cloud computing for law firms chris loh overview of

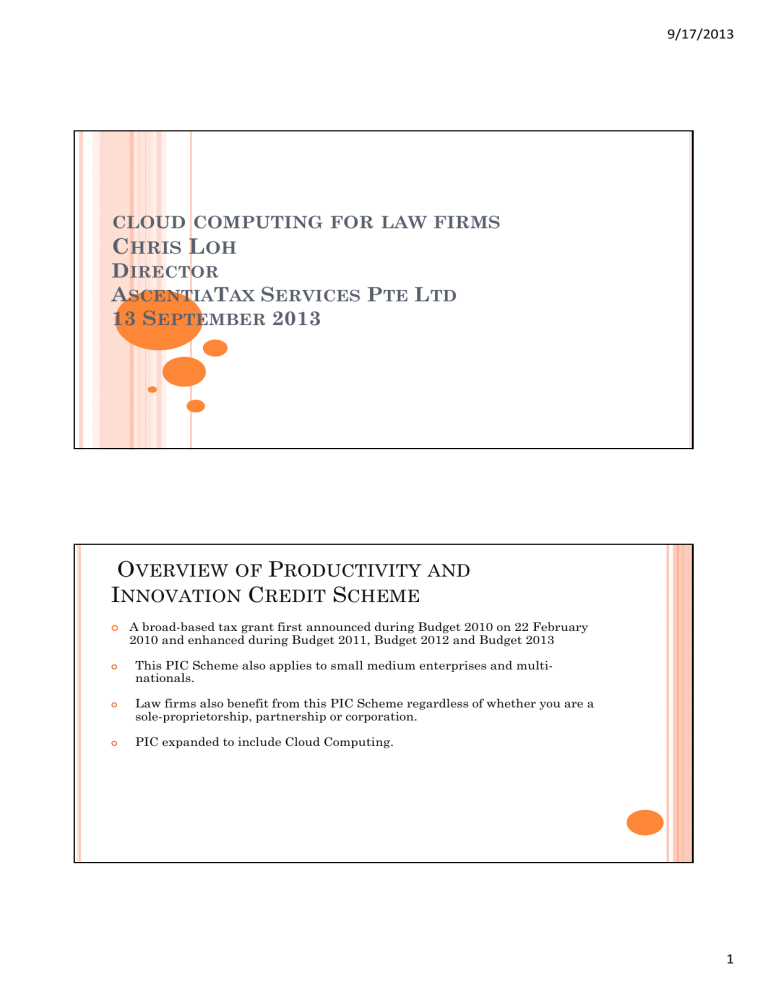

CLOUD COMPUTING FOR LAW FIRMS

C

HRIS

L

OH

D IRECTOR

A SCENTIA T AX S ERVICES P TE L TD

13 S EPTEMBER 2013

O VERVIEW OF P RODUCTIVITY AND

I

NNOVATION

C

REDIT

S

CHEME

A broad-based tax grant first announced during Budget 2010 on 22 February

2010 and enhanced during Budget 2011, Budget 2012 and Budget 2013

This PIC Scheme also applies to small medium enterprises and multinationals.

Law firms also benefit from this PIC Scheme regardless of whether you are a sole-proprietorship, partnership or corporation.

PIC expanded to include Cloud Computing.

9/17/2013

1

O VERVIEW OF P RODUCTIVITY AND I NNOVATION

C REDIT S CHEME

R&D 400% tax deduction for S$400,000 of qualifying expenditure on R&D conducted in

Singapore and overseas per year of assessment (YA) and 150%/100% for balance expenditure.

Acquisition of IP / In-house licensing

400% allowance for S$400,000 of qualifying cost from acquiring IP rights / in-house licensing incurred per YA and 100% allowance for balance expenditure.

Registration of IP Rights

Investments in IT and

Automation

400% tax deduction for S$400,000 of qualifying costs of registering patents, trademarks, designs and plant varieties incurred per YA and 100% tax deduction for balance expenditure.

400% allowance for S$400,000 of expenditure incurred on qualifying investments in automation per YA and 100% allowance for balance expenditure.

Investments in Design 400% tax deduction for S$400,000 of qualifying expenditure on eligible design activities done in Singapore per YA and 100% tax deduction for balance expenditure.

Training 400% tax deduction for S$400,000 of qualifying training expenditure for external training and Certified in-house training per YA and 100% tax deduction for balance expenditure.

9/17/2013

P RODUCTIVITY AND I NNOVATION C REDIT

S

CHEME

– C

LOUD COMPUTING

Which category does cloud computing fall under?

Answer: IT and Automation equipment.

How is cloud computing different from the rest of the PIC categories?

Answer: Cloud computing is a service and not an equipment.

2

P RODUCTIVITY AND I NNOVATION C REDIT

S CHEME – C LOUD COMPUTING

Definition of Cloud Computing

Defined under section 14T of the ITA as:

“cloud computing service” means any information technology service delivered by means of cloud computing.

9/17/2013

P RODUCTIVITY AND I NNOVATION C REDIT

S

CHEME

– C

LOUD COMPUTING

Source: Wikipedia

Cloud computing providers offer their services according to several fundamental models:

- infrastructure as a service (IaaS),

- platform as a service (PaaS), and

- software as a service (SaaS)

3

P RODUCTIVITY AND I NNOVATION C REDIT

S CHEME – C LOUD COMPUTING

Source: IRAS slide 38 of the Slide show “Productivity and Innovation

Credit Scheme &Budget 2013 Highlights for Businesses”

9/17/2013

O VERVIEW OF P RODUCTIVITY AND I NNOVATION

C

REDIT

S

CHEME

Qualifying Persons or ‘Companies’?

Section 37I(21) defines "qualifying person" to be any company or firm (including a partnership) that —

(a) carries on a trade or business in Singapore; and

(b) employs and makes contributions to the Central

Provident Fund in respect of not less than 3 local employees based on the payroll for the last month (or such other month as the Comptroller may determine) of its basis period for the qualifying year of assessment in question.”

Point to note: A sole-proprietorship or partnership can claim for enhanced deductions for registration costs of IPRs but not WDA on acquisition of IPRs!

4

W

HO CAN CLAIM CLOUD COMPUTING

Who can claim a tax deduction on cloud computing?

Answer: Everyone!

9/17/2013

Q

UALIFYING CAP

Enhanced tax deduction (ETD) Vs Cash conversion (CC)

Under the ETD, the cap is S$400,000 per YA.

However, 3 YAs can be combined to S$1.2 million.

Under the CC, the cap is S$100,000 per YA.

No combine cap over the YAs.

5

C LOUD COMPUTING IS PART OF IT AND

AUTOMATION EQUIPMENT

Example: Cloud computing expenditure incurred for $500,000

Balance of expenditure incurred in excess of $400,000 will enjoy deduction at current level

Total = $1,700,000

$100,000

--------------------------------

$100,000

(100% deduction)

$400,000 $1,600,000

(400% * $400,000 )

Expenditure

P

ER EQUIPMENT CONCEPT NOT APPLICABLE ON

COMPUTING

Law Firm A acquires server of $400,000.

Law Firm A cannot choose to convert part of it to cash. If CC is selected, the remaining balance of

$300,000 is forfeited for capital allowance purposes.

Cloud computing is a service, the cost can be split for both CC and ETD i.e. $100k for CC and balance of S$300k for ETD.

9/17/2013

6

O VERVIEW OF P RODUCTIVITY AND I NNOVATION

C REDIT S CHEME

Why convert when allowances/deductions are forfeited?

“Per IPR basis”/ “Per equipment basis”/ “Per application basis”

Amount ($)

Qualifying expenditure incurred for a server (automation) 168,000

1,200,000 Cap on qualifying expenditure

Amount of deductions/allowances

400% x $168,000

672,000

Less: Amount converted to cash grant

Balance of deductions/allowances for the YA

Total cash grant

($100,000 x 60%)

100,000

(capped)

Forfeited

60,000

(capped)

9/17/2013

O VERVIEW OF P RODUCTIVITY AND I NNOVATION

C

REDIT

S

CHEME

Partial conversion

Illustration on cash grant conversion (YA 2013)

Qualifying expenditure incurred cloud computing services

Cap on qualifying expenditure

Amount of deductions/allowances

400% x $10,000

Less: Amount converted to cash grant

Balance of deductions/allowances for the YA

Total cash grant

($10,000 x 60%)

Amount ($)

20,000

1,200,000

40,000

10,000

40,000

6,000

7

O VERVIEW OF P RODUCTIVITY AND I NNOVATION

C

REDIT

S

CHEME

Food for thought

-

Company spending $100 on cloud computing services can enjoy $68

in tax savings

400% deduction on $100 = $400

-

Tax savings = 17% x $400 = $68 OR should this be effective tax rate x $400?

$100 $400

$68

Cash conversion saving = 60% x $100 – (17% x $100) = $43

O VERVIEW OF P RODUCTIVITY AND I NNOVATION

C

REDIT

S

CHEME

1.

2.

3.

4.

Cash Conversion

Conditions: Businesses with at least 3 local (Singapore citizens and SPRs with CPF contribution) employees may convert up to $100,000 (not less than $400) of the expenditure under the scheme into non-taxable maximum cash grant of $60,000 ($100,000 at 60%) per YA

For YA 2013 to 2015, businesses cannot convert up to a combined total

Hire purchase equipment with repayment period over 2 basis period do not qualify but will qualify with effect from

YA 2012

Only arm’s length transaction between related parties are eligible for the cash payout.

9/17/2013

8

O VERVIEW OF P RODUCTIVITY AND I NNOVATION

C REDIT S CHEME

•

•

•

Administrative Procedures (2013)

Submit PIC Cash Payout Application Form and relevant Annexes (+ CPF record of payment for 10 or less employees businesses)

Current year quarterly claim available

Revenue figure for the qualifying period Cash = $250 x 60%

= $150

$1000

$250

Expenditure

$150

Cash

Tax Deductions

9/17/2013

W

ITHHOLDING TAX

As cloud computing service is a service,

Singapore withholding tax may apply if the payments are made to a NR for services rendered in Singapore.

9

D

ISPELLING MYTHS

Faq 15

Do I need to give a breakdown of the cloud computing payment?

IRAS reply: No. The full cloud computing payment will qualify for

PIC.

In practice, we have received the following queries:-

A. Copies of the invoice

B. Copy of the agreement contract signed between company and supplier

C. Function and features of the expenditure and flowchart for the automation process

D. How has cloud computing improved your Company’s productivity

PIC

FOR

IT

AND

A

UTOMATED

E

QUIPMENT

Definition of ‘Prescribed Automation Equipment’

Prescribed automation equipment listed in “Income Tax (Automation Equipment) Rules 2004,

2010”.

PIC Automation Equipment List

List includes existing Section 19A(2) Prescribed Automation Equipment with further additions, including:

1. Computers and peripherals;

2. Software etc

3. IRAS now allows taxpayers to submit application for approved automated equipment on a case-by-case basis, subject to conditions.

Purchased Equipment

Given on due claim

Partial claim allowed on 1 equipment so as to cap $300,000

Taxpayer can choose to claim 100% accelerated allowances, 3 years/ 2 years (for YA 2011)/ tax useful life or defer the claim

No enhanced allowances shall be made if equipment is leased out

9/17/2013

10

PIC FOR IT AND A UTOMATED E QUIPMENT FOR

LAW FIRMS

MS Office, Acrobat - Yes

Practice Management / Accounting Software - Yes

LEAP, Legalpac, Hotdocs, Lawdocs, Worldox - Yes

Specialist practice software - Yes

Litigation Support Software eg –Evidence Organiser, Caseroom, Nextpoint, Nuix - Yes

Corp Sec Software - Yes

Trademark case Management Software - Yes

Cloud Software Subscriptions - Yes

Gmail – Yes | Singnet Email No

Dropbox, Box, Egnyte, Microsoft 365 - Yes

Cloud Calendaring system - Action-IT - Yes

Subscription to Justice Online - Yes

Subscription to Court e-Filing Systems - No

Computers, Servers, Backup Software, Email (eg MS Exchange) - Yes

Scanners, 3 in one copier, scanner, printer - Yes

Ipads, Smartphones - Yes

9/17/2013

PIC

FOR

IT

AND

A

UTOMATED

E

QUIPMENT

Leasing of software

Prior to public consultation of the Income Tax (Amendment) Bill 2010, leasing of software would not have qualified unless it is installed in a qualifying equipment to be leased.

Condition to qualify

The enhanced deduction is limited to payments where the end-user has no rights to reverse engineer, decompile, or disassemble the software, or exploit the copyright of the software. Only rights to use the software.

Points of consideration

(1) Does this apply to situation whereby MNCs’ headquarters sublicence software rights to Singapore related entities on a pay as you use charging basis per annum?

(2) Note that maintenance of software (e.g. debugging, helpdesk support) does not qualify for PIC

11

PIC FOR IT AND A UTOMATED E QUIPMENT

Minimum Ownership Period of Equipment

Base allowances

Claim deduction

Disposed within 1 year

Disposed after 1

Compute BA/BC year

Cash conversion

Disposed within 1 year

Disposed after 1 year

Enhanced allowances

Deemed as income

Remaining balance forfeited

Adjustments not required

(note)

Full recovery subject to waiver

(refer to scenarios)

No recovery

Note: For PIC equipment written off over 3 years or over working life, any enhanced allowances that has yet to be drawn down is fully available to the taxpayer as balancing allowances.

9/17/2013

PIC B

ONUS

– N

EW

Businesses will get a dollar to dollar matching for expenditure in qualifying expenses, subject to a qualifying cap of S$15,000 for the combined YAs 2013 to 2015.

This is on-top of the existing PIC benefit.

The qualifying conditions are as follows:-

Incurred at least S$5,000 in each relevant YA.

Have active business operations in Singapore (i.e. Dormant companies are not entitled);

You need to contribute CPF to at least 3 employees (excluding SP, directors

who are also shareholders and partners); a.

At the last month of the relevant YA for businesses claimed the enhanced tax deduction; and b.

At the last month of the relevant quarter(s) for PIC cash payout.

Disbursement will only take place after July 2013 and October 2013 for cash conversion option and enhanced tax deduction cases respectively.

Please note that the PIC Bonus is taxable.

12

9/17/2013

PIC B

ONUS

– N

EW

Qualifying PIC Expenditure

PIC Cash Payout

PIC Bonus

Total PIC Benefits

YA 2013 YA 2014 YA 2015

$6,000 $3,000 $12,000

$3,600 $1,800 $7,200

($6,000 x 60%) ($3,000 x 60%) ($12,000 x 60%)

$6,000 $0 $9,000

$9,600 $1,800 $16,200

Extracted from IRAS website

S

UMMARY

Capping of Expenditure and Cash Conversion

Cap on

Applied at

Expenditure Cap

Qualifying expenditure for each of the 6 categories

Sole-proprietorship/ partnership/ company level

$800K

Cash Conversion Cap

Expenditure from all the 6 categories

YA 2011-12

YA 2013

YA 2014

YA 2015

$1,200K

$60K

$60K

$60K

$60K

13

S

UMMARY

Prescribed Automation Equipment

Purchase

100% CA Tax treatment

(Before YA 2011)

PIC (YAs 2011 to

2015)

Qualifying costs

Ownership period

Cash conversion basis

Cloud computing

100% deduction

400% of first $400K incurred

Costs of equipment

(incl. HP asset)

100% on balance

1 year from date of acquisition

Per “equipment” basis

Cloud computing service payments

NA

NA

9/17/2013

THE END

14