Consumer Electronics M&A Report - Intrepid Investment Bankers LLC

advertisement

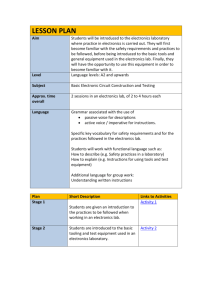

Consumer Electronics M&A Report March 2014 Consumer Electronics M&A Report – Welcome! Welcome to the inaugural edition of the Intrepid Investment Bankers LLC Consumer Electronics M&A Report. This newsletter is designed to provide updated information on select M&A transactions, public company valuations, and other trends impacting middle market companies in the consumer electronics industry. We hope it will serve as a useful tool for your business and any future deal-making activity. Please enjoy and feel free to pass it along to others in the consumer electronics industry. Gary Rabishaw, Managing Director and Head of the Consumer Electronics Practice Adam Abramowitz, Senior Vice President and Co-Head of the Consumer Electronics Practice Recently Announced Transactions Jawbone Round II – Jawbone, developer of the Jambox Bluetooth speaker and UP fitness band, will be raising $250 million in a new investment round led by Rizvi Traverse Management, valuing the company at $3.3 billion post-money. Previously, Jawbone raised $375 million of financing and we expect this new round to further fuel its growth ahead of an IPO or sale. Google Adds Nest Labs – Google announced the acquisition of Nest Labs, known for its intelligent thermostats and connected home devices, for approximately $3 billion. Prior to the transaction, Nest was rumored to be raising $150 million in a Series D round with an implied valuation of $2 billion. This deal provides Google with a new growth category of connected devices and world-class engineering and design talent with an Apple pedigree. Device Makers Change Hands – Lenovo Group agreed to acquire Motorola Mobility Holdings from Google for $2.9 billion in late January 2014. Lenovo surpassed Dell as the world’s largest PC manufacturer in June 2013, according to IDC, in part due to growth of the ThinkPad line of laptops that it acquired from IBM in 2004. The Chinese manufacturer plans to use the Motorola platform to strengthen its position in the growing handset market. The transaction follows Microsoft’s announced acquisition of Nokia’s Devices & Services business for $5.0 billion. GoPro Files Confidential IPO – GoPro, maker of rugged and portable cameras used in extreme sports, has filed a confidential IPO in a secretive process through the JOBS Act reserved for businesses with under $1 billion of revenue. The high-growth company sold 2.3 million cameras in 2012 generating generated over $500 million of revenue. GoPro founder Nick Woodman remains the majority shareholder with a 77% stake after selling 9% to Foxconn Technology in late 2012 in a transaction that valued the business at $2.25 billion. Dolby Acquires Doremi Labs – Dolby Laboratories signed a definitive agreement to acquire Doremi Labs, the leading provider of digital cinema video playback solutions. Doremi Labs’ technology will complement Dolby's Atmos object-based sound platform. Consideration for the transaction includes $92.5 million of cash plus $20 million in contingent consideration to be earned over four years. In Case You Missed It… Holiday Cheer for CE – Sales of PCs, TVs, tablets and headphones during the holiday season collectively rose 3.7% to $9.5 billion, The NPD Group reported, compared to a rise of just 1% from 2011 to 2012. Read more here. Harman Reviving Infinity Audio – Infinity Audio will launch its first major product since 2008 and has announced a five-year partnership with rock band Linkin Park. Infinity also has a new social-media campaign underway. Read more here. Building Value in Your Business Many factors will influence a Company’s valuation and salability. Each month we will highlight ways in which to raise investor interest and enhance the value of your company: Customer Concentration Wearables Catch On – Wearables reached a new level of consumer awareness at more than 50%, with 28% of consumers likely to buy a device in the near future, according to The NPD Group. Despite widespread awareness, adoption rates may be held back by form factor, cost and durability. Read more here. Best Buy Profits in Q4 – Best Buy posted fourth-quarter profits that topped analysts’ estimates after cutting expenses and increasing sales through its online store. Read more here. Tablet Ownership Continues Growth In U.S. – The Consumer Electronics Association (CEA) reports that 44% of online U.S. consumers owned tablets as of December 2013, an increase of 6% from the previous year. Read more here. Beats Music Acquires Topspin Media – Beats Music adds Topspin Media, a platform allowing artists to connect with fans and promote merchandise, as it looks to expand and add functionality to its music streaming service. Read more here. Concentration is an inherent risk of any business, particularly in the CE space where Amazon, Best Buy and Walmart dominate the landscape. As a private business owner, it is critical to minimize overreliance on any one customer by targeting multiple distribution channels and building international sales. Try to keep your customers below 30% of revenue where possible. If a customer exceeds this threshold, try to diversify products among different buyers and categories in order to mitigate a potential buyer concern and lessen a risk factor in your business. Newegg Challenges Amazon Prime – Newegg announced Newegg Premier, a subscription plan with free three-day shipping and free returns for $49 per year. Premier, currently in a beta test stage, comes amid rumors of an imminent price increase to Amazon Prime memberships. Read more here. U.S. TV Shipments Plummet – U.S. TV unit shipments declined 9% from 2012 to 2013, as domestic consumers continued to hold off purchases through most of the year, according to a new report from IHS Technology . Read more here. Sony’s Credit Lowered to Junk – Moody’s downgraded Sony’s credit rating to Ba1 – one level below investment grade. The rating reflects Sony’s struggle to gain share in the smartphone and tablet markets while TV sales decline. Read more here. RadioShack Struggles Through Holidays – RadioShack plans to close 1,100 stores after holiday sales through the retailer declined by more than 20% year over year. Read more here. Samsung Unveils New Devices at Mobile World Congress – Samsung displayed the Galaxy S5, the Gear 2, Gear Neo and Gear Fit health band in Barcelona. Read more here. Publicly Traded Consumer Electronics Companies ($ in thousands) Last Twelve Months Company Revenue Growth Enterprise Value / LTM Enterprise Value Market Cap Revenue Gross Margin EBITDA Margin 1-year 3-year Revenue EBITDA $446,951 $1,854 $16,446 $121,679 $470,756 $3,710 $9,324 $162,212 $173,992 $6,714 $51,228 $213,903 37.4% 20.8% 23.4% 39.8% 32.5% 0.4% 4.4% 22.8% 5.7% (29.6%) 2.9% 13.7% 31.6% (10.0%) (0.4%) 13.9% 2.6x 0.3x 0.3x 0.6x 7.9x NM 7.4x 2.5x Entertainment Technology Dol by La bora tori es , Inc. DTS Inc. Rovi Corpora tion Ti Vo Inc. $3,606 $314 $3,049 $794 $4,250 $360 $2,378 $1,624 $904 $118 $538 $406 89.8% 92.3% 82.8% 57.8% 33.1% 15.4% 33.7% 2.2% (3.3%) 18.0% 2.3% 33.7% (1.4%) 13.1% (0.2%) 22.8% 4.0x 2.7x 5.7x 2.0x 12.0x 17.3x 16.8x NM Electronic Accessories Ga rmi n Ltd. Ha rma n Interna tiona l Indus tri es , Inc. Logi tech Interna tiona l SA Pa ra metri c Sound Corpora tion (Turtle Bea ch) Skul l ca ndy, Inc. VOXX Interna tiona l Corpora tion ZAGG Inc. $9,131 $6,850 $2,082 $659 $201 $441 $131 $10,460 $7,079 $2,462 $563 $236 $317 $128 $2,632 $4,744 $2,107 $202 $239 $829 $219 53.5% 26.5% 34.5% 31.5% 45.3% 28.9% 39.7% 24.8% 8.7% 6.0% 12.2% 8.7% 6.2% 15.7% (3.1%) 11.9% (2.6%) (2.3%) (14.7%) 3.0% (17.0%) (0.7%) 10.9% (3.4%) 30.1% 18.5% 13.1% 42.3% 3.5x 1.4x 1.0x 3.3x 0.8x 0.5x 0.6x 14.0x 16.5x 16.5x NM 9.7x 8.5x 3.8x Connected Home Control 4 Corpora tion Nortek Inc. (Core Bra nds ) Uni vers a l El ectroni cs Inc. $385 $2,149 $587 $466 $1,107 $664 $129 $2,244 $529 50.3% 30.0% 28.6% 6.4% 9.1% 9.9% 17.3% 0.6% 14.3% 19.7% 6.4% 16.9% 3.0x 1.0x 1.1x NM 10.5x 11.2x Diversified Electronics Manufacturing JVC KENWOOD Corpora tion Hon Ha i Preci s i on (Foxconn) Pa na s oni c Corpora tion Pi oneer Corpora tion Sha rp Corpora tion Sony Corpora tion $653 $33,118 $32,847 $1,406 $13,938 $29,853 $303 $36,008 $28,961 $801 $5,246 $17,876 $3,058 $124,168 $73,833 $4,751 $27,930 $74,448 26.7% 8.6% 27.1% 19.8% 18.0% 22.5% 4.7% 4.5% 8.4% 6.9% 6.3% 4.6% 1.2% (2.1%) (7.9%) 7.8% 0.9% 14.5% (4.7%) 12.3% (0.9%) 1.8% (3.5%) 1.3% 0.2x 0.3x 0.4x 0.3x 0.5x 0.4x 4.5x 6.0x 5.3x 4.3x 8.0x 8.7x Mobile Device Manufacturing Appl e Inc. HTC Corpora tion LG El ectroni cs Inc. Sa ms ung El ectroni cs Co. Ltd. TEV / Revenue Multiples 20.0x 4.0x 16.0x 3.2x TEV / Revenue TEV / EBITDA TEV / EBITDA Multiples 12.0x 8.0x Google acquires Nest 2.4x Control4 IPO 1.6x Turtle Beach IPO 4.0x 0.8x 0.0x 0.0x Mobile Device Manufacturing Entertainment Technology Electronic Accessories Connected Home One-Year Stock Performance Diversified Electronics Manufacturing Three-Month Stock Performance 30% 100% 24.3% 19.3% 55.3% 50% 22.0% 7.3% 0% (16.4%) Average Stock Performance Average Stock Performance 66.1% 15.7% 15% 3.0% 0% (8.9%) -15% -50% Mobile Device Manufacturing Entertainment Technology Electronic Accessories Connected Home Diversified Electronics Manufacturing Note: Indices calculated on an equally-weighted basis; All data sourced from S&P Capital IQ; “NM” stands for “Not Meaningful” Mobile Device Manufacturing Entertainment Technology Electronic Accessories Connected Home Diversified Electronics Manufacturing Intrepid’s Consumer Electronics and Professional Entertainment Products Practice Connected Home Lifestyle Electronics • Control Systems • Home Automation • Mobile Devices • Lighting • Networking • Mobile Accessories Pro Audio / Musical Instruments Audio • Wearables • Loudspeakers • Apple/iOS Ecosystem • Custom Installation • Studio monitors • Sound Reinforcement • Microphones • Musical Instruments • Mixing • Audio Technologies • Cases • Headphones Consoles • Live Sound a portfolio company of has been acquired by a portfolio company of a portfolio company of a portfolio company of has been acquired by has been acquired by an affiliate of has been acquired by has been acquired by * * * Linear Corporation, a subsidiary of * *Represents transactions executed by principals of Intrepid at prior securities firms. Practice Team Gary Rabishaw Adam Abramowitz Greg Passani Managing Director grabishaw@intrepidib.com Senior Vice President aabramowitz@intrepidib.com Analyst gpassani@intrepidib.com 11755 Wilshire Boulevard, Suite 2200 Los Angeles, California 90025 Phone: 310.478.9000 • Fax: 310.478.9004 www.intrepidib.com Member FINRA/SIPC About Intrepid Investment Bankers LLC Intrepid Investment Bankers LLC, headquartered in Los Angeles, provides high impact and differentiated advice to middle market business owners and mission critical execution for maximizing value in capital transactions. Intrepid's services include M&A advisory, equity and debt capital raises and strategic advice in complex transactions. The firm serves entrepreneur and familyowned businesses, financial sponsors and major corporations. Collectively, the senior banker team at Intrepid brings over 180 years of mergers and acquisitions advisory experience in over 350 transactions spanning a broad range of industries. Intrepid augments its international capabilities through its membership in M&A International Inc., an exclusive global alliance of independent middle market M&A advisory firms in 39 countries, which completed over 330 transactions worldwide in 2013. www.intrepidib.com Member FINRA/SIPC.