DePaul University

advertisement

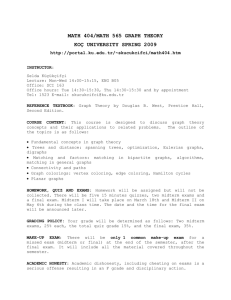

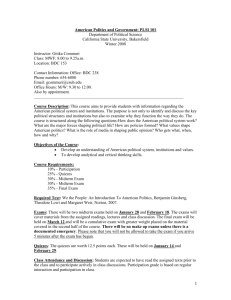

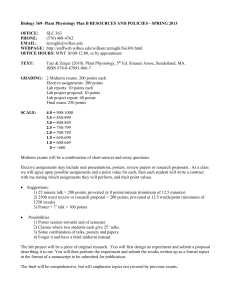

School of Accountancy Accounting 550 – Advanced Topics in Auditing Instructor: Ed Doyle, CPA, CIA, CISA, MBA Phone: (630) 408-2063 - Cell Email: edoyle.67@me.com Twitter: @WQ2015ACC550 Web Page: http://oll.depaul.edu Office Hours : Required Text : information By appointment Please consult the bookstore website for the most recent edition ISBN Principles of Auditing and Other Assurance Services, Whittington & Pany Irwin McGraw Hill Course Objectives The class will build on the audit principles learned in Audit I with an emphasis on the implementation and application of generally accepted auditing standards, and the practical application of the standards, within the context of accounting transaction cycles. This replicates the process in which audits are conducted by public accounting firms and presents specific accounting transaction cycle information that is routinely tested on standardized exams such as the CPA and CIA exams. Teaching Methods This course will place significant importance on specific technical language and terminology, as presented in the textbook, and the student’s ability to apply that language and terminology to inclass presentations, class discussions and exams. The lectures in the class will provide a description of why audits are conducted, while the textbook will provide a description of how audits of the various accounting transaction cycle are conducted. It is critical to combine an understanding of both perspectives for purposes of the midterm and final and for those of you planning on taking a standardized exam in the future. This course will include podcast lectures, class discussions and in-class case presentations. Students are required to enroll in the D2L course site. If you have not previously enrolled in D2L, you will need to create an account. All course materials, including slides, homework solutions, and supplemental materials will be available on the D2L course site. The student’s responsibility is to read all material prior to the lecture/discussion and complete problem assignments prior to review in the class. It will be a significant benefit to students to read chapters in advance of presentations. You are encouraged to ask questions and make comments during the course of lecture Exams Please note that this course makes use of online exams. Remote Proctor Now (RPN) software will be used to ensure the integrity of the midterm and final 1 exams. The midterm and final exams will not be available to students unless the RPN software is used. RPN works with a web-camera and microphone either built-in or attached to the computer (the computer you use must have a camera). These devices identify the student and capture video and audio throughout the exam. This video and audio will be used for the purpose of establishing if any violations of the Code of Conduct occurred during the test. If Code of Conduct violations are determined, the student will be referred to the Academic Integrity Board. http://academicintegrity.depaul.edu/ There is a student demo available here: http://www.screencast.com/t/dJM4WfTRl. Attendance Attendance is strongly encouraged. As described above, the lectures in the class will provide a description of why audits are conducted, while the textbook will provide a description of how audits of the various accounting transaction cycle are conducted. Group Case Assignment During the course of the quarter, Group Case studies will be presented to the class. The purpose of the case presentations is to generate discussion of important issues in the text. Specific format and requirements of the case will be provided to each group one week prior to their presentation. Presentations will be evaluated on use of specific audit technical language and other criteria that will be provided to you. In addition, each team member will be asked to evaluate the contribution of the other team members. Code of Conduct Students are expected to observe the School of Accountancy & MIS Code of Conduct, which can be found on the University’s website. Grading: Course grades will be based on the following weights Midterm exam Final exam Case Studies Total 45% 45% 10% 100% Grade Scale 93% A 90% A87% B+ 83% B 80% B77% C+ 73% C 70% C60% D 59% F 2 Course Schedule DATE Topic Reading Assignment January 6 Audit Sampling Chapter 9 1-4,9,12,19,20,30-32,37 January 13 Revenue Cycle Chapter 10 11,12,13,16,17,18,21,25,33,35,37 January 20 Revenue Cycle Chapter 11 4,8,9,14,16,17,19,27,28,36 January 27 Expenditure Cycle Chapter 14 5,7,9,15,17,22,23,26,34 February 3 February 10 Midterm Conversion Cycle Chapter 12 6,7,8,9,11,13,25,31,34 Operational and Compliance Auditing Debt and Equity Capital Chapter 21 1,2,7,9,11,12,13,16,41 Chapter 15 3,5,6,7,15,16,32 Property, Plant and Equipment Internal Control in an IT Environment Chapter 13 5,6,7,8,9,15,17,19,32,33 Chapter 8 1,2,12,14,20,30 February 17 February 24 March 3 March 10 March 17 Discussion Problems/Case Studies Final Exam Note: Dates for lecture topics and homework assignments are tentative and may be changed. _______________________________________________________________________________ 3