Master Thesis International MSc in Finance

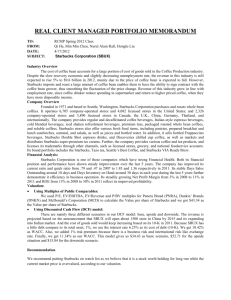

advertisement