” of working harder for more

stuff.

Other studies have refuted this notion,

suggesting richer countries are happier than

poorer countries.

Now comes a study published in The Journal

of Consumer Research, “When Wanting

is Better Than Having,” suggesting that

happiness is derived more from thinking about

a purchase than actually making the purchase

itself. The study’s author, Martha Richins,

concludes that “thinking about acquisition

provides momentary happiness boosts to

www.conlondart.com

materialistic people....but the positive emotions

associated with acquisition are short-lived.”

Perhaps we should all undertake a selfstudy to verify these findings. Start by logging

into Amazon.com. Then, shop around, put

a few items in your cart, and leave before

proceeding to check-out. Do you notice a

happiness boost? If so, spend that extra cash

on a fun travel experience, or -- crazy as this

sounds -- save it.

To learn more about the happiness study,

see The Atlantic’s recent story, "Why Wanting

Expensive Things Makes Us So Much Happier

than Buying Them." http://www.theatlantic.

com/business/archive/2013/06/why-wantingexpensive-things-makes-us-so-much-happierthan-buying-them/276717/

Mark Your Calendars:

Managing Your Financial Journey with CBS Analyst Jill Schlesinger

The NAPFA Consumer Education Foundation is hosting a

special consumer education seminar at the Marriott

Downtown Hotel in Philadelphia on October 8 with CBS

News business analyst Jill Schlesinger. She will present a one-hour session on financial

independence during some of life’s key transitions, such as blending two lives, retirement,

and divorce. After her presentation, Schlesinger and a panel of NAPFA-Registered Financial

Advisors will respond to questions from audience members.

"Jill Schlesinger has been a long-time advocate for consumers and a trusted source of

financial information," said NCEF President Jamie Milne. "We are delighted that she will help

the NAPFA Consumer Education Foundation (NCEF) reach out to the public about how to

build an actionable and strong financial plan."

This event will mark the official launch of the Managing Life’s Financial Journey Project,

the newest education program from the NCEF. The Journey Project is an online resource of

objective information about a wide range of consumer finance issues, organized around key

transitional moments and themes. For more information about the seminar and NCEF’s

activities, go to www.napfafoundation.org.

Standard Bearer for the Profession - Champion for the Public - Beacon for Objective Financial Advisors

www.NAPFA.org

D

Conlon Dart Wealth Management

5