Chapter-1: Financial Accounting Self Assessment Questions

advertisement

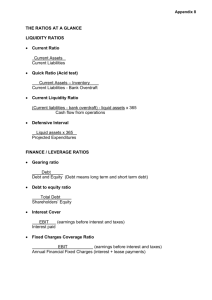

Chapter-1: Financial Accounting Self Assessment Questions 1. A complete set of financial statements for Hartman Company, at December 31, 1999, would include each of the following, except: a. Balance sheet as of December 31, 1999. b. Income statement for the year ended December 31, 1999. c. Statement of projected cash flows for 2000. d. Notes containing additional information that is useful in interpreting the financial statements. 2. Information is cost effective when: a. The information aids management in controlling costs. b. The information is based upon historical costs, rather than upon estimated market values. c. The value of the information exceeds the cost of producing it. d. The information is generated by a computer-based accounting system. 3. Although accounting information is used by a wide variety of external parties, financial reporting is primarily directed toward the information needs of: (a) Investors and creditors. (b) Government agencies such as the Internal Revenue Service. (c) Customers. (d) Trade associations and labor unions. 4. Any expense that gives benefit for a period of less than twelve months is called ……………... a. Capital Expense b. Revenue Expense c. Revenue Receipt d. Deferred Expense 5. Prepaid rent given in the Trial Balance will be treated as a (an): a. Asset b. Liability c. Revenue d. Deferred expense 6. If Assets = Rs. 99,500 and Owner's equity = Rs. 50,500 then Liabilities =? a. Rs. 49,000 b. Rs. 55,000 c. Rs. 125,000 d. Rs. 115,700 7. Sale of goods to Amir is wrongly debited to Umair A/c instead of Amir A/c. Both are debtors of business, this is an example of: a. Error of Omission b. Error of Commission c. Error of Principle d. Error of Original entry 8. Which of the following is TRUE about a merchandising company? a. A merchandising company's business is to buy and sell products. b. A merchandising company must use the perpetual system to account for merchandising inventory. c. A merchandising company's business is to provide services. d. None of the given options 9. Money spent to acquire or upgrade physical assets is known as: a. Revenue Expense b. Capital Expense c. Administrative Expense d. Operating Expense 10. Goods of Rs. 1,000 purchased from Mr. “A” were recorded in sales book. The rectification of this error will: a. Increase the gross profit b. Reduce the gross profit c. Have no effect on gross Profit d. None of these 11. An amount of Rs. 200 received from Mr. "P" but credited to Mr. "Q" would affect: a. Accounts of P & Q b. Only Cash Account c. Only P’s account d. Only Q’s account 12.………….. is the art of recording, classifying and summarizing the transactions and events of a business and interpreting the results thereof. a. Book-keeping b. Accounting c. Management d. Auditing 13 What will be debited, if Mohsin commenced business with cash? a. Cash account b. Capital account c. Drawings account d. Proprietor account 14. Current accounts of the partners should be opened when the capitals are: a. Fixed b. Fluctuating c. Floating d. Normal 15. Which of the following is (are) type(s) of Public Limited Companies? a. Listed company b. Non listed company c. Private limited company d. Both Listed Company and non listed company 16. The charter of a company which defines the limitations and powers of the company is called: a. The memorandum of association b. Articles of association c. Statutory report d. Certificate of commencement 17. Merchandise on hand at either the beginning or end of the reporting period is called………………….. a. Raw material b. Cost of good sold c. Work in process d. Inventory 18. The balance sheet reported a beginning balance of $20,000 in Accounts Receivable and an ending balance of $15,000. Credit Sales of $200,000 were made during the year. Using this information, compute cash collected from customers. a. $205,000 b. $195,000 c. $200,000 d. $215,000 19. Financial statements are prepared: a. Only for publicly owned business organizations. b. For corporations, but not for sole proprietorships or partnerships. c. Primarily for the benefit of persons outside of the business organization. d. In either monetary or nonmonetary terms, depending upon the need of the decision maker. 20. The basic purpose of an accounting system is to: a. Develop financial statements in conformity with generally accepted accounting principles. b. Provide as much useful information to decision makers as possible, regardless of cost. c. Record changes in the financial position of an organization by applying the concepts of double-entry accounting. d. Meet an organization's need for accounting information as efficiently as possible. Answers for Self Assessment Questions 1. (c) 2.(c) 3.(a) 4.(b) 5.(a) 6. (a) 7.(b) 8. (a) 9.(b) 10.(b) 11.(a) 12.(a) 13.(a) 14.(a) 15. (d) 16.(b) 17.(d) 18.(a) 19.(c) 20. (d) Chapter-2: Financial Statement Analysis Self Assessment Questions 1. Which of the following is not a reason financial analysis is useful to investors? a. Investors read financial statements either to monitor their current investments or to plan their future ones b. Future trends can always be accurately predicted c. Current position is the base on which future performance must be built d. Past performance is often a good indicator of future performance 2. In relation to a company, creditors are least concerned with: a. b. c. d. Its solvency Its profitability Its future share price Its short-term liquidity 3. In relation to a company, investors are least concerned with: a. b. c. d. Its profitability Its short-term liquidity Its future share price Its solvency 4. Which of the following is not true of trend analysis? (several possible answers) a. b. c. d. It concentrates on different geographic segments of production It concentrates on the relative size of current assets It examines the relationships of percentage changes to each other All of the above 5. In order to have a smoothed rate of growth, we use: a. b. c. d. Common-size statements Trends statements CAGR Financial ratios 6. Which of the following statements are true in relation to common-size statements analysis? (several possible answers) a. b. c. d. It may concentrate on the gross margin percentage It uses changes in euro amount and percentage terms to identify patterns It may concentrate on the relative size of current assets Both (a) and (c) 7. The difference between total current assets and total current liabilities is: a. b. c. d. Accounting working capital Trade working capital Operating working capital Net assets 8. Which of the following is a short-term liquidity ratio? a. b. c. d. Current ratio Quick ratio Inventory turnover All of the above 9. Gofrade srl has a current ratio of 1.2. If its ending inventory is understated by € 12,000 and beginning inventory is overstated by € 20,000, Gofrade's inventory turnover, current and quick ratios would be: a. b. c. d. Inventory turnover: higher; Current ratio: lower; Quick ratio: higher Inventory turnover: higher; Current ratio: lower; Quick ratio: lower Inventory turnover: higher; Current ratio: lower; Quick ratio: unaffected Inventory turnover: lower; Current ratio: lower; Quick ratio: lower 10. Financial statements report only items that have significant economic value.” This statement summarizes which basic accounting concept? a. b. c. d. Materiality. Matching. Realization. Disclosure. 11. Which basic accounting concept does the following statement summarize? “Transactions are recorded using price paid, not current prices.” a. b. c. d. Historical cost. Matching. Conservatism. Disclosure. 12. Which basic accounting concept prohibits firms from frequently changing their method of valuing inventory? a. b. c. d. Consistency. Disclosure. Conservatism. Historical cost. 13. Which of the following does not indicate high quality of earnings? a. b. c. d. Earnings are stable. Conservative accounting methods were used to calculate earnings. Earnings are from financing activities. The firm has no extraordinary income. 14. Which of the following is least likely to be associated with low-quality earnings? a. b. c. d. Increase in intangible assets. Slowdown in inventory turnover. One-time sources of income. Decrease in borrowings. 15. If the trend of the current ratio is increasing, while the trend of the acid-test ratio is decreasing over a period of time, this could be a warning that the firm is: a. b. c. d. Having trouble collecting its receivables. Purchasing too much treasury stock. Paying "extra" dividends. Carrying excess inventories. 16. Return on Investment is computed as: a. b. c. d. Net income divided by average total assets. Net income divided by total sales. Net income divided by average total owners' equity. Sales divided by average total assets. 17. Which of the following is not a category of financial statement ratios? a. b. c. d. Financial leverage. Liquidity. Profitability. Reliability. 18. An individual interested in making a judgment about the profitability of a company should: a. b. c. d. Review the trend of working capital for several years. Calculate the company's ROE for the most recent year. review the trend of the company's ROI for several years. compare the company's price/earnings ratio trend the most recent year with the industry average price/earnings ratio trend for the most recent year. 19. A potential creditor's judgment about granting credit would be most influenced by the potential customer's: a. b. c. d. most recent acid-test ratio. trend of acid-test ratio over the past three years. practice with respect to taking cash discounts offered by current suppliers. price/earnings ratio. 20. The comparison of activity measures of different companies is complicated by the fact that: a. b. c. d. dollar amounts of assets may be significantly different. only one of the companies may have preferred stock outstanding. the number of shares of common stock issued may be significantly different. different inventory cost flow assumptions may be used. Answers for Self Assessment Questions 1. (b) 2.(c) 3.(b) 4.(d) 5.(c) 6. (d) 7.(c) 8. (d) 9.(c) 10.(a) 11.(a) 12.(a) 13.(c) 14.(d) 15. (d) 16.(a) 17.(d) 18.(d) 19.(c) 20. (d) Chapter-3: Fund Flow Statement Self Assessment Questions 1. According to the accounting profession, which of the following would be considered a cash-flow item from an "investing" activity? a. b. c. d. cash inflow from interest income. cash inflow from dividend income. cash outflow to acquire fixed assets. all of the above. 2. According to the Financial Accounting Standards Board (FASB), which of the following is a cash flow from a "financing" activity? a. b. c. d. cash outflow to the government for taxes. cash outflow to shareholders as dividends. cash outflow to lenders as interest. cash outflow to purchase bonds issued by another company. 3. If the following are balance sheet changes: $5,005 decrease in accounts receivable $7,000 decrease in cash $12,012 decrease in notes payable $10,001 increase in accounts payable a "use" of funds would be the: a. b. c. d. $7,000 decrease in cash. $5,005 decrease in accounts receivable. $10,001 increase in accounts payable. $12,012 decrease in notes payable. 4. On an accounting statement of cash flows an "increase(decrease) in cash and cash equivalents" appears as a. b. c. d. a cash flow from operating activities. a cash flow from investing activities. a cash flow from financing activities. none of the above. 5. Uses of funds include a (an): a. b. c. d. decrease in cash. increase in any liability. increase in fixed assets. tax refund. 6. Which of the following would be included in a cash budget? a. b. c. d. depreciation charges. dividends. goodwill. patent amortization. 7. An examination of the sources and uses of funds statement is part of: a. b. c. d. a forecasting technique. a funds flow analysis. a ratio analysis. calculations for preparing the balance sheet. 8. Which of the following is NOT a cash outflow for the firm? a. b. c. d. depreciation. dividends. interest payments. taxes. 9. Which of the following would be considered a use of funds? a. b. c. d. a decrease in accounts receivable. a decrease in cash. an increase in account payable. an increase in cash. 10. The cash flow statement in the United States is most likely to appear using a. a "supplementary method." b. a "direct method." c. an "indirect method." d. a "flow of funds method." 11. For a profitable firm, total sources of funds will always a. b. c. d. total uses of funds. be equal to be greater than be less than have no consistent relationship to 12. The sustainable growth rate (SGR) can be expressed as: a. the percentage change in retained earnings assuming a steady state model where the retention rate is held constant. b. being positively related to the firm's target return on equity and negatively related to its target retention rate. c. the maximum annual percentage increase in sales that can be achieved based on target operating, debt, and dividend-payout ratios. d. being negatively related to the firm's target return on equity and positively related to its retention rate. 13. A firm receives cash for 30% of its sales with the remaining 70% being credit sales. Of the credit sales, 20% are collected in the month of sale, 60% in the month following the sale, and 20% in the second month following the sale. Forecasted sales for January through April are $400,000, $500,000, $600,000, and $400,000 respectively. What are total cash receipts in the month of April? a. b. c. d. $120,000 $400,000 $498,000 $530,000 14. A firm makes all purchases on credit. Cash payment on this trade credit is required in the month following purchase on 70% of all purchases. The firm takes a 2% cash discount and makes payment for the remaining 30% of all purchases in the month of purchase. Forecasted purchases for January through April are $300,000, $375,000, $450,000, and $300,000 respectively. In the month of March, what is the total cash disbursement for purchases? a. $132,300 b. $394,800 c. $403,200 d. $450,000 15. Assume that total cash receipts for January through June are $100, $120, $80, $60, $120, and $190 respectively. Also assume that total cash disbursements for January through June are $80, $100, $80, $150, $150, and $70 respectively. Your firm has a beginning cash balance at the beginning of January of $55. At the end of what month is the firm forecasting a negative cash balance? a. b. c. d. June. May. April. March. 16. Assume that total cash receipts for January through June are $100, $120, $80, $60, $120, and $190 respectively. Also assume that total cash disbursements for January through June are $80, $100, $80, $150, $150, and $70 respectively. Your firm has a beginning cash balance at the beginning of January of $20 and requires a minimum cash balance of $30. At the end of what month is the firm forecasting a cash balance below the minimum? a. b. c. d. January. February. March. April. 17. Which of the following statements regarding forecasted ending cash balances? a. The cash balance is simply a forecast and the ending cash balance can be more correctly viewed via a probability distribution of possible ending cash balances. b. The forecasted ending cash balance reveals the firm's actual profits. c. From an internal management standpoint, a range of possible cash balances is much less useful to managers than a single most-likely ending cash balance. d. If the forecasted ending cash balance is below a minimum required level, then the firm will have to borrow funds. 18. Information that goes into ........................ can be used to help prepare ......................... a. a forecast balance sheet; a forecast income statement b. forecast financial statements; a cash budget c. a cash budget; forecast financial statements d. a forecast income statement; a cash budget 19. In preparing a forecast balance sheet, it is likely that either cash or ........................ will serve as a "plug figure" or balancing factor to ensure that assets equal liabilities plus shareholders' equity. a. b. c. d. retained earnings accounts receivable shareholders' equity Notes payable (short-term borrowings) 20. The accounting statement of cash flows reports a firm's cash flows segregated into what categorical order? a. b. c. d. Operating, investing, and financing. Investing, operating, and financing. Financing, operating and investing. Financing, investing, and operating. Answers for Self Assessment Questions 1. (c) 2.(b) 3.(d) 4.(d) 5.(c) 6. (b) 7.(b) 8. (a) 9.(d) 10.(c) 11.(a) 12.(c) 13.(c) 14.(b) 15. (b) 16.(d) 17.(a) 18.(c) 19.(d) 20. (a) Chapter-4: Cost Accounting Self Assessment Questions 1. ..........................process of accounting for the incurrence of cost and the control of cost. a. b. c. d. Financial accounting Cost accounting Managerial accounting None of these 2. The objective of determining the ..........................of products is of main importance in cost accounting. a. b. c. d. cost cost accounting Both (a) and (b) None of these 3. Cost accounting provides information regarding the cost to make and ..........................product or services. a. b. c. d. supply manufacture buy sell 4. Cost accounting helps the management in providing information for..........................decisions for formulating operative policies. a. b. c. d. corporate managerial government All of these 5. A ..........................system provides immediate information regarding stock of raw material, semi-finished and finished goods. a. b. c. d. business accounting managerial accounting cost accounting financial accounting 6. Cost accounting is the process of determining and accumulating the …………….or activity. a. b. c. d. cost of product cost of labor cost of land None of these 7. The results shown by …………………differ from those shown by financial accountant. a. b. c. d. account manager cost accountant chartered accountant None of these 8. Management enables to check the wastage in term of time and expenses. a. True b. False 9. Cost accounting can be most beneficial as a tool for management in …………….. a. b. c. d. planning forecasting budgeting risk taking 10. Cost accounting lacks a dynamic procedure. a. True b. False 11. Accounting is related to..................... a. b. c. d. management control management function Both (a) and (b) None of these. 12. The collection and presentation of accounting information come within the area of Cost accounting. a. True b. False 13. A study of sociology helps to understand the behaviour of man in groups. a. True b. False 14. Cost accounting is.................. to management needs. a. b. c. d. low sensitive highly sensitive Both a and b None of these. 15. The accounting data required for managerial decisions is properly compiled and classified is............... a. b. c. d. modifies data provides data facilitates control None of these. 16. Cost accounting is mainly concerned with the rearrangement of the information provided by.............. a. b. c. d. cost accounting accounting financial accounting None of these. 17. The financial data are so devised and systematically development that they become a unique tool for management decision. a. True b. False 18. CIS stands for................. a. b. c. d. Comparative Income Sheet Comparative Income Statement Comparative Income Size None of these. 19. All of the following are characteristics of managerial accounting, except: a. Reports are used primarily by insiders rather than by persons outside of the business entity. b. Its purpose is to assist managers in planning and controlling business operations. c. Information must be developed in conformity with generally accepted accounting principles or with income tax regulations. d. Information may be tailored to assist in specific managerial decisions. 20. In comparison with a financial statement prepared in conformity with generally accepted accounting principles, a managerial accounting report is more likely to: a. b. c. d. Be used by decision makers outside of the business organization. Focus upon the operation results of the most recently completed accounting period. View the entire organization as the reporting entity. Be tailored to the specific needs of an individual decision maker. Answers for Self Assessment Questions 1 (b) 2 (a) 3 (d) 4 (b) 6 (a) 7 (b) 8 (a) 9 (c) 5 (c) 10(b) 11 (b) 12 (a) 13 (a) 14 (b) 15 (a) 16 (c) 17 (a) 18 (b) 19 (c) 20 (d) Chapter-5: Budget Self Assessment Questions 1. A budget a. b. c. d. is a substitute for management is an aid to management can operate or enforce itself is the responsibility of the accounting department 2. Which one of the following is not a benefit of budgeting? a. b. c. d. It facilitates the coordination of activities It provides definite objectives for evaluating performance It provides assurance that the company will achieve its objectives It requires all levels of management to plan ahead on a recurring basis 3. Budgeting is usually most closely associated with which management functions? a. b. c. d. Planning Directing Motivating Controlling 4. A common starting point in the budgeting process is a. b. c. d. expected future net income past performance to motivate the sales force a clean slate, with no expectations 5. budget period should be a. b. c. d. monthly for a year or more long-term long enough to provide an obtainable goal under normal business conditions 6. The starting point in preparing a master budget is the preparation of the a. b. c. d. production budget sales budget purchasing budget personnel budget 7. The word budget developed from bougette or ‘small bag’ in middle French. a. True b. False 8. A sales forecast a. b. c. d. shows a forecast for the firm only shows a forecast for the industry only shows forecasts for the industry and for the firm plays a minor role in the development of the master budget 9. The process of budgetary control includes: a. b. c. d. preparation of various budgets continuous comparison of actual performance with budgetary performance and revision of budgets in the light of changed circumstances All of these 10. Budgets do not specify the expenses an employee or an organizational unit in an establishment is authorized or permitted to incur for different types of activities or assets. a. True b. False 11. Which of the following would be found in a cash budget? a. b. c. d. Capital expenditure Accrued expenditure Provision for doubtful debts Depreciation 12. If annual consumption is 2,500 units, the cost of reordering is £100 and the storage and holding cost per unit is £2, then the economic order quantity would be: a. b. c. d. 1,000 units 707 units 433 units 500 units 13. Which of the following is not a cash outflow? a. b. c. d. Cash drawings New equipment Commission paid Depreciation 14. A forecast set of final accounts is also known as: a. b. c. d. Sales budget Capital budget Cash budget Master budget 15. The acronym OPT in budgeting would refer to: a. b. c. d. Organization, people, time Other people’s time Optimized purchasing technology Optimized production technology 16. Net cash flow can be calculated by: a. b. c. d. Cash inflows less cash outflows Cash inflows plus cash outflows Opening balance of cash plus cash inflows Profits less expenses 17. Which of the following is not suitable action for a firm to take during a cash flow shortage? a. Extend credit period with suppliers b. Bonus issue of shares c. Overdraft arrangement d. Selling off assets 18. Differences between cash and profit can be explained by which of the following? a. b. c. d. Cash drawings Not taking credit from suppliers Cash sales Expenses being paid on time 19. A problem for a firm of maintaining high stock levels would not include: a. b. c. d. Opportunity cost of money tied up in stocks Risk of spoilage Storage costs Meet unexpected demand 20. If annual consumption is 150,000 units, the cost of reordering is £250 and the storage and holding cost per unit is £48, then the economic order quantity would be: a. b. c. d. 884 units 240 units 1,050 units 1,250 units Answers for Self Assessment Questions 1 (b) 2 (c) 3 (a) 4 (b) 5 (d) 6 (b) 7 (a) 8 (c) 9 (d) 10 (b) 11 (a) 12 (d) 13 (d) 14 (d) 15 (d) 16 (a) 17 (b) 18 (a) 19 (d) 20 (d) Chapter-6: Marginal Costing Self Assessment Questions 1. The collection and presentation of accounting information come within the area of Cost accounting. a. True b. False 2. A study of sociology helps to understand the behavior of man in groups. a. True b. False 3. Cost accounting is.................. to management needs. a. b. c. d. low sensitive highly sensitive Both a and b None of these. 4. Thus, cost......... analysis is an important medium through which one can a. b. c. d. cost marginal profit volume-profit None of these 5. The work-in progress and finished stocks are valued at marginal costs only. a. True b. False 6. The overhead expenses which do not vary with the activity level are called...... a. b. c. d. variable overheads fixed overheads semi variable overheads none of these 7. To use of job...........method will be useful for accounting system a. b. c. d. labor person costing accountant 8. This method is followed where by-products cost………. are processed to dispose of waste material more a. b. c. d. (a)products cost (b) financial (c)material (d) None of these 9. The standard may be arrived at on the basis of past average ……….. Or may be fixed according to the principles of standard costing a. b. c. d. price financial costing None of these 10. The type of spoilage that should not affect the cost of inventories is a. b. c. d. abnormal spoilage seasonal spoilage normal spoilage indirect spoilage 11. Absorption costing is also called: a. b. c. d. total costing. activity based costing. marginal costing. variable costing. 12. Which of the following types of costs are allocated to cost centres? a. b. c. d. Direct and indirect costs. Only direct costs. Only indirect costs. Only semi variable costs. 13. Which one of the following bases would be most appropriate for apportioning a company's general advertising costs? a. b. c. d. Purchases in each division. Stock levels in each division. Number of customers in each division. Sales in each division (£). 14. A company's service centre costs totalled £95,000, and are reapportioned to three production departments (A, B and C) in the ratio 33:25:17 respectively. What is the total amount (to the nearest pound) apportioned to departments C? a. b. c. d. £1,267. £21,533. £31,667. £41,800. 15. A business absorbs overheads on the basis of hours worked on a specific job. If the overhead absorption rate has been calculated at £30 per hour, and a job is estimated to take 20 hours, what price would be charged to the customer if the company's mark-up is 50%? a. b. c. d. £1,200. £900. £600. £300. 16. Activity based costing relates costs to: a. b. c. d. the total indirect costs of a product. the hours spent on manufacturing products. the activities which generate costs on products. the amount of raw materials used within a product. 17. Under marginal costing, the break even point is found by the following formula: a. b. c. d. total sales divided by the contribution per unit. total fixed costs divided by the contribution per unit. total variable costs divided by the contribution per unit. fixed costs per unit divided by the total contribution. 18. A retail company sells computers, each of which is sold for £250 and bought from the manufacturer for £100. The retailer’s fixed costs are £150,000. Maximum possible sales are 3,000. How many computers must be sold to break-even? a. b. c. d. 2,000. 3,000. 750. 1,000. 19. Using the information in question 8, how much profit or loss would be made if 2,700 computers were sold? a. b. c. d. £162,000 profit. £150,000 loss. £255,000 profit. £450,000 profit. 20. Using the information in question 8, how many computers would have to be sold for the company two and a profit of £180,000? a. b. c. d. 2,200. 1,200. 1,000. 720. Answers for Self Assessment Questions 1. (a) 2.(a) 3.(b) 4.(c) 5.(a) 6. (b) 7.(c) 8.(b) 9.(b) 10.(a) 11 (a) 12 (a) 13 (d) 14 (b) 15 (b) 16 (c) 17 (b) 18 (d) 19 (c) 20 (a) Chapter-7: Meaning of Financial Management Self Assessment Questions 1. Financial Management deals with .................. of funds and their effective utilization in the business. a. b. c. d. money share procurement investment 2. Financial Management is mainly concerned with the effective funds management in the............ a. b. c. d. organization business market None of these 3. The concept of finance includes capital, funds, money, and amount. a. True b. False 4. Economic concepts like micro and macroeconomics are directly applied with the ..............approaches. a. b. c. d. employee management financial management production management None of these 5. Business finance cannot broadly be defined as the activity concerned with planning, raising, controlling, administering of the funds used in the business. a. True b. False 6. Production performance needs finance, because production department requires ............, machinery. a. b. c. d. capital material raw material None of these 7. Modern approaches of the financial management applied large number of mathematical and statistical tools and techniques. a. True b. False 8. The financial manager or finance department is responsible to allocate the adequate finance to the............................. a. b. c. d. HR department marketing department financial department production department 9. Financial planning is an important part of the business concern, which helps to promotion of an enterprise. a. True b. False 10. ..................maximization is also called as cashing per share maximization. a. b. c. d. finance loss Profit None of these 11. Which of the following is not a reason for international investment? a. To provide an expected risk-adjusted return in excess of that required. b. To gain access to important raw materials. c. To produce products and/or services more efficiently than possible domestically. d. International investments have less political risk than domestic investments. 12. The ........................ refers to the orderly relationship between spot and forward currency exchange rates and the rates of interest between countries. a. b. c. d. one-price rule interest-rate parity purchasing-power parity exchange-power parity 13. The ........................ is especially well suited to offer hedging protection against transactions risk exposure. a. b. c. d. forward market spot market transactions market inflation-rate market 14. An accounting loss or gain that arises from translating the assets and liabilities of a foreign subsidiary (non-dollar denominated) into the parent company's currency is accounted for as a translation adjustment ......................... a. b. c. d. in the owners' equity section on the income statement in both the balance sheet and income statement on internal accounting records only and does not materially impact accounting income 15. A multinational company that is faced with mild interference up to complete confiscation of all assets is encountering ......................... a. b. c. d. translation risk exposure transactions risk exposure political risk exposure a very bad day 16. A written statement by the exporter ordering the importer to pay a specific amount of money upon presentation to drawee to whom it is addressed is known as a ......................... a. b. c. d. bill of lading sight draft time draft letter of credit 17. A trade agreement in which a domestic firm accepts whiskey for full payment on a sale of computer equipment is an example of ......................... a. b. c. d. export factoring forfaiting a scene from the classic movie "Animal House" countertrade 18. AusAmer is an exporter who has sold outright their accounts receivable to another institution. This is an example of ......................... a. b. c. d. export factoring forfaiting striding countertrade 19. Which of the following is not an example of an international trade draft? a. b. c. d. Time draft. Sight draft. Both the first and second answers are correct. None of the answers given are correct. 20. Assume the nominal interest rates (annual) in the country of Freedonia and the United States are 6% and 12% respectively. What is the implied 90-day forward rate if the current spot rate is 5 Freedonian marks (FM) per U.S. dollar? a. b. c. d. 4.732 4.927 5.074 5.283 Answers for Self Assessment Questions 1. (c) 2. (b) 3. (a) 4. (b) 5. (b) 6. (c) 7.(a) 8.(b) 9.(a) 10. (c) 11.(d) 12.(b) 13.(a) 14.(a) 15. (c) 16.(b) 17.(d) 18.(a) 19.(c) 20. (b) Chapter-8: Capital Budgeting Self Assessment Questions 1. Capital Budget is also known as ".............. Decision Making”. a. b. c. d. Support Investment short-term None of these 2. Capital budgeting is concerned with the firm's formal process for the acquisition and investment of capital. This given by............................... a. b. c. d. Hamption, John John Linkon Donald 3. Capital budgeting decisions involve long-term implication for the firm, and influence its risk complexion. a. True b. False 4. Capital expenditure activities are made up of two distinct processes: a. b. c. d. making the planning and implementing making the decision and goals making the decision and implementing None of these 5. NPV = PV of inflow + PV of outflow. a. True b. False 6. Present value of inflow a. (a) Profitability index (PI) Present value of inflow PV of outflow PV of outflow Present value of inflow PV of inflow c. (c) Profitability index (PI) Present value of inflow PV of inflow d. (d) Profitability index (PI) PV of outflow b. (b Profitability index (PI) 7. Corporate executives face ………………tasks in achieving good financial management. a. b. c. d. four two three None of these 8. Appraisals are important as they help to evaluate …………….and aid increments. a. b. c. d. results performance both (a) and (b) financial groth 9. Pay-back period is also termed as "Pay-out period" or Pay-off period. a. True b. False 10. Pay-back period can be computed by dividing cash outlays (original investment) by……………... a. b. c. d. half cash inflows monthly cash inflows annual cash inflows None of these 11. The objective of ..........................is to put the capital available to the best possible use. a. b. c. d. decision ranking short-term assets None of these 12. The evaluation of projects should be performed by group of experts who have axe to grind. a. True b. False 13. The audience for a proposal usually includes both managers and engineers. a. True b. False 14. The return on investment formula: ROI (Gain from Investment Cost of Investment) Cost of Interest ROI (Gain from Investment Cost of Investment) Cost of Interest ROI (Gain from Investment Cost of Investment) Cost of Investment ROI (Gain from Investment / Cost of Investment) Cost of Interest a. b. c. d. 15. The market value of our investment in equity shares depends upon the performance of the company we invest in. a. True b. False 16. The average rate of inflation in India has been less than…………. during the last two decades. a. b. c. d. 5% per.annum 8% per.annum 4% per.annum 10% per.annum 17. An asset or investment is said to be ………..…..if it can be converted into cash quickly, and with little loss in value. a. b. c. d. flow assets liquid None of these 18. Average investment =. a. b. c. d. Original investment-2 Original investment+2 Original investment÷3 Original investment÷2 19. The contribution of top management in generating investment ideas is generally confined to expansion or diversification projects. a. True b. False 20. In the case of a bank fixed deposit, we can raise loans up to ……….of the value of the deposit; and to that extent, it is a liquid investment. a. b. c. d. 75% to 91% 75% to 90% 72% to 90% 70% to 95% Answers for Self Assessment Questions 1. (b) 6. (a) 11. (b) 2. (a) 7.(c) 12. (b) 3. (a) 8.(b) 13. (a) 4. (c) 9.(a) 14. (c) 5. (b) 10. (c) 15. (a) 16. (b) 17.(c) 18.(d) 19.(a) 20. (b) Chapter-9: Cost of Capital Self Assessment Questions 1. Cost of capital usually is expressed: a. b. c. d. In percentage terms, as a percentage of the face value of the investment. In percentage terms, as a percentage of the amount invested. In dollar terms, in real dollars. In dollar terms, in nominal dollars. 2. Cost of capital is market driven. a. True b. False 3. Cost of capital is based on historical returns. a. True b. False 4. Cost of capital is determined by the market and represents the degree of a. b. c. d. by investors perceived danger perceived risk perceived riskiness perceived hazard 5. The overall (weighted average) cost of capital is composed of a weighted average of …………. a. b. c. d. the cost of common equity and the cost of debt the cost of common equity and the cost of preferred stock the cost of preferred stock and the cost of debt the cost of common equity, the cost of preferred stock, and the cost of debt 6. When calculating the WACC for a firm, one should use the book values of debt and equity. a. True b. False 7. The components of a company’s capital structure include: a. b. c. d. Accounts payable, long-term debt, and preferred stock. Accounts payable, preferred stock, and common stock. Accounts payable, long-term debt, and common stock. Long-term debt, preferred stock, and common stock. 8. The debt policy of a firm is significant influenced by the a. b. c. d. consideration charge cost expense expenditure 9. Tax rates affect the after-tax cost of debt. As tax rates increase, the cost of debt decreases, decreasing the cost of capital. a. True b. False 10. Discounting at the WACC assumes that debt is rebalanced every period to maintain a constant ratio of debt to market value of the firm. a. True b. False 11. A single, overall cost of capital is often used to evaluate projects because: a. it avoids the problem of computing the required rate of return for each investment proposal. b. it is the only way to measure a firm's required return. c. it acknowledges that most new investment projects have about the same degree of risk. d. it acknowledges that most new investment projects offer about the same expected return. 12. The cost of equity capital is all of the following EXCEPT: a. the minimum rate that a firm should earn on the equity-financed part of an investment. b. a return on the equity-financed portion of an investment that, at worst, leaves the market price of the stock unchanged. c. by far the most difficult component cost to estimate. d. generally lower than the before-tax cost of debt. 13. In calculating the proportional amount of equity financing employed by a firm, we should use: a. b. c. d. the common stock equity account on the firm's balance sheet. the sum of common stock and preferred stock on the balance sheet. the book value of the firm. the current market price per share of common stock times the number of shares outstanding. 14. To compute the required rate of return for equity in a company using the CAPM, it is necessary to know all of the following EXCEPT: a. b. c. d. the risk-free rate. the beta for the firm. the earnings for the next time period. the market return expected for the time period. 15. In calculating the costs of the individual components of a firm's financing, the corporate tax rate is important to which of the following component cost formulas? a. b. c. d. common stock. debt. preferred stock. none of the above. 16. The common stock of a company must provide a higher expected return than the debt of the same company because a. b. c. d. there is less demand for stock than for bonds. there is greater demand for stock than for bonds. there is more systematic risk involved for the common stock. there is a market premium required for bonds. 17. A quick approximation of the typical firm's cost of equity may be calculated by a. b. c. d. adding a 5 percent risk premium to the firm's before-tax cost of debt. adding a 5 percent risk premium to the firm's after-tax cost of debt. subtracting a 5 percent risk discount from the firm's before-tax cost of debt. subtracting a 5 percent risk discount from the firm's after-tax cost of debt. 18. Market values are often used in computing the weighted average cost of capital because a. b. c. d. this is the simplest way to do the calculation. this is consistent with the goal of maximizing shareholder value. this is required in the U.S. by the Securities and Exchange Commission. this is a very common mistake. 19. For an all-equity financed firm, a project whose expected rate of return plots should be rejected. a. b. c. d. above the characteristic line above the security market line below the security market line below the characteristic line 20. Some projects that a firm accepts will undoubtedly result in zero or negative returns. In light of this fact, it is best if the firm a. b. c. d. adjusts its hurdle rate (i.e., cost of capital) upward to compensate for this fact. adjusts its hurdle rate (i.e., cost of capital) downward to compensate for this fact. does not adjust its hurdle rate up or down regardless of this fact. raises its prices to compensate for this fact. Answers for Self Assessment Questions 1. (b) 2.(a) 3.(b) 4.(b) 5.(d) 6. (b) 7.(d) 8.(b) 9.(a) 10.(a) 11. (a) 12. (d) 13. (d) 14. (c) 15. (b) 16. (c) 17.(a) 18.(b) 19.(c) 20. (c) Chapter-10: Working Capital Management Self Assessment Questions 1. Funds are also needed for short-term purposes, that is, for current operations of the business. a. True b. False 2. This minimum level of investment in current assets is not permanently locked up in business and is therefore referred to as permanent or fixed or regular working capital. a. True b. False 3 ……………..is said to be the life blood of a business same way as agency management system. a. Permanent working capital b. Fluctuating working capital c. Fixed working capital d. Working capital 4. The minimum level of investment in current assets regularly employed in business is called ……………….. a. Permanent working capital b. Fluctuating working capital c. Fixed working capital d. Working capital 5. The extra working capital needed to support the changing business activities is called ……………… a. b. c. d. Fluctuating working capital. Fluctuating working capital Fixed working capital Working capital 6. The net profit is a source of working capital to the extent it has been earned in cash. a. True b. False 7. Working capital is the amount of liquid assets which an organization has at bank. a. True b. False 8 ………………investment requirements varies from one company to another. a. Permanent working capital b. Fluctuating working capital c. Fixed working capital d. Net working capital 9 …………………………..management is crucial for the organization for its day to day operations. a. Permanent working capital b. Fluctuating working capital c. Working capital investment d. Working capital 10. The cash inflow can not be calculated by adjusting non-cash items such as depreciation, out-standing expenses, losses written off, etc, from the net profit. a. True b. False 11. The ………………program begins with a foundation that is focused on basic data integrity. a. b. c. d. Inventory Management Finance Management Risk Management None of These 12. Farm machinery is a good example of ……… a. b. c. d. finance Management profitable inventory environment None of these 13. Management of inventory is a powerful driver of ………………performance. a. b. c. d. environment cost inventories financial None Of these 14. The inventory capital charge is calculated as: inventory ×……………….. a. cost of capital b. cost of finance c. cost of total value d. None of these 15. One-bin inventory system is a simple inventory control system which depends on supply at……………… intervals. a. b. c. d. fixed value fixed time fixed demand None of these 16. A FIFO warehouse system is an inventory ……………system. a. finance management b. control c. warehouse d. management 17. Inventory management is a very important function that determines the health of the supply chain as well as the impacts the financial health of the …………….sheet. a. b. c. d. balance finance record None of these 18. Inventory control records are essential to making buy-and-sell…………… a. b. c. d. control decisions management none of these. 19. FIFO method, cost is computed on the assumption that goods sold or consumed are those which have been longest on hand and that those remaining the stock present the latest purchases or production. a. True b. False. 20. .................... are significant in the analysis of the consequences of 'increases in inventory replacements cost because of their effect on the amount of net earnings. a. b. c. d. Business Income tax rates Management none of these. Answers for Self Assessment Questions 1 (a) 2 (b) 3 (d) 4 (c) 5 (a) 6 (a) 7 (b) 8 (d) 9 (c) 10 (b) 11.(a) 12. (b) 13. (c) 14. (a) 15.(b) 16. (d) 17. (a) 18. (b) 19 (a) 20(b)