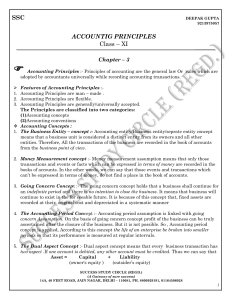

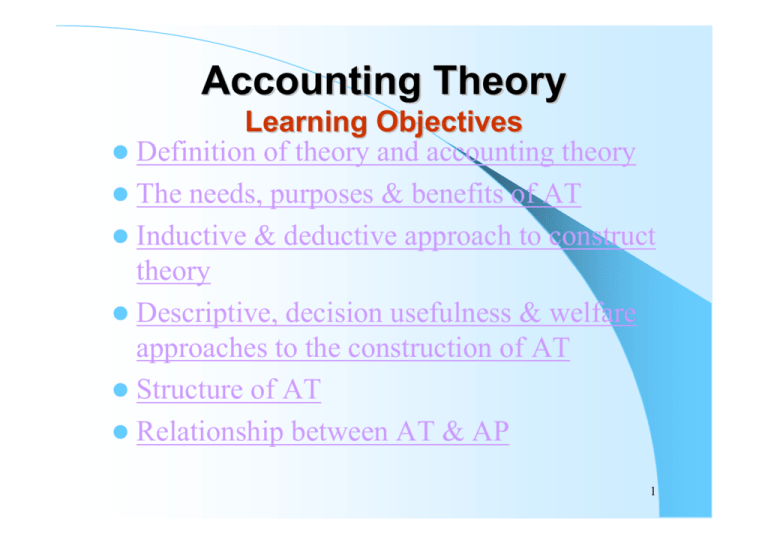

Accounting Theory

advertisement

Accounting Theory Learning Objectives Definition of theory and accounting theory The needs, purposes & benefits of AT Inductive & deductive approach to construct theory Descriptive, decision usefulness & welfare approaches to the construction of AT Structure of AT Relationship between AT & AP 1 Accounting Theory Defined as: A set of broad principles that provides a general frame of reference by which accounting practice can be evaluated and guides development of new practices and procedures. (Hendrickson, 1982) or A cohesive set of conceptual, hypothetical and pragmatic propositions explaining and guiding the accountant’s action in identifying, measuring and communicating economic information. 2 Nature and Purpose of Theory Theory can be defined as a set of general propositions, used as principles of explanation of the apparent relationship among certain observed phenomena, events or things. Proposition – statements concerned with the relationship among concepts. Concepts – generalized idea or expression in words about events observed in the real world. Theory is used as basis of explanation with regard to how/why certain phenomena happens the way they do. Explanation as well as prediction offers by theory is important as it enhance our understanding of the phenomena that exist in reality Generally theory is sometimes said to deal with the creation of scheme of ideas which provide definition of the problem observed and the understanding of it. 3 Needs and Importance of Accounting Theory To provide a basis for prediction and explanation of accounting behaviors and events and help to understand current development in accounting practice. Provide general frame of reference by which accounting practice can be evaluated. Guide the development of new practices and procedures. 4 Purposes of Accounting Theory Helps to evaluate existing practice. E.g. are methods and techniques used by accountants valid or correct in terms of what it should be?. This is to eliminate unnecessary diversities in accounting treatment for similar items. From the evaluation of existing practices, reasons for diversity that cannot be eliminated may be discovered and explained. This will enhance our understanding of current practice and facilitate in the regulating the profession by policy makers. Theory also assist in the development of future practice where it serves as basis in the development of accounting standards. As business practices becomes more sophisticated , new accounting problems may arise that require development of new techniques and procedures. The goal of theory is to provide coherent set of logical principles that form the general frame of reference for evaluating and developing new accounting practices. 5 Benefits of Accounting Theory To guide the body responsible for establishing accounting standards. To provide a frame of reference for resolving accounting questions in the absence of a specific promulgated standard. To determine bounds for judgment in preparing financial statements. To increase financial statement’s users’ understanding of and confidence in financial statements. Enhance comparability. Improve the image of the profession. 6 Theory Construction 1. Descriptive – inductive theory which derived from factual empirical observation, describe what reality is like. 2. Normative – deductive theory which describe what the empirical world should be regardless of its reality. 7 Approaches to the Construction/Development of Accounting Theory. Three basic approaches: 1. Descriptive approach 2. Decision usefulness approach 3. Welfare approach 8 Descriptive Approach Theories developed are concerned with what accountants do, that is the practice of accounting. Making observation to look for similarity and recurrence and drawing generalized conclusions from those observation or practices. (E.g. observed how accountants record assets) The focus of the theory is to explain what accountant do or the functional tasks of an accountant and enable prediction to be made and hence its treatment in the book. In standard setting the setter are concerned with discussing the varied practices used by accountant and reaching a consensus on the most feasible basis to reduce diversity of practices within which descriptive theory has developed. Involves the process of specifying the objectives of financial statements, selecting the postulates of accounts, deriving the principles of accounting and developing the techniques of accounting. 9 Decision Usefulness Approach Emerged due to the expansion of behavioral research into accounting – based on the thought that the purpose of accounting reports is to influence action or behavior of users (e.g. users make investment decision based on information in the F/S). Two types of theories in this approach are empirical and normative theories. Empirical Approach – employs statistical technique (research) to make accounting research more rigorous and to improve the reliability of results. Normative Method – concerned with specifying the manner in which decision to be made serves as a precondition to considering the information requirement. It focus on decision models used by decision maker and provides insight on information needs of decision makers as a basis for developing accounting theory. (Refer to page 34) 10 Welfare Approach An extension of decision making approach which consider the effects of decision making in social welfare due to the effects of the decision made base on the accounting information do have effect to the external society. It resulted in a social welfare dimension to accounting theory – Social Responsibility Accounting. 11 Accounting Theory and Policy Making The two groups that determine accounting policy are the government and the accounting profession. The government employs legislative process to ensure minimum level information disclosed in company’s report. Accounting profession as a regulatory body deals with problems of accounting standards implied in financial reports. Refer to page 35 – Figure 3.2 12 Relationship Between Theory and Practice Influence of policy makers in setting up rules in the form of accounting standards. Practice may be changed to accommodate theory. The form of accounting information reported depends on practices adopted, i.e. practices imposed by policy maker in response to the needs of users. Theory provides an abstraction of needs and serves as a basis to provide value judgment in accounting policy making. If deficiencies occur in either accounting theory or policy making or accounting practices, it will impair usefulness of accounting information. Usefulness of accounting information may be improved via research findings in policies devised by policy makers. 13 Structure of Accounting Theory The structure of accounting theory serve as frame of reference that is use to judge the extend to which a particular accounting technique of accounting is adequate. Based on a set of elements and relationship that govern the development of accounting technique. The five elements in the structure of an accounting theory are: Objectives of Financial Statement Accounting postulates ( assumptions) Accounting concepts Accounting principles Accounting techniques Refer to page 36 – Figure 3.3 14 Objectives of Financial Statements To present fairly and conformity with GAAP, the position, results of operation and changes in financial position for investors to make relevant investment and credit decisions. The objectives contain three areas: – User of information; specifically the investors group, to whom the information is directed. – Purpose to which accounting information is generated, that is for making investment and credit decisions. – Nature of content of information specified, that is on performance, position and changes in position of an 15 enterprise. Accounting Postulates Entity Postulate – entities are separate and distinct from owners entities. Accountants report transactions of enterprise itself, not of owners of enterprise. It applies to sole proprietorship, partnership and corporation. Going Concern Postulate – business entity is assumed not to be liquidated in the foreseeable future. Unit-of-measure Postulate – information expressed in terms of monetary unit.. This postulate is also a stable monetary postulate where the purchasing power of money is assumed to be stable over time. Accounting Period Postulate – the financial reports depicting changes in the wealth of firm should be disclosed periodically. 16 Theoretical Concept Theory - proprietor, the owner, is the focus of attention. Proprietorship ASSETS – LIABILITIES = PROPRIETORSHIP’ EQUITY Assets belong to the proprietor and liabilities are his obligation, the resulting outcome is the net worth of owner or the proprietor. 17 Entity Theory – – entity to be separate and distinct from those who provide capital to the entity. – It is the entity and not the owner to be the centre of accounting interest. – All accounting procedures are conducted from the viewpoint of the entity. – Does not focus on net worth of owner, but the business that owns the assets and liable to all obligations. ASSETS = EQUITIES + LIAB – Equities represent rights or claim on assets of the entity. – As provider of funds, shareholders have no claim to any particular assets or income of the company, except those dividends declared by the company. 18 Fund Theory – do not focus on owner or the entity but the groups of assets and related obligations and restriction that governs the use of the assets. ASSETS = RESTRICTION ON ASSETS Fund is directed for specified purpose via services derived from the use of the assets. Focuses on the administration and appropriate use of assets. Fund theory is applicable for government and nonprofit organization. 19 Accounting Principles Cost Principle Revenue Principles Matching Principle Objectivity Principle Consistency Principle Full Disclosure Principle Conservatism Principle Materiality Principle 20 Accounting Techniques Accounting techniques are specific rules derived from the accounting principles that account for specific transactions and events faced by the accounting entity. 21 Tutorials Harvey and Keer, Financial Accounting Theory and Standards: Chapter 3:The Role of Accounting Theory. Harvey and Keer, Financial Accounting Theory and Standards: Chapter 1:The Construction of Financial Accounting Theory. Glautier, M.W.E and Underdown, B., Accounting Theory and Practice, Chapt. 4. Ahmed Belkaoui, The Nature of an Accounting Theory, pp. 56-57. 22