The Hyperinflation in Russia in the 1990's

advertisement

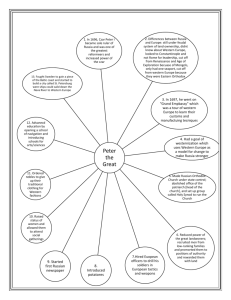

The Hyperinflation in Russia in the 1990's http://www.applet-magic.com/russianinflpod.htm San José State University Department of Economics applet-magic.com Thayer Watkins Silicon Valley & Tornado Alley USA The Hyperinflation in Russia in the 1990's The Nature of the Effect of the Removal of Price Controls The nature of the hyperinflation in Russia in the 1990's is widely misunderstood. It was not due to any shock therapy; it was due to the expansion of the money supply by the central bank of Russia. The removal of price controls would have resulted only in a one-time ostensible price increase, but even this is dependent upon an erroneous notion of what 1 of 11 7/7/08 3:33 PM The Hyperinflation in Russia in the 1990's http://www.applet-magic.com/russianinflpod.htm constitutes a price. When price controls hold prices down below their market equilibrium rate they create a shortage at the control level of prices and a black market. People cannot buy as much as they would like at the control prices and often it is only a lucky few with inside connections who get to buy at the control prices. Those without those connections and those who want more than they get at the control price must go to the black market and pay the higher price. The real market and the real market price is the black market price. Suppose gasoline is rationed and the ration price set at $4 per gallon but the black market price is $7 per gallon. Someone who buys gasoline at $4 per gallon decides whether to use that gallon or sell it on the black market based upon the black market price of $7 per gallon not the purchase price of $4 per gallon. The real price therefore even for those who buy at the control price is the black market price. The black market price is not only higher than the control price, it is higher than the equilibrium price. Therefore when price controls are removed the real price goes down not up. The real price goes from the black market price down to the market equilibrium price. The control price is irrelevant but it is the price that would be used in price indices for measuring inflation. So the effect of the removal of price controls is not real inflation but the change from a bogus price to a real market price. However, without the continual expansion of the money supply there would be no further price increase. Monetary Policy in Russia in the 1990's 2 of 11 7/7/08 3:33 PM The Hyperinflation in Russia in the 1990's http://www.applet-magic.com/russianinflpod.htm The head of the Central Bank of Russia was Viktor Gerashchenko. He was a dedicated Communist and, as such, not at all interested in having the Russian economy make a smooth transition from the Stalinist central control system to some version of a private market economy. Most of the State Enterprises of the Soviet Union operated at a deficit; i.e., the ruble value of their products was less than the ruble costs of the labor and raw materials that went into producing them. Under the old system the state covered the difference. During the transition the government of Russia stopped covering those deficits. The enterprises were then faced with a choice of cutting costs, shutting down or finding some other way to cover the deficit. The only feasible way to cover their costs was to get loans from the Central Bank. The financial system in Russia was complicated and enigmatic but in a simpler system the effects of those loans would have worked as follows. The loans were in the form of accounts granted at the central bank. In a fractional reserve banking system accounts at the central bank are high powered money. The total money supply expands by a multiple of the amount of those central bank accounts granted. When the money supply expands in excess of the real growth of the economy there is an increase in the price level -- inflation. In the case of Russia at the time there was no real Viktor Gerashchenko growth in the economy, it was in fact contracting. If the money supply expands 5 percent and production is contracting 20 percent this is an expansion of the money supply by about 25 percent per unit of output and there would be correspondingly high impact on the price level. When inflation develops the velocity of money increases and thus the impact on the rate of inflation is due to the sum of the rate of growth of the money supply and the rate of increase of the velocity of money. Thus prices are hit by a triple whammy of expanding money supply, decreasing output and increasing money velocity. This is how inflation rates can be driven to astronomical levels. For more on this see the dynamics of inflation and episodes of hyperinflation. As the price level went up the state enterprises had to go to Viktor Gerashchenko and the Central Bank for bigger and bigger loans so the rate of inflation escalated, reaching a level of about 5000 percent per year. Finally Viktor Gerashchenko was fired as head of the Central Bank of Russia in 1994 and his replacement was able to bring the inflation rate down to about 10 percent per month. In 1998 after the Russian default on its debt Boris Yeltsin in some complicated political arrangement reappointed Gerashchenko as head of the Central Bank. This time he was not the disaster that he was in the early 1990's. Perhap he was chastened by Jeffrey Sachs' depiction of him as the "Worst Central Banker in the world." Gerashchenko continued to head the Central Bank until 2002 when he retired from the Bank but went into politics and was elected to the Duma. Tatyana Paramonova Below are the rates of inflation provided by the International Monetary Fund (IMF) on 3 of 11 7/7/08 3:33 PM The Hyperinflation in Russia in the 1990's http://www.applet-magic.com/russianinflpod.htm inflation in Russia from 1993 to 2004. The IMF was not able to provide that statistics on the more severe inflation that preceded 1993. Annual Rates of Inflation (%/yr) in Russia, 1993-2004 4 of 11 Inflation in Year Producer Prices (%/yr) Inflation in Consumer Prices (%/yr) Inflation in the Wage Level (%/yr) 1993 943.76 874.62 822.1 1994 337.00 307.38 255.9 1995 236.46 197.41 142.2 1996 51.21 47.57 64.8 1997 14.67 14.62 23.7 1998 7.03 NA 15.3 1999 58.95 85.65 54.7 7/7/08 3:33 PM The Hyperinflation in Russia in the 1990's http://www.applet-magic.com/russianinflpod.htm 2000 46.53 20.77 52.5 2001 19.17 21.50 43.3 2002 10.43 15.72 27.3 2003 16.38 13.66 26.1 2004 23.35 10.89 22.5 The IMF gives the rates of inflation in consumer prices from 1993 to 1997. From this a price level for each year can be computed. The Money Supply and the Price Level in Russia, 1993-1998 Consumer Price Level 5 of 11 (millions of rubles) 7/7/08 3:33 PM The Hyperinflation in Russia in the 1990's http://www.applet-magic.com/russianinflpod.htm Year (1993=100) Money Supply QuasiMoney 1993 100.0 23,881 17,102 1994 974.62 68,544 61,187 1995 3970.41 151,627 124,514 1996 11808.39 192,402 164,922 1997 17425.64 270,602 192,246 1998 19973.27 344,113 289,514 For 1998 and the years thereafter the IMF gives an index of consumer prices. The Money Supply and the Price Level in Russia, 1998-2004 6 of 11 7/7/08 3:33 PM The Hyperinflation in Russia in the 1990's http://www.applet-magic.com/russianinflpod.htm (millions of rubles) Consumer Money Year Price Level Supply (2000=100) QuasiMoney 1998 44.6 344,113 289,514 1999 82.8 527,627 465,574 2000 100.0 880,524 688,460 2001 121.5 1,193,395 944,816 2002 140.6 1,498,463 1,361,524 2003 159.8 2,181,933 1.780,151 2004 177.2 2,848,345 2,450,354 The Quantity Theory of Money explains the increase in prices as being not only due to there being more money in circulation but that it is being spent faster. The income velocity of money is defined as the Gross Domestic Product (GDP) divided by the money in circulation. 7 of 11 7/7/08 3:33 PM The Hyperinflation in Russia in the 1990's http://www.applet-magic.com/russianinflpod.htm The velocity of money in Russia for the period 1993 to 2004 are given below. In this case the period was one of the moderation of inflation and there is a downward trend in the velocity of money after 1996. 8 of 11 Money+ GDP Year (billions Quasi-Money rubles/yr) (billions rubles) Money Velocity (times per year) 1993 172 41.0 4.20 1994 611 129.7 4.71 1995 1585 275.8 5.75 1996 2200 357.3 6.16 1997 2602 462.8 5.62 1998 2630 633.6 5.68 1999 4823 993.2 4.86 2000 7306 1569.0 4.66 7/7/08 3:33 PM The Hyperinflation in Russia in the 1990's http://www.applet-magic.com/russianinflpod.htm 2001 8944 2138.2 4.18 2002 10818 2860.0 3.78 2003 13201 3962 3.33 2004 16779 5299 3.17 Conclusions The hyperinflation in Russia in the 1990's followed the standard senario. The money supply was increased excessively leading to inflation. The velocity of money increased adding to the impact of the increased money supply on prices. The vicious circle continued until Viktor Gerashchenko was replaced as head of the Central Bank. The blame for the social devastation which resulted from the hyperinflation such as the impoverishment of the pensioners and the destruction of the value of lifetime savings lies with the monetary policies of Viktor Gerashchenko. When Gerashchenko was replaced by Tatyana Paramonova the hyperinflation quickly disappeared although significant inflation continued. (To be continued.) 9 of 11 7/7/08 3:33 PM The Hyperinflation in Russia in the 1990's http://www.applet-magic.com/russianinflpod.htm HOME PAGE OF applet-magic HOME PAGE OF Thayer Watkins 10 of 11 7/7/08 3:33 PM The Hyperinflation in Russia in the 1990's 11 of 11 http://www.applet-magic.com/russianinflpod.htm 7/7/08 3:33 PM