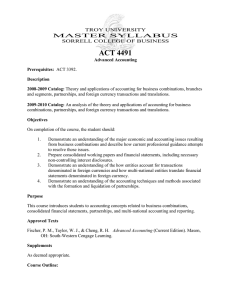

Advanced Financial Accounting Advanced Financial Accounting is an accounting course that builds upon the principles and concepts of Financial Accounting to explore more complex accounting topics. It covers advanced topics such as business combinations, consolidated financial statements, foreign currency transactions, partnerships, and other specialized accounting topics. Overview of some of the main topics covered in Advanced Financial Accounting: Business Combinations: This topic covers mergers and acquisitions, where one company buys another company or merges with it. Accounting for business combinations can be complex, and involves recognizing and valuing assets and liabilities, recording goodwill, and determining the fair value of the acquired assets and liabilities. Consolidated Financial Statements: This topic covers the preparation of consolidated financial statements, which combine the financial statements of a parent company and its subsidiaries. Consolidated financial statements are required by accounting standards when a company has control over another entity. Foreign Currency Transactions: This topic covers accounting for transactions that occur in foreign currencies. It involves the use of exchange rates to translate foreign currency transactions into the functional currency of the reporting entity. Partnerships: This topic covers the accounting for partnerships, including the allocation of profits and losses, the admission and withdrawal of partners, and the preparation of partnership financial statements. Other specialized accounting topics: Advanced Financial Accounting may also cover other specialized accounting topics such as accounting for pensions, leases, and financial instruments. Overall, Advanced Financial Accounting is a complex and challenging course that requires a strong understanding of financial accounting principles and a deep knowledge of specialized accounting topics. Business Combinations: Business combinations occur when one company acquires another company or merges with it. Advanced Financial Accounting covers accounting for business combinations and the steps involved in recognizing and valuing assets and liabilities, recording goodwill, and determining the fair value of the acquired assets and liabilities. The accounting treatment for business combinations varies depending on the level of control the acquiring company has over the acquired company. When the acquiring company has control over the acquired company, the accounting treatment is called a "merger accounting" or "acquisition accounting," while when the acquiring company has less than control over the acquired company, the accounting treatment is called "investment accounting." Consolidated Financial Statements: Consolidated financial statements combine the financial statements of a parent company and its subsidiaries into a single set of financial statements. Advanced Financial Accounting covers the preparation of consolidated financial statements and the accounting standards and procedures required for their preparation. It involves identifying and eliminating intercompany transactions and balances, recognizing non-controlling interests, and accounting for goodwill arising from the acquisition of subsidiaries. Foreign Currency Transactions: Foreign currency transactions occur when a company engages in transactions denominated in a foreign currency. Advanced Financial Accounting covers the accounting treatment for foreign currency transactions, including the use of exchange rates to translate foreign currency transactions into the functional currency of the reporting entity. It involves recognizing gains and losses from foreign currency transactions, and accounting for forward contracts and options used to hedge against foreign currency risk. Partnerships: Partnerships are formed when two or more individuals or entities come together to carry on a business. Advanced Financial Accounting covers the accounting treatment for partnerships, including the allocation of profits and losses, the admission and withdrawal of partners, and the preparation of partnership financial statements. It involves accounting for partner capital accounts, partnership income, and tax allocations. Other specialized accounting topics: Advanced Financial Accounting may also cover other specialized accounting topics such as accounting for pensions, leases, and financial instruments. These topics require an understanding of the accounting standards and procedures specific to each topic, and can be complex and challenging to master. For example, accounting for pensions involves recognizing and measuring pension liabilities and assets, accounting for contributions, and recognizing actuarial gains and losses. Similarly, accounting for leases involves identifying lease arrangements, determining the lease term, and accounting for lease payments and assets and liabilities on the balance sheet. Finally, accounting for financial instruments involves recognizing and measuring financial assets and liabilities, accounting for interest and dividends, and recognizing gains and losses from fair value changes.