Camp Smith Laurie

advertisement

1.

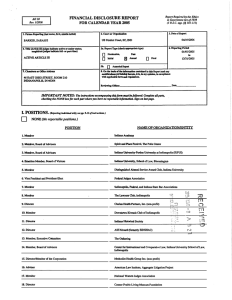

FOR CALENDAR YEAR 2009

Fuson Reporting (last name. first, middle initial)

Smith Camp, Laurie

(5 u.s.c. app.

2. Court or Organlzadon

m judges indica1e active or senior sta!us;

magistrate judge• indicate full- or part-time)

03/1612010

Sa. Report Type (check appropriate type)

D

D

U.S. District Judge - Active

Nomination,

Initial

Sb. D

Office Address

6. Repordn11: Ferlod

OI/Olf2009

to

12131(2009

Date

[ZI

§§ 101-l I I)

3. Date of Report

U.S. District Court - Nebraska

-4. Title (Article

7. Ch1.111bers or

Report Required by the Ethics

inGovernmentActo/1978

FINANCIAL DISCLOSURE REPORT

.A.010

Rev. JIZOIO

AnnURI

D

Final

Amended Report

contained ill this Rep ort and any

modifications pertaining thereto, It II, 111 my eplnlon, In compliance

with applicable laM and regulations.

8. On the buls or the informatloa

I I I South 18th Plaza

Suite 32!0

Omaha, NE68102

Date

Reviewing Officer

IMPORTANT NOTES: The instructions accompanY;ng this form 111ust be/oUo.wd. Complete all parts,

checking the NONE box for each part where you htn'e no reportable informafion. Sign on last page.

J. POSIT!0NS. (Reportbtg ilulivibtll only; St!l! pp. 9-lJ offiling U.Stmtions.)

D

NONE (No reportable positions.)

NAME OF ORGANIZATION/ENTITY

POSITION

I.

Omaha Rotary

Director

2.

3.

4.

5.

C"J

,...,,

c:::>

C.'>

( "')

,- .....,

3:

:_.-,..

r..-::;·:::;

-

t .....

..:...: ::t>

-...

-J .....:...

n

rr._

C> ::t>

-lj&

II. AGREEMENTS. (Reportbtg indMd1tal ollly; ••e pp. U-16 offillng btstr11etions..) '

[ZJ

NONE

··--

(No reportable agreements.)

.....,

fARIIES AND IERMS

CJ

fTI

C5

:.:0

N

N

J>

9

::u

m

('")

111

<

rn

C1

.C"

I.

2.

3.

Smith Camp, Laurie

FINANCIAL DISCLOSURE REPORT

Page 2 of7

Name of Penon Reportlnc

Date of Report

Smith Camp, Laurie

03/1612010

III. N 0 N-INVESTMENT INcoME. (Rq>0rti1tg illdividMal and spouse; •upp. 17-2/ ofjilbtg brslntt:Oons.)

A. Filer's Non-Investment Income

[Z]

NONE (No reportable non-investment income.)

SOURCE AND TYPE

INCOME

(yours, not spouse's)

I.

2.

3.

4.

B. Spouse's Non-Investment Income

-

lfyou ""'n 111arrud liMrU.g ""'portion of tlttt rttporting year, complttu tltis s«til>n.

(Dollar amo11nt flOI req11ired exceptfor honoraria.)

[Z]

NONE (No reportable non-investment income.)

SOURCE AND IDE

I.

2.

3.

4.

IV. REIMBURSEMENTS -trtlllSportatw,., wdgmg,fooJ. ttntert.ainment

(lnc/udes those to spou.re and dependent children; see pp.

(Z]

NONE (No reportable reimbursements.)

SOURCE

I.

2.

3.

4.

s.

15-27 offiling instructions.)

DATES

LOCATION

PURPOSE

ITEMS PAID OR PROVIDED

FINANCIAL DISCLOSURE REPORT

Page 3of7

Name of Penon Reporting

Date of Report

Smith Camp, Laurie

03/1612010

V. GIFTS. (Includes tliou to spoase uu/ tl pnuknt cltlldnn; stt pp. 18-31 offiling lnstractiorrs.)

[ZJ

NONE

(No reportable gifts.)

SOURCE

DESCRIPTION

VALUE

I.

2.

3.

4.

5.

VI. LIABILITIES. (lncllldt:S tltos ofspoase and deµnJrnt chiUren; Jtt pp. 32-JJ offiling instrvctiom.)

[ZJ

NONE

(No reportable liabilities.)

CREDITOR

I.

2.

3.

4.

5.

DESCRlPTION

VALUE CODE

FINANCIAL DISCLOSURE REPORT

Name of Penan

Page4 of7

Datt of Report

Smith Camp, Laurie

VII. INVESTMENTS and TRUSTS

D

porting

03/16/2010

-income. ..,1"'' 1rrua.:1ums

u

(Tnc1tu1e3 11iou of:rpollS• IUU/ .upenden1 children; see PP. J-t-60 offiling iru1ruc1ums.J

NONE (No reportable income, assets, or transactions.)

A.

B.

c.

Description of Assets

Income dwing

Gross value at end

(including trust assets)

reporting period

ofr<:porting period

Place "(X)" after each asset

exempt from prior disclosure

0.

Transactions during

(I)

Amount

Code I

(2)

Type (e.g,

div, rent.

(I)

Value

(2 )

Value

Code2

(A-H)

Method

Type(e.g.,

buy, sell,

or inL)

(J-P)

Code 3

redemption)

(I)

(3)

(2)

Value

Date

mm/dd/yy Code 2

{J-P)

{Q-W)

I.

Fidelity Adv. Mid CapT

D

Dividend

2.

Massachusetts Mutual Annuity

E

Interest

0

T

3.

Lincoln Benefit Life Annuity

E

Interest

0

T

4.

Lincoln Benefit Life Annuity (Retirement)

B

Interest

M

T

5.

Exxon

B

Dividend

L

T

6.

GE

B

Dividend

K

T

7.

IBM

B

Dividend

M

T

g_

Ameritrade Brokage Account (f)'k/a

Accutrade - Cash Account)

None

I

T

9.

-Disney

A

Dividend

K

T

10.

-Honeywell

B

Dividend

L

T

I I.

--Boeing

A

Dividend

I

T

12.

-- LEN (Class A Lennar)

A

Dividend

K

T

13.

- NSM (Nat'! Semiconducter)

A

Dividend

l

T

14.

-- WMI (Waste Management)

B

Dividend

K

T

15.

Federated Account

B

Interest

0

T

16.

U.S. Allianz Variable Annuities(Retirement)

None

N

T

17.

U.S. Allianz Variable Annuity

None

0

T

l. Income Gain Codes:

(See Colwms Bl and 04)

2. Value Codes

(See Co!unms Cl ond Dl)

$2,500

B •Sl,001

F•SSO,OO! -S!00,000

G =S!00.001- Sl,000.000

•

Codes

(Se< Colwnn C2)

Pl

G

L-SS0,001-SlOO,OOO

M -Sl00,001 • $2.S0,000

n -ss.000.001 • si.s,000.000

Pl •$1,000,001 -$5,000,000

Q •Appraisal

R -Coot (Real Estate Only)

s

U •Bool:. Value

v -otllCI"

W •E:.timated

PJ -$25,000,001 - 150,000,000

3. Value

9117109

Ill -M= 1han SS,000,000

K •SlS,001

SS0,000

{if private:

transaction)

D •SS,001

0 =SSOO,OOl -Sl,000,000

•

(A-H)

H1 -Sl,000.001 -$5,000,000

N -$250,00 I

SS00,000

(5)

Identity of

buyerfseller

C •$2,.101 - S.l.000

J -S!S,000 or lcu

-

(4)

Gain

Code I

---

Sold

A -Sl.000 or !cu

g period

P4 •More Ihm SS0,000,000

·

•

SIS,000

T .Cash Market

EESlS,001. SS0,000

Name of Person Reporting

FINANCIAL DISCLOSURE REPORT

Page 5 of7

Dair

Smith Camp, Laurie

03/1612010

VII. INVESTMENTS and TRUSTS - btcowu, wl/u, UIUISOCtU'1U (Indwin tltosufspo

0

or Report

and .tuhnl childrm; SU pp.

1'-U offdiJt8 butrvcd4tU.)

NONE (No reportable income, assets, or transactions.)

A.

B.

c.

D.

Drscription of Assets

Income dwing

Gross value at end

Transactions during reporting period

reporting period

of reporting period

(including trust assetS)

(I)

Type(e.g.,

(2)

(3)

Date

Value

Method

buy, sell,

mm/dd/yy

Code2

Code3

redemption)

(I)

(2)

(I)

Place "(X)" after each asset

Amount

Typc(e.g.

Value

(2)

Value

exempt from prior disclosure

Code I

div., rent,

Code 2

(J-P)

(A·H)

or

int)

(J-P)

(Q-W)

18.

Fidelity Blue Chip Value Fund

D

Dividend

0

T

19.

Fidelity International Discovery Fund

B

Dividend

L

T

2 0.

Fidelity Ellport Multinational Fund

A

Dividend

K

T

21.

Fidelity Balanced Fund

D

Dividend

N

T

22.

Fidelity Tax Free Money Market Acct

A

Interest

J

T

23.

LPL Financial Money Marlcet(X)

A

Interest

L

T

24.

All State Annuity

B

Interest

M

T

25.

TransAmerica Annuity

B

Interest

N

T

26.

Guardian Annuity

A

Interest

N

T

Buy

1214/09

N

27.

Fidelity Mid Cap

B

Dividend

M

T

Buy

11/17/09

L

J. Income Gain Codes:

(Seo Columns Bl

and

D4)

2. Value Codes

(See ColllrnllS CJ ond DJ)

(See Column C2)

(S)

Identity of

Code I '

A •SJ,000 or I=

B sJ,001-SZ..SOO

C •S!..501

G =SJ00.001-Sl.000,000

HI -Sl,000,001-$5,000,000

H2 -Mor< than SS.000.000

J •SIS,000 or lcu

K-SU,001 -SS0,000

L •SS0,001

M -Sl00.001

N -$250,00 I • SS00.000

0 •SS00,001

Pl =$1,000,001

Q•Appni.W

U •Book Value

- $50,000,000

•

Sl,000,000

I

buyerfseller

(if private

transaction)

I

F =$50,001-$100,000

Pl -$2.1,000,001

3. Value Method Code!

I

(A-H) I

(4)

Gain

•

SS,000

•

S 100,000

•

$5,000,000

D •SS,001 • SIS,000

r

$2.10,000

P2 •SS,000,001

P4 More than $50,000,000

R -C03l (Real Estate Only)

S -Asseumcnt

V-othcr

w -Estimated

T =Cub Market

•

$25,000,000

E=SlS,001

•

SS0,000

FINANCIAL DISCLOSURE REPORT

Page 6 of7

Date of Report

NameofPenon Reporting

Smith Camp, Laurie

VID. ADDITIONAL INFORMATION OR EXPLANATIONS.

03/1612010

(lndkaleputofRtport.J

FINANCIAL DISCLOSURE REPORT

Page 7 of7

Name of Pcnon Reporting

Date of Re(>Ort

03/16/2010

Smith Camp, Laurie

IX. CERTIFICATION.

I certify that all Information given above (Including Information pertaining to my spouse and minor or dependent children, If any) Is

accurate, true, and complete to the best of my knowledge and belief, and that any Information not reported was withheld because it met applicable statutory

provisions permitting non-disclosure.

I further certify that earned Income from outside employment and honoraria and the acceptance of gifts which have been reported are

compliance with the provbions of 5 U.S.C. app. § 501 et. seq., 5 U.S.C. § 7353, and Judicial Conference regulations.

In

NOTE: ANY INDIVIDUAL WHO KNOWINGLY AND WILFULLYFALSIFIES ORFAILS TO FILE THIS REPORT MAY BE SUBJECT TO CIVIL

AND CRIMINAL SANCTIONS (5 U.S.C. app. § 104)

FILING INSTRUCTIONS

Mail signed original and 3 additional copies to:

Committee on Financial Disclosure

Administrative Office of the United States Courts

Suite 2-301

One Columbus Circle, N.E.

Washington, D.C. 20544