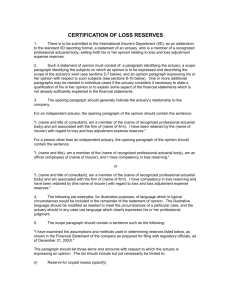

Report on policy liabilities - Autorité des marchés financiers

advertisement