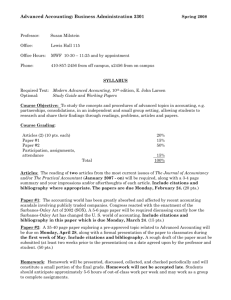

English - Anabatic Technologies

advertisement