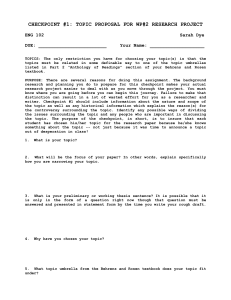

Read the Complaint - Law Offices of Howard G. Smith

advertisement

UNITED STATES DISTRICT COURT DISTRICT OF NEW JERSEY ________________, Individually and On Behalf of All Others Similarly Situated, Plaintiff, v. CHECKPOINT SYSTEMS INC., GEORGE BABICH, JR., JEFFREY O. RICHARD, and JAMES M. LUCANIA, Case No.: DRAFT CLASS ACTION COMPLAINT FOR VIOLATIONS OF THE FEDERAL SECURITIES LAWS JURY TRIAL DEMANDED Defendants. CLASS ACTION COMPLAINT Plaintiff _________ (“Plaintiff”), by and through his attorneys, alleges the following upon information and belief, except as to those allegations concerning Plaintiff, which are alleged upon personal knowledge. Plaintiff’s information and belief is based upon, among other things, his counsel’s investigation, which includes without limitation: (a) review and analysis of regulatory filings made by Checkpoint Systems Inc. (“Checkpoint” or the “Company”), with the United States (“U.S.”) Securities and Exchange Commission (“SEC”); (b) review and analysis of press releases and media reports issued by and disseminated by Checkpoint; and (c) review of other publicly available information concerning Checkpoint. NATURE OF THE ACTION AND OVERVIEW 1. This is a class action on behalf of purchasers of Checkpoint securities between March 5, 2015 and November 3, 2015, inclusive (the “Class Period”), seeking to pursue remedies under the Securities Exchange Act of 1934 (the “Exchange Act”). 2. Checkpoint manufactures and sells loss prevention, inventory management, and labeling solutions to the retail and apparel industries. Checkpoint’s loss prevention solutions purportedly enable retailers to safely display merchandise in an open environment. The Company also provides inventory management solutions in the form of Radio Frequency Identification products and services, principally for closed-loop apparel retailers and department stores. The Company’s products purportedly give customers precise details on merchandise location and quantity as it travels from the manufacturing source through to the retail store. 3. On November 3, 2015, after the market closed, the Company filed a Current Report on Form 8-K with the SEC. The Current report disclosed that Checkpoint “discovered financial statement errors attributable to the accounting for its quarterly income tax provision.” As a result, the Company further disclosed that “the unaudited financial statements for the CLASS ACTION COMPLAINT 1 quarterly period ended March 29, 2015, the quarterly period ended June 28, 2015 and the yearto-date period ended June 28, 2015 contained in the Company’s Quarterly Reports on Form 10-Q for the quarterly period ended March 29, 2015 and the quarterly period ended June 28, 2015 should no longer be relied upon.” The Company stated that, based on its current assessment, the changes will be as follows “Quarter ended March 29, 2015: increase in tax expense of $1.8 million, increase in net loss of $1.8 million, and decrease in diluted earnings per share of $0.04; Quarter ended June 28, 2015: increase in tax expense of $4.1 million, increase in net loss of $4.1 million, and decrease in diluted earnings per share of $0.10; and Year-to-date ended June 28, 2015: increase in tax expense of $5.9 million, increase in net loss of $5.9 million, and decrease in diluted earnings per share of $0.14.” The Company also disclosed that it “intends to amend its Annual Report on Form 10-K for the year ended December 28, 2014 to reflect the conclusion by management that the Company’s internal control over financial reporting and disclosure controls and procedures were not effective as of December 28, 2014.” 4. On this news, shares of Checkpoint fell $1.73, or 22.4%, to close at $5.97 on October 29, 2015, on unusually high trading volume. 5. Throughout the Class Period, Defendants made false and/or misleading statements, as well as failed to disclose material adverse facts about the Company’s business, operations, and prospects. Specifically, Defendants made false and/or misleading statements and/or failed to disclose: (1) that the Company lacked adequate internal controls over accounting; (2) that the Company understated its tax expense and misstated other key financial data in financial reports filed with the SEC in violation of Generally Accepted Accounting Principles (“GAAP”); and (3) that, as a result of the foregoing, the Company’s financial statements and Defendants’ statements about Checkpoint’s business, operations, and prospects, CLASS ACTION COMPLAINT 2 were false and misleading and/or lacked a reasonable basis. 6. As a result of Defendants’ wrongful acts and omissions, and the precipitous decline in the market value of the Company’s securities, Plaintiff and other Class members have suffered significant losses and damages. JURISDICTION AND VENUE 7. The claims asserted herein arise under Sections 10(b) and 20(a) of the Exchange Act (15 U.S.C. §§78j(b) and 78t(a)) and Rule 10b-5 promulgated thereunder by the SEC (17 C.F.R. § 240.10b-5). 8. This Court has jurisdiction over the subject matter of this action pursuant to 28 U.S.C. §1331 and Section 27 of the Exchange Act (15 U.S.C. §78aa). 9. Venue is proper in this Judicial District pursuant to 28 U.S.C. §1391(b) and Section 27 of the Exchange Act (15 U.S.C. §78aa(c)). Substantial acts in furtherance of the alleged fraud or the effects of the fraud have occurred in this Judicial District. Many of the acts charged herein, including the dissemination of materially false and/or misleading information, occurred in substantial part in this Judicial District. In addition, the Company’s principal executive offices are located within this Judicial District. 10. In connection with the acts, transactions, and conduct alleged herein, Defendants directly and indirectly used the means and instrumentalities of interstate commerce, including the United States mail, interstate telephone communications, and the facilities of a national securities exchange. PARTIES 11. Plaintiff, as set forth in the accompanying certification, incorporated by reference herein, purchased Checkpoint common stock during the Class Period, and suffered damages as a CLASS ACTION COMPLAINT 3 result of the federal securities law violations and false and/or misleading statements and/or material omissions alleged herein. 12. Defendant Checkpoint is a Pensylvania corporation with its principal executive offices located at 101 Wolf Drive, PO Box 188, Thorofare, New Jersey 08086. 13. Defendant George Babich, Jr. (“Babich”) was, at all relevant times, President and Chief Executive Officer (“CEO”) of Checkpoint. 14. Defendant Jeffrey O. Richard (“Richard”) was, at all relevant times, Chief Financial Officer (“CFO”) of Checkpoint until March 23, 2015. 15. Defendant James M. Lucania (“Lucania”) was, at all relevant times, Acting CFO and Treasurer of Checkpoint beginning March 23, 2015. 16. Defendants Babich, Richard, and Lucania are collectively referred to hereinafter as the “Individual Defendants.” The Individual Defendants, because of their positions with the Company, possessed the power and authority to control the contents of Checkpoint’s reports to the SEC, press releases and presentations to securities analysts, money and portfolio managers and institutional investors, i.e., the market. Each defendant was provided with copies of the Company’s reports and press releases alleged herein to be misleading prior to, or shortly after, their issuance and had the ability and opportunity to prevent their issuance or cause them to be corrected. Because of their positions and access to material non-public information available to them, each of these defendants knew that the adverse facts specified herein had not been disclosed to, and were being concealed from, the public, and that the positive representations which were being made were then materially false and/or misleading. The Individual Defendants are liable for the false statements pleaded herein, as those statements were each “group-published” information, the result of the collective actions of the Individual Defendants. CLASS ACTION COMPLAINT 4 SUBSTANTIVE ALLEGATIONS Background 17. Checkpoint manufactures and sells loss prevention, inventory management, and labeling solutions to the retail and apparel industries. Checkpoint’s loss prevention solutions purportedly enable retailers to safely display merchandise in an open environment. The Company also provides inventory management solutions in the form of Radio Frequency Identification products and services, principally for closed-loop apparel retailers and department stores. The Company’s products purportedly give customers precise details on merchandise location and quantity as it travels from the manufacturing source through to the retail store. Materially False and Misleading Statements Issued During the Class Period 18. The Class Period begins on March 5, 2015. On that day, Checkpoint issued a press release entitled, “Checkpoint Systems, Inc. Announces Fourth Quarter and Full Year 2014 Results.” Therein, the Company, in relevant part, stated: Fourth Quarter Adjusted EBITDA Increased 10.9% Full Year 2014 Adjusted EBITDA Increased 17.7% to $79 million Full Year 2014 Adjusted EPS up 83.1% to $0.76 per share Board of Directors Declares Special Cash Dividend of $0.50 per Share Company Issues 2015 Guidance THOROFARE, N.J.--(BUSINESS WIRE)--Mar. 5, 2015-- Checkpoint Systems, Inc. (NYSE:CKP) today reported financial results for the fourth quarter and fiscal year ended December 28, 2014. Fourth Quarter GAAP Results Net revenues from continuing operations in the fourth quarter of 2014 decreased 5.8%, to $183.1 million from $194.4 million in the fourth quarter of 2013. Foreign currency translation effects resulted in $7.4 million or 3.8% of the decrease in net revenues. During the quarter, gross profit margins were 43.3% CLASS ACTION COMPLAINT 5 compared with 38.8% in the fourth quarter of 2013. Selling, general, and administrative (SG&A) expenses in the fourth quarter of 2014 increased $1.7 million, or 3.1%, to $56.4 million from $54.7 million in the fourth quarter of 2013. Operating income in the fourth quarter of 2014 was $12.8 million, $7.3 million, or 132.1%, higher than $5.5 million in the same period last year. Net income from continuing operations in the fourth quarter of 2014 was $0.12 per diluted share, versus a loss of $0.12 per diluted share in the same period last year. Fourth Quarter Adjusted Non-GAAP Operating Income, EBITDA and Earnings per Share Adjusted Non-GAAP operating income from continuing operations was $19.3 million in the fourth quarter of 2014, $2.4 million greater than $16.9 million in the same period last year. Adjusted EBITDA was $27.1 million in the fourth quarter of 2014, $2.7 million higher than $24.4 million in the fourth quarter of 2013. Adjusted Non-GAAP net earnings from continuing operations in the fourth quarter of 2014 was $0.26 per diluted share compared to $0.30 per diluted share in the same period last year. (See accompanying Reconciliation of GAAP to NonGAAP Financial Measures). Checkpoint Systems' President and Chief Executive Officer, George Babich, said, “I am pleased to announce another strong quarter of profitability despite significant industry and foreign currency translation headwinds. We delivered revenue and EBITDA at the high end of our expectations while net earnings exceeded our expectations. Our process improvement initiatives continue to deliver outstanding year over year results. Gross profit margins increased more than 450 basis points in the fourth quarter, and by more than 400 basis points for the full year. Gross profit margins were again higher across nearly all product lines, driven by continued manufacturing cost reductions, the benefits of our restructuring and profit improvement initiatives and manufacturing and supply chain efficiencies. Gross margins were favorably impacted by the mix of revenues toward EAS consumables, reflecting the continuing mix of our business to a more recurring revenue stream.” Jeff Richard, Executive Vice President and Chief Financial Officer, said, “Checkpoint has delivered $47.6 million of free cash flow in 2014 vs. $12.1 million in 2013. This result reflects a year of hard work and outstanding execution on many of our Lean Six Sigma and other projects around the globe. Our balance sheet remains at its strongest level in several years, with cash exceeding total debt by $70 million.” CLASS ACTION COMPLAINT 6 Selected Discussion and Analysis of Fourth Quarter 2014 Results Net revenues decreased 5.8% to $183.1 million compared with $194.4 million for the fourth quarter of 2013. Foreign currency effects resulted in a 3.8% decrease to net revenues. Merchandise Availability Solutions (MAS) revenues decreased 4.7% to $126.4 million versus the fourth quarter of 2013, principally driven by foreign currency effects of 4.2%. Reductions in EAS Systems and RFID installation revenue, reflecting the sunset of multiple chain-wide projects which occurred in the fourth quarter 2013, were nearly offset by a significant increase in EAS Consumables and Alpha® sales, reflecting the recurring revenue component of those projects. Apparel Labeling Solutions (ALS) revenues decreased 9.3% to $43.1 million, reflecting a decrease in the legacy labeling business and partially offset by continued growth in sales of RFID labels. Foreign currency effects resulted in a 2.0% decrease to ALS net revenues. Retail Merchandising Solutions (RMS) revenues decreased 4.5% to $13.6 million, reflecting the impact of the weakening Euro. RMS revenue increased 1.8% on a constant currency basis, primarily attributable to stronger sales volumes in the hand-held labeling business. Gross profit margin was 43.3% compared with 38.8% for the fourth quarter of 2013. MAS gross profit margin was 47.2% compared with 42.1% in the fourth quarter of 2013. The increase was principally due to manufacturing cost savings, margin enhancement initiatives, and a favorable mix of sales toward higher margin products, partially offset by under-absorbed professional services. ALS gross profit margin was 33.8% compared with 30.3% in the fourth quarter of 2013. The increase was principally due to Project LEAN initiatives and improved manufacturing efficiencies. RMS gross profit margin was 37.1% compared with 36.3% in the fourth quarter of 2013. The increase was primarily due to margin improvement initiatives and better overhead absorption. SG&A expenses were $56.4 million compared with $54.7 million in the fourth quarter of 2013. The increase is due to higher employee-related CLASS ACTION COMPLAINT 7 expenses in 2014 primarily driven by higher incentive-based compensation accruals. Cost reductions totaling approximately $1.7 million from the expanded Global Restructuring Plan, including Project LEAN, as well as a continuous focus on streamlining SG&A helped minimize the increase in SG&A. Operating income was $12.8 million compared with $5.5 million in the fourth quarter of 2013. Non-GAAP operating income was $19.3 million, compared with $16.9 million in the fourth quarter of 2013. (See accompanying Reconciliation of GAAP to Non-GAAP Financial Measures). Restructuring expense was $4.0 million relating to the implementation of the Profit Enhancement Plan, partially offset by the wind-down of the Global Restructuring Plan, including Project LEAN. Total restructuring expense incurred from all plans since the inception of the Global Restructuring Plan totals $83.5 million ($15.7 million non-cash). Adjusted EBITDA was $27.1 million, compared with $24.4 million in the fourth quarter of 2013. (See accompanying Reconciliation of GAAP to Non-GAAP Financial Measures). Cash flow provided by operating activities was $23.6 million compared with $25.3 million in the fourth quarter of 2013. Capital expenditures were $5.1 million in the fourth quarter of 2014. Special Dividend Earlier today, the Board of Directors declared a special cash dividend of $0.50 per share. The dividend will be paid on April 10, 2015 to all stockholders of record on March 20, 2015. “The authorization of this special dividend by our Board reflects our commitment to building stockholder value through the execution of our strategic plan and disciplined approach to capital allocation,” said Mr. Babich. “With our solid free cash flow and our strongest balance sheet in years, we are pleased to return approximately $21 million to stockholders while investing in our businesses and ensuring adequate liquidity to act quickly on any acquisition opportunities.” 2015 Outlook Based on an assessment of market conditions, current customers' orders and commitments, and assuming continuation of current foreign exchange rates, Checkpoint is initiating guidance for 2015. This guidance does not include the impact of acquisitions, divestitures, restructuring and one-time or unusual charges CLASS ACTION COMPLAINT 8 resulting from debt refinancing, litigation fees or settlements and gains or losses generated by non-routine operating matters which we may record during the year. Projected income taxes for the year can be impacted by changes in the mix of pretax income and losses in the countries in which we operate. The valuation allowance on U.S. deferred tax assets results in a GAAP tax rate on U.S. pre-tax income or losses of essentially 0%. When the mix of income or losses shifts from the U.S. to a country where the income tax rate is in the normal range, our effective tax rate will increase. Additionally, we continue to monitor our profitability in the U.S. to determine whether there is sufficient evidence that may result in a full or partial release of the U.S. valuation allowance. Should this occur, the 0% GAAP tax rate in the U.S. will revert to its normal range of nearly 40%, including state income taxes. The combination of these factors can have a significant impact on the amount of reported income tax expense, and therefore our earnings per share, when compared with the projections that are the basis of our outlook. Mr. Babich added, “Our business is significantly impacted by large-scale capital projects, the timing of which can be difficult to forecast. The roll-on and roll-off of these projects can generate large swings in revenue and profitability. While we continue to execute a number of EAS and RFID pilots and tests, retailers remain cautious about their in-store capital expenditures. While it is certainly possible that some of these tests will transition into chain-wide rollouts, our guidance assumes that none will occur during fiscal 2015. Our guidance also assumes an incremental $7-10 million total investment in R&D and SG&A to fund our growth initiatives, with primary benefits beginning in 2016.” Mr. Richard added, “Like many other multinational companies, we will face tremendous currency headwinds in 2015 due to the strengthening US dollar. Over two-thirds of our revenues are denominated in foreign currencies with particular exposure to the Euro, the Japanese Yen, the British Pound and the Australian Dollar. We expect fiscal 2015 total capital expenditures in the range of $20 to $25 million. We expect our continuous working capital improvement projects will help offset the free cash flow impact of our increased capital spending.” 19. Net revenues are expected to be in the range of $575 million to $625 million. Adjusted EBITDA is expected to be in the range of $55 million to $68 million. Non-GAAP diluted net earnings per share attributable to Checkpoint Systems, Inc. is expected to be in the range of $0.40 to $0.50, assuming an effective tax rate of approximately 35%. On the same day, Checkpoint filed its Annual Report with the SEC on Form 10-K CLASS ACTION COMPLAINT 9 for the fiscal year ended December 28, 2015. The Company’s Form 10-K was signed by Defendant Babich, and reaffirmed the Company’s financial statements previously announced the same day. 20. The Company’s Form 10-K contained certifications pursuant to the Sarbanes- Oxley Act of 2002 (“SOX”), signed by Defendants Babich and Richard, who certified: 1. I have reviewed this Form 10-K of Checkpoint Systems, Inc.; 2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report; 3. Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report; 4. The registrant’s other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d15(f)) for the registrant and have: a) Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared; b) Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; c) Evaluated the effectiveness of the registrant's disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and CLASS ACTION COMPLAINT 10 d) Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; 5. The registrant’s other certifying officer(s) and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the equivalent functions): a) All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting. 21. On May 6, 2015, Checkpoint issued a press release entitled, “Checkpoint Systems, Inc. Announces First Quarter 2015 Results.” Therein, the Company, in relevant part, stated: Company Reports Highest First Quarter Gross Profit Margin in 21 Years Organic Merchandise Visibility™ Revenue Growth of 41% Company Reaffirms 2015 Guidance THOROFARE, N.J.--(BUSINESS WIRE)--May 6, 2015-- Checkpoint Systems, Inc. (NYSE: CKP) today reported financial results for the fiscal first quarter ended March 29, 2015. For more details on the Company’s results, please see the supplemental presentation materials, “First Quarter 2015 Financial Review,” posted to the Company’s website at http://ir.checkpointsystems.com and furnished to the SEC on Form 8-K. First Quarter GAAP Results Net revenues in the first quarter of 2015 decreased 12.8%, to $128.5 million from $147.4 million in the first quarter of 2014. Foreign currency translation effects resulted in an $11.5 million or 7.8% decrease in net revenues. During the quarter, gross profit margins were 44.0%, an increase of more than 170 basis points compared to the same period last year. CLASS ACTION COMPLAINT 11 Selling, general, and administrative (SG&A) expenses in the first quarter of 2015 decreased $3.0 million, or 5.6%, to $51.3 million from $54.3 million in the first quarter of 2014. Operating loss in the first quarter of 2015 was $0.3 million, $2.5 million below the $2.2 million of income in the same period last year. Net loss in the first quarter of 2015 was $0.02 per diluted share, versus nil per diluted share in the same period last year. First Quarter Adjusted Non-GAAP Operating Income, EBITDA and Earnings per Share Adjusted Non-GAAP operating income was $1.9 million in the first quarter of 2015, $2.2 million lower than $4.1 million in the same period last year. Adjusted EBITDA was $10.0 million in the first quarter of 2015, $1.8 million lower than $11.8 million in the first quarter of 2014. Adjusted Non-GAAP net earnings per diluted share was $0.04 in the first quarter of 2015, flat compared to the same period last year. (See accompanying Reconciliation of GAAP to Non-GAAP Financial Measures.) Checkpoint Systems' President and Chief Executive Officer, George Babich, said, “Despite lower revenue driven by continued foreign currency headwinds and the sunset of our significant 2014 EAS hardware rollouts, I am pleased that we were able to report our highest first quarter gross profit margin in 21 years.” Mr. Babich added, “As we previously outlined, 2015 will be a challenging year as we work to secure our next significant rollout and begin to drive organic revenue growth through our investment spending on strategic growth initiatives. We are making good progress on both fronts, and I am gaining confidence that we will secure at least one signed contract for an additional new hardware rollout beginning later this year. I am also encouraged that our spending on certain strategic initiatives will begin to take root in 2016. In the first quarter alone, we have significantly increased our rate of investment year-over-year in both R&D and capital expenditures, up $0.7 million and $2.5 million, respectively. SG&A spending in constant dollar terms is up nearly $1 million as well, although masked by the $4 million SG&A benefit from foreign currency translation effects. We have added strategic headcounts in sales and product management to target underserved vertical markets. We have engaged consultants to complement our in-house expertise to focus on our supply chain optimization project. We have invested in new equipment and IT systems to enhance our capabilities and increase automation in our Apparel Labeling business. These investments reflect our commitment to organic growth despite the challenging market conditions.” Mr. Babich concluded, “In addition, we remain committed to exploring strategic CLASS ACTION COMPLAINT 12 acquisitions and partnerships to round out our portfolio of products that will help drive topline growth and improved operating margins.” Selected Discussion and Analysis of First Quarter 2015 Results Net revenues decreased 12.8% to $128.5 million compared with $147.4 million for the first quarter of 2014, due to an organic decrease of 5.0% and foreign currency effects of 7.8%. Merchandise Availability Solutions (MAS) revenues decreased 12.8% to $81.5 million versus the first quarter of 2014, principally driven by foreign currency translation effects of $8.0 million or 8.6%. The organic decline of 4.2% was attributable to EAS Systems, Alpha® and EAS Consumables, reflecting the sunset of North American and European chain-wide projects which occurred in the first quarter of 2014, partially offset by an increase in RFID solution sales in both North America and Europe. Apparel Labeling Solutions (ALS) revenues decreased 11.6% to $37.2 million, reflecting a decrease in the legacy labeling business due to lower tag volumes at certain key North American and European retailers, certain market share losses in Europe and Asia and the timing of Chinese New Year. Foreign currency effects led to a $1.5 million, or 3.6%, decline in segment revenues. Retail Merchandising Solutions (RMS) revenues decreased 17.1% to $9.8 million, nearly all related to foreign currency translation effects. Organic revenues declined just $0.1 million, reflecting the sunset of a major project in North America, nearly offset by strong retail display sales volumes in Europe. Gross profit margin was 44.0%, more than 170 basis points higher than the first quarter of 2014. MAS gross profit margin was 50.6%, more than 360 basis points higher than the 47.0% recorded in the first quarter of 2014. The increase was principally due to the mix of revenue toward higher margin products and services. Better professional service absorption more than offset the weaker factory overhead absorption generated by lower production volumes. This gross profit margin is not sustainable, as the Euro-based profit in our supply chain in the first quarter of 2015 was locked-in at significantly higher rates than exist today. We estimate that MAS gross profit would have been approximately $2 million lower in the first quarter of 2015 if the current rates had existed when our CLASS ACTION COMPLAINT 13 supply chain earned this profit. ALS gross profit margin was 31.1% compared with 33.5% in the first quarter of 2014. The decrease was principally due to accelerated depreciation for certain machinery in Asia that will be removed from production, overhead under-absorption in our factories due to lower sales volumes and the impact of a later Chinese New Year. ALS margins will continue to suffer yearover-year from the strengthening U.S. Dollar. RMS gross profit margin was 37.7%, nearly 180 basis points better than 35.9% in the first quarter of 2014. The increase was primarily due to our margin improvement initiatives and better factory overhead absorption. SG&A expenses were $51.3 million compared with $54.3 million in the first quarter of 2014. The decrease is related to foreign currency translation effects of just under $4 million. The benefits of our cost reduction initiatives were offset by incremental spending related to our strategic initiatives and management transition costs. Operating loss was $0.3 million compared with $2.2 million of income in the first quarter of 2014. Non-GAAP operating income was $1.9 million compared with $4.1 million in the first quarter of 2014. (See accompanying Reconciliation of GAAP to Non-GAAP Financial Measures.) Adjusted EBITDA was $10.0 million, compared with $11.8 million in the first quarter of 2014. (See accompanying Reconciliation of GAAP to NonGAAP Financial Measures.) Cash used in operating activities was $0.4 million compared with $8.6 million provided by operating activities in the first quarter of 2014. Capital expenditures were $5.8 million in the first quarter of 2015 compared to $3.3 million in the first quarter of 2014. Outlook for 2015 Based on an assessment of market conditions, current customers' orders and commitments, and assuming continuation of current foreign exchange rates, Checkpoint is reaffirming its guidance for 2015. This guidance does not include the impact of acquisitions, divestitures, restructuring and one-time or unusual charges resulting from litigation fees or settlements and gains or losses generated by non-routine operating matters which we may record during the year. CLASS ACTION COMPLAINT 14 Projected income taxes for the year can be impacted by changes in the mix of pretax income and losses in the countries in which we operate. The valuation allowance on U.S. deferred tax assets results in a GAAP tax rate on U.S. pre-tax income or losses of essentially 0%. When the mix of income or losses shifts from the U.S. to a country where the income tax rate is in the normal range, our effective tax rate will increase. Additionally, we continue to monitor our profitability in the U.S. to determine whether there is sufficient evidence that may result in a full or partial release of the U.S. valuation allowance. Should this occur, the current GAAP tax rate in the U.S. will be significantly impacted. The combination of these factors can have a material effect on the amount of reported income tax expense, and therefore our earnings per share, when compared with the projections that are the basis of our outlook. James Lucania, Acting Chief Financial Officer and Treasurer, said, “Like so many other U.S. multinational corporations, Checkpoint’s reported top and bottom line results will continue to be impacted negatively by the strong U.S. Dollar. Though several of our selling currencies have weakened since we presented our initial guidance, we believe anticipated new business will offset the lost revenue from currency translation. Therefore we continue to expect 2015 results within our prior guidance range.” Net revenues are expected to be in the range of $575 million to $625 million, unchanged from prior guidance. Adjusted EBITDA is expected to be in the range of $55 million to $68 million, unchanged from prior guidance. Non-GAAP diluted net earnings per share is expected to be in the range of $0.40 to $0.50, assuming an effective tax rate of approximately 35%, unchanged from prior guidance. 22. On the same day, Checkpoint filed its Quarterly Report with the SEC on Form 10- Q for the fiscal quarter ended March 29, 2015. The Company’s Form 10-Q was signed by Defendant Lucania, and reaffirmed the Company’s financial statements previously announced the same day. The Form 10-Q contained certifications pursuant to SOX, signed by Defendants Babich and Lucania, substantially similar to the certifications described in ¶20, supra. 23. On August 3, 2015, Checkpoint issued a press release entitled, “Checkpoint Systems, Inc. Announces Second Quarter 2015 Results.” Therein, the Company, in relevant part, stated: CLASS ACTION COMPLAINT 15 Organic Merchandise Visibility™ Revenue Growth of 29% Company Secures Major New EAS Customer Company Reaffirms 2015 Guidance Board of Directors Authorizes $30 Million Share Repurchase Plan THOROFARE, N.J.--(BUSINESS WIRE)--Aug. 3, 2015-- Checkpoint Systems, Inc. (NYSE: CKP) today reported financial results for the fiscal second quarter ended June 28, 2015. For more details on the Company’s financial results, please see the supplemental presentation materials, “Second Quarter 2015 Financial Review,” posted to the Company’s website at http://ir.checkpointsystems.com and furnished to the SEC on Form 8-K. “I am pleased to report second quarter performance in-line with management's expectations,” said George Babich, Checkpoint Systems’ President and Chief Executive Officer. “While we continue to face a number of challenges in our business, including enormous year-over-year foreign currency headwinds, the sunset of our significant 2014 EAS hardware rollouts and challenging market dynamics in ALS, we are executing on our operational and strategic plans and our 2015 investments in topline growth initiatives are beginning to gain traction.” Mr. Babich added, “I have the great pleasure to announce that we recently secured a contract for a new EAS hardware rollout with a major Asian retailer. While the details of this project remain confidential, we are displacing a competitor’s systems with a suite of Checkpoint products, adding to our long list of competitive market share wins over the past decade without any major customer attrition. We have just begun the installation work and expect to recognize revenue related to the project in the second half of 2015 and into 2016.” “We also reached an agreement with one of our largest North American customers. Beginning in the second half of 2015, this customer will upgrade their existing Checkpoint RF EAS antennas with our next generation of dual RF/RFIDready antennas as they prepare to use RFID tags both for EAS loss prevention as well as for inventory visibility.” “Finally, later in 2015 and into 2016, we expect one of our largest European customers will begin to deploy our Merchandise Visibility solutions in approximately 150 stores and distribution centers in France. This represents the next step forward with this retailer who we expect to deploy our end-to-end Merchandise Visibility solutions worldwide, beginning in the DC, then into the back-of-store, then in-store.” “We are now in discussion, proof of concept, pilot, or partial deployment phases of our Merchandise Visibility solutions in more than 30 retailers across the globe. CLASS ACTION COMPLAINT 16 Checkpoint is the thought leader for these retailers as they explore the myriad of benefits RFID technology has to offer in their stores and distribution centers and we are confident that we will convert many of these projects to full deployments in the years to come.” “While we continue to face a number of challenges in our businesses, we also continue to gain share in EAS as we transition and transform our legacy businesses by expanding our RFID capabilities and gaining share in the fastgrowing market.” Share Repurchase Program The Board of Directors has authorized the repurchase of up to $30 million of common shares over the next two years. Mr. Babich added, “This share repurchase authorization reflects our confidence in Checkpoint’s financial strength and our long-term growth prospects, including the broader adoption of RFID technology by our retail customers. Share repurchases are a key element of our capital allocation strategy which aims to maximize stockholder value while maintaining the financial flexibility to pursue organic investments and strategic acquisitions as opportunities arise.” Selected Discussion and Analysis of Second Quarter 2015 Results Net revenues decreased 13.7% to $147.6 million compared with $170.9 million for the second quarter of 2014, due to an organic decrease of 5.2% and foreign currency effects of 8.5%. Merchandise Availability Solutions (MAS) revenues decreased 18.1% to $91.3 million versus the second quarter of 2014, partially driven by foreign currency translation effects of $10.0 million or 9.0%. The organic decline of 9.1% was attributable to EAS Systems, Alpha® and EAS Consumables, reflecting the sunset of North American and European chain-wide projects which occurred in the second quarter of 2014, partially offset by an increase in RFID solution sales in Europe. Apparel Labeling Solutions (ALS) revenues decreased 1.5% to $47.0 million, as foreign currency translation effects of $2.5 million, or 5.3%, offset a 3.8% organic revenue increase. RFID label revenues grew more than 20% year-over-year, while our legacy ticket and tag business was effectively flat despite significant competitive pricing pressures in certain geographies. Retail Merchandising Solutions (RMS) revenues decreased 21.3% to $9.3 million, nearly all related to the year-over-year decline in the Euro. Organic revenues declined 3.5%, reflecting the sunset of CLASS ACTION COMPLAINT 17 a major project in North America and softer retail display sales in Asia. Gross profit margin was 41.7%, just under 70 basis points lower than the second quarter of 2014. MAS gross profit margin was 47.2%, more than 120 basis points higher than the 46.0% recorded in the second quarter of 2014. The increase was principally due to significant margin improvements in EAS Systems, Alpha and RFID Solutions as we realize the benefits of our operational initiatives in field service, professional services, pricing and supply chain optimization. The margin improvement was partially offset by the stronger US Dollar eroding overall supply chain margins, as well as unfavorable manufacturing variances in our EAS Consumables factories from lower production volumes and higher input costs. ALS gross profit margin was 31.6% compared with 36.2% in the second quarter of 2014. The decrease was due to the weaker Euro, accelerated depreciation for certain machinery in Asia that has been removed from production, under-absorption due to lower production volumes and competitive pricing pressures in certain geographies due to market oversupply. RMS gross profit margin was 38.1%, 420 basis points better than 33.9% in the second quarter of 2014. The increase was primarily due to our margin improvement initiatives. SG&A expenses were $51.9 million compared with $55.4 million in the second quarter of 2014. The decrease is primarily related to foreign currency translation effects of $4.8 million. The benefits of our cost reduction initiatives were offset by incremental spending increases related to our strategic initiatives. Operating loss was $4.5 million compared with $13.0 million of income in the second quarter of 2014. The 2015 operating loss includes a $9.0 million one-time litigation settlement expense. Net loss was $0.13 per diluted share versus income of $0.23 per diluted share in the second quarter of 2014. Non-GAAP operating income was $4.8 million compared with $13.3 million in the second quarter of 2014. (See accompanying Reconciliation of GAAP to Non-GAAP Financial Measures.) Non-GAAP earnings per diluted share was $0.10 compared with $0.25 in CLASS ACTION COMPLAINT 18 the same period last year. (See accompanying Reconciliation of GAAP to Non-GAAP Financial Measures.) Adjusted EBITDA was $12.9 million, compared with $21.0 million in the second quarter of 2014. (See accompanying Reconciliation of GAAP to Non-GAAP Financial Measures.) Cash provided by operating activities was $0.1 million compared with $12.7 million in the second quarter of 2014. The 2015 figure includes the effect of a $9.0 million one-time litigation settlement payment. Capital expenditures were $4.7 million in the second quarter of 2015 compared to $3.5 million in the second quarter of 2014. Outlook for 2015 Based on an assessment of market conditions, current customers' orders and commitments, and assuming continuation of current foreign exchange rates, Checkpoint is reaffirming its guidance for 2015. This guidance does not include the impact of acquisitions, divestitures, restructuring and one-time or unusual charges resulting from litigation fees or settlements and gains or losses generated by non-routine operating matters which we may record during the year. Projected income taxes for the year can be impacted by changes in the mix of pretax income and losses in the countries in which we operate. The valuation allowance on U.S. deferred tax assets results in a GAAP tax rate on U.S. pre-tax income or losses of essentially 0%. When the mix of income or losses shifts from the U.S. to a country where the income tax rate is in the normal range, our effective tax rate will increase. Additionally, we continue to monitor our profitability in the U.S. to determine whether there is sufficient evidence that may result in a full or partial release of the U.S. valuation allowance. Should this occur, the current GAAP tax rate in the U.S. will be significantly impacted. The combination of these factors can have a material effect on the amount of reported income tax expense, and therefore our earnings per share, when compared with the projections that are the basis of our outlook. James Lucania, Acting Chief Financial Officer and Treasurer, said, “We will continue to face some margin pressures for the remainder of 2015, especially in EAS Consumables where lower production volumes are driving under absorption, exacerbated by rising material and direct labor costs in the factories. In our ALS businesses, market overcapacity in certain geographies is generating some significant pricing pressures which we expect will continue. However, we expect that the incremental income from our new EAS contract will help to offset these pressures and we continue to expect 2015 results within our prior guidance range.” Net revenues are expected to be in the range of $575 million to $625 CLASS ACTION COMPLAINT 19 million, unchanged from prior guidance. 24. Adjusted EBITDA is expected to be in the range of $55 million to $68 million, unchanged from prior guidance. Non-GAAP diluted net earnings per share is expected to be in the range of $0.40 to $0.50, assuming an effective tax rate of approximately 35%, unchanged from prior guidance. On the same day, Checkpoint filed its Quarterly Report with the SEC on Form 10- Q for the fiscal quarter ended June 28, 2015. The Company’s Form 10-Q was signed by Defendant Lucania, and reaffirmed the Company’s financial statements previously announced the same day. The Form 10-Q contained certifications pursuant to SOX, signed by Defendants Babich and Lucania, substantially similar to the certifications described in ¶20, supra. 25. The above statements contained in ¶¶18-24 were false and/or misleading, as well as failed to disclose material adverse facts about the Company’s business, operations, and prospects. Specifically, these statements were false and/or misleading statements and/or failed to disclose: (1) that the Company lacked adequate internal controls over accounting; (2) that the Company understated its tax expense and misstated other key financial data in financial reports filed with the SEC in violation of GAAP; and (3) that, as a result of the foregoing, the Company’s financial statements and Defendants’ statements about Checkpoint’s business, operations, and prospects, were false and misleading and/or lacked a reasonable basis. Disclosures at the End of the Class Period 26. On November 3, 2015, after the market closed, the Company filed a Current Report on Form 8-K with the SEC disclosing that the Company had inadequate internal controls over accounting and that the Company filed false financial statements. The Current report, in relevant part, disclosed: During the preparation of the third quarter financial statements, the Company CLASS ACTION COMPLAINT 20 discovered financial statement errors attributable to the accounting for its quarterly income tax provision. As a result of these errors, on November 2, 2015, the Audit Committee of the Board of Directors (the “Audit Committee”) of Checkpoint Systems, Inc. (the “Company”) concluded that the unaudited financial statements for the quarterly period ended March 29, 2015, the quarterly period ended June 28, 2015 and the year-to-date period ended June 28, 2015 contained in the Company’s Quarterly Reports on Form 10-Q for the quarterly period ended March 29, 2015 and the quarterly period ended June 28, 2015 should no longer be relied upon due to the effect of financial statement errors that are attributable to an error in the accounting for the Company’s quarterly income tax provision. Accordingly, investors should no longer rely upon the Company’s previouslyissued financial statements for these periods and any earnings releases or other Company communications relating to these periods. The Company intends to restate its previously-issued financial statements for the quarterly periods ended March 29, 2015 and June 28, 2015 and the six month period ended June 28, 2015 through the filing of amended Quarterly Reports on Form 10-Q/A for the quarterly periods ended March 29, 2015 and June 28, 2015. These amended Quarterly Reports on Form 10-Q/A will be filed with the Securities and Exchange Commission (“SEC”) as soon as possible. Based on our assessment to date, we expect the key impacts on our previously reported results for the first and second quarters of fiscal 2015 to be as follows: Quarter ended March 29, 2015: increase in tax expense of $1.8 million, increase in net loss of $1.8 million, and decrease in diluted earnings per share of $0.04; Quarter ended June 28, 2015: increase in tax expense of $4.1 million, increase in net loss of $4.1 million, and decrease in diluted earnings per share of $0.10; and Year-to-date ended June 28, 2015: increase in tax expense of $5.9 million, increase in net loss of $5.9 million, and decrease in diluted earnings per share of $0.14. * * * As a result of the determination to restate these previously-issued financial statements, management re-evaluated the effectiveness of the design and operation of the Company’s internal control over financial reporting and disclosure controls and procedures and has concluded that the Company did not maintain effective controls over the period end financial reporting process for the quarterly periods ended March 29, 2015 and June 28, 2015. Specifically, effective controls were not maintained over the accounting for our quarterly income tax calculation surrounding the inclusion or exclusion of entities with valuation allowances. Additionally, the Company incorrectly calculated the valuation allowance related to a non U.S. entity with a deferred tax liability related to an indefinite lived intangible. Because of this material weakness, management, CLASS ACTION COMPLAINT 21 including the Chief Executive Officer and Acting Chief Financial Officer, concluded that the Company’s disclosure controls and procedures were not effective as of March 29, 2015 and June 28, 2015. The control deficiency constituted a material weakness, but did not result in a material misstatement to the Company’s audited consolidated financial statements for the year ended December 28, 2014, or any of the interim unaudited consolidated financial statements for the quarters included therein. However, the control deficiency could have resulted in a material misstatement to the annual or interim consolidated financial statements that would not have been prevented or detected. The Company intends to amend its Annual Report on Form 10-K for the year ended December 28, 2014 to reflect the conclusion by management that the Company’s internal control over financial reporting and disclosure controls and procedures were not effective as of December 28, 2014. The amended Annual Report on Form 10-K will be filed with the SEC as soon as possible. 27. On this news, shares of Checkpoint fell $1.73, or 22.4%, to close at $5.97 on October 29, 2015, on unusually high trading volume. CHECKPOINT’S VIOLATION OF GAAP RULES IN ITS FINANCIAL STATEMENTS FILED WITH THE SEC 28. These financial statements and the statements about the Company’s financial results were false and misleading, as such financial information was not prepared in conformity with GAAP, nor was the financial information a fair presentation of the Company’s operations due to the Company’s improper recording of tax expense, in violation of GAAP rules. 29. GAAP are those principles recognized by the accounting profession as the conventions, rules and procedures necessary to define accepted accounting practice at a particular time. Regulation S-X (17 C.F.R. § 210.4-01(a)(1)) states that financial statements filed with the SEC which are not prepared in compliance with GAAP are presumed to be misleading and inaccurate. Regulation S-X requires that interim financial statements must also comply with GAAP, with the exception that interim financial statements need not include disclosure which would be duplicative of disclosures accompanying annual financial statements. 17 C.F.R. § 210.10-01(a). CLASS ACTION COMPLAINT 22 30. The fact that Checkpoint announced that it intends to restate certain of its financial statements, and informed investors that these financial statements should not be relied upon is an admission that they were false and misleading when originally issued (APB No.20, 713; SFAS No. 154, 25). 31. Given these accounting irregularities, the Company announced financial results that were in violation of GAAP and the following principles: (a) The principle that “interim financial reporting should be based upon the same accounting principles and practices used to prepare annual financial statements” was violated (APB No. 28, 10); (b) The principle that “financial reporting should provide information that is useful to present to potential investors and creditors and other users in making rational investment, credit, and similar decisions” was violated (FASB Statement of Concepts No. 1, 34); (c) The principle that “financial reporting should provide information about the economic resources of Checkpoint, the claims to those resources, and effects of transactions, events, and circumstances that change resources and claims to those resources” was violated (FASB Statement of Concepts No. 1, 40); (d) The principle that “financial reporting should provide information about Checkpoint’s financial performance during a period” was violated (FASB Statement of Concepts No. 1, 42); (e) The principle that “financial reporting should provide information about how management of Checkpoint has discharged its stewardship responsibility to owners (stockholders) for the use of Checkpoint resources entrusted to it” was violated (FASB Statement of Concepts No. 1, 50); CLASS ACTION COMPLAINT 23 (f) The principle that “financial reporting should be reliable in that it represents what it purports to represent” was violated (FASB Statement of Concepts No. 2, 5859); (g) The principle that “completeness, meaning that nothing is left out of the information that may be necessary to insure that it validly represents underlying events and conditions” was violated (FASB Statement of Concepts No. 2, 79); and (h) The principle that “conservatism be used as a prudent reaction to uncertainty to try to ensure that uncertainties and risks inherent in business situations are adequately considered” was violated (FASB Statement of Concepts No. 2, 95). 32. The adverse information concealed by Defendants during the Class Period and detailed above was in violation of Item 303 of Regulation S-K under the federal securities law (17 C.F.R. §229.303). CLASS ACTION ALLEGATIONS 33. Plaintiff brings this action as a class action pursuant to Federal Rule of Civil Procedure 23(a) and (b)(3) on behalf of a class, consisting of all those who purchased Checkpoint’s securities between March 5, 2015 and November 3, 2015, inclusive (the “Class Period”) and who were damaged thereby (the “Class”). Excluded from the Class are Defendants, the officers and directors of the Company, at all relevant times, members of their immediate families and their legal representatives, heirs, successors or assigns and any entity in which Defendants have or had a controlling interest. 34. The members of the Class are so numerous that joinder of all members is impracticable. Throughout the Class Period, Checkpoint’s securities were actively traded on the New York Stock Exchange (the “NYSE”). While the exact number of Class members is CLASS ACTION COMPLAINT 24 unknown to Plaintiff at this time and can only be ascertained through appropriate discovery, Plaintiff believes that there are hundreds or thousands of members in the proposed Class. Millions of Checkpoint shares were traded publicly during the Class Period on the NYSE. As of March 2, 2015, Checkpoint had 41,830,156 shares of common stock outstanding. Record owners and other members of the Class may be identified from records maintained by Checkpoint or its transfer agent and may be notified of the pendency of this action by mail, using the form of notice similar to that customarily used in securities class actions. 35. Plaintiff’s claims are typical of the claims of the members of the Class as all members of the Class are similarly affected by Defendants’ wrongful conduct in violation of federal law that is complained of herein. 36. Plaintiff will fairly and adequately protect the interests of the members of the Class and has retained counsel competent and experienced in class and securities litigation. 37. Common questions of law and fact exist as to all members of the Class and predominate over any questions solely affecting individual members of the Class. Among the questions of law and fact common to the Class are: (a) whether the federal securities laws were violated by Defendants’ acts as (b) whether statements made by Defendants to the investing public during the alleged herein; Class Period omitted and/or misrepresented material facts about the business, operations, and prospects of Checkpoint; and (c) to what extent the members of the Class have sustained damages and the proper measure of damages. 38. A class action is superior to all other available methods for the fair and efficient CLASS ACTION COMPLAINT 25 adjudication of this controversy since joinder of all members is impracticable. Furthermore, as the damages suffered by individual Class members may be relatively small, the expense and burden of individual litigation makes it impossible for members of the Class to individually redress the wrongs done to them. There will be no difficulty in the management of this action as a class action. UNDISCLOSED ADVERSE FACTS 39. The market for Checkpoint’s securities was open, well-developed and efficient at all relevant times. As a result of these materially false and/or misleading statements, and/or failures to disclose, Checkpoint’s securities traded at artificially inflated prices during the Class Period. Plaintiff and other members of the Class purchased or otherwise acquired Checkpoint’s securities relying upon the integrity of the market price of the Company’s securities and market information relating to Checkpoint, and have been damaged thereby. 40. During the Class Period, Defendants materially misled the investing public, thereby inflating the price of Checkpoint’s securities, by publicly issuing false and/or misleading statements and/or omitting to disclose material facts necessary to make Defendants’ statements, as set forth herein, not false and/or misleading. Said statements and omissions were materially false and/or misleading in that they failed to disclose material adverse information and/or misrepresented the truth about Checkpoint’s business, operations, and prospects as alleged herein. 41. At all relevant times, the material misrepresentations and omissions particularized in this Complaint directly or proximately caused or were a substantial contributing cause of the damages sustained by Plaintiff and other members of the Class. As described herein, during the Class Period, Defendants made or caused to be made a series of materially false and/or CLASS ACTION COMPLAINT 26 misleading statements about Checkpoint’s financial well-being and prospects. These material misstatements and/or omissions had the cause and effect of creating in the market an unrealistically positive assessment of the Company and its financial well-being and prospects, thus causing the Company’s securities to be overvalued and artificially inflated at all relevant times. Defendants’ materially false and/or misleading statements during the Class Period resulted in Plaintiff and other members of the Class purchasing the Company’s securities at artificially inflated prices, thus causing the damages complained of herein. LOSS CAUSATION 42. Defendants’ wrongful conduct, as alleged herein, directly and proximately caused the economic loss suffered by Plaintiff and the Class. 43. During the Class Period, Plaintiff and the Class purchased Checkpoint’s securities at artificially inflated prices and were damaged thereby. The price of the Company’s securities significantly declined when the misrepresentations made to the market, and/or the information alleged herein to have been concealed from the market, and/or the effects thereof, were revealed, causing investors’ losses. SCIENTER ALLEGATIONS 44. As alleged herein, Defendants acted with scienter in that Defendants knew that the public documents and statements issued or disseminated in the name of the Company were materially false and/or misleading; knew that such statements or documents would be issued or disseminated to the investing public; and knowingly and substantially participated or acquiesced in the issuance or dissemination of such statements or documents as primary violations of the federal securities laws. As set forth elsewhere herein in detail, Defendants, by virtue of their receipt of information reflecting the true facts regarding Checkpoint, his/her control over, and/or CLASS ACTION COMPLAINT 27 receipt and/or modification of Checkpoint’s allegedly materially misleading misstatements and/or their associations with the Company which made them privy to confidential proprietary information concerning Checkpoint, participated in the fraudulent scheme alleged herein. APPLICABILITY OF PRESUMPTION OF RELIANCE (FRAUD-ON-THE-MARKET DOCTRINE) 45. The market for Checkpoint’s securities was open, well-developed and efficient at all relevant times. As a result of the materially false and/or misleading statements and/or failures to disclose, Checkpoint’s securities traded at artificially inflated prices during the Class Period. On March 5, 2015, the Company’s stock closed at a Class Period high of $13.43 per share. Plaintiff and other members of the Class purchased or otherwise acquired the Company’s securities relying upon the integrity of the market price of Checkpoint’s securities and market information relating to Checkpoint, and have been damaged thereby. 46. During the Class Period, the artificial inflation of Checkpoint’s stock was caused by the material misrepresentations and/or omissions particularized in this Complaint causing the damages sustained by Plaintiff and other members of the Class. As described herein, during the Class Period, Defendants made or caused to be made a series of materially false and/or misleading statements about Checkpoint’s business, prospects, and operations. These material misstatements and/or omissions created an unrealistically positive assessment of Checkpoint and its business, operations, and prospects, thus causing the price of the Company’s securities to be artificially inflated at all relevant times, and when disclosed, negatively affected the value of the Company stock. Defendants’ materially false and/or misleading statements during the Class Period resulted in Plaintiff and other members of the Class purchasing the Company’s securities at such artificially inflated prices, and each of them has been damaged as a result. 47. At all relevant times, the market for Checkpoint’s securities was an efficient CLASS ACTION COMPLAINT 28 market for the following reasons, among others: (a) Checkpoint stock met the requirements for listing, and was listed and actively traded on the NYSE, a highly efficient and automated market; (b) As a regulated issuer, Checkpoint filed periodic public reports with the SEC and/or the NYSE; (c) Checkpoint regularly communicated with public investors via established market communication mechanisms, including through regular dissemination of press releases on the national circuits of major newswire services and through other wide-ranging public disclosures, such as communications with the financial press and other similar reporting services; and/or (d) Checkpoint was followed by securities analysts employed by brokerage firms who wrote reports about the Company, and these reports were distributed to the sales force and certain customers of their respective brokerage firms. Each of these reports was publicly available and entered the public marketplace. 48. As a result of the foregoing, the market for Checkpoint’s securities promptly digested current information regarding Checkpoint from all publicly available sources and reflected such information in Checkpoint’s stock price. Under these circumstances, all purchasers of Checkpoint’s securities during the Class Period suffered similar injury through their purchase of Checkpoint’s securities at artificially inflated prices and a presumption of reliance applies. NO SAFE HARBOR 49. The statutory safe harbor provided for forward-looking statements under certain circumstances does not apply to any of the allegedly false statements pleaded in this Complaint. CLASS ACTION COMPLAINT 29 The statements alleged to be false and misleading herein all relate to then-existing facts and conditions. In addition, to the extent certain of the statements alleged to be false may be characterized as forward looking, they were not identified as “forward-looking statements” when made and there were no meaningful cautionary statements identifying important factors that could cause actual results to differ materially from those in the purportedly forward-looking statements. In the alternative, to the extent that the statutory safe harbor is determined to apply to any forward-looking statements pleaded herein, Defendants are liable for those false forwardlooking statements because at the time each of those forward-looking statements was made, the speaker had actual knowledge that the forward-looking statement was materially false or misleading, and/or the forward-looking statement was authorized or approved by an executive officer of Checkpoint who knew that the statement was false when made. FIRST CLAIM Violation of Section 10(b) of The Exchange Act and Rule 10b-5 Promulgated Thereunder Against All Defendants 50. Plaintiff repeats and realleges each and every allegation contained above as if fully set forth herein. 51. During the Class Period, Defendants carried out a plan, scheme and course of conduct which was intended to and, throughout the Class Period, did: (i) deceive the investing public, including Plaintiff and other Class members, as alleged herein; and (ii) cause Plaintiff and other members of the Class to purchase Checkpoint’s securities at artificially inflated prices. In furtherance of this unlawful scheme, plan and course of conduct, defendants, and each of them, took the actions set forth herein. 52. Defendants (i) employed devices, schemes, and artifices to defraud; (ii) made untrue statements of material fact and/or omitted to state material facts necessary to make the CLASS ACTION COMPLAINT 30 statements not misleading; and (iii) engaged in acts, practices, and a course of business which operated as a fraud and deceit upon the purchasers of the Company’s securities in an effort to maintain artificially high market prices for Checkpoint’s securities in violation of Section 10(b) of the Exchange Act and Rule 10b-5. All Defendants are sued either as primary participants in the wrongful and illegal conduct charged herein or as controlling persons as alleged below. 53. Defendants, individually and in concert, directly and indirectly, by the use, means or instrumentalities of interstate commerce and/or of the mails, engaged and participated in a continuous course of conduct to conceal adverse material information about Checkpoint’s financial well-being and prospects, as specified herein. 54. These defendants employed devices, schemes and artifices to defraud, while in possession of material adverse non-public information and engaged in acts, practices, and a course of conduct as alleged herein in an effort to assure investors of Checkpoint’s value and performance and continued substantial growth, which included the making of, or the participation in the making of, untrue statements of material facts and/or omitting to state material facts necessary in order to make the statements made about Checkpoint and its business operations and future prospects in light of the circumstances under which they were made, not misleading, as set forth more particularly herein, and engaged in transactions, practices and a course of business which operated as a fraud and deceit upon the purchasers of the Company’s securities during the Class Period. 55. Each of the Individual Defendants’ primary liability, and controlling person liability, arises from the following facts: (i) the Individual Defendants were high-level executives and/or directors at the Company during the Class Period and members of the Company’s management team or had control thereof; (ii) each of these defendants, by virtue of their CLASS ACTION COMPLAINT 31 responsibilities and activities as a senior officer and/or director of the Company, was privy to and participated in the creation, development and reporting of the Company’s internal budgets, plans, projections and/or reports; (iii) each of these defendants enjoyed significant personal contact and familiarity with the other defendants and was advised of, and had access to, other members of the Company’s management team, internal reports and other data and information about the Company’s finances, operations, and sales at all relevant times; and (iv) each of these defendants was aware of the Company’s dissemination of information to the investing public which they knew and/or recklessly disregarded was materially false and misleading. 56. The defendants had actual knowledge of the misrepresentations and/or omissions of material facts set forth herein, or acted with reckless disregard for the truth in that they failed to ascertain and to disclose such facts, even though such facts were available to them. Such defendants’ material misrepresentations and/or omissions were done knowingly or recklessly and for the purpose and effect of concealing Checkpoint’s financial well-being and prospects from the investing public and supporting the artificially inflated price of its securities. As demonstrated by Defendants’ overstatements and/or misstatements of the Company’s business, operations, financial well-being, and prospects throughout the Class Period, Defendants, if they did not have actual knowledge of the misrepresentations and/or omissions alleged, were reckless in failing to obtain such knowledge by deliberately refraining from taking those steps necessary to discover whether those statements were false or misleading. 57. As a result of the dissemination of the materially false and/or misleading information and/or failure to disclose material facts, as set forth above, the market price of Checkpoint’s securities was artificially inflated during the Class Period. In ignorance of the fact that market prices of the Company’s securities were artificially inflated, and relying directly or CLASS ACTION COMPLAINT 32 indirectly on the false and misleading statements made by Defendants, or upon the integrity of the market in which the securities trades, and/or in the absence of material adverse information that was known to or recklessly disregarded by Defendants, but not disclosed in public statements by Defendants during the Class Period, Plaintiff and the other members of the Class acquired Checkpoint’s securities during the Class Period at artificially high prices and were damaged thereby. 58. At the time of said misrepresentations and/or omissions, Plaintiff and other members of the Class were ignorant of their falsity, and believed them to be true. Had Plaintiff and the other members of the Class and the marketplace known the truth regarding the problems that Checkpoint was experiencing, which were not disclosed by Defendants, Plaintiff and other members of the Class would not have purchased or otherwise acquired their Checkpoint securities, or, if they had acquired such securities during the Class Period, they would not have done so at the artificially inflated prices which they paid. 59. By virtue of the foregoing, Defendants have violated Section 10(b) of the Exchange Act and Rule 10b-5 promulgated thereunder. 60. As a direct and proximate result of Defendants’ wrongful conduct, Plaintiff and the other members of the Class suffered damages in connection with their respective purchases and sales of the Company’s securities during the Class Period. SECOND CLAIM Violation of Section 20(a) of The Exchange Act Against the Individual Defendants 61. Plaintiff repeats and realleges each and every allegation contained above as if fully set forth herein. 62. The Individual Defendants acted as controlling persons of Checkpoint within the meaning of Section 20(a) of the Exchange Act as alleged herein. By virtue of their high-level CLASS ACTION COMPLAINT 33 positions, and their ownership and contractual rights, participation in and/or awareness of the Company’s operations and/or intimate knowledge of the false financial statements filed by the Company with the SEC and disseminated to the investing public, the Individual Defendants had the power to influence and control and did influence and control, directly or indirectly, the decision-making of the Company, including the content and dissemination of the various statements which Plaintiff contends are false and misleading. The Individual Defendants were provided with or had unlimited access to copies of the Company’s reports, press releases, public filings and other statements alleged by Plaintiff to be misleading prior to and/or shortly after these statements were issued and had the ability to prevent the issuance of the statements or cause the statements to be corrected. 63. In particular, each of these Defendants had direct and supervisory involvement in the day-to-day operations of the Company and, therefore, is presumed to have had the power to control or influence the particular transactions giving rise to the securities violations as alleged herein, and exercised the same. 64. As set forth above, Checkpoint and the Individual Defendants each violated Section 10(b) and Rule 10b-5 by their acts and/or omissions as alleged in this Complaint. By virtue of their positions as controlling persons, the Individual Defendants are liable pursuant to Section 20(a) of the Exchange Act. As a direct and proximate result of Defendants’ wrongful conduct, Plaintiff and other members of the Class suffered damages in connection with their purchases of the Company’s securities during the Class Period. PRAYER FOR RELIEF WHEREFORE, Plaintiff prays for relief and judgment, as follows: (a) Determining that this action is a proper class action under Rule 23 of the Federal CLASS ACTION COMPLAINT 34 Rules of Civil Procedure; (b) Awarding compensatory damages in favor of Plaintiff and the other Class members against all defendants, jointly and severally, for all damages sustained as a result of Defendants’ wrongdoing, in an amount to be proven at trial, including interest thereon; (c) Awarding Plaintiff and the Class their reasonable costs and expenses incurred in this action, including counsel fees and expert fees; and (d) Such other and further relief as the Court may deem just and proper. JURY TRIAL DEMANDED Plaintiff hereby demands a trial by jury. Dated: GLANCY PRONGAY & MURRAY LLP By:_____________________ Lionel Z. Glancy Robert V. Prongay Lesley F. Portnoy 1925 Century Park East, Suite 2100 Los Angeles, CA 90067 Telephone: (310) 201-9150 Facsimile: (310) 201-9160 LAW OFFICES OF HOWARD G. SMITH Howard G. Smith 3070 Bristol Pike, Suite 112 Bensalem, PA 19020 Telephone: (215) 638-4847 Facsimile: (215) 638-4867 Attorneys for Plaintiff _____________ CLASS ACTION COMPLAINT 35