Chapter 5: The Stock Market

advertisement

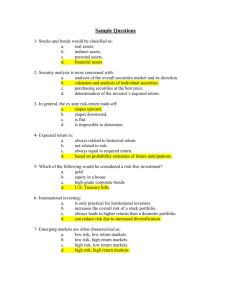

Chapter 5: The Stock Market I. Primary Market Where securities are issued for the first time, either in initial public offerings (IPO) or seasoned offerings. Regulated under the Securities Act of 1933. A. The Functions of Investment Bankers (IB) 1. Financing: a. Underwriting (firm commitment) - IB buy the entire issue & assume the risk of failure; compensated in spread and fees. b. Best efforts - IB do not finance & firm retains risk; primarily used for smaller, regional issues; IB receive fees. c. Dutch Auction – method used for US Treasury securities and Google’s IPO. (Another view!) 2. Marketing & Distribution: a. Syndicate - Team of IB led by one or several IB, each promising to sell a percentage of issue. A syndicate increases the likelihood of successful offering. b. Tombstone advertisement - Public notice of “intent” to sell; only prospectus can make an offer or solicitation; includes price, quantity and list of IB to contact. c. Road show - Presentations that IB perform for interested investors just before the offering (for institutions and wealthy individuals). 3. Registration: IBs are experts in the legal requirements of the regulatory process, and in determining the type and timing of financing. They advise and guide a firm through the entire process, from deciding what securities to issue to making changes in the registration forms that are required by the SEC. 4. After Market Support: IBs develop and maintain an aftermarket for new issues of stock. The purpose is to promote a successful issue. FIN 330: Chapter 5, page 1 B. The Registration Process 1. - SEC registration statement is required under 1933 Securities Act Reviewed and approved by S.E.C. which just looks for proper disclosure. - Includes financial statements, terms of new issue, any existing securities, and information about the company’s management. 2. - The prospectus The official offer following SEC approval Available to all prospective buyers Includes offer price & information in the registration statement A preliminary prospectus (a red herring) is circulated prior to SEC approval. 3. Rule 415 (shelf registration) In 1982 the SEC allowed firms to register securities that they could keep “on the shelf” for up to 2 years without issuing them. Rule 415 allows firms to time the sale better and reduce costs. 4. Registration exemptions: Federal & municipal government securities Regulated industries’ securities (banks, insurance companies) Private placements (Rule 144A) a) sales to limited number (less than 35); b) sales to qualified “sophisticated” investors; c) sales of less than $1.5M per year. Restrictions on resale of these securities. C. Advantages and Disadvantages of Going Public: Advantages: Access to capital Liquidity Valuation Raise market value Changes in capital structure Diversification Exit strategy Disadvantages: Loss of control Reporting costs attachment Disclosure requirements Emotional FIN 330: Chapter 5, page 2 II. The Secondary Market Where existing financial securities are traded. A healthy primary market requires a smoothly functioning secondary market. The secondary market is regulated under the Securities Exchange Act of 1934. Types of Secondary Markets A. Auction market: Where “price discovery” occurs around a central location with the help of the “auctioneer.” NYSE (1792): Created when 24 traders signed the “Buttonwood Agreement”. In 2006 the NYSE transformed from a non-profit corporation (with 1366 seats) to a publicly traded company (ticker symbol: NYX). (Membership seats are replaced with annual trading licenses). In April 2007 NYSE-Euronext is formed, merging NYSE with major European exchanges. B. Negotiated market: The OTC NASDAQ (National Association of Securities Dealers Automated Quotation). Electronic network of dealers (a dealer market ) trading unlisted (not listed on an exchange) stocks. Prior to 1971 stock data circulated on pink sheets & required contacting dealers by phone to trade. C. Electronic Communications Networks (ECNs) (2009 Report on ECNs) NYSE-Archipelago, Bloomberg Tradebook. The original ECN was INSTINET (1969) which provided direct trading between institutions. ECNs are computer networks that bypass market makers and directly link buyers with sellers. Originally involved large block trades and now expanded to individual investors. FIN 330: Chapter 5, page 3 III. Basic Types of Orders Market order: The order is executed as soon as possible, at the market price. Execution is guaranteed, but not the price. Can be a “surprise” when you learn the price was not what you hoped. Limit order: The order is executed at the price you specify, or better. The price is guaranteed, but not the execution (if the price is never reached, you will not get a trade). Stop (loss) order: A suspended order on the specialist’s books that becomes a market order when the stop price is reached. The execution is then guaranteed, but not the price. Example: Current price is $70 Stop-sell at $65: When price reaches $65, it becomes a market order to sell. Used to limit losses (thus the name: stop loss order) Stop-buy at $75: When price reaches $75, it becomes a market order to buy. Usually used to limit losses in a short-sale situation. Stop-limit order: combination stop order & limit order. Stop order becomes a limit order at a specified price. The stop and the limit prices are both pre-specified. Example: same example (current price is $70) Stop at $65, limit $60: When price reaches $65, it becomes a limit order to sell. The limit price of $60 means don’t sell if price continues to fall below $60. This type of order is used to limit losses but may result in you holding a stock worth less than $60. FIN 330: Chapter 5, page 4 IV. U.S. Stock Market Indexes A. The DJIA - Grandfather of Stock Indexes (1896) Charles Dow and Edward D. Jones began a 2-page newsletter reporting the average price for 11 stocks (9 railroads) in 1884. 1896 – Newsletter evolves into the first industrial average (12 industrial stocks) May 26,1896: Dow = 40.94 1928 – First year when 30 industrial stocks were included. The DJIA includes large blue-chip stocks and represents about 20% of the market value of all publicly owned U.S. stocks. Dow is an unusual “average” since it uses a divisor other than 30 due to stocks splits, additions, deletions, & mergers since inception. DJTA - 20 transportation companies DJUA - 15 utilities Dow Composite: Composite of all 65 companies B. Standard and Poor’s 500 (1957) - data dates to 1926. 500 large companies, primarily industrial (75%); 90% are listed on NYSE; represents75-80% of market value of all publicly owned U.S. stocks, thus it is a broader barometer of the entire market than the DJIA. C. NYSE Composite - 3,000+ companies representing about 80% of market value of all publicly owned U.S. stocks. Over 2/3rds of all companies listed in last 12 years. D. NASDAQ Composite – 5,000+ companies in the NASDAQ composite including around 3,000 NMS companies and around 1,400 NASDAQ smallcap market companies. E. Wilshire 5000 (1974) - Wilshire Associates tracks over 7,000 stocks. F. Russell 2000 is the small stock index and includes 2000 smallest of 3000 largest companies in the U.S. FIN 330: Chapter 5, page 5 Calculating a Price-Weight and Value-Weighted Index A. Dow Jones Industrial Average: Price-weighted index DJIAt = Pit / N N = divisor Simply add up the prices of the 30 stocks in the Dow Jones and divide by the divisor. (divisor: 0.132129493 on August 2, 2012) Divisor adjusts for stock splits, additions and deletions, stock buybacks, by adjusting divisor. B. S&P500 Index: Market-value weighted index i=1 500 S&P500 = Pit Qit x(k) Pib Qib Numerator = the market value of all stocks at time period t Denominator = the market value of all stocks during the base period k = a multiplier Thus, on first day of index, S&P500 = 10 If the total market value rose by 10% during the first year the index value will be 11 at the end of one year. C. Value Line Index: an equally weighted geometric average The daily percentage change in each stock (1700) is calculated The geometric average of these changes is computed. The Index value is increased (decreased) by this average. All stocks have the same impact. High priced or high market value stocks have no more influence than low ones. FIN 330: Chapter 5, page 6