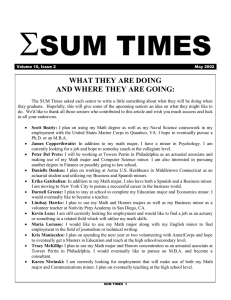

Samuel Benidt

Actuarial Present Value and

Sensitivity Analysis

What does an Actuary do?

Areas of Actuarial Work

Life Insurance

Property and Casualty Insurance (P&C)

Health Insurance

Pension

Consulting

Life Insurance

Life companies principally serve two functions

◦ to insure against financial loss in result of death

◦ to save and invest money for retirement

Less exposed to risk than P&C companies

Invested in longer term assets

Types of Products

◦ Term Life, Whole Life, Universal and Variable

Universal

◦ Fixed, Deferred, and Variable Annuities

◦ Asset Management, Mutual Funds

Why do companies use life tables?

To help predict the amount that will be paid out in claims (known as liabilities)

Example:

◦ Tom, aged 22, buys a one year, $250,000 term policy

◦ Expected claims equals total amount at risk times the probability of claim

◦ Expected claims = $250,000*0.000987=$246.75

Note that $246.75 is the average amount of claims expected by the insurance company

Actual claims may differ substantially

The Collective Risk Pool

The basis of insurance

A large number of people buy an insurance product

Only some of them will be affected – The risk is shared among the group

The company is able to predict total claim amounts of the entire risk pool accurately

The Time Value of Money

A dollar today is worth more than a dollar one year from now

◦ At 7 % interest, $1.00 becomes $1.07 one year from now, but $1 received one year from now is worth: $1.00/1.07=$0.93

PV = FV/ (1+i)^t

Whole Life Example

Suppose Tom, aged 22, buys a $250,000 whole life policy.

◦ His expected number of years left is 56.5

◦ That means on average, the company will pay out $250,000 in 56.5 years.

◦ PV = FV/ (1+i)^t

◦ The present value of this liability is thus:

$250,000/(1.07)^(56.5)=$5,467.09

Limitations of these examples

The probabilities I used were taken from data representing ALL of the U. S. population

◦ Mortality rates are known to differ according to certain socioeconomic, demographic, gender, and health factors

◦ Companies must draw up their own life tables based on their own customer base

The actual modeling process of these life policies is much more complex than indicated

Where does the Actuary come in all of this?

I worked in an area of the company known as Corporate Actuarial

◦ Statutory income statements and balance sheets

Actuarial Present Value

3 basic components of valuing an insurance policy

◦ Expected present value of premiums (known as assets)

◦ Expected claims (liabilities)

◦ Cost of selling the contract by insurance salesmen (called “financial representatives”)

Total Value=Expected value of assets –

Expected value of liabilities – acquisition costs

My First Project: Sensitivity Analysis

The value of a contract changes over time

PV = FV/ (1+i)^t

Assumptions that can change the value of an insurance contract

◦ Mortality Rates: causes change in present value of liabilities due to when claims are paid out

◦ Interest Rates: causes change in how much future dollars are worth – generally affects assets more, but not always

◦ Managing interest rate risk is known as duration analysis

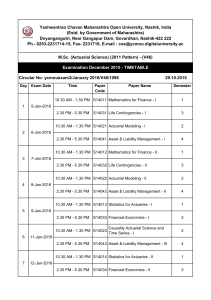

Sensitivities to be tested:

Mortality/Morbidity: Mortality/Morbidity rates were scaled up and down by 10% in the ALFA model

Interest/Discount rates: Up and down 1% from 7%

Equity Rate: Increased/Decreased rates premiums grew at up and down 1%

Lapse/Termination rates: Up and down by10%

Rates chosen to provide input for an upcoming audit of the firm’s financial statements

Appendix

Bellis, Claire et al., Understanding Actuarial Management: The

Actuarial Control Cycle

Black, Kenneth Jr. and Harold Skipper Jr., Life Insurance

Easton, Albert E. and Timothy F. Harris, Actuarial Aspects of

Individual Life Insurance and Annuity Contracts

Hull, John C., Options, Futures, and Other Derivatives

Conclusion

Thanks for coming

Any Questions?