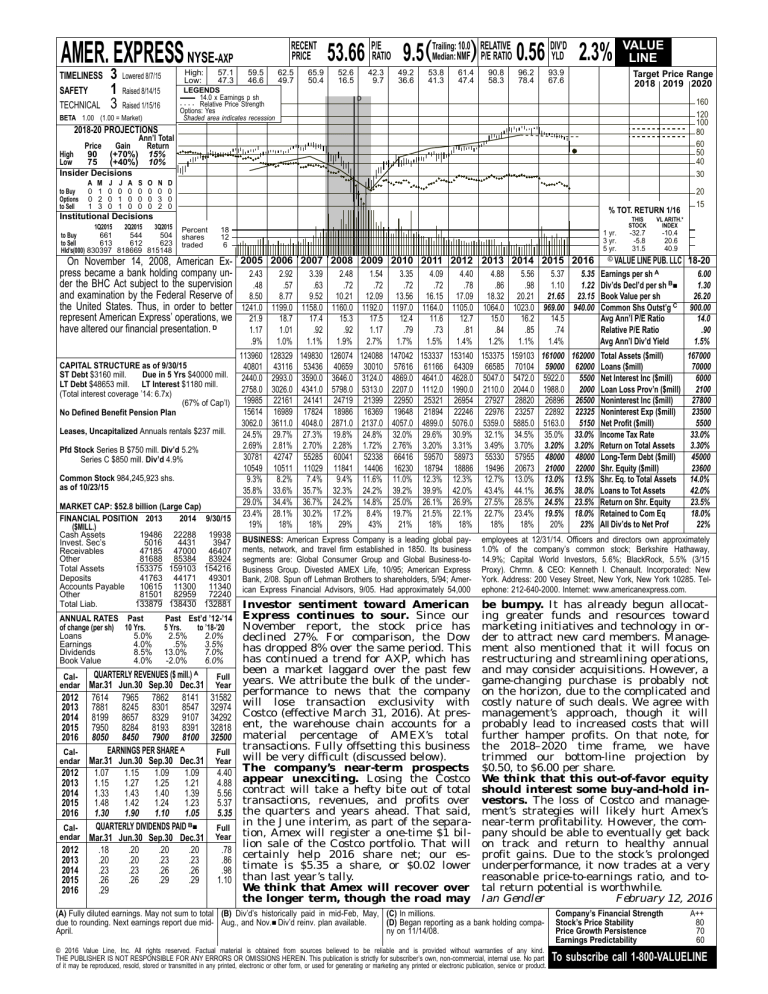

AMER. EXPRESS NYSE-AXP

TIMELINESS

SAFETY

TECHNICAL

3

1

3

High:

Low:

Lowered 8/7/15

57.1

47.3

RECENT

PRICE

59.5

46.6

62.5

49.7

65.9

50.4

10.0 RELATIVE

DIV’D

Median: NMF) P/E RATIO 0.56 YLD 2.3%

53.66 P/ERATIO 9.5(Trailing:

52.6

16.5

LEGENDS

14.0 x Earnings p sh

. . . . Relative Price Strength

Options: Yes

Shaded area indicates recession

Raised 8/14/15

Raised 1/15/16

BETA 1.00 (1.00 = Market)

42.3

9.7

49.2

36.6

53.8

41.3

61.4

47.4

90.8

58.3

96.2

78.4

93.9

67.6

VALUE

LINE

Target Price Range

2018 2019 2020

D

160

120

100

80

60

50

40

30

2018-20 PROJECTIONS

Ann’l Total

Price

Gain

Return

High

90 (+70%) 15%

Low

75 (+40%) 10%

Insider Decisions

to Buy

Options

to Sell

A

0

0

1

M

1

2

3

J

0

0

0

J

0

1

1

A

0

0

0

S

0

0

0

O

0

0

0

N

0

3

2

D

0

0

0

% TOT. RETURN 1/16

Institutional Decisions

1Q2015

2Q2015

3Q2015

661

544

504

to Buy

to Sell

613

612

623

Hld’s(000) 830397 818669 815148

Percent

shares

traded

18

12

6

1 yr.

3 yr.

5 yr.

THIS

STOCK

VL ARITH.*

INDEX

-32.7

-5.8

31.5

-10.4

20.6

40.9

20

15

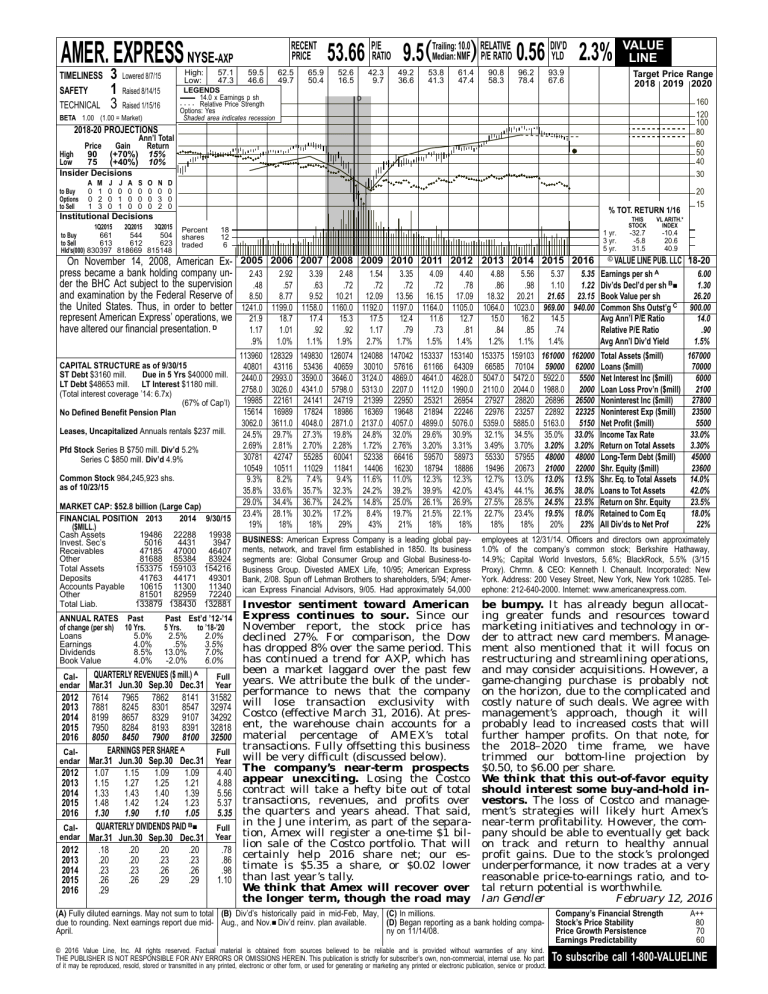

On November 14, 2008, American Ex- 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 © VALUE LINE PUB. LLC 18-20

press became a bank holding company un- 2.43 2.92 3.39 2.48 1.54 3.35 4.09 4.40

4.88

5.56

5.37

5.35 Earnings per sh A

6.00

der the BHC Act subject to the supervision

.48

.57

.63

.72

.72

.72

.72

.78

.86

.98

1.10

1.22 Div’ds Decl’d per sh B■

1.30

and examination by the Federal Reserve of 8.50 8.77 9.52 10.21 12.09 13.56 16.15 17.09 18.32 20.21 21.65 23.15 Book Value per sh

26.20

the United States. Thus, in order to better 1241.0 1199.0 1158.0 1160.0 1192.0 1197.0 1164.0 1105.0 1064.0 1023.0 969.00 940.00 Common Shs Outst’g C 900.00

represent American Express’ operations, we

21.9

18.7

17.4

15.3

17.5

12.4

11.6

12.7

15.0

16.2

14.5

Avg Ann’l P/E Ratio

14.0

have altered our financial presentation. D

1.17

1.01

.92

.92

1.17

.79

.73

.81

.84

.85

.74

Relative P/E Ratio

.90

.9%

1.0%

1.1%

1.9%

2.7%

1.7%

1.5%

113960

CAPITAL STRUCTURE as of 9/30/15

40801

ST Debt $3160 mill.

Due in 5 Yrs $40000 mill.

2440.0

LT Debt $48653 mill. LT Interest $1180 mill.

2758.0

(Total interest coverage ’14: 6.7x)

19985

(67% of Cap’l)

15614

No Defined Benefit Pension Plan

3062.0

Leases, Uncapitalized Annuals rentals $237 mill.

24.5%

2.69%

Pfd Stock Series B $750 mill. Div’d 5.2%

30781

Series C $850 mill. Div’d 4.9%

10549

Common Stock 984,245,923 shs.

9.3%

as of 10/23/15

35.8%

29.0%

MARKET CAP: $52.8 billion (Large Cap)

23.4%

FINANCIAL POSITION 2013

2014 9/30/15

19%

($MILL.)

128329

43116

2993.0

3026.0

22161

16989

3611.0

29.7%

2.81%

42747

10511

8.2%

33.6%

34.4%

28.1%

18%

149830

53436

3590.0

4341.0

24141

17824

4048.0

27.3%

2.70%

55285

11029

7.4%

35.7%

36.7%

30.2%

18%

126074

40659

3646.0

5798.0

24719

18986

2871.0

19.8%

2.28%

60041

11841

9.4%

32.3%

24.2%

17.2%

29%

124088

30010

3124.0

5313.0

21399

16369

2137.0

24.8%

1.72%

52338

14406

11.6%

24.2%

14.8%

8.4%

43%

147042

57616

4869.0

2207.0

22950

19648

4057.0

32.0%

2.76%

66416

16230

11.0%

39.2%

25.0%

19.7%

21%

153337

61166

4641.0

1112.0

25321

21894

4899.0

29.6%

3.20%

59570

18794

12.3%

39.9%

26.1%

21.5%

18%

Cash Assets

Invest. Sec’s

Receivables

Other

Total Assets

Deposits

Accounts Payable

Other

Total Liab.

19486 22288 19938

5016

4431

3947

47185 47000 46407

81688 85384 83924

153375 159103 154216

41763 44171 49301

10615 11300 11340

81501 82959 72240

133879 138430 132881

ANNUAL RATES Past

of change (per sh) 10 Yrs.

Loans

5.0%

Earnings

4.0%

Dividends

8.5%

Book Value

4.0%

Past Est’d ’12-’14

5 Yrs.

to ’18-’20

2.5%

2.0%

.5%

3.5%

13.0%

7.0%

-2.0%

6.0%

QUARTERLY REVENUES ($ mill.) A

Mar.31 Jun.30 Sep.30 Dec.31

2012 7614 7965 7862 8141

2013 7881 8245 8301 8547

2014 8199 8657 8329 9107

2015 7950 8284 8193 8391

2016 8050 8450 7900 8100

EARNINGS PER SHARE A

Calendar Mar.31 Jun.30 Sep.30 Dec.31

2012

1.07

1.15

1.09

1.09

2013

1.15

1.27

1.25

1.21

2014

1.33

1.43

1.40

1.39

2015

1.48

1.42

1.24

1.23

2016

1.30

1.90

1.10

1.05

QUARTERLY DIVIDENDS PAID B■

Calendar Mar.31 Jun.30 Sep.30 Dec.31

2012

.18

.20

.20

.20

2013

.20

.20

.23

.23

2014

.23

.23

.26

.26

2015

.26

.26

.29

.29

2016

.29

Calendar

Full

Year

31582

32974

34292

32818

32500

Full

Year

4.40

4.88

5.56

5.37

5.35

Full

Year

.78

.86

.98

1.10

1.4%

1.2%

1.1%

1.4%

Avg Ann’l Div’d Yield

1.5%

153140 153375 159103 161000 162000 Total Assets ($mill)

167000

64309 66585 70104 59000 62000 Loans ($mill)

70000

4628.0 5047.0 5472.0 5922.0

5500 Net Interest Inc ($mill)

6000

1990.0 2110.0 2044.0 1988.0

2000 Loan Loss Prov’n ($mill)

2100

26954 27927 28820 26896 26500 Noninterest Inc ($mill)

27800

22246 22976 23257 22892 22325 Noninterest Exp ($mill)

23500

5076.0 5359.0 5885.0 5163.0

5150 Net Profit ($mill)

5500

30.9% 32.1% 34.5% 35.0% 33.0% Income Tax Rate

33.0%

3.31% 3.49% 3.70% 3.20% 3.20% Return on Total Assets

3.30%

58973 55330 57955 48000 48000 Long-Term Debt ($mill)

45000

18886 19496 20673 21000 22000 Shr. Equity ($mill)

23600

12.3% 12.7% 13.0% 13.0% 13.5% Shr. Eq. to Total Assets 14.0%

42.0% 43.4% 44.1% 36.5% 38.0% Loans to Tot Assets

42.0%

26.9% 27.5% 28.5% 24.5% 23.5% Return on Shr. Equity

23.5%

22.1% 22.7% 23.4% 19.5% 18.0% Retained to Com Eq

18.0%

18%

18%

18%

20%

23% All Div’ds to Net Prof

22%

BUSINESS: American Express Company is a leading global payments, network, and travel firm established in 1850. Its business

segments are: Global Consumer Group and Global Business-toBusiness Group. Divested AMEX Life, 10/95; American Express

Bank, 2/08. Spun off Lehman Brothers to shareholders, 5/94; American Express Financial Advisors, 9/05. Had approximately 54,000

employees at 12/31/14. Officers and directors own approximately

1.0% of the company’s common stock; Berkshire Hathaway,

14.9%; Capital World Investors, 5.6%; BlackRock, 5.5% (3/15

Proxy). Chrmn. & CEO: Kenneth I. Chenault. Incorporated: New

York. Address: 200 Vesey Street, New York, New York 10285. Telephone: 212-640-2000. Internet: www.americanexpress.com.

Investor sentiment toward American

Express continues to sour. Since our

November report, the stock price has

declined 27%. For comparison, the Dow

has dropped 8% over the same period. This

has continued a trend for AXP, which has

been a market laggard over the past few

years. We attribute the bulk of the underperformance to news that the company

will lose transaction exclusivity with

Costco (effective March 31, 2016). At present, the warehouse chain accounts for a

material percentage of AMEX’s total

transactions. Fully offsetting this business

will be very difficult (discussed below).

The company’s near-term prospects

appear unexciting. Losing the Costco

contract will take a hefty bite out of total

transactions, revenues, and profits over

the quarters and years ahead. That said,

in the June interim, as part of the separation, Amex will register a one-time $1 billion sale of the Costco portfolio. That will

certainly help 2016 share net; our estimate is $5.35 a share, or $0.02 lower

than last year’s tally.

We think that Amex will recover over

the longer term, though the road may

be bumpy. It has already begun allocating greater funds and resources toward

marketing initiatives and technology in order to attract new card members. Management also mentioned that it will focus on

restructuring and streamlining operations,

and may consider acquisitions. However, a

game-changing purchase is probably not

on the horizon, due to the complicated and

costly nature of such deals. We agree with

management’s approach, though it will

probably lead to increased costs that will

further hamper profits. On that note, for

the 2018–2020 time frame, we have

trimmed our bottom-line projection by

$0.50, to $6.00 per share.

We think that this out-of-favor equity

should interest some buy-and-hold investors. The loss of Costco and management’s strategies will likely hurt Amex’s

near-term profitability. However, the company should be able to eventually get back

on track and return to healthy annual

profit gains. Due to the stock’s prolonged

underperformance, it now trades at a very

reasonable price-to-earnings ratio, and total return potential is worthwhile.

Ian Gendler

February 12, 2016

(A) Fully diluted earnings. May not sum to total (B) Div’d’s historically paid in mid-Feb, May, (C) In millions.

due to rounding. Next earnings report due mid- Aug., and Nov.■ Div’d reinv. plan available.

(D) Began reporting as a bank holding compaApril.

ny on 11/14/08.

© 2016 Value Line, Inc. All rights reserved. Factual material is obtained from sources believed to be reliable and is provided without warranties of any kind.

THE PUBLISHER IS NOT RESPONSIBLE FOR ANY ERRORS OR OMISSIONS HEREIN. This publication is strictly for subscriber’s own, non-commercial, internal use. No part

of it may be reproduced, resold, stored or transmitted in any printed, electronic or other form, or used for generating or marketing any printed or electronic publication, service or product.

Company’s Financial Strength

Stock’s Price Stability

Price Growth Persistence

Earnings Predictability

A++

80

70

60

To subscribe call 1-800-VALUELINE