the speech - Australian Prudential Regulation Authority

advertisement

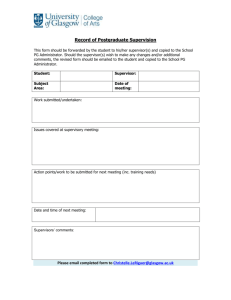

THE ROLE OF SUPERVISION IN SEEKING A BALANCE BETWEEN SAFETY AND EFFICIENCY WAYNE BYRES Executive General Manager, Diversified Institutions Division Australian Prudential Regulation Authority Paper presented to the UNSW Australian School of Business Conference on Systemic Risk, Basel III, Financial Stability and Regulation 28 June 2011, Shangri-La Hotel, Sydney 2 THE ROLE OF SUPERVISION IN SEEKING A BALANCE BETWEEN SAFETY AND EFFICIENCY1 Thank you for the invitation to be part of this opening session: I‟m very pleased to be able to be part of such an impressive program. This morning I want to talk about balance, and the role that effective supervision can play in the balance between safety and efficiency. Much of the debate about the regulatory reform agenda post-crisis, both internationally and here in Australia, has been about balance: the cost of financial instability on the one hand, versus the cost that regulation to avoid instability imposes on the other. We know that it is pointless to create a zero risk financial system. A zero risk system will have zero activity, and therefore generate zero value. On the other hand, history tells us a zero constraint financial system will inevitably lead to significant instability – certainly beyond the tolerance of the community to bear. The ideal balance is obviously somewhere between zero constraint on risk, and absolute prohibition of risk. As regulators, we seek to balance the financial safety that we desire for the community with the costs that we impose to achieve that safety. But there‟s another debate on balance that is also important, although getting much less attention. That debate is the balance to be found between better regulation and better supervision. Indeed, I need no better evidence that the value of supervision is often forgotten than its absence from the lengthy name of this conference! For today‟s purposes, I define „regulation‟ as the sum of the legislation, prudential standards, and guidance material available to and produced by agencies like APRA. In broad terms, these are the rules. „Supervision‟ is often defined as the process by which we seek to ensure that regulated firms stay within the rules. Under such a definition, regulation is the key, with supervision acting to police the regulations. I suspect this is the view held in many parts of the world: that regulation is the primary tool that ultimately determines the stability of the financial system, and supervisors will play a secondary role by ensuring compliance with it. It is perhaps best summed up by one foreign supervisor, who recently noted when asked to describe his agency‟s supervisory approach prior to the financial crisis: “if something is not prohibited by the rules, it‟s OK.” APRA applies an alternate philosophy: we believe no set of rules can adequately and efficiently deal with a system as complex as a financial system. Our approach views supervision as the primary means by which we can promote long-term safety and soundness of financial institutions. So we endeavour to establish regulation that supports supervision, and then seek to use balanced supervision as the key to long term financial safety and stability. We also expect this approach, which can be tailored and take account of nuances and subtleties in individual circumstances in a manner a rulebook cannot, will be more flexible and responsive, and therefore hopefully less costly, than „regulation-first‟ philosophies. 1 I would like to acknowledge the significant contribution of my colleague Charles Littrell (APRA‟s Executive General Manager, Policy Research and Statistics) to this paper. 3 A prudential supervisor has two critical functions. First, it strives to identify the risks emerging within each of its regulated flock, and more broadly at the industry and economy level. Second, it must intervene as necessary to ensure that its regulated firms protect themselves from all reasonably foreseeable risks, so that they will be able to meet their financial promises in all reasonable circumstances. To be successful, the supervisor requires a great deal of competence in risk assessment, and an effective regime of supervisory intervention (which in turn requires both an ability, and a willingness, to intervene – again, regulation is not enough on its own). Is there an optimal balance of competence and intervention? Can a supervisor with a high degree of competence afford to be less interventionist? On the other hand, can a supervisor with a high propensity to intervene at the slightest sign of trouble afford to be slightly less concerned with the accuracy of its risk assessments? This chart provides a neat way of summarising where we see the right balance. On the vertical axis is the degree of competence the supervisor has in risk assessment. On the horizontal axis is the supervisor‟s propensity to intervene in a regulated firm‟s affairs. Let‟s start with the worst case in the lower left corner. Supervisors positioned here have limited competence and limited ability to intervene, and could reasonably be called ornamental. In this scenario, a supervisory regime exists but in fact has no practical value. The less kind would call such a regime useless. In fact, supervisory agencies are often called useless after a major financial failure or string of failures. The reality is often more complex. Some supervisors may find themselves in the upper left corner. That is, they can see the emerging risks, but struggle do much about them. Supervisors in this position are ineffective; they wring their hands and fret, but without doing much to change the direction their flock is heading in. What about if we move towards the lower right corner? Here we get intervention that will be increasingly frequent but poorly directed, creating a supervisor that is unpredictable at best, and dangerous at worst. Much intervention will be unwarranted, but without any guarantee that material risks will be detected and averted. Having ruled out the other three corners as unsuitable, I‟m afraid the top right corner is unsuitable for day-to-day supervision as well. The top right corner I‟ve characterised as dictatorial, and generally is not the optimal setting either. Unless you think supervisors are generally better qualified to run regulated firms than their Boards and management – which I do not – then the upper right corner is not the place to position a supervisory system either. My experience suggests that a supervisor should seek to adopt a balanced position, combining a high degree of competence in risk assessment with continuous but generally mild intervention. Very few Boards or executives, after all, run their 4 institutions on the basis that they are happy with a material risk of failure. When our supervisors point out deficiencies in a given firm‟s approach, this is from the basis of our advantaged position of observing not only that firm but all its Australian competitors, and also with our focus primarily upon risks and their management. Most are happy to take this free advice on board and respond accordingly. That is not to say we don‟t sometimes adopt a firmer approach. Occasionally – and thankfully only occasionally we encounter a firm run by people who are less competent, cooperative, or honest than we might prefer. In such circumstances, the dictatorial approach might well be needed. But even here, balance is necessary: we might still be able to deal cooperatively with a struggling but honest management team, but a firm run by competent but dishonest management will leave us no choice but to intervene quickly and harshly. How does regulation tie into this model, and our focus upon finding the appropriate supervisory balance? As it happens, rather neatly. Good access to information is vital for the supervisory risk assessment process. So a great deal of APRA‟s regulation is therefore directed to ensuring that our supervisors routinely receive a wide range of information from regulated firms, including statistical returns, attestations from responsible persons, audit and actuarial reports, business plans, capital plans, and the like. In addition to the large body of regular reports, our regulatory infrastructure also ensures that supervisors can access, in essence, the same data that is available to the senior management and Board of each regulated firm. There are some limitations relating to legal privilege, but these rarely hinder our work. Furthermore, we can and do require regulated firms and their responsible persons to produce new data and analyses, when this is necessary for supervisory purposes. Ease of information access should be taken for granted by prudential supervisors. In the Australian case, we are fortunate in possessing highly developed information access powers which, as I have said, are a foundation for good risk assessment. Among our intervention tools, we possess two that are not necessarily always held elsewhere, but which turn out to be extremely useful. The first tool is the ability to set individual capital requirements for regulated firms. This tool currently applies to authorised deposit-taking institutions, including banks, and general insurance companies, and APRA has reforms in process that will extend this tool to the life insurance sector. My experience is that the ability to set individual capital requirements under the so-called „Pillar 2‟ approach to supervisory discretion is a powerful force for change. When a supervisor says, for example, “we have reviewed your loan loss provisions and are not convinced they are adequate”, some regulated firms are more responsive than others. When 5 the supervisor instead says “we have reviewed your loan loss provisions and you haven‟t convinced us they are adequate, so your minimum capital requirement will be increased by 50 basis points until you do”, then effective action is remarkably facilitated. APRA routinely sets and varies Pillar 2 adjustments for banks, building societies, and credit unions, and this approach has a good track record. Here again, however, balance is necessary. APRA neither sets nor varies a firm‟s capital requirements without careful consideration and a substantial internal review. This ensures the intervention is based on sound risk assessment, and keeps us in the balanced, rather than unpredictable, territory on my chart earlier. The second tool, used far less commonly, is our directions power. Under this power in the banking and insurance Acts, APRA possesses the broad ability to direct firms. The trigger for this power is a regulated firm‟s inability to observe its regulatory requirements, or APRA‟s consideration that the firm is operating unsoundly, or in a manner that could reasonably lead to its failure. Importantly, the directions power triggers well before actual or imminent failure by a regulated firm, so in need our supervisors can issue directions in time to hopefully avert failure. The fundamental precept behind the directions power is that at the end of the day, if there is a material difference of opinion between APRA and a regulated firm, then APRA‟s opinion is the one that counts. This is clearly an extraordinary power and is only deployed in exceptional circumstances. This is a good example of the adage „speak softly, and carry a big stick.‟ The concept that our opinion is the one that ultimately counts changes the supervisory conversation with firms from negotiation about whether they will improve, to how and how quickly they will improve. Sensible managers and directors understand that they never want to put themselves in this position, so the directions power is valuable, even though it is seldom used. This speech‟s topic is the balance between supervision and regulation. As I‟ve said, our experience indicates that the optimal mix is structured in such a way as to ensure regulation empowers supervision. In other regimes, we see instances in which regulation can restrict supervision. For example, take a rule that says something along the lines of “when a firm‟s capital falls below a certain level, then supervisors can intervene.” While ostensibly supporting supervisory intervention, this rule also says, in essence, that as long as the firm‟s capital is above the critical level, then supervisors can‟t intervene. This is contrary to the Australian approach, which sanctions intervention whenever the supervisor, based on a thorough risk assessment, considers it necessary. Of course, there is a risk that supervisors could overuse their powers, and could become dictatorial when there is no reason to do so. But the global experience of recent years has demonstrated that the risk of overly empowered supervisors is very much less than the risk of insufficiently supervised financial institutions. And certainly in APRA‟s case, there are external appeal mechanisms for a firm that wants to challenge our decisions, except in the most extreme circumstances. To be successful supervisors, and to adopt the optimal mix of supervision empowered by regulation that we advocate, supervisory agencies need three things from government: sufficient funds to undertake the job, sufficient statutory powers, and moral support. APRA has been well served on all three fronts. Amongst the world‟s advanced countries, it is difficult to see any agencies that were materially under-funded, or that lacked reasonable powers expressed in black 6 letter law. Pre crisis, however, there was a large difference in the degree of moral support given to their activities. This is a critical issue, and I would like to highlight a quote from the US Financial Crisis Commission to make the point: “we do not accept the view that regulators lacked the power to protect the financial system. …. Too often, they lacked the political will – in a political and ideological environment that constrained it – as well as the fortitude to critically challenge the institutions and the entire system they were entrusted to oversee.”2 In short, all the funding and legislative power in the world won‟t help a supervisor prevent financial failures if the supervisor lacks the self-confidence to undertake early, constant, and effective intervention. Prudential regulators often state that financial failures are inevitable. This is true, but the frequency and impact of failure can be greatly improved by effective prudential regulation and supervision. Please don‟t take my message today the wrong way: I believe that strong regulation is an essential pre-condition for financial stability and institutional safety. But it must also be the right sort of regulation: that is, it must empower and not inhibit active prudential supervision. The reaction globally to the GFC has, to date, largely been focussed on regulation: a push for more and higher quality capital, restrictions on proprietary and derivatives trading, and a greatly enhanced regulatory regime for liquidity risk. APRA supports the need for, and the direction, of this reform agenda. In parts of the world, supervision clearly did not do its job as well as we might have hoped. But we need to be wary of an outcome which says we should have more rules to deal with supervisory inadequacies. And it is outright dangerous if it leads to the view that more rules will allow a weak and non-interventionist supervisory regime to be continued. Rather, now that we have broken the back of the major regulatory reforms, we should think hard about the optimal mix of regulation and supervision, and make sure we have the right sort of regulation to empower our supervisors into the future. Thank you for your attention, and I look forward to the remainder on the conference. 2 Final Report of the National Commission on the Causes of the Financial and Economic Crisis in the United States (January 2011), p. xviii