NextCard_A Look Back at the Rise-and-Fall of an

advertisement

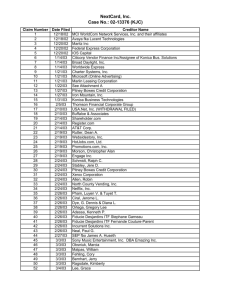

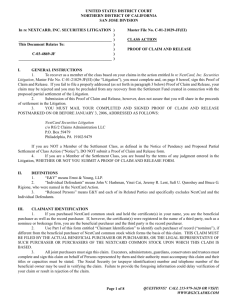

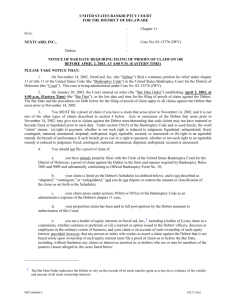

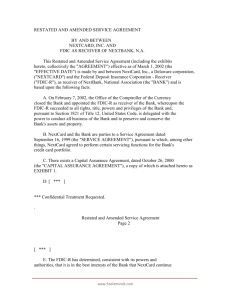

A Look Back at the Rise-and-Fall of an Early Dot.com Lender Timeline of Events Company Overview -- Launches NextCard Visa (Heritage Bank of Commerce is the credit card lender) 1998 -- Introduces Rewards and Platinum credit card products 1999 -- 2001 -- Launches Priceline.com co-branded credit card Launches Amazon.com co-branded credit card Fed declares NextCard undercapitalized; NextCard announces it was improperly categorizing credit losses as fraud and held for sale Company put up for sale after it could not establish $140MM in additional loan loss reserves required by the Fed JUL. 2002 - - Completes acquisition of Textron National Bank; announces intent to name NextBank, N.A. MAR. FEB. 2000 - - DEC. SEP. 1997 JUL. MAY JAN. Company founded as “Internet Access Financial Corporation” OCT. -- NOV. 1996 Founded: 1996 Founder: Jeremy Lent (former CFO of Providian Financial Corporation) Headquarters: San Francisco, California Business Model: Credit card lender offering instant credit online (marketed as “first true Internet Visa”) Initial / Planned Differentiators: (1) cost of acquisition, (2) reach of internet user base Product Offering Receives bank charter from OCC (i.e., NextBank) Base, Rewards and Platinum credit card product -- Pricing: Applicants given customized offers based on risk profile -- Balance Transfer: Customers offered automated balance transfer at 2.90% APR upon approval -- NextCard Rewards: Points redeemable for variety of goods and services, discounts at retailers and miles accepted at major airlines Also offered early generation co-branded products with partners such as Amazon.com and Priceline.com Lent steps down as CEO; remains Chairman and Chief Strategy Officer The Rise Company was founded on the premise of two primary components of its business model: 1. Low cost of acquisition via direct marketing strategies 2. Interactive, customizable credit offering and instant credit decision using proprietary algorithms over the internet 1.7 million credit card applications were submitted for the NextCard in the 15-months after launch - NextCard would become the nation’s largest Internet credit card lender (~$2B in loans by 2001) Fed forces the company to cease operations Lays off 90% of work force; stock delisted from NASDAQ exchange The Fall 200k accounts are sold to Merrick Bank for $126 million FDIC deactivates remaining 800k credit card accounts after failing to find a buyer The company experienced higher than reported credit losses (disclosed ~8% in 2001)1 and its cost per new account ranged from ~$95-$100 in 2000 Regulators concluded that NextCard (1) misclassified seriously delinquent loans that should have been written-off as “loans held for sale” and “fraud losses” and (2) substantially changed its reserve methodology to avoid P&L impact NextCard was declared undercapitalized by the Fed in Oct. 2001 and subsequently ceased operations in 2002 after it was unable to establish the additional $140MM in reserves mandated by the OCC under proper accounting practices Growth Managed Credit Card Receivables ($MM) (Period End Balances as of March 31st) $1,595 $2 $96 1998 1999 $639 2000 2001 NextCard had 1.1 million accounts by the end of 2001 For more information please contact: John Grund, Partner, john.grund@firstannapolis.com U.S. Headquarters 1 Sources: Wall Street Journal, FORTUNE Magazine, cardtrak.com, San Francisco Business Times, CNET, SFGate, NY Times, LA Times, SEC filings. David Woynerowski, Partner, david.woynerowski@firstannapolis.com European Office Three Park Place, Suite 200 l Annapolis, Maryland 21401 P: 410.855.8500 l info@firstannapolis.com NextCard: A Look Back at the Rise-and-Fall of an Early Dot.com Lender Actual charge-off rate using the accounting methods deemed acceptable by the OCC. NextCard would have reported ~6% for the period under its own improper classification methods according to SEC transcripts. 1 of 1 Keizersgracht 313-I l 1016 EE Amsterdam l The Netherlands P:+31 (0)20 530 0360 © 2016 First Annapolis Consulting, Inc.