Securitization and Reconstruction of Financial Assets and

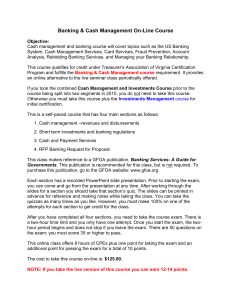

advertisement

Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 1 Application to Banks Section 2(1)(c) All the Banking Companies, Nationalized Banks, the State Bank of India as well as its subsidiary Banks and Co-operative Banks are within the meaning of the word bank for the purpose of this Act. (Co-operative banks are specified as included in definition section 2(1)(c) by Gazette publication dated 28/01/2003) P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 2 Act not applicable in certain cases (Section 31) Any security interest for securing repayment of any financial asset not exceeding one lakh rupees. Any security interest created in agricultural land. Any case in which the amount due is less than 20% of the principal amount and interest thereon. Pledge of movables. Any conditional sale, hire-purchase or lease or any other contract where no security interest has been created. P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 3 ASSET RECONSTRUCTION Section 2(2)(b) Acquisition of any right or interest, in the security, by any bank or by any securitization company or reconstruction company for the purpose of realization of such financial assistance is called as asset reconstruction. P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 4 SECURITIZATION Section 2(1)(z) Securitization means acquisition of financial asset by securitization or reconstruction company from the Bank for realization of debt. It is also called asset reconstruction It also includes change or take over of the management of the business of the borrower for proper management of business of the borrower. P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 5 BORROWER Section 2(1)(f) The borrower means, any person who has been granted financial assistance by any bank or who has given any guarantee or who has created any mortgage, hypothecation or pledge as security for the financial assistance granted by any bank or a person who becomes borrower of a securitization company or reconstruction company consequent upon acquisition by it of any right or interest of any bank or financial institution in relation to such financial assistance. P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 6 CENTRAL REGISTRY Section 2(1)(g) and 20 The registering office set up or caused to be set up by the Central Government. With this set up all the transactions of asset securitization, reconstruction as well as transactions of creation of security interests shall have to be registered with this authority, as prescribed. The Central Registry shall be in addition to and not in derogation / substitute of any of the provisions contained in the Registration Act, the Companies Act, the Motor Vehicles Act and some such other Acts. The registry will serve the purpose of maintaining credit information for the lenders. P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 7 Central Registry – CERSAI The Central Registry of Securitization, Asset Reconstruction and Security Interest of India (CERSAI) is set up under section 20 of the SARFAESI Act. Indian Banks’ Association has initiated the incorporation of Central Registry under Companies Act. The said company shall be maintaining and operating the Central Registry for and on behalf of the Central Government. P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 8 Central Registry - Rules To regulate the Central Registration issues rules named ‘The Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest (Central Registry) Rule, 2011’ are introduced. The rules are published in Gazette of India dated 31st March, 2011. P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 9 Central Registry - Rules The rules have defined ‘transaction’ to mean as any transaction of securitization of financial assets or reconstruction of financial assets or security interest created over the property and also modification and satisfaction thereof. (Rule 2(e)) P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 10 Central Registry - Rules As of now, only transaction by way of equitable mortgage / mortgage by way of deposit of title deeds is required to be filed – Rule 4(2). Form – I is for creation and modification of security interest with fee of Rs. 500/- for loan above Rs. 5.00 lakh and Rs. 250/- for loan below Rs. 5.00/- lakh. Form – II is for satisfaction of security interest with fee of Rs. 250/-. Form – III is for securitization or reconstruction of asset with fee of Rs. 1000/-. Form – IV for satisfaction of securitization or reconstruction with fee of Rs. 50/-. P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 11 Central Registry - Rules Though section 23, 24 and 25 and rule 4(1) say that particulars of all the ‘transactions’ shall be filed before the Central Registrar, currently only equitable mortgage transactions are covered for filing. For remaining transactions rule 4(3) says that Govt. may specify the forms. Rule 4(4) says that the inter se priority or pari passu status of security interest, as the case my be, in case of two or more lenders must be specified. P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 12 DEBT RECOVERY TRIBUNAL and DEBT Section 2(1)(i) and 2(1)(ha) Debt Recovery Tribunal shall mean Tribunal established under the Recovery of Debts Due to Banks and Financial Institutions Act, 1993. Debt shall have the meaning assigned to it in section 2(g) of the Debts Due to Banks and Financial Institutions Act, 1993. (Debt means any liability, inclusive of interest, which is claimed as due from a person by a bank or financial institution or consortium of them, whether secured or unsecured.) P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 13 DEFAULT Section 2(1)(j) When the borrower does not pay any principal debt or any interest on the principle debt or any other amount payable to the secured creditor and due to such non-payment the account of such borrower is classified as nonperforming asset (NPA) in the books of accounts of the secured creditor it is called default. P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 14 FINANCIAL ASSET Section 2(1)(l) a claim to any debt or receivables or part thereof whether secured or unsecured or any debt or receivable secured by mortgage of immovable property or hypothecation or pledge of movable property or any right or interest in the security, whether full or part, securing debt or any beneficial interest in any movable or immovable property or in debt, receivables, whether such interest is existing, future, accruing, conditional or contingent or any financial assistance P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 15 HYPOTHECATION Section2(1)(n) Hypothecation means, a charge in or upon any movable property - existing or future - created by a borrower - in favour of a secured creditor - without delivery of possession of the movable property to such creditor - as a security for financial assistance P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 16 NON PERFORMING ASSET Section 2(1)(o) An asset or account of a borrower classified by a bank as sub-standard, doubtful or loss-asset in accordance with the directions or under guidelines relating to asset classification issued by the Reserve Bank of India. P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 17 PROPERTY Section 2(1)(t) Property means, immovable property, movable property, any debt or any right to receive payment of money whether secured or unsecured, receivables, whether existing or future, intangible assets such as known-how, patent, copyright, trade mark, license, franchise or any other business or commercial right of similar nature. P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 18 SECURITY AGREEMENT Section 2(1)(zb) Security agreement means an agreement, instrument or any other document or arrangement under which security interest is created in favour of secured creditor. This includes creation of mortgage by deposit of title deeds with the secured creditors. P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 19 SECURED ASSET Section 2 (1)(zc) Secured Asset means the property on which security interest is created. The powers given by SARFAESI Act for enforcement of securities are against secured assets only. P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 20 SECURED CREDITOR and SECURED DEBT Section 2 (1)(zd) and 2(1)(ze) Any bank or any consortium or group of banks in whose favour security interest is created by the borrower for due repayment is called as secured creditor. Secured debt means a debt which is secured by any security interest. P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 21 SECURITY INTEREST Section 2(1)(zf) Any right, title and interest of any kind whatsoever upon the property created in favour of any secured creditor is called as security interest. This includes any charge, hypothecation, assignment other than those specified in section 31. Section 31 specifies lien, pledge, conditional sale, hire-purchase, lease and any security interest in agricultural land etc. as excluded. P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 22 Taking the asset for securitization When the bank or financial institution decides that the financial asset be now acquired by the securitization company or reconstruction company a notice may be given about such acquisition to the obligor i.e. borrower or any other person liable to repay to the bank. P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 23 ENFORCEMENT OF SECURITY INTEREST Section 13(1) Under the SARFAESI Act a secured creditor can enforce the security interest created in his favors without the intervention of the Court or Tribunal. This power given to the secured creditor has overriding effect over the provisions related to mortgage in the Transfer of Property Act, 1882 as in that Act Court intervention is required. P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 24 NOTICE FOR ENFOIRCEMENT OF SECURITY Section 13(2) of the SARFAESI Act speaks about the notice to be given by the secured creditor to the borrower who has defaulted in making the repayment and whose account is classified as NPA. Contd. …….. P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 25 NOTICE FOR ENFOIRCEMENT OF SECURITY The precondition to get the right to serve this notice is that the notice should be asking the borrower to discharge in full his liabilities to the secured creditors within sixty days from the date of notice. Failing to pay so by the borrower the secured creditor gets further rights as detailed in the Act. Contd. ……. P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 26 NOTICE FOR ENFOIRCEMENT OF SECURITY The notice should give the details of the amount payable by the borrower and the secured asset intended to be enforced by the secured creditor in the event of non-payment of secured debt by the borrower. Contd. …….. P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 27 NOTICE FOR ENFOIRCEMENT OF SECURITY Though the Act contemplates giving of only two particulars, viz. details of amount payable and details of securities, in the notice said above, it is more proper to give the details of defaults, overdue period and the date from which the account is classified as NPA, facility-wise securities and particulars of security documents executed by the borrower. Contd. …… P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 28 NOTICE FOR ENFOIRCEMENT OF SECURITY The Act or the rules made there under has not prescribed any format of notice to be given. However, this notice is a statutory notice having consequence that the borrower is prohibited from transferring the property mentioned in the notice in any way. Contd. …… P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 29 NOTICE FOR ENFOIRCEMENT OF SECURITY Any contravention of these legal consequences if made by the borrower is punishable under the SARFESI Act. So it is advisable that the notice mentions about the legal consequences and penal provisions. Contd. …… P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 30 NOTICE FOR ENFOIRCEMENT OF SECURITY The Act does not contemplate a reply from the borrower to the notice. But the borrower may reply or make representation to the notice so received by him. Contd. …… P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 31 NOTICE FOR ENFOIRCEMENT OF SECURITY If the borrower submits any reply to the said notice, the Bank is required to give reply to that notice under Section 13(3A) within a week. Contd. …. P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 32 NOTICE FOR ENFOIRCEMENT OF SECURITY The secured creditor must apply his mind to the objection raised by the borrower in reply to the notice served on him by the secured creditor and reasons for rejection must be conveyed to the borrower. Contd. …. P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 33 NOTICE FOR ENFOIRCEMENT OF SECURITY The reply to the borrower giving the reasons for not accepting the objections of the borrower does not give an occasion to resort to any proceedings, such as stay application, injunction etc. to restrain creditor’s actions. Contd. …. P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 34 NOTICE FOR ENFOIRCEMENT OF SECURITY The reply to the borrower giving the reasons for not accepting the objections of the borrower does not give an occasion to resort to any proceedings, such as stay application, injunction etc. to restrain creditor’s actions. P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 35 Borrower not paying as per notice Bank can take possession of the secured assets of the borrower including the right to transfer by way of lease, assignment or sale for realization of money from the secured asset. This right can be exercised only when substantial part of the business of the borrower is held as security for the debt. Take over the management of the secured asset of the borrower including the right to transfer by way of lease, assignment or sale and realize the secured asset. Contd. ….. P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 36 Borrower not paying as per notice Appoint any person as manager to manage the security assets the possession of which has been taken over by the secured creditor. Require at any time, by giving notice in writing, any person who has acquired the secured asset from the borrower and from whom any money is due or may become due to the borrower, to pay to the secured creditor. Such demands from the other person will be to the extent of secured debt. P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 37 How to appropriate sale proceeds Section 13(7) When sale of secured asset is made the appropriation of sale proceeds realized are required to be made in the following order, Firstly, towards costs, charges and expenses incidental towards preservation and protection of securities, insurance premiums etc. that are recoverable from the borrower. Secondly, towards the due of the secured creditors. Thirdly, if there is any surplus it will be paid to the person entitled there to in accordance with the right and interests. P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 38 Who should exercise powers from Bank The SARFAESI Act has given different rights to the secured creditor. The rights of a secured creditor under the Act need be exercised by one or more of its officers authorized in this behalf in such manner as may be prescribed. The powers of enforcing securities need to be exercised prudently, fairly and with due care and caution the Rules framed under SARFESI act say, rule 2(a), that Authorized Officer should be of the level equivalent to Chief Manager of a public sector bank or equivalent or any other authorized person exercising powers of superintendence, direction and control of the business or affairs of the creditors. P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 39 Restrictions on borrower on receiving notice u/s. 13(2) Section 13(13) When the borrower receives the notice from the creditor under section 13(2) the borrower shall not transfer by way of sale, lease or otherwise, other than in the ordinary course of business, any of his secured assets referred to in the notice without prior written consent of the secured creditor. Non compliance with this provision attracts penal provisions under SARFAESI Act that provide punishment of imprisonment of one year or fine or both. P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 40 Procedure to sale the property The provisions of section 13 at different sub sections give power to the secured creditor for taking into possession of the security and then sell the same. This entire process involves several factors of fairness and technicalities. Therefore, the Rules framed under SARFAESI Act have laid down below mentioned procedural aspect in this connection. Some broad procedures and precautions as per Rules are as under, i. Inventory of the property taken into possession be made and the property must be entrusted to any person authorized or appointed by the secured creditor. Contd. …… P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 41 Procedure to sale the property ii. The secured creditor shall take care of the property under his possession as an owner of ordinary prudence, preserve and protect the secured assets and insure the same if necessary till they are sold. iii. If the property is subject to speedy or natural decay or the expense of keeping such property in custody are likely to exceed its value, the authorized officer can sell it at once. iv. For taking possession and then sale of immovable property, the secured creditor is required to serve a possession notice as nearly as possible as given in Appendix iv to the Rules on the borrower and by affixing the possession notice on the outer door or at the conspicuous place at the property. Contd.…… P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 42 Procedure to sale the property v. The authorized officer is required to obtain valuation of immovable property before sale, fix the reserve price after consulting secured creditor and sell it by methods permitted under Rule 8. The valuation must be done by the ‘approved valuer’. He must be a registered as a valuer under section 34-AB of the Wealth Tax Act, 1957 and approved by the Board. (Definition of Valuer rule 2(d)). vi. The authorized officer is required to publish the possession notice in two leading newspapers, one of which should be in vernacular language. Contd.… P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 43 Procedure to sale the property vii. Before 30 days of sale of immovable property the borrower should be given notice about the sale. If the sale is by public auction or inviting tenders from public, notice is required to be published in two leading news-papers, one of which should be in vernacular language, detailing the terms of sale. Contd. …. P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 44 Procedure to sale the property viii. If the price for secured asset is coming less than the reserve price, the authorized officer can sell the asset at a lower price with the consent of the borrower and secured creditor. ix. When the offer of sale of property is accepted by the purchaser and the secured creditor accepting the offer confirms the sale, the purchaser has to deposit 25% of the offer price. x. In case of immovable property, the purchaser has to deposit the amount required to clear the encumbrance. The authorized officer then has to pay and remove encumbrance after giving notice to the concerned parties. Contd.….. P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 45 Sale Certificate for property sold by Bank Rules 7, 8 and 9 On payment of sale price, the authorized officer shall issue sale certificate in prescribed format Appendix – III for movable property and Appendix – IV for immovable property. For immovable property such certificate is conveyance and requires stamping as may be required under the relevant State laws. P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 46 Judicial Authority’s help to Bank for taking possession Section 14 When the secured creditor is required to take possession or control of the secured asset or when the secured asset is required to be sold or transferred under the provisions of the SARFAESI Act, the secured creditor can take help of the Chief Metropolitan Magistrate or the District Magistrate by making request in writing. On such request being made the Chief Metropolitan Magistrate or the District Magistrate, as the case may be, shall take possession of security asset and documents relating thereto. The Metropolitan Magistrate or the District Magistrate may take or cause to be taken such steps and use or cause to be used such force as may be in his opinion necessary. Any act of the Metropolitan Magistrate or the District Magistrate for and while taking possession of the security shall not be called in question in any court or before any authority. P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 47 Notice on taking Management of the borrower concern When the secured creditor takes over the management of business of a borrower, he may publish a notice in a news paper published in English language and in a news paper published in Indian language in circulation in the place where the principal office of the borrower is situated, for appointment of, Director - if the borrower is a company as defined in the companies Act, 1956, to be the directors of such company or Administrator - in any other case, to be the administrator of the business of borrower. P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 48 Effect of notice and taking over the management On publication of such notice, the directors of the company in case the borrower is a company and in other cases person holding any office having power of superintendence, direction and control of the business of the borrower immediately before publication of the notice, shall be deemed to have vacated their offices. As effect of this, any contract or management between the borrower and any directors or manager thereof shall be deemed to be terminated. On publication of the above said notice and then after the appointments of directors or the administrators as stated above, all the property and effects of the business of borrower is deemed to be in the custody of the directors or the administrators so appointed, as the case may be. Contd. ….. P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 49 Effect of notice and taking over the management All the directors or the administrators are empowered to take such steps as may be necessary to take into their custody or under their control all the property, effects and actionable claims to which the borrower is entitled. Thereafter, the directors or the administrators are alone entitled to exercise all the powers of superintendence, direction and control of the business of the borrower. Such powers are derived as if from the memorandum or articles of association of the company or from any other source whatsoever. Contd. …. P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 50 Effect of notice and taking over the management Where the management of the business of a borrower which is a company as defined in the Companies Act, 1956 is taken over by the secured creditor, then, notwithstanding anything contained in the Companies Act 1956 or the memorandum or in the articles of association following effects apply; The shareholders of the company can lawfully appoint any person to be a director of the company. No resolution passed by the shareholders of the company shall be given effect to unless approved by the secured creditor. No proceeding for the winding up of such company or for the appointment of a receiver for the company shall lie in any court, except with the consent of the secured creditor. Contd. ….. P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 51 Effect of notice and taking over the management No managing director or director or any person in charge of management of the business of the borrower shall be entitled to any compensation for the loss of office or for premature termination of any contract of management entered into by him with the borrower. This provision has a overriding effect over any other laws or contract. However, if any director or any other person controlling the management has to recover any amount from borrower, it can be recovered. Where the management of the business of a borrower has been taken over by the secured creditor, on realization of the debt in full the secured creditor shall restore the management of the business of the borrower to him. P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 52 Challenging before DRT Bank’s action to take possession Section 17 Any person, including borrower, aggrieved by any of the measures taken by the secured creditor or his authorized officer for taking possession of the security may make an application along with the prescribed fees to the Debts Recovery Tribunal having jurisdiction within forty five days from the date on which such measure are taken. The Debts Recovery Tribunal has to dispose of the application, as far as may be, in accordance with the provisions of the recovery of Debts Due to Banks and Financial Institutions Act, 1993 and rules made there under. The application has to be disposed as early as possible but within sixty days. Contd. …. P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 53 Challenging before DRT Bank’s action to take possession Section 17 If for any reason it is not possible to so dispose the application, the Tribunal has to record the reasons for delay but such delay should not be beyond four months from the date of filing of the application. If any such application is not disposed so within four months, the aggrieved party can prefer an application to the Appellate Tribunal for seeking directions for the early disposal of the application. P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 54 Appeal to Appellate DRT Section 18 Any person aggrieved by any order made by the Debts Recovery Tribunal can prefer appeal along with the prescribed fees to the appellate Tribunal within thirty days from the date of receipt of the order of Debts Recovery Tribunal. No appeal can lie unless the borrower deposits 50% of the debt claimed by the secured creditor. The Tribunal has powers for reasons to be recorded to reduce this amount to 25% of the claim amount. P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 55 Filing of security interest etc. before Central Registrar Section 23 Filing of details of transactions of securitization, reconstruction and creation of security interest is required to be filed with the Central Registrar. The period of filing such details in prescribed form with prescribed fees is thirty days after the date of transaction or creation of security. The particulars are required to be filed as stated above by the securitization company or the reconstruction company or the secured creditor, as the case may be. The delay in filing the said particulars can be condoned by the Central Registrar for a period of next thirty days after the first thirty days prescribed, on payment of fees not more than ten times of the prescribed fees. P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 56 Filing of modification and satisfaction of security interest etc. Section 24 On modification of the security interest etc., it is required to be filed before the Central Registrar. On satisfaction of the security interest etc., the same is also required to be filed before the Central Registrar. P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 57 PROTECTION OF ACTION TAKEN IN GOOD FAITH Section 32 The secured creditors and their officers are protected by the provisions made in the Act for actions taken in good faith. For initiating actions by the secured creditor under the Act no suit, prosecution or any other legal proceeding can be taken against the secured creditor or his officers. This protection is given so that actions contemplated and authorized under SARFAESI Act can be taken without fear of counter action from the borrower or any other person having interest in the property. P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 58 Civil Courts no jurisdiction Section 34 The SARFAESI Act has conferred jurisdiction on many matters to the Debts Recovery Tribunal or the Appellate Tribunal. Therefore, for any such matters where empowerment and jurisdiction is to the Debts Recovery Tribunal or the Appellate Tribunal, no Civil Court shall have jurisdiction to entertain any suit or proceeding. Similarly, any Court or Authority cannot grant injunction in such matters and actions taken or to be taken under this Act as well as under Recovery of Debts Due to Banks and Financial Institutions Act, 1993. Due to such provisions the implementation of the Act becomes effective. P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 59 Limitation Act – applicable Section 36 The actions, the secured creditor can take against the security under the SARFAESI Act, are required to be taken within the limitation period prescribed under the Limitation Act. That means the action has to be taken within three years from the date on which cause of action arose. P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 60 Dues after the SARFAESI actions If after sale of securities the claim is not fully satisfied and still there are any dues to be recovered from the borrower, the creditor is required to file civil suit before the Civil Court or a claim before the Debt Recovery Tribunal or the Authorities / Courts under the Co-operative Societies Act, as may be, within limitation period, as applicable. Therefore, the secured creditor will have to make an assessment, before taking possession of the security, whether it would be possible to sell the security and make eventual claim for shortfall within the limitation period. P. R. Kulkarni, Consultant Banking, Law and Banking Technology and Author,Pune 61 Thank you Presentation and Training by P. R. Kulkarni Consultant Banking, Law and Banking Technology and Author Pune. 9850812443 kingbankers@rediffmail.com www.prkulkarni.com P. R. Kulkarni, Consultant - Banking, Law and Banking Technology and 62