WHAT IS MANAGEMENT

advertisement

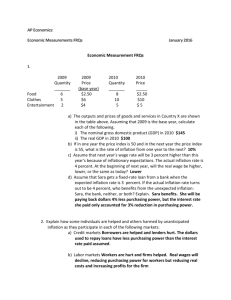

BONUS CASES BONUS CASE 13-2 When Money Loses its Meaning When money decreases in value because of inflation, people tend to place less trust in it as a method of storing value, and look for alternative means of storing their wealth that would be more efficient. Hyperinflation—extremely high inflation that can range from 100% to 10,000% annually—makes money particularly unstable. In fact, hyperinflation makes money meaningless. That is what happened in Germany during the 1920s. A pack of cigarettes, for example, had a price tag of 200 trillion marks. As a result, people ceased to use the official, but worthless, currency and resorted to using other objects as money (such as clothes, appliances, jewelry, antiques, diamonds, silver, and gold). These objects effectively became money. Subsequently, the German economy collapsed, setting the stage for the rise of Nazism. Hyperinflation in post-World War I Germany is one of the worst such cases in this century. Nevertheless, there are numerous recent examples of hyperinflation. In the South American country of Bolivia, for example, prices during 1984 rose at an annual rate of 10,000%. A hamburger cost 1 million pesos, a loaf of bread sold for 300,000 pesos, and one night’s lodging in a good hotel cost 35 million pesos. Hyperinflation in Bolivia skyrocketed to the point where the peso was virtually worthless. The most severe known incident of inflation was in Hungary after the end of World War II when prices rose at a rate of 4.19 x 1016.% per month. (Prices doubled every 15 hours.) More recently, Yugoslavia suffered 5 x 1015% inflation per month (prices doubled every 16 hours) between October 1993 and January 1994. i DISCUSSION QUESTIONS FOR BONUS CASE 13-2 1. Why did official money lose its meaning in Germany during the 1920s? 2. Do you believe that the United States could be facing a hyperinflation problem in the foreseeable future? Why or why not? 3. How can we deal with hyperinflation? What is the role of the Federal Reserve in controlling inflation? How does it perform this function? ANSWERS TO DISCUSSION QUESTIONS FOR BONUS CASE 13-2 1. Why did official money lose its meaning in Germany during the 1920s? When a government gets into financial trouble, one of the ways to finance those problems is through inflation. If the government owes people money, that debt is lessened considerably if money is worth less and less. A government can also print money to pay its bills. The more money pumped into an economy, though, the higher inflation becomes. The principle, again, is too much money chasing too few goods. When a government is preparing for war, it often prints lots of money to pay for war materials. This is very inflationary, and has resulted in inflation in many countries. 13.1 2. Do you believe that the United States could be facing a hyperinflation problem in the foreseeable future? Why or why not? The economy of the United States steadily grew throughout the early 2000s, and inflation was down from double-digit levels of a decade ago. Many felt that inflation was under control. But by early 2008, producer prices shot up rapidly, raising inflation fears. Any threat of war or collapse in the banking system could further fuel inflationary pressure. The Federal Reserve plays a pivotal role in all this by controlling the money supply. 3. How can we deal with hyperinflation? What is the role of the Federal Reserve in controlling inflation? How does it perform this function? The Fed has three tools for managing the money supply: (1) reserve requirements, which keeps money out of circulation, (2) open-market operations that manage the money supply by the purchase and sale of securities, and (3) the discount rate (the rate charged banks for borrowing funds from the Fed). By keeping the money supply in balance, the Fed can lessen pressures for inflation. Too tight a policy can result in another depression, too loose a policy could result in hyperinflation. i Source: http://en.wikipedia.org 13.2 INTRODUCTION TO BUSINESS: Instructor’s Resource Manual