Valuation Formulas for Stocks

advertisement

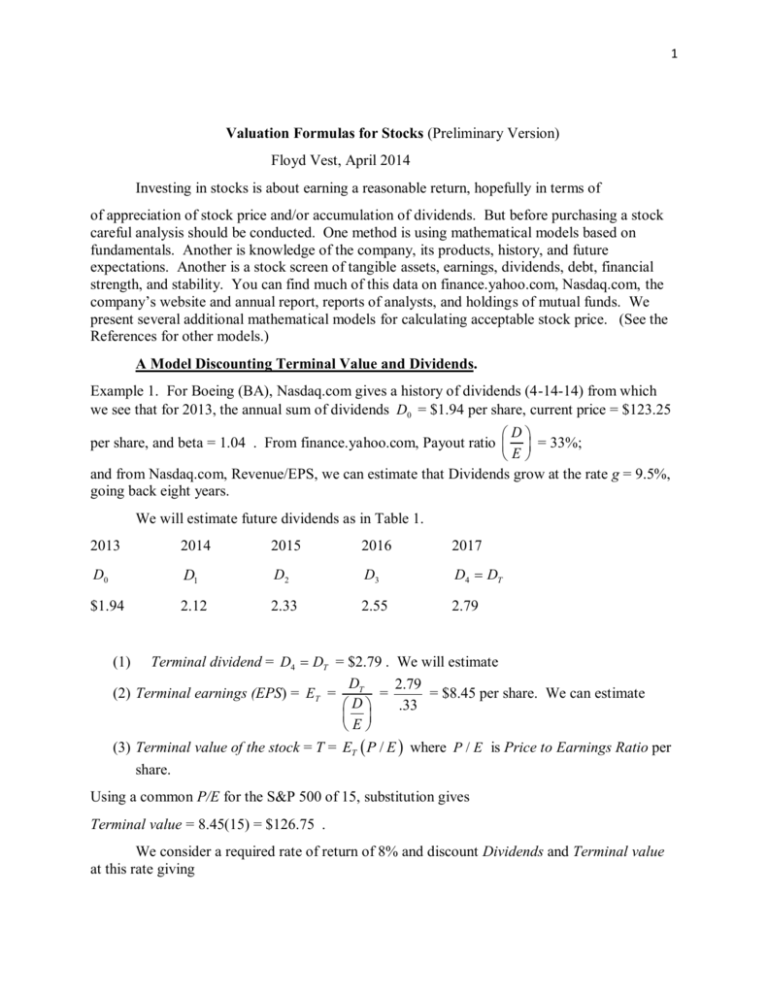

1 Valuation Formulas for Stocks (Preliminary Version) Floyd Vest, April 2014 Investing in stocks is about earning a reasonable return, hopefully in terms of of appreciation of stock price and/or accumulation of dividends. But before purchasing a stock careful analysis should be conducted. One method is using mathematical models based on fundamentals. Another is knowledge of the company, its products, history, and future expectations. Another is a stock screen of tangible assets, earnings, dividends, debt, financial strength, and stability. You can find much of this data on finance.yahoo.com, Nasdaq.com, the company’s website and annual report, reports of analysts, and holdings of mutual funds. We present several additional mathematical models for calculating acceptable stock price. (See the References for other models.) A Model Discounting Terminal Value and Dividends. Example 1. For Boeing (BA), Nasdaq.com gives a history of dividends (4-14-14) from which we see that for 2013, the annual sum of dividends D0 = $1.94 per share, current price = $123.25 D per share, and beta = 1.04 . From finance.yahoo.com, Payout ratio = 33%; E and from Nasdaq.com, Revenue/EPS, we can estimate that Dividends grow at the rate g = 9.5%, going back eight years. We will estimate future dividends as in Table 1. 2013 2014 2015 2016 2017 D0 D1 D2 D3 D4 DT $1.94 2.12 2.33 2.55 2.79 Terminal dividend = D4 DT = $2.79 . We will estimate DT 2.79 (2) Terminal earnings (EPS) = ET = = = $8.45 per share. We can estimate D .33 E (3) Terminal value of the stock = T = ET P / E where P / E is Price to Earnings Ratio per share. (1) Using a common P/E for the S&P 500 of 15, substitution gives Terminal value = 8.45(15) = $126.75 . We consider a required rate of return of 8% and discount Dividends and Terminal value at this rate giving 2 Value of the stock = V = 2.12(1+.08 )1 2.33(1.08)2 2.55(1.08)3 2.79(1.08)4 126.75(1.08)4 = 8.03 + 93.17 = $101.20 where the quoted price is $123.25 . From finance.yahoo.com, the P/E is given as 20.68 for Boeing. Using this gives Terminal value = ET P / E = T = 8.45(20.68) = $174.75 . Discounting at 8% gives V = 8.04 + 174.75(1.08 ) 4 = 8.04 + 128.45 = $136.49 which is closer to the quoted price of $123.25. You could check the five year and recent stock price chart for Boeing on finance.yahoo.com and extrapolate price increase, and see if current price is at all-time high. To summarize this discount model, Value of the stock = the sum of present values of future Dividends and Terminal value discounted at the required rate of return. DT Ter min al ~ dividend and Payout ~ ratio D E (5) Terminal value = T = ET ( P / E ) = (Terminal earnings) (Price to Earnings ratio). See the Exercises for justifying this model. (4) Terminal earnings = ET Fair Value of a Stock from P/E and EPS. Example 2. For Citicorp (C), finance.yahoo.com (4-15-14) reports that Price = $49.21, EPS = $4.41, beta = 2.27, and P/E = 10.96. The model gives (6) Fair price = P / E ( EPS ) . Substitution gives Fair price = (10.96)(4.41) = $48.33 which is close to the current price of $49.21 . In finance.yahoo.com, click on Industry and you will see that Citigroup is a Money Center Bank. Read the Money Center Bank news and you will learn about Citigroup and other banks. At Nasdaq.com, click on Revenue/EPS to see the history of Revenue, EPS, and Dividends. You will see the recent annual sum of dividends of $.04. At the current Price, .04 Dividend yield is = .08%. We would not apply a Dividend discount model to this stock. 49.21 If you read analysts’ reports, you will see that they us this model of Fair value from P/E and EPS. (See the Exercises for justification of this model.) For Citigroup, the history of EPS back to 2005 is ragged with some negative, but some analysts see an improvement in EPS and P/E and apply the above model suggesting an increase in the Price of the stock. Under finance.yahoo.com, Key Statistics, you will see that Price/Book for Citigroup = .73. Why is the company selling for less than its listed assets? Check Bank of America (BAC) at .79 and Wells Fargo Bank (WFC) at 1.60. 3 A Benjamin Graham Stock Value Model. Benjamin Graham was a famous and successful value investor. He published the “The Intelligent Investor” (Banrnsandnoble.com, paper back, used, $6.69). Millions of copies have been sold. (See Wikipedia.org.) One of his famous models for Stock value is 4.4 (6) Estimated value = EPS (8.5 + 2 G) where EPS is Earnings per Aaa Share, G is growth rate of EPS expressed in percent, and Aaa is the interest rate for highly rated ten year bonds. A current revision of his formula is 4.4 (7) Estimated value = EPS (7 + 1.5G) where AAA is the interest rate on 30 AAA year AAA corporate bonds. Graham developed the model for stocks with “average risk”. For stock with greater risk, the model can be adjusted. Example 3. We will apply the model to Boeing (BA) stocks discussed above. From finance.yahoo.com and Nasdaq.com, we have for Boeing, an estimate G = growth rate of EPS = 8% and EPS = $5.96. Substitution gives 4.4 Estimated value = 5.96(7 + 1.5(8)) = $138.40 and compared to the quoted Price of 3.6 $123.25 . For current bond rates, see fmsbonds.com and click on Market Yields. It is recommended that the Graham type formula be applied to stocks that have passed previous value screens of the firm’s assets, earnings, dividends, and financial strength . Graham’s analysis involved the balance of a stock and bond portfolio and whether bonds are preferred to stocks. As interest rates rise in the denominator, the Estimated value of the stock declines. Graham invested in stocks selling at a deep discount to their intrinsic value. The historical growth rate of EPS is often used as a proxy for future growth rate. At the time of the formation of his model, the Aaa stood for ten year corporate bond yields which averaged 4.4%. As interest rates rise and are used to discount the EPS, they are worth less to the investor. Applying this formula to some stocks (for example Microsoft (MSFT)) gives Values extremely above the market price. For long term investments, one might estimate future bond rates such as 6.5% as occurred in 1999. Side Bar Notes: Low volatility mutual funds have low beta and low P/E. The number of such funds has doubled to 35 since the start of 2012. Only one is three years old. They can still lose money. In 2008, the S&P 500 lost 37% and a leading low volatility fund lost 17%. Some have a beta as low as .66 (Money, p. 44, Oct. 2013). Interpret what the beta = .66 means. Increasing your stock holding during retirement. By a Monte Carlo analysis, for a portfolio of stocks and bonds, over thirty years, it is suggested that the optimal path is starting at 30% stocks and then increasing to about 70%. This path compared to many others had the highest percent of success of 95.1%. (Kites, Michael E. and Wade D Pfau, “Reduce Stock 4 Exposure in Retirement, or Gradually Increase It?” AAII Journal, April 2014). The data results was explained in terms of market volatility, dollar cost averaging, and the sequencing effect. APYE and APY. The APYE is an annualized rate representing the amount of interest actually earned and is based on the average daily balance. APY represent compounding as if the funds were in an account for one year. APY is for comparison. A Stock market bubble is when market participants drive stock prices high and then prices collapse. A recent bubble is the Dot-com bubble for what is called tech-stocks. For example CISCO Systems (CSCO) stock climbed to $70 per share in April 2000 and dropped to $13 in 2003, an 81% drop in price. The NASDAQ stock composite spiked to 5000 in the year 2000 and dropped back to 1200 by 2002, a 76% drop. (See Wikipedia.org.) Stock splits. Companies can have their own changes in stock prices. For example GE (General Electric) went from $75 a share in 1962 to $16 a share in 2011 (finance.yahoo.com). It has recovered to $26 in 2014 and pays a 3.46% dividend. Historically GE stocks had been strong. But there is a catch in the history of GE stocks. Since 1971, GE has had six stock splits. Most were: for one stock, you get two (stocksplithistory.com). According to Matt Krantz, USA Today, Jan. 2011, $.80 invested in GE stocks in 1970, with splits is worth $17.90 in 2011. Dividends had accumulated to $13.10. This gives $31, and without dividends reinvested, a 9.8% return. The S&P 500 returned 9.7% with dividends reinvested during that period. Small-cap stocks of the Russell 2000 have averaged in the last five years a return of 20%. Since the beginning of 2000, they have averaged 10.3% per year while the large-caps of the S&P 500 averaged 3.7%. Stocks in the Russell 2000 currently trade at an average P/E of 69 compared to a P/E of 17 for the S&P 500. Experts think small-cap stocks are in a bubble. It is true that small-caps have, in the long run from the 1920s, outperformed large-caps by two percentage points. But they underperformed for about 14 years from 1985 to 1999. This could happen again. (Do a calculation comparing the accumulated value for the usual $10,000 invested.) (Fortune, April 28, 2014, p. 48) The Russell 2000 is the recognized index for small-cap stocks. The average market capitalization for the index is $1.26 Billion and the median is $528 million. For any stock in the S&P 500, the market capitalization is at least $4.0 Billion (Wikipedia.org). Exercises: Show your work. Label answers, variables, and numbers. Answer in complete sentences when appropriate. Give your dates and sources. Exercises for a Model Discounting Terminal Value and Dividends: #1. Look up the Dividends for Boeing (BA) and estimate the historical growth rate. See Nasdaq.com, Revenue/EPS. #2. With one formula For Table 1, calculate the present value for the appreciated and discounted dividends for BA. #3. Give an argument justifying the Discount Model for Terminal Value and Dividends. What assumptions are made? 5 #4. What does beta = 1.04 tell you about Boeing stock? $5. If for Boeing, it trades at a Terminal value of 15 times Terminal earnings, what is Terminal value? #6. Check the five year history of Boeing stock prices and estimate annual rate of growth of price. Is the stock at all-time high. #7. Click Major Holders on finance.yahoo.com for Boeing and report the mutual funds which hold BA. #8. Click Press Releases on finance.yahoo.com and read about Boeing. What does Boeing sell and service? Where is Boeing located? #9. Click Competitors on Nasdaq.com and report. Compare Market Cap. Report. #10. At Nasdaq.com, click on Analysts Research. Click on Guru Analysis. Report. #11. For Lockheed Martin (LMT), apply the Discount Model for Terminal Value and Dividends. #12. For Lockheed Martin (LMT), do the Exercises 6, 7, 8, 9, and 10 above. Exercises for Fair Value of a Stock from P/E and EPS: #13. What and when were the negative EPS for Citigroup (C)? Look in nasdaq.com, Revenue/EPS. What do you think caused them? #14. Go to Nasdaq.com for Citigroup (C), Revenue/EPS, and estimate the growth of EPS. Use the given Price and EPS to check the given P/E. #15. Give an argument to justify the Fair Value of a Stock from P/E and EPS Model. What assumptions are made? #16. Look up beta for Citigroup. What does this tell you about Citigroup stock? What does this suggest about the anticipated discounting rate of return for the stock? #17. Check the five year history of Price for Citigroup and estimate its annual rate of growth. Is the stock at an all-time high? #18. Click Major Holders on finance.yahoo.com and see what mutual funds hold Citigroup. Report. #19. Click Competitors in nasdaq.com and report major competitors for Citigroup. #20. At Nasdaq.com, click on Analysts’ Research. Report. Click on Guru Analysis. Report. #21. For Bank of America ( BAC ), apply the Fair Value of a Stock from P/E and EPS Model. #22. For Bank of America (BAC ), do Exercises 1, 6, 7, 8. Exercises for a Benjamin Graham Stock Value Model: #23. Give a discussion of the Benjamin Graham Model. What assumptions are made? 6 #24. For Boeing (BA) go to Nasdaq.com and click on Revenue/EPS and estimate the historical growth of EPS and examine dividends. Report. #25. Apply a Benjamin Graham Model to Lockheed Martin (LMT). #26. For LMT, do Exercises 1, 6, 8, and 10. What products does Lockheed Martin sell and service? Other Exercises: #27. From Boak, Josh and Paul W. Wiseman, “Fees may be shrinking your 401(k),” Denton Record Chronicle, April 13, 2014, AP Economic Writers. Can you make sense out of these numbers? They assume a 25 year-old earns a US median income of $30,500 and puts five percent of his pay in his 401(k), while the employer chips in another five percent. If the fund charges an annual fee of 0.25 percent, and the investment return averages 6.8 percent, the account would equal $476,745 when the worker turned 67. At a fee of one percent, only $405,454, a $71,000 shortfall. At 1.3 percent, only $380,649, a $96,000 shortfall. The worker would have to work four more years to make up the gap. This analysis assumes a pay increase of 3.6 percent a year. The article gives an average fee for 401(k) plans of .83 percent. If you doubt your calculations, try it on dinkytown.net. Select 401(k) Calculator. It will probably agree with your results. Can you calculate an estimate of the article’s numbers? #28. Go to dinkytown.net and select a calculator that interests you. Run it and print with an example. Use your algebra, formulas, and scientific calculator to check their calculations. Show your work. State your conclusions. #29. Give a meaning of some of the statistics and ratios for Boeing (BA). For example P/E P 123.25 was 20.68 and EPS was $5.96 per share per year. With Price P = $123.25, = = E 5.96 1 E 20.7 . So it takes 20.7 years for EPS to pay P. The inverse is = = .048 meaning EPS 20.7 P pays about 5% of price P per year. The inverse of some ratios is a rate. See yahoo.finance.com including Key Statistics and other sections of the web site for Boeing. #30. Westinghouse Electric. Everyone knows that China has a terrible pollution problem. It is building 29 nuclear power stations designed by Westinghouse and others. (Fortune, April 28, 2014, p. 14.) Each generator costs about $3 Billion to build. Which country other than US has the most nuclear generators? See p. 16. Toshiba-owned Westinghouse Electric is part of Toshiba Corporation (TOSBF) on finance.yahoo.com. With Market Cap of $17.39 Billion at $4 per share, how many shares are outstanding? With EPS of $0.19 and P/E = $22.19, how long does it take earnings to pay price? Look up Key Statistics and interpret. Read Profile about Toshiba Corporation. 7 References in this course: “Valuation of Dividend Stocks” “Dividend Growth” “High Dividend Yields on Stocks and Low Interest Rates on CDs and Bonds” “Stock Pricing Models” “Mathematics and the Stock Market” Other References: Johnson, Robert R., Thomas R. Robinson, and Stephen M. Horan, “Selecting a Valuation Method to Determine a Stock’s Value,” AAII Journal, April 2014, p. 17. For a free course in financial mathematics, with emphasis on personal finance, for upper high school and undergraduate college, see COMAP.com and click on the box and register. They will email you a password. Just click on an article in the annotated bibliography, download it, and teach it. Unit 1: The Basics of Mathematics of Finance, Unit 2: Managing Your Money, Unit 3: Long-term Financial Planning, Unit 4: Investing in Stocks and Bonds, Unit 5: Investing in Real Estate, Unit 6: Solving Financial Formulas for Interest Rate. Unit 7: More Advanced or Technical (for about ten articles in this area, see the UMAP Journal at COMAP). Additional articles on Financial Mathematics or Related to Personal Finance. Your school library can probably provide you with a portal to electronic resources including magazines and journal articles. You might arrange a portal for your home computer. You may have access to the AAII Journal from which some of this article is taken and which provides stock screens and a discussion of criterion. See AAII.com.